Almost every one of us desires to live in a beautiful house. Those of us that already do, should consider ourselves very privileged. But there are many who do not have this basic need well covered. Young adults soon after they start earning at some point of time dream of owning a home. Note that proper financial planning and wealth management is required in order to build assets for yourself.

“I think buying a home is the best investment that any individual can make”-John Paulson

Today we are going to learn about the attributes of buying a home and the mistakes to avoid.

Take a concrete decision whether to stick around or might plan to leave

The first thing to keep in mind would be if you will stay in a particular place for a considerable time. Or is there a high probability that you will move out? None of us know what the future holds in for us but with reasonable certainty, we can estimate that. Houses are highly illiquid assets and are sold with great difficulty if such a need arises.

Stick to your budget

Buying a home involves a huge sum of money. You should do thorough financial planning. The EMI you will be paying, the down payment you need to make. Is it the financially right time to buy? Whether you have sufficient savings or you are borrowing too much? Borrowing above your limits means financial distress in the future.

Get a clear understanding of your finances (income, debt, and other assets). Know how much you can finance and how much loan you need to take and the interest you would be paying. Get a prior idea of what portion of your monthly income you are willing to pay as EMI and make your financial planning accordingly.

Know the added costs and the factor in the full costs of home ownership

It’s not just about EMI or down payment but owning a house involves a lot of other costs as well. There are maintenance costs, utilities, property tax, and home insurance. Consider all these and then evaluate whether you can afford a house at the present moment or do you need to wait for it?

Don’t raid your retirement funds

People often do this mistake of using whatever savings or investment they have into buying a house. Retirement, emergency or child’s education funds are there to serve their specified purpose. Don’t raid these funds to buy a house. Separate allocation must be made to buy a house otherwise your whole financial planning may go haywire.

Don’t put down a nominal try to make a 20% down payment

Down payment should cover a significant portion oftotal cost of the house. Going by thumb rule, it should be around 20%. Lower down payment brings about a whole lot of problems like longer duration of mortgage payment, higher monthly EMIs and no major home equity. If something comes up and there is no proper financial planning,you may have to sell your house. You will receive a very low amount after taking care of all closing expenses.

Check your credit score before applying for a home loan

While applying for home loan, if you have a proper credit score, you get favorable credit terms like higher amount and better negotiation terms. Maintaining a proper credit score always benefits a home-buyer.

A higher credit score can be obtained by repaying loans in time, avoiding excessive use of credit, prepaying loans with surplus funds. Also check properly which bank provides a better offer. It is not necessary that the bank which is tied-up with the broker will offer the best deal.

Determine the cost that you can afford

Setting a house budget is crucial in the home buying process. Most financial advisors say that people should not spend more than 36% of their gross income on total debt (includes all the debt like mortgage, student loan, personal loan, etc.). And not more than 28% of your gross income should go towards the mortgage payment.

Example: If your monthly income is Rs. 50,000 then your mortgage payment should not exceed Rs.14000. But this is a thumb rule if your other expenses are lower this can be adjusted accordingly.

“A brand-new home entitles you to brand new anything” may cause you pain.

When we buy a new house, there is this persistent feeling of getting new furniture, home appliances or even a new car. Be careful with this familiar tendency, it may put serious pressure on your finances. Just figure out what you really need and then proceed with careful financial planning.

Don’t neglect to get everything in writing

While buying a new house getting proper paperwork done is of utmost importance. The broker or dealer may try to trick you into something that may cause you major agony in future.

For example, while making the deal it may so happen that the furniture or kitchen appliances are shown but when you enter your new home they have been taken away. So, get everything in writing and then proceed with the deal.

Always do the inspection before you close the deal

Look carefully at all aspects before making the final decision. If there’s an offer of a 2 BHK at Rs. 40 lakhs while normal market average is around Rs. 50 lakhs, it is not necessarily the cheapest deal. It could be that the size of the flats is much smaller.

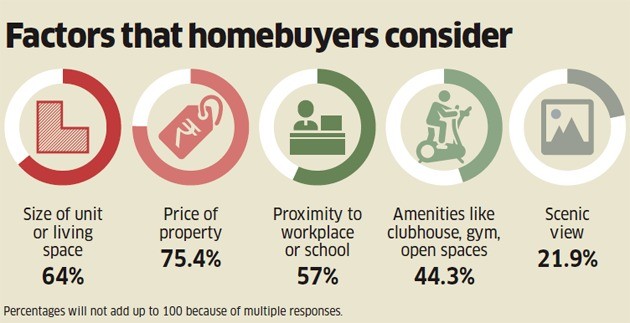

Other aspects such as the location of the house, its distance from the workplace, supermarket, hospital, school, park and other amenities should also be considered. Essential amenities like electricity and water supply should be thoroughly checked before selecting the project.

image source: economictimes.com

Consulting a certified financial planner is a good way to go about if you are not certain about your home buying criteria checks and other financial planning.

Bottomline

Yes! Agreed buying a house takes a lot of work and financial planning. But I would argue that working on every detail is worth it. Afterall, it’s your life’s savings and it is a long-term investment. Often generations stay in a particular house. So, plan your home-purchase with utmost care!