Penny stocks!! Yes, you heard it right! You must have heard about this term? If not, then penny stocks are those stocks that trade at a very low market price and have a very low market capitalization. These kinds