- What Are Growth Mutual Funds?

- What are the Main Characteristics of Growth Mutual Funds?

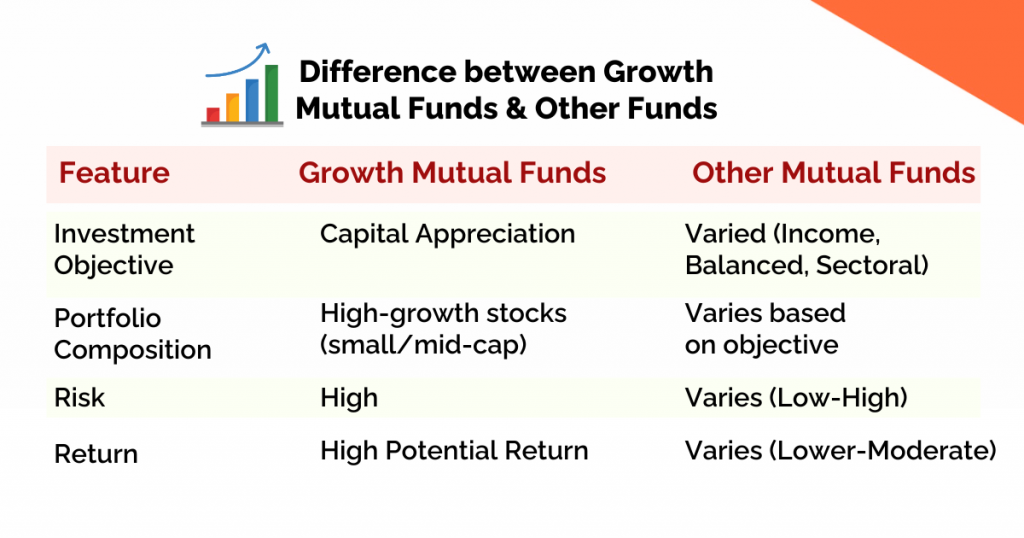

- How Growth Mutual Funds are Different from other Funds?

- What are the Benefits of Investing in Growth Mutual Funds?

- How do fund managers select stocks for inclusion in a growth fund?

- Performance Analysis of Growth Mutual Funds

- How to Evaluate Growth Mutual Funds' Performance?

- How to Select the Right Growth Mutual Fund?

- How to Start Investing in Growth Mutual Funds?

- Conclusion

- Frequently Asked Questions (FAQs)

One common strategy used by people to increase their wealth over time is mutual fund investing.

Growth mutual funds are among the different kinds of mutual funds that are especially made to offer capital appreciation through investments in the stocks of businesses with strong growth prospects.

These funds are a desirable choice for individuals looking to gradually increase their wealth because they promise to provide sizable returns over time.

Mutual funds that primarily invest in the equities of firms predicted to see above-average growth in sales and earnings are known as growth mutual funds.

These funds usually target businesses in developing markets or sectors, as well as those with cutting-edge goods and services that have the potential to become profitable in the future.

Growth mutual fund investment managers look to find and invest in businesses that have the potential to generate big increases in share value.

In today’s blog, let us discuss about Growth Mutual Funds and How can invest in these types of funds:

What Are Growth Mutual Funds?

A particular class of mutual funds known as “growth mutual funds” is dedicated to buying stocks of businesses that have a strong chance of seeing above-average growth in their earnings and share values.

Growth mutual funds‘ main goal is to generate capital appreciation over the long run by making investments in businesses that are anticipated to see rapid growth and increases in market value.

What are the Main Characteristics of Growth Mutual Funds?

Here are the main characteristics of mutual funds:

1. Capital Appreciation

Investing in stocks of businesses that are expected to see significant increases in market value and earnings is the primary objective of growth mutual funds. These funds usually focus on businesses with excellent development prospects that are part of developing sectors or industries, like technology, healthcare, or consumer discretionary.

2. High Growth Potential

Businesses having a high potential for growth are invested in by growth mutual funds. These businesses can be just getting started, offer cutting-edge goods or services, or work in industries that are expanding quickly.

3. Long-Term Focus

Investors with a lengthy investing horizon can typically benefit from growth mutual funds. The fund managers hope to generate substantial returns over time by taking advantage of the compounding impact, even though there may be some short-term volatility.

