Blue chip stocks are of those large companies that are financially stable and have gained a national reputation. Owing to their credibility, they are known for low volatility, stable growth and returns against economic challenges and tough market conditions. Want to learn more about building a great portfolio? Join the NSE Academy Certified Equity Research Analysis course by Elearnmarkets.

The term “blue chip stocks” comes from a card game called ‘poker’, where the blue betting disk or “chip” holds the highest value.

Also read: Blue Chip Stocks

How do blue chip stocks yield good returns?

Before getting into the reasons as to why you should invest in blue chip stocks, it’s important to understand why they yield good returns.

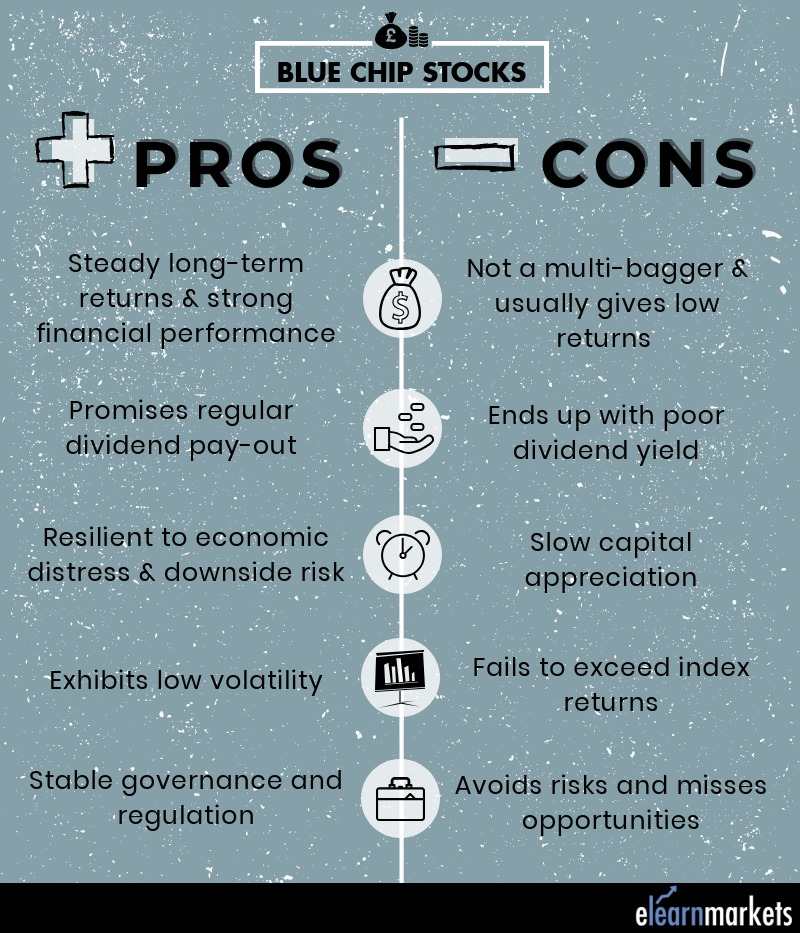

These stocks have gotten widespread acceptance and are almost taken for granted. These automated companies, who have matured, have maintained a record of profitability over the years. With a stable debt-to-equity ratio, average Price-to-Earnings ratio, and interest coverage ratio, blue chip stocks report a steady performance over a period of time. Their strong financial position, stable growth rate, excellent management staff, brand image, and goodwill sustain them through challenging business cycles and market trends.

Why should we invest in blue chip stocks?

Blue chip stocks are considered a safe haven for most investors. For someone looking to make a long-term investment, it’s important to know a few reasons why it’s so popular and why one should consider investing in blue-chip stocks.

Earnings are stable

For everyone, the primary goal is to get good returns on their investments. And, that is exactly what blue-chip stocks offer. Blue chip companies have steady earnings over a certain time-period, becoming reliable and earning the trust of its stakeholders. Even during an economic downturn, they seem to be doing “something right” to have their fundamentals in place. Be it a bearish influence n the market, one need not worry about their investment in blue-chip stocks.

Regular dividend payouts

Blue-chip companies display a strong trend of paying a dividend to its shareholders, timely and consistently. They may not show a constant increase in prices, but cover it up with uninterrupted dividend payouts. Not only does it provide the benefit of capital appreciation in the long-run, but also acts as an additional cherry on the top, in terms of income and inflation-protection.

Strength in Financial Base

A typical blue-chip company is usually not under a massive debt-burden, having sturdy financial ratios and efficient operating cycles, making for a strong financial standing. We’ve already discussed how blue-chip stocks don’t undergo fluctuation, thus carrying minimal investor risk. They support strong balance sheets, cash flows and business models contributing to continuous growth. Investment in blue-chip stocks is seen as secure and steady, especially due to the strong fundamental base of the company. These companies are rarely ever involved in scams or frauds. They have an understanding of the business they are in and have a very convincing vision for the company’s future.

Promote Diversification

Blue-chip stocks are one of the more stable ones and carry nominal risk. They can reduce your portfolio’s risk profile. Now, you may be someone who likes taking risks, but some security does nobody harm. These stocks give you a chance to balance out your losses. These companies don’t have only a single revenue channel, they have diversified business interests, which shield them from operational setbacks. Portfolio diversification has its own pros and cons.

Read more on this: Portfolio diversification – do’s and don’ts

Provide a competitive edge

Blue chip stocks are of those companies that have a competitive edge over the other players in their industry. Being cost-efficient and holding such high franchise value, they have great distribution control gaining a presence worldwide. They remain market leaders, providing high-quality offerings and increasing goodwill. Some of these brands have become family-names; their products sell regardless the economic scenario, and holding their stock is considered prestigious.

Blue chip stocks maintain a profitable history and are reliable more often than not. They have seen a lot of ups and downs and have survived turbulences in the market. But sometimes, even the good ones have may be troublesome for investors.

How did they gain popularity amongst experienced investors?

Even though investing in blue chip stocks seems outdated, it still remains a favorite of experienced investors and financial institutions.

Experienced investors see it as an heirloom since it allows building up of deferred tax liabilities unless it’s encashed. It gives a huge long-term advantage, as you won’t have to pay tax when the value of the blue chip stocks increase.

Since it has a steady compounding rate of return with reinvestment of dividends, it has a reputation of providing a shelter in economic disasters. Most experienced players have survived the sub-prime crisis of 2008 and know that these dividend-paying blue chip stocks don’t suffer much in a bearish economy, because of ‘yield support’. These companies are at a benefit in the long-run as they tend to buy their weakened competitors at reasonable prices when the economy is facing a downfall.

An inexperienced investor becomes greedy too soon, they want to become rich immediately. And take a hit while shooting for the stars. They don’t acknowledge the uncertainty of the market, and when it falls, they will lose a substantial part of their holding, no matter what people say.

Due to the credibility of these companies and the stability of their financial statements, blue chip stocks are popular among experienced investors as they act as a source of passive income. The diversification of these blue chip stocks reduces the risk and danger.

You may also read: 6 basic points which you should definitely know about Stock Market

In conclusion,

Blue chip stocks may not always seem like a good short-term investment, but in the long-run, it creates high value due to the steady growth and returns. It has the capability to quickly recover from distress because of their strong financial base.

Even a newbie will have a positive cash flow if they invest in blue chip stocks. They are a must in a portfolio, not only for new investors but also even for experienced market players.