The Arms Index also known as TRIN is a breadth indicator developed by Richard W. Arms in the year 1967.

It basically serves to identify conditions where the market is short-term overbought or oversold.

It compares the advancing and declining stock issues and trading volume as an indicator to judge the overall market sentiment.

It draws the relationship between the market demand and supply data and helps to predict price movement on an intraday basis.

This index is calculated by dividing the Advance-Decline (AD) ratio by the Advance-Decline (AD) volume ratio.

You may do NSE Academy Certified Technical Analysis course to understand and develop your understanding of the various aspect of Technical analysis and improve your trading.

Calculation

TRIN = (The number of advancing stocks/The number of declining stocks)/(The composite volume of advancing stocks/The composite volume of declining stocks)

Let’s take an example to understand in detail-

Advancing Issues- 1900

Declining Issues- 1100

AD ratio- 1900/1100 = 1.8

Advancing Volume- 1400

Declining Volume- 600

AD Volume ratio- 1400/600 = 2.3

Thus, TRIN= 1.8/2.3= 0.78

The value of 0.74 indicates that far more volume went into the stocks that were advancing than the stocks that were declining.

The ratio would have been 1 in case both the ratios would have been proportionate.

However, value above 1 indicates that more stocks went into declining than advancing.

Interpretation of Arms Index

An Arms index value below 1 is considered to be bullish, a value of 1 indicates balanced market and value above 1 represents the bearish market.

Bullish reading< 1

Neutral reading= 1

Bearish reading> 1

The farther is the value from 1, the greater is the contrast in force between buying and selling on an intraday basis.

Also read: Triple screen trading system: the Alexander Elder way of trading

A value that that goes above 3 is considered oversold market and the market has turned over bearish.

A value that goes below 0.50 indicates an overbought market and that bullish sentiment is too dramatic.

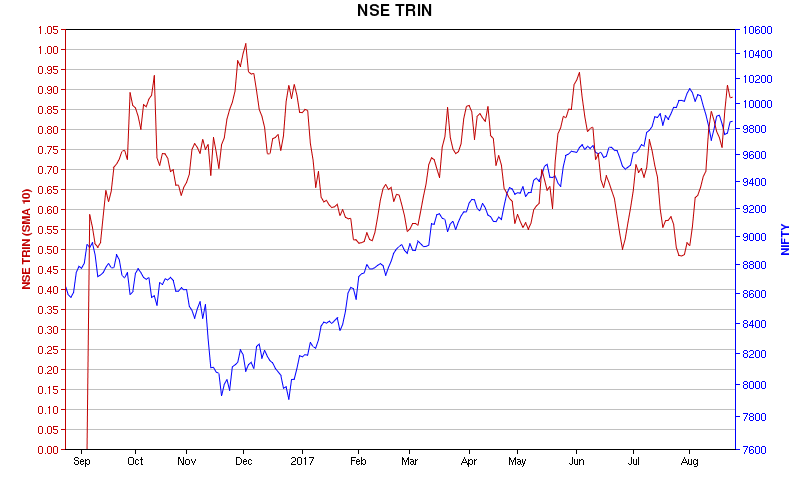

Due to the volatility of daily readings, the Arms Index is often displayed as a 10-day simple moving average plotted on a scale.

Know More: How to trade using moving average on different timeframes?

The market is taken as overbought when this 10-day moving average goes below 0.80 and market becomes oversold when this 10 day moving average reaches 1.20.

However, the Arms index stays within this 0.8-1.2 range majority of the time.

Bottomline

Relative Strength Index (RSI) and Stochastic are most commonly used measures to identify overbought and oversold conditions.

Both the indicators use stock’s price in relation to its own trading range.

However, the Arms Index is based on the overall market performance, more specifically in terms of breadth and volume.

You should also combine it with other technical parameters to confirm your trades.

In order to get the latest updates on Financial Markets visit Stockedge