Candlestick chart patterns are one of the most commonly used trading patterns amongst the trader’s community. Not only they are easy to spot, they are also easy to trade. That is the reason most traders love to trade candlestick chart patterns.

We know that there are different types of candlestick patterns which are available to trade. Some patterns are the blend of three candles whereas some patterns consist only two, also there is a tradeable pattern which carries only one candle. Not only in the candlestick charts but this patterns can also be found in bar charts.

| Table of Contents |

|---|

| Identification of Pipe Tops and Bottoms |

| The psychology behind the candles |

| Pipe Tops and Bottom Trading Pattern |

| Real-time Examples |

| Bottom Line |

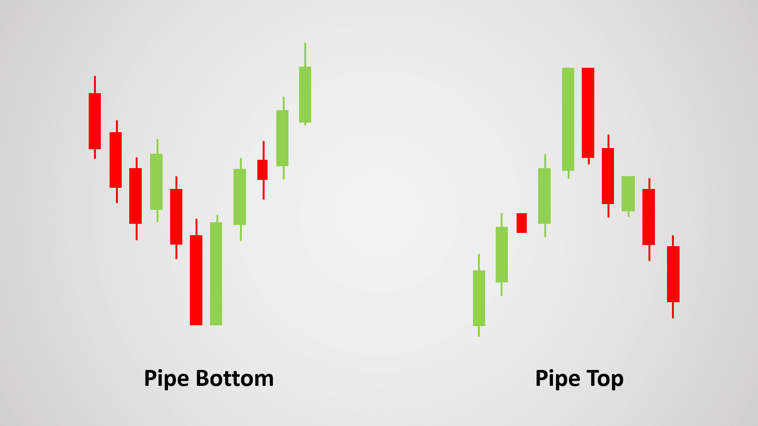

In this article, we are going to discuss double candlestick formation patterns named ‘Pipe Tops’ and Pipe Bottoms’ which were identified by Thomas N. Bukowski (Investor and Technical Analyst). The pattern is suitable for any time frame but it performs better in a longer time frame (weekly or monthly).

