Investing is risky by nature. While most investors aim to make money off of their investments, there is also a chance that they could end up losing some or all of their money. Investors can compare the potential gains and losses of an investment using the risk-reward ratio.

The risk reward ratio calculates an investment’s probability of profit and loss.

Simply divide the risk by the reward to obtain the ratio if you can determine the potential risk and reward of a trade. Consider it this way: The profit you can anticipate on investment for every dollar of trade-related risk.

As a result, the risk-reward ratio can quickly reveal whether an investment is worthwhile. This is well-liked by day traders who want to enter and exit the market quickly because it enables them to choose how much to risk to potentially gain.

What is the Risk Reward Ratio?

The risk reward ratio shows how much an investor might gain from an investment for every dollar they risk. The expected returns of an investment and the level of risk required to earn those returns are often compared using risk-reward ratios.

It is frequently preferable to have a lower risk return ratio because it indicates a lower risk for a similar potential gain.

Why is it Important?

Investors can determine whether a potential investment is worthwhile by using the risk return ratio. In contrast, a low ratio indicates the opposite, that the potential reward is smaller than the potential risk. Investors can make better investment decisions and manage risk skillfully by being aware of the risk return ratio.

How to Calculate Risk Reward Ratio?

You must divide the amount you stand to lose (the risk) by the amount you stand to gain (the reward) if your investment performs as anticipated in order to arrive at the risk/return ratio, also referred to as the risk-reward ratio.

The risk reward ratio’s formula is-

Risk Reward Ratio = Potential Loss / Potential Gain

What does Risk Reward Ratio tell you?

Investors can reduce their likelihood of losing money on trades by using the risk reward ratio. Even if a trader makes some money, if their win rate is less than 50%, they will eventually lose money.

The difference between a trade entry point to a stop-loss and a sell or take-profit order is measured by the risk reward ratio. These two can be compared to determine the ratio of reward to risk or profit to loss.

When trading individual stocks, investors frequently use stop-loss orders to help limit losses and actively manage their investments with a risk/reward focus.

A stop-loss order is a trading trigger put on a stock that, if it drops below a predetermined low, automatically sells the stock from a portfolio. Through this, investors can set stop-loss orders automatically

Example

Think of this illustration: A trader places a stop-loss order at Rs. 15 and buys 100 shares of XYZ Company at Rs. 20 to limit losses to Rs. 500.

Assume that this trader thinks XYZ’s price will rise to Rs. 30 in the upcoming few months. In this instance, the trader is willing to take an Rs. 5 per share risk in exchange for an anticipated Rs. 10 per share profit when the position is closed.

The trader would be said to have a 1:2 risk/reward ratio on that specific trade since they stand to make twice what they have risked. Similar strategies can be used with derivatives contracts like puts, which grant their owners the right to sell the underlying asset at a predetermined price.

The stop-loss order can be changed in order to change the risk reward ratio if an investor prefers to aim for a 1:5 risk reward ratio for a specific investment (five units of expected return for each additional unit of risk). However, it’s crucial to realize that by doing so, the investor has altered the likelihood that their trade will be successful.

Watch our webinar on Principles of Risk & Money Management in Professional Trading