4. Risk Profile

Growth mutual funds tend to carry a higher risk compared to other types of mutual funds, such as income or value funds. This is because they invest in companies that may not yet be profitable or established, relying heavily on future growth potential.

How Growth Mutual Funds are Different from other Funds?

Growth mutual funds are differentiated from other mutual fund categories by their unique investment goals, approaches, and securities that they focus on.

The following are some salient distinctions between growth mutual funds and other fund categories:

1. Goal of Investment

Growth Funds: Invest in businesses with strong growth potential in the long run with the goal of gaining capital appreciation. These businesses can be less well-known or smaller, yet substantial stock price increases are anticipated.

Other Funds: May have a variety of goals, such as investing in a particular industry (sectoral funds), producing income (income funds), or striving for a balance between income and growth (balanced funds).

2. Composition of a Portfolio

Investments in growth funds often consist of a larger percentage of stocks with strong growth potential. These stocks typically represent mid-sized or smaller businesses with a higher risk profile, known as small-cap stocks.

Other Funds: Depending on the fund’s goal, may invest in a broader range of assets. Balanced funds may contain a combination of growth and value companies, sectoral funds concentrate on a particular industry, and income funds may own a higher percentage of dividend-paying stocks and bonds.

3. Risk and Return

Growth funds: Investing in them is typically associated with high risk and big profit. Larger losses are a possible along with the potential for huge profits, particularly in the near term.

Other Funds: The type of fund affects the risk-return profile. Compared to growth funds, income and balanced funds are typically less volatile, with smaller potential returns but also reduced risk. Depending on the performance of the selected sector, sectoral funds may be more volatile.

What are the Benefits of Investing in Growth Mutual Funds?

Here are the Benefits of Investing in Growth Mutual Funds:

Potential for Higher Returns

Investing in businesses with substantial growth potential is the goal of growth funds. In comparison to other investing possibilities, these companies may be smaller or more recent, and although while they entail greater risk, their stock prices have the potential to rise significantly over time.

Exposure to Companies With Strong Growth Potential

Growth funds, as previously indicated, concentrate on businesses that have the potential for growth that is above average. As a result, investors can take advantage of these companies’ potential and profit from their success.

Diversification

Growth funds invest in a variety of growth-oriented companies across several industries, notwithstanding their focus on growth-oriented enterprises. This diversity lessens the impact of a single company’s underperformance on the fund as a whole and helps disperse risk.

Capital Appreciation

Compounding is advantageous to investors in growth funds since they reinvest their earnings, including dividends and capital gains, back into the fund. This implies that returns are produced on both the initial investment and the cumulative earnings, which could, in the long run, result in a sizable capital appreciation.

How do fund managers select stocks for inclusion in a growth fund?

For growth funds, fund managers choose stocks using a blend of research methods and investment philosophies as discussed below-

Investment Approaches

Top-down vs. Bottom-up: Regardless of the state of the economy as a whole, bottom-up selection places an emphasis on the competitive advantages, growth potential, and fundamentals of individual enterprises.

Top-down selection finds businesses with great development possibilities within selected sectors after first analyzing the economy as a whole and prospective industries.

Research Methods

Financial statement analysis: To evaluate a company’s revenue growth, profitability margins, debt levels, and general financial health, managers carefully review its financial statements.

Growth measures: A company’s potential for growth can be determined in large part by looking at measurements like return on equity (ROE), earnings per share (EPS) growth, and sales growth rate.

Management analysis: An important consideration is the calibre and background of a company’s management team. Effective leadership is necessary to overcome obstacles and promote future development.

Market research: Determining a company’s long-term survival requires an understanding of the competitive environment, industry trends, and prospective disruptions.

Performance Analysis of Growth Mutual Funds

Here are some of the Factors influencing the performance of growth mutual funds-

Stock Selection: One important consideration is the fund manager’s capacity to recognize businesses with real growth prospects. Their research methods and investment philosophies have a big influence on the fund’s performance.

Market Conditions: Growth funds generally benefit from bull markets since growth equities have substantial price increases and investor sentiment is generally optimistic. On the other hand, growth funds may have difficulties during downturn markets because to the possibility of a drop in firm valuations and selling by investors due to risk aversion.

Industry Performance: The growth fund’s overall returns are significantly influenced by the performance of the industries it invests in. Rapidly expanding industries like technology or healthcare can greatly improve the performance of the fund.