Also read: Japanese Candlestick Pattern: MARUBOZU

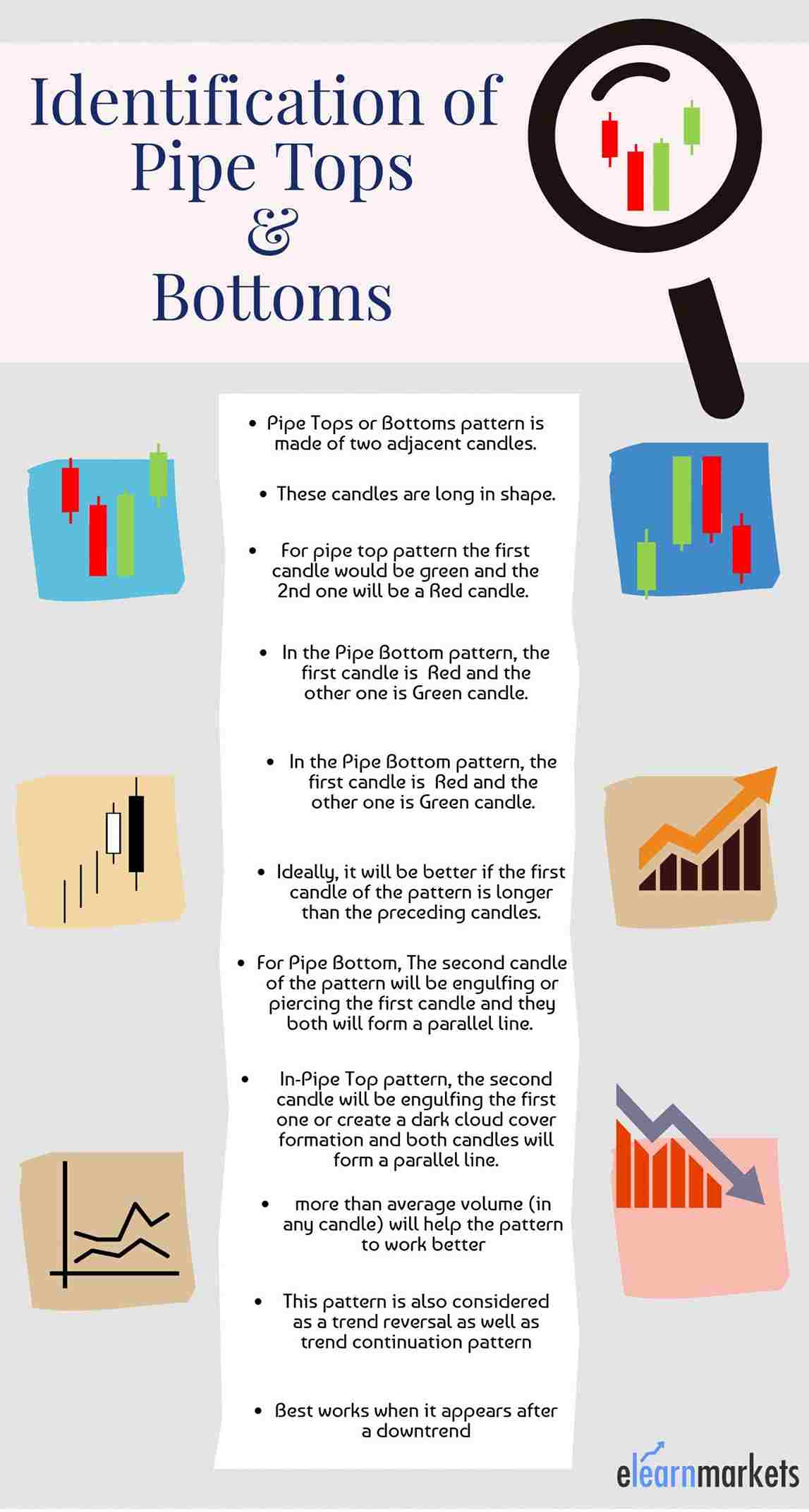

Many of the traders are quite familiar with ‘Bullish Engulfing’ and ‘Piercing Pattern’ as bullish reversal patterns. Some special cases among these two patterns are classified as ‘Pipe Bottoms’. Similarly, on the bearish side, some exclusive instances of ‘Bearish Engulfing’ and ‘Dark Cloud Cover’ falls into the category of pipe tops.

Identification of Pipe Tops and Bottoms

The psychology behind the candles:

There is psychology involved in every candlestick formation. So, it is obvious that the pattern will also have a psychology backing up since they are formed by candles.

Pipe Tops formation indicates that the bulls are exhausted to push the market upwards and bears are preparing to make the market fall. Just the opposite happens in Pipe Bottoms formation Where the Sellers lose their momentum to pull the market further down and the bulls start to take control of the market.

Pipe Tops and Bottom Trading Pattern:

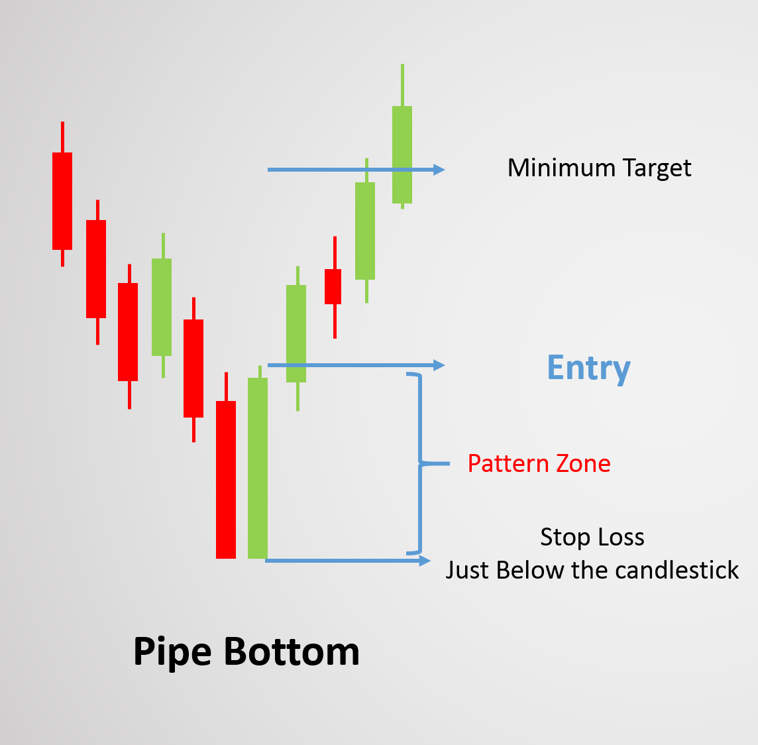

Trading the pattern is our ultimate motto. As we have seen that the pattern is self-expressive, so we can follow the thumb rule here. But what is that thumb rule?

