Key Takeaways

- Basics of Japanese Candlesticks: Understand how open, high, low, and close prices form each candle for any timeframe.

- History & Origin: Learn how Munehisa Homma developed candlestick charting in 1700s Japan to predict prices.

- Types & Structure: Know what real bodies, shadows, shaven heads, and shaven bottoms indicate about price action.

- Bullish vs Bearish Signals: Identify how candle colours and shapes reflect market sentiment and trend direction.

- Practical Use in Trading: See how traders use Japanese candlestick patterns for short-term analysis and spotting trend reversals.

Japanese candlesticks represent one of the most enduring charting methods in technical analysis, with origins stretching back nearly three centuries.

These visual tools transform raw price data into easily interpretable patterns that help traders understand market psychology and predict potential price movements.

Historical Background

The candlestick methodology emerged in 18th-century Japan, specifically around 1750, when a prosperous rice merchant named Munehisa Homma began applying his analytical techniques at the Sakata Rice Exchange.

His success was remarkable. Historical accounts suggest he achieved over 100 consecutive profitable trades, building substantial wealth through his innovative approach to market analysis.

The terminology used in candlestick patterns reflects Japan’s military culture during that era. Pattern names such as “Three advancing white soldiers” and “counterattack lines” demonstrate this martial influence, adding a distinctive character to the analytical framework.

