This article focuses on the basics of equity research. To know more about investing in an informed manner you may do: NSE Academy Certified Equity Research Analysis.

Hope you had a nice weekend. By the way, I went to Udaipur in the weekend for a getaway with my friends and also to celebrate my birthday. We stayed in Lalit Laxmi Vilas Palace, a blend of royal and heavenly experience both in terms of beauty and food.

I love traveling places and exploring different foods and in this trip, I discovered a connection between food and our sensory organs. I believe that the real magic of food is not achieved unless we employ our 5 sensory organs to enjoy its royalty. So do try this, the next time when you will have your food. We use our eye to cherish the beauty and presentation of the food, hands i.e. touch, to feel the warmth or the chill, nose to relish its aromatic fragrance, tongue to cherish its taste and finally ears. Ears? Hold on my friends, it plays an important role because many people like the pleasing sound of having food: say the sound of having a sip of tea.

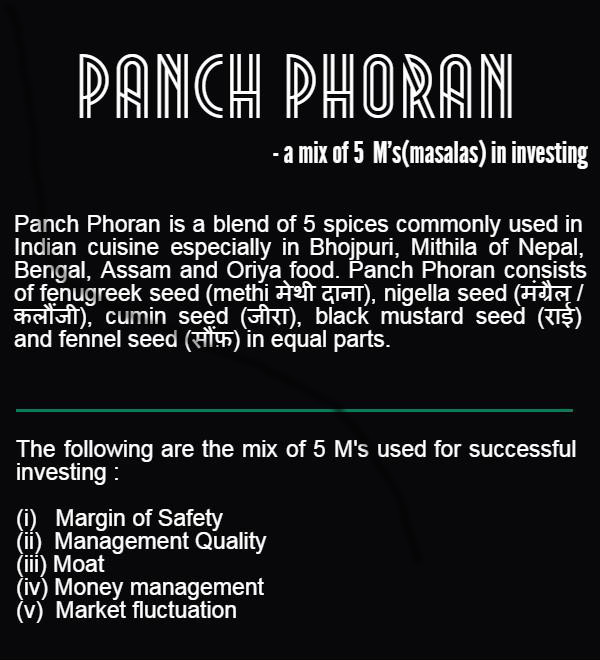

Similarly, in Investing we have a mix of 5 spices i.e. mantras which will make our investing life happy and successful and is tried and tested over the decades by the legends. The following are the mix of 5 ingredients for successful investing.

(i) Margin of Safety– It is a method of buying securities at a significant discount from their underlying values and holding them until more of their value is realized. The key to this process is to get the securities at a bargain price. Benjamin Graham, the father of Value Investing, said,

“The Margin Of Safety becomes much more evident when we apply it to the field of undervalued or bargain securities. We have by definition, a favourable difference between price on one hand and indicated or appraisal value on the other. That difference is the safety margin”.

It acts as a cushion to protect the investor against any loss which may arise due to human error, bad luck, extreme volatility etc. Margin Of Safety is important since-

- Future is unpredictable

- Investors being a human have a tendency to commit a mistake

Ben Graham said, “ There is no such thing as a good or bad stock; there are only cheap stocks and expensive stocks. Even the best company becomes a ‘sell’ when its stock price goes too high, while the worst company is worth buying if its stock goes low enough”

Also Read– Margin of safety matters!

(ii) Management Quality– The management is one of the most vital things to be analyzed while investing because they sit in the driving seat of the company and if they are a bad driver, no matter how big a car you have, they are sure to commit an accident. “Investing in India follows the same rule as elsewhere, there is one crucial difference- here the quality of management has to be considered closely. Abroad one can go by what is there in the books, but here you have to add an additional layer- the management” said Nemish Shah, Co-founder, and Director of Enam Holding.

The good management has a potential to make the company a stellar performer amidst the ailing sector which might suffer from external problems. One of the very good examples of the above situation is Jindal Steel and Power Limited(JSPL), a commodity company whose management has shown a commendable performance over the last decade and a half. The stock has touched the high of Rs 245.05 in June 2018, which was available at Rs 2 in 2001. It has fetched a return of 37% annually against 15% for the index in the same period.

It’s advisable to stay away from those firms who constantly raise capital and dilute equity and also which are highly leveraged except in the case where it is needed in the short-term to enhance its competitive edge.