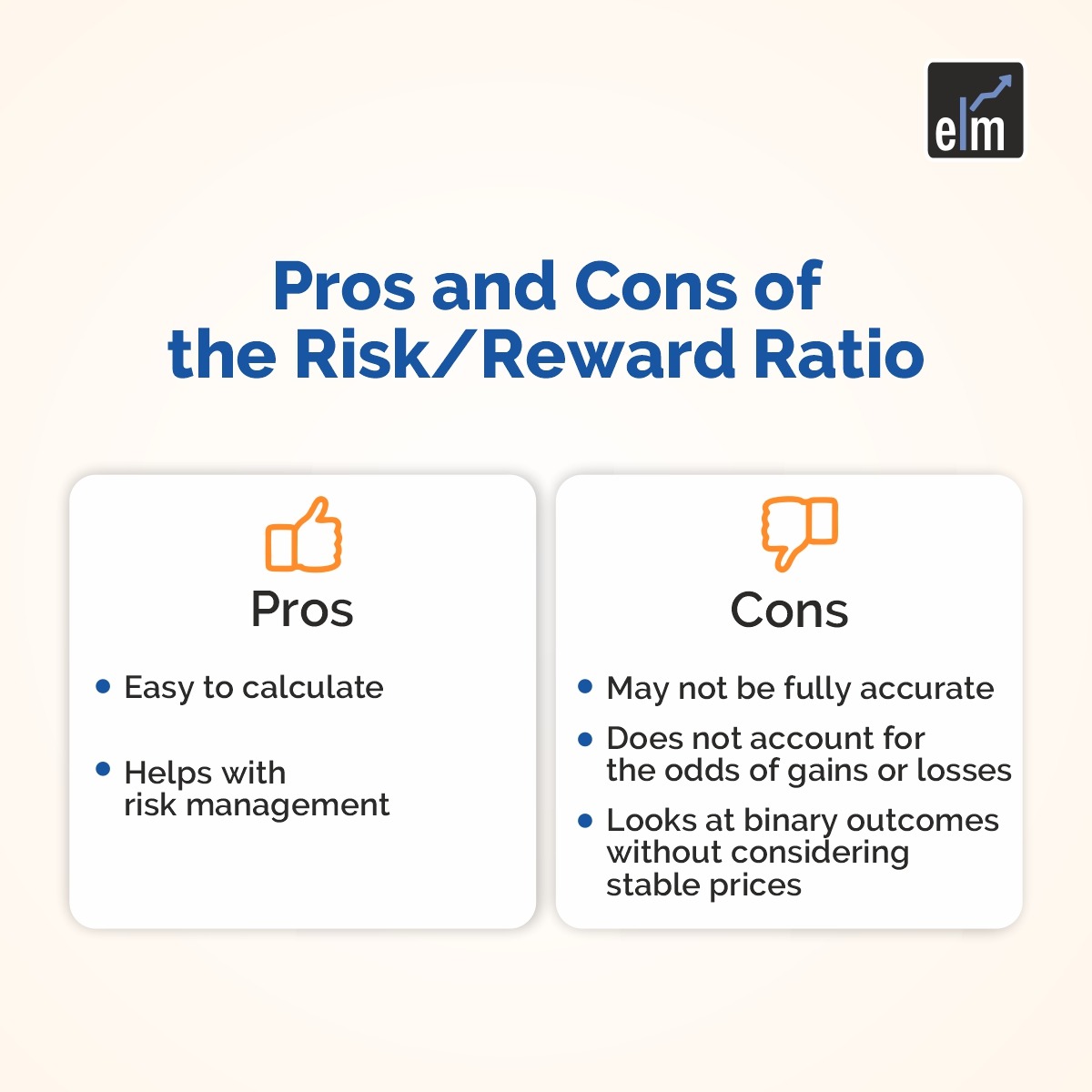

Pros and Cons of Risk Reward Ratio

Below are the benefits of Risk Reward Ratio:

- Simple to calculate- Investors can easily use the risk/reward ratio to make decisions on the spot because it has a very straightforward formula.

- Assists in risk management- An investor has more information to choose whether to make a trade after the ratio describes the risk of an investment.

Below are the disadvantages-

- Possibly not entirely accurate – The investor’s stop-losses and potential profits are used to calculate risk/reward ratios. A security’s price may increase or decrease too quickly for an investor to sell it at the desired price, so the actual gain or loss may be greater than the potential gain or loss.

- Ignores the likelihood of gains or losses: The risk/reward ratio only takes into account the potential gains and losses that an investment could incur. The calculation does not allow for the likelihood of either outcome to be taken into account.

- The ratio ignores stable prices in favor of binary outcomes: Prices for securities can go up or down, but they can also remain stable. This possibility is not taken into consideration by risk/reward ratios, which is a disadvantage for day traders who want to

You can also do our course on Masterclass on Short-term Momentum Trading

Watch our video on Risk Reward Ratio

Bottomline

The risk-reward ratio calculates the likelihood that an investment or project will generate more money than it will cost. Generally, a higher risk-reward ratio is preferred because it offers the chance of a higher return on investment without taking excessive risks. An excessive ratio suggests that an investment may be too risky.

We should always start off our journey with learning first before earning. You can look into our certificate course on derivatives to enhance your knowledge.

You can also checkout our equity derivatives course to learn some advanced topics.

We hope you found this blog informative and use the information to its maximum potential in the practical world. Also, show some love by sharing this blog with your family and friends and helping us spread financial literacy.

Happy Investing!

To get the latest updates about Financial Markets, visit StockEdge