Anatomy of a Candlestick

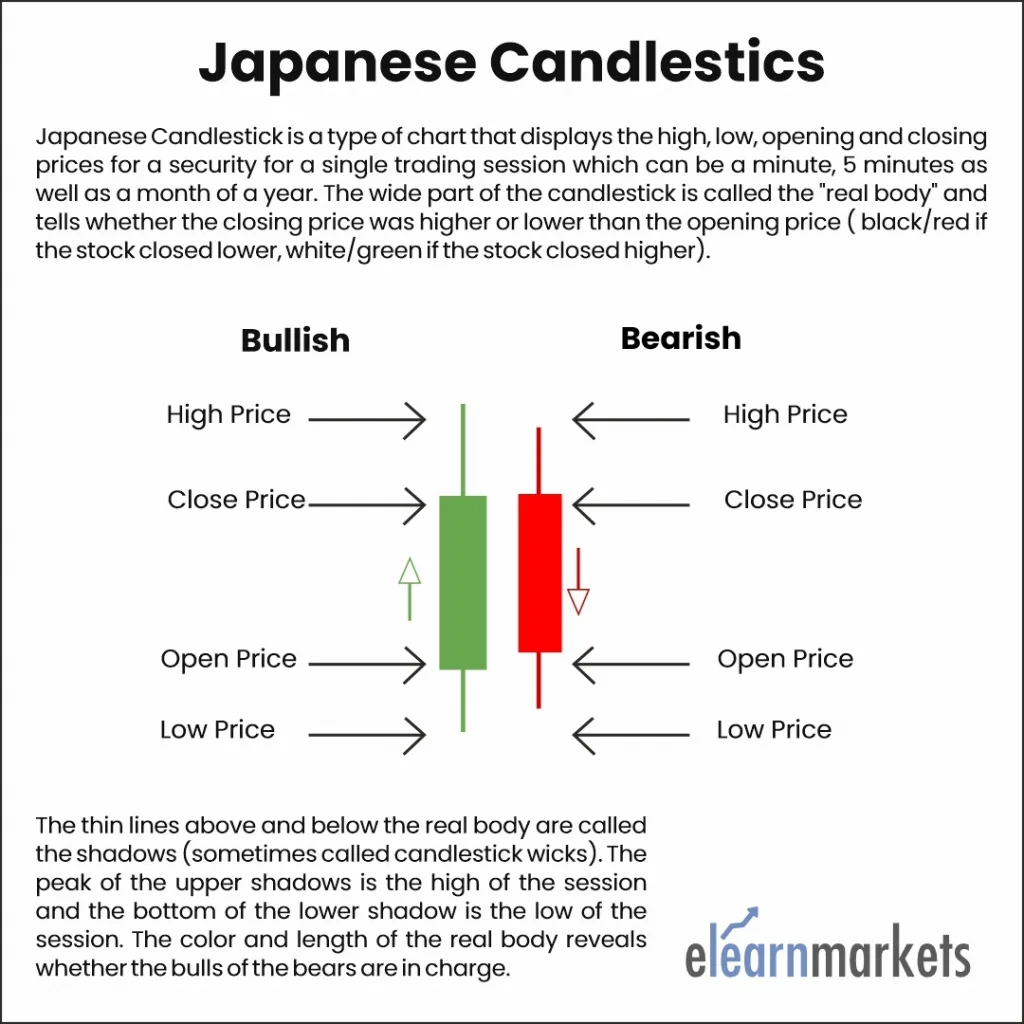

Every candlestick visualizes four critical price points for a specific timeframe:

The Real Body: This rectangular section shows the relationship between opening and closing prices. The body’s position reveals which price was higher, opening or closing, providing immediate insight into directional movement during the period.

Color Coding: The body’s color conveys vital information about price direction. Green or white bodies indicate upward movement (closing price exceeded opening price), reflecting bullish activity. Conversely, red or black bodies show downward movement (closing price fell below opening price), signaling bearish pressure.

Shadows (Wicks): Thin lines extending from the body represent price extremes. The upper shadow marks the period’s highest price, while the lower shadow indicates the lowest price reached. These elements reveal volatility and rejected price levels.