Entry:

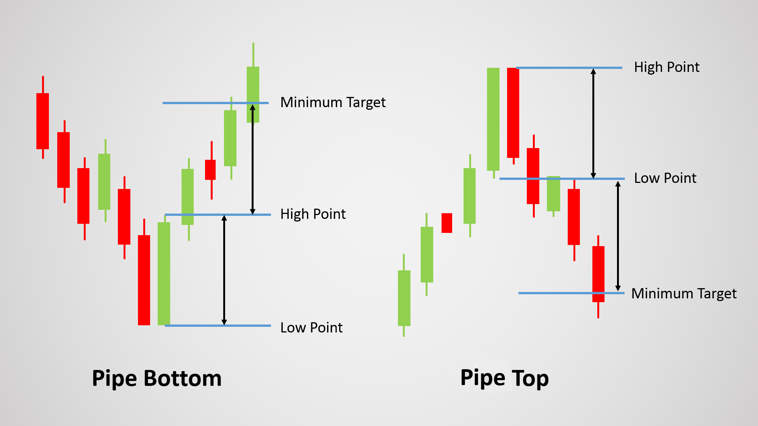

As you know that Pipe bottoms come after a downtrend and it contains a Red (First candle) and a Green (second candle) candle. After the pattern is confirmed we will take a long position. Take your entry after the price crosses the highest point of the pattern.

The exact opposite should be done in case of Pipe Tops formation. On the top of an uptrend, a red candle is formed followed by a green candle. We have to take our short position just below the lowest point of the pattern.

Target:

Booking the profit is little tricky for this candlestick pattern. Basically, traders measure the distance between High and low of the pattern. Then it is added to the highest point of the pattern (For Pipe Bottoms pattern). This should be our first target where we can book our partial or full profit.

Similarly, for Pipe Tops pattern, the difference between high and low points is subtracted from the lowest point of the pattern.

Stop loss:

The stop loss is actually very costly for this pattern. As per the basic thumb rule, we should put our stop just below the pattern. But, in any case, if it gets a hit, the loss will be really expensive to bear.

Otherwise, we can put the stop or get out from the existing position if the price starts trading within the pattern’s range (High and low point).

Real-time Examples:

Here we have the one-day chart of ICICI Bank Ltd (September 2014). After a Prolonged downtrend, the Pipe Bottom formation appears. See how price reverted back from that level.

In the Nifty 50 weekly chart (October 2010), a Pipe Top formation has been spotted. The pattern appeared on the top of an uptrend and after the formation, we witnessed how price fell from that level.

Here is another chart of Nifty 50 (June 2009). This is an example of Pipe Bottom pattern. But, in this scenario, this formation worked as a price continuation pattern. The uptrend started from level 2600 and continued up to level 4600 until it faced the resistance of 5000 level. The pattern appeared after a short-term downfall and from that level, the market again started moving upward with its bullish sentiment.

Conclusion

Candlestick patterns or Bar patterns are always fun to trade. But we have to recognize the pattern perfectly.

We are reiterating the fact that ‘Pipe Bottoms’ are special cases among ‘Bullish Engulfing’ and ‘Piercing Patterns’ where the lengths of two candles forming the pattern are much higher than previous candles. Similarly, in the case of ‘Pipe Tops’.

Timing your entry and exit is also important while trading this kind of pattern. However, In the longer time frame, this rule is not applicable.

You can take the help of moving averages or any indicators and oscillators to take better entry and exit decisions.

Please remember that volume will be the key player when trading this pattern. So always watch for the adequate amount of volume before considering it a pattern.

In order to get the latest updates on Financial Markets visit https://stockedge.com/

Thanks for the auspicious writeup. It actually used to be a entertainment account it. Look advanced to far introduced agreeable from you! By the way, how can we keep up a correspondence?