Economic Factors: Government policies, interest rates, and inflation can all affect a company’s potential for growth and, in turn, the success of growth funds.

Below are some of the best performing growth mutual funds-

| Funds Name | AUM | Returns (3YEAR) | Benchmark return |

| Nippon India Multi-Cap Fund | 27746 | 32.88 | 19.77 |

| SBI Contra Fund | 26777 | 31.54 | 17.99 |

| HDFC Large & Midcap Fund | 17314 | 27.42 | 19.08 |

| ICICI Pru Focused Equity Fund | 7583 | 25.09 | 19.77 |

| ICICI Pru Dividend yield Fund | 3626 | 32.67 | 19.77 |

How to Evaluate Growth Mutual Funds’ Performance?

Benchmarking: Examine the fund’s performance in relation to an appropriate benchmark index, such as the Nifty Next 50 Index, which monitors the performance of the 50 largest Indian companies that follow the Nifty 50. This aids in evaluating the fund’s performance in comparison to the market as a whole.

Risk-adjusted returns: Take a look at measures that take both returns and risk into account, such as the Sortino or Sharpe ratios. Better success in relation to the fund’s level of risk-taking is indicated by a greater ratio.

Return consistency: Assess the fund’s return consistency over an extended period of time. In general, a fund that continuously performs well is seen as more dependable.

How to Select the Right Growth Mutual Fund?

Investment Goal: Make sure your financial objectives line up with those of the fund. Think about your investing horizon and risk tolerance.

Fund Manager’s Past Performance: Examine the fund manager’s track record of managing growth funds and experience.

Expense Ratio: Investors who have lower expense ratios will see larger returns.

Portfolio Composition: Examine the fund’s holdings to learn about the industries and kinds of businesses it supports. Make sure it fits your investing objectives and risk tolerance.

How to Start Investing in Growth Mutual Funds?

Here are the steps that you follow to start investment in the Growth Mutual Funds-

1. Assess Your Risk Tolerance and Investment Horizon

Risk Tolerance: Because growth funds concentrate on businesses with a less track record, they naturally incur higher risk than other mutual fund categories. You must assess your comfort level with possible losses with sincerity.

Investment Horizon: Growth funds provide you time to ride out market turbulence and take advantage of potential compound growth, making them excellent for long-term investment goals (preferably five years or more).

2. Do Your Research

Gain an understanding of growth funds by familiarizing yourself with their features, advantages, and risks (as previously described).

Look at Possible Funds: Examine the range of growth funds that are available in India from major asset management companies (AMCs). To compare different funds, use internet tools such as Morningstar, Value Research and StockEdge

3. Choose an Investment Platform

Growth funds can be purchased directly from the AMC website (direct plan) or via an advisor or distributor (standard plan). Generally speaking, direct plans have lower expense ratios.

Investments in mutual funds can also be made through a number of mobile apps and online investment platforms.

4. Start Investing

Select the amount of money you want to invest after deciding on a platform and growth fund. A Systematic Investment Plan (SIP) enables you to invest a defined amount on a regular basis (monthly, quarterly, etc.), fostering discipline and possibly averaging out the cost per unit over time. Alternatively, you can invest a lump sum.

Conclusion

To mitigate risk, diversify your portfolio by allocating investments across various growth and other mutual fund categories. To capitalize on future growth and avoid making impulsive decisions during market volatility, maintain a long-term perspective on your investments. Use tools like an SIP calculator to plan your investments more effectively and estimate potential returns over time. Regularly monitor your portfolio and rebalance it when necessary to maintain the right asset allocation. Remember, this is a general guideline. Consulting a financial expert can provide personalized investment advice.

Frequently Asked Questions (FAQs)

1. What are growth mutual funds?

Mutual funds specializing in growth make investments in businesses with strong potential for stock price growth. These businesses are usually more recent, smaller, and in fast-growing sectors. In comparison to other mutual funds, they are riskier even if they have the potential for larger rewards.

2. What are the risks associated with growth mutual funds?

Growth mutual funds are often more erratic and are prone to large value swings, particularly in bear markets. If they have a high concentration in a certain industry, they could also be more vulnerable to dangers unique to that industry.

3. How should I evaluate a growth mutual fund?

A growth mutual fund’s past performance in comparison to its peers and benchmark, the fund manager’s background and style of investing, costs and fees, and the structure of the fund’s portfolio should all be taken into account.