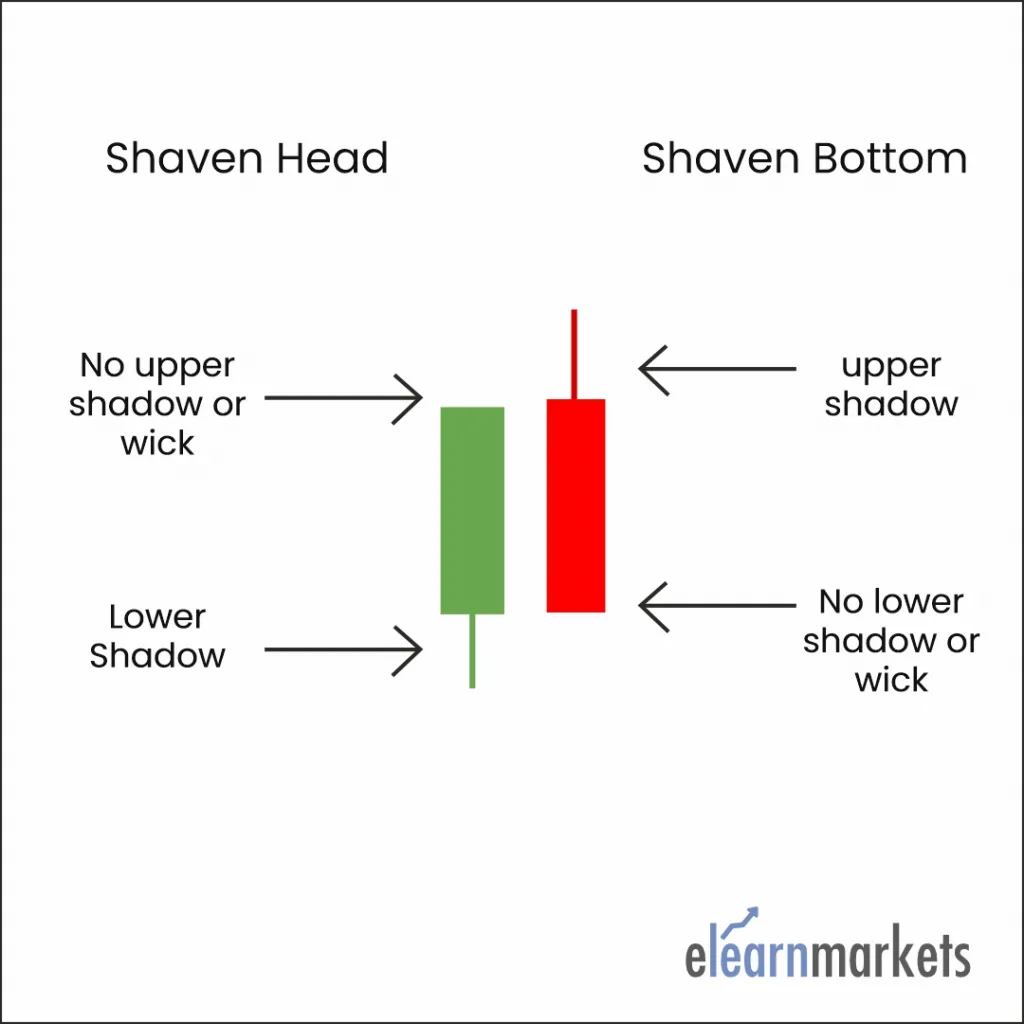

Special Formations: Candlesticks without upper shadows are termed “shaven heads,” while those lacking lower shadows are called “shaven bottoms.” These formations provide additional context about price behavior and momentum.

You can read about different candlestick patterns in our free e-book.

Timeframe Flexibility

Candlestick charts adapt to various trading styles and strategies. A single candlestick can represent price action across timeframes ranging from one minute to one month. This versatility has facilitated the growth of short-term trading approaches, enabling intraday and swing traders to analyze market movements with precision.

Interpreting Market Sentiment

Bullish Signals: When closing prices exceed opening prices, the resulting green or white candles suggest buyer dominance and positive momentum. These formations often appear during uptrends or at potential reversal points from declining markets.

Bearish Signals: Red or black candles, where closing prices fall below opening prices, indicate seller control and negative pressure. Such patterns frequently emerge during downtrends or when upward movements lose strength.

Shadow Analysis: Extended shadows reveal significant intraday volatility with ultimate rejection of extreme prices. Long upper shadows suggest selling pressure at higher levels, while long lower shadows indicate buying support at lower prices. Conversely, minimal or absent shadows demonstrate sustained directional conviction throughout the period. The line above the real body is the upper shadow, and the one that appears below is called the lower shadow. A candle having no upper shadow is said to have a shaven head, whereas one with no lower shadow is called a shaven bottom.

Although the Japanese view the real body as the decisive price movement, shadows are mostly thought of as superfluous price fluctuations.

Also Read: Japanese Candlestick Pattern – MARUBOZU

Practical Application

While Japanese candlesticks display identical information to traditional bar charts, their visual presentation makes pattern recognition more intuitive. The graphical nature of candlesticks allows traders to quickly identify formation sequences associated with trend changes and continuation patterns.

The Japanese trading philosophy emphasizes the real body as the primary price movement, viewing shadows as secondary fluctuations. This perspective helps traders focus on the most significant price action when making decisions.

Candlestick analysis excels in short-term timeframe evaluation, making it particularly valuable for identifying immediate opportunities and potential trend reversals. Modern traders combine candlestick patterns with other technical tools to build comprehensive trading strategies that leverage both historical price structure and current market dynamics.

You can watch the video below to know more about Japanese Candlestick by watching the video below:

You can learn the patterns in detail with our Candlestick Course Online.

Bottomline:

You can also explore candlestick scans on the StockEdge app, where traders track real-time patterns to support intraday and swing decisions.

We hope that the above write-up has helped you to gain an understanding of Japanese Candlestick.

Feel free to give your feedback by using the comment box below.

Learn more about Japanese Candlesticks in NSE Academy Certified Technical Analysis course on Elearnmarkets.

Happy Learning!!

Frequently Asked Questions (FAQs)

1. What do the colours of a candlestick represent?

Candlestick colours simply show whether the price moved up or down during that period. A green or white candle means the price closed higher than it opened, showing buying strength. A red or black candle means the price closed lower than it opened, showing selling pressure. Colours help traders quickly understand market sentiment.

2. What are bullish and bearish candlesticks?

A bullish candlestick forms when the price closes higher than it opened, showing that buyers were in control. A bearish candlestick forms when the price closes lower than it opened, showing selling pressure. Traders use these candles to understand whether the market is leaning towards buying or selling during that time.

3. What do long shadows or no shadows indicate in a candlestick chart?

Long shadows show that the price moved a lot within the period but couldn’t hold those levels, meaning there was rejection or volatility. A candle with no upper shadow suggests strong buying till the close, while no lower shadow shows steady selling. These signals help traders understand market strength or weakness more clearly.

Good work!

Hi,

Thank you for Reading!

Keep reading!

I think you have observed some very interesting points, thanks for the post.