Also Read: How to Evaluate management of a company

(iii) Moat– Moat refers to the ability of the company to create a competitive edge over its peers so as to retain its market share and long-term profits from its competitors. The term ‘Moat’ was first coined by legendary Investor Warren Buffett. He said, “The key to investing is determining the competitive advantage of any given company and above all, the durability of that advantage. The products or services that have wide sustainable moats around them are the ones that deliver rewards to investors”.

Companies having moats are more valuable than the company without moats because they protect the company against competition that would help it to earn high ROE and if the company is able to sustain the moat, then these high return would also sustain for a long time. Moat may be created in terms of brand value, technological innovation, cost advantage, high switching cost, size advantage etc.

Buffett in his 1994 letters to shareholders said, “Look for the durability of the franchise. The most important thing to me is figuring out how big a moat there is around the business. What I love is, of course, are a big castle and a big moat with piranhas and crocodiles”

Also Read:Moats vs Floats

(iv) Money management– The term money management looks very simple but it plays a very vital role. No matter how better the investor you are, it makes no sense if you don’t have the funds to invest when a real opportunity comes your way.

An Uncle of mine who separates Rs 5000 every month for investment in share market but invests only 30% of it when the market rises too much and 60-70% when the market falls sharply. He keeps the remaining balance in liquid assets. However, he doesn’t invest entire 100% whether market rises or falls because he believes those funds to be utilized whenever there is a crash in the market so as to pick up the gems at garbage prices. There‘s an old saying, “Buy when there’s blood in the streets”

One of the important aspects of money management is ‘savings’ and one should try to eliminate their unimportant expenses because it is going to help them in the times of need. A guy who gets a job or starts his business career, he starts spending ruthlessly and at times his expenses exceed the income thus eating up all the extra saving he made before. The formula for savings should be changed from Income – expenses to:

Expenses= Income – Savings

Say you earn Rs 20000 a month and instead of deducting the expenses to come down to savings, you fix your savings say Rs 5000 and then try to manage the entire month with Rs 15000 as expenses. There is a nice small book titled, “The Richest Man in Babylon” which you can read in order to get the importance of savings habit.

I think finding a favorable bet offering an edge is only 50% of the job while the remaining 50% is money management. If you look at any great investor or trader across generations, sound money management principles are an integral part of their approach. I think George Soros is a genius and I owe a lot of important lessons to him. The success rate in his case was only 30%( i.e. 7 out of 10 trades he made turned out to be a mistake eventually) and he still compounded money at around 30% CAGR over 30+ years period and made US $ 20 billion for himself. So for Soros, money management played a very significant role in his success. I think the following quote by George Soros best sums up money management and I think is worth its weight in gold- “It’s not whether you are right or wrong that’s important, but how much you make when you’re right and how much you lose when you’re wrong”

Also Read: Mastering Trading Psychology and Money Management to Trade Effectively

(v) Market fluctuation– Common stocks are subjected to wide fluctuations in their prices. Many investors consider price fluctuations as a significant risk and the investment is considered risky at those times regardless of the fundamental. Benjamin Graham said, “Price fluctuations have only one significant meaning for the true investor. They provide him with an opportunity to buy wisely when prices fall sharply and to sell wisely when they advance a great deal. at other times he will do better if he forgets about the stock market and pays attention to his dividend returns and to the operating results of his companies”

I believe these fluctuations should be considered as a friend to an investor because it provides opportunities to enter into the stock at lower prices thus fetching more returns in the process. Warren Buffett said, “Look at market fluctuations as your friend rather than your enemy, profit from folly rather than participate in it”. The investor should keep trust in his research and should not worry about the short-term fluctuations otherwise investing in equities is not for him. A shrewd investor actually makes the use of market fluctuations in his favor. A shrewd investor is one who buys in a bear market when everyone else is selling and sells in a bull market when everyone else is buying. Ben Graham said, “The more successful the company, the greater are likely to be the fluctuations in the price of its shares. This really means that, in a very real sense, the better the quality of common stock, the speculative it is likely to be at least as compared with unspectacular middle-grade issues”. He further adds, “The stock market often goes far wrong and sometimes an alert and courageous investor can take advantage of its patent errors”.

The investing could be made simple and successful if we follow the above points in a disciplined manner. These points have been tried and tested by the successful investment gurus over the past decades. However, everyone has their own style of investment and the above ingredients could be mixed in a varied proportion to suit your own need.

Bottomline

In order to get the latest updates about Financial Markets visit our website https://stockedge.com/