Many Investors end up goofing either their dividends or bonus etc as they only focus on trading without paying any attention to the corporate announcements of the company. Else they are not aware of the Ex-date and Record date in the stock markets and thus goofs up on tax fewer benefits like dividends or bonuses etc.

So let us understand with the example of a bonus as a corporate action to understand the difference between the ex-date and record date in a stock market.

| Table of Contents |

|---|

| Corporate action and its Effects |

| Ex-date and Record date cum bonus date |

| Who is eligible for bonus share? |

| Effect on Share price |

| Key Takeaways |

Corporate action and its Effects:

Bonus share is fully paid up additional share that is issued to the existing shareholder of the company without any additional cost, based upon the number of shares that a shareholder owns.

Bonus shares are issued by companies to capitalize on their free reserves. They share their retained earnings with their shareholders in the absence of any CAPEX or expansion in the near future.

Bonus issue of shares reduces the EPS of the company.

Bonus issue increases the Paid-up share capital and reduces the reserve and surplus (retained earnings) of the company.

Bonus share is issued to each shareholder according to their stake in the company.

For example: when a company offers 1:4 bonus shares, it means a shareholder will get 1 free share for 4 shares held. So if an investor holds 100 shares at the time of bonus then they will become 125 shares after ex-bonus.

Ex-date and Record date cum bonus date

To determine whether you get the bonus share or not, you need to look at two important dates. They are the ex-date and record date.

The record date is the date set by the company under which the investor must own shares by that date, to be eligible for a bonus announced by the company.

All the investors holding the share on the record date are eligible to get a bonus share of the company.

Learn the essential Feature of Trading – Basics of Financial Market

After the announcement of the bonus but before the record date, the shares are referred to as “Cum bonus.”

The Ex-date is usually set one business day prior to the record date as we follow T+2 days as our trading cycle.

Who is eligible for bonus share?

India follows the T+2 rolling settlement for the delivery of shares.

Shares must be bought before the Ex-date because, if you purchase the share on the Ex-date, then it will not be credited to your Demat account on the record date and therefore, you will not be eligible for the bonus share but the person who sold the share to you will be eligible for the same.

Also Read: Stock Split v/s Bonus

This holds true for all kinds of corporate actions be it rights, stock split, or dividends.

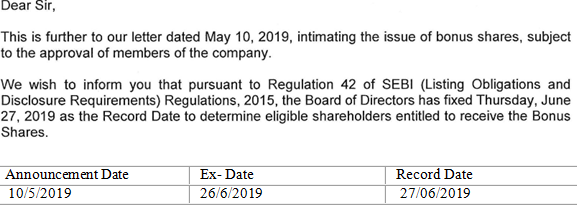

Here is an example of Relaxo Footwear:

Now if you purchase the share on the Ex-date i.e. 26/6/2019, the share will not be credited to your account by the record date because of T+2 Settlement. Thus you have to purchase one day before the Ex-date i.e. 25/06/2019.

If 25/06/2019 happens to be a non-trading day then you have to purchase it on 24/06/2019 to be eligible to receive the bonus.

Therefore, if you purchase the share one day prior to Ex-date, you get the bonus share. The bonus shares are generally credited to the shareholder’s accounts within a Period of fifteen-day from the record date.

Also Read: Corporate Action – Is it a call to action for a Shareholder?

Effect on Share price:

The share price of the company falls in the same proportion as the bonus share issues. So, in a 1:4 bonus issue, the share valuation price generally falls by 25% on the day of the Ex-date.

Frequently Asked Questions

What are bonus shares exactly?

Bonus share is the fully paid up additional shares issued to the existing shareholder’s of the company depending upon the number of shares they already own, without any additional costs.

Why company issue bonus shares?

Company issues bonus shares to capitalize their free reserves, increases the EPS and paid up capital and reduce the reserves and surplus of the company. It also woos new investors into the company.

What happens to the market price of shares when bonus shares are issued?

Market price of the share reduces in the same proportion as the bonus share is issued.

What is the ex-bonus date?

Ex-date is a business day prior to the record date as T+2 days of trading cycle is followed.

What is record date?

Record date is the date which is set by the company under which investor owns the shares by that date which is eligible for bonus announced by that company.

Key Takeaways:

- Knowledge of both Ex-date and record date is important to undertake the right trades.

- Ascertaining to receive any Bonus rights and Dividends is effected on the Ex-date.

- One can sell the share after the Record date thus does not make the mistake of selling the share after the Ex-date only.

Sir,

Please let me know, if someone purchase 2 days before Ex date is according to rules is eligible for bonus. But if he sells share on or after Ex date but before Record date than how he will get shares? Such shares are generally held with Stock broker in his pool account. What to do if broker refuse to give bonus and just stick on record date.

Hi,

If you have shares before the Ex-date then only you will be eligible to get the bonus. You can sell the shares after getting the bonus.

Thank you for Reading!

If I Sell the Shares On Record date or After Record date, will I get the Bonus Shares or not ?

Hi,

Shares bought or sold after this date are traded ex-bonus. Typically, when shares become ex-bonus, their price falls in the ratio in which bonus shares are issued. However, there is a gap of four to six weeks before the shareholders actually receive their bonus shares. It is only then that the shares can be sold.

Thank you for Reading!

Hi

I am Vivek my questions -how many days of ex-date the bonus is credited

Share Purchase Date : 12.11.2021

Bonus Issue Date : 17.11.2021

Ex-date : 17.11.2021

I am Eligible or not for bonus

Hi,

You are eligible as you are purchasing the shares before the ex-dividend date.

Thank you for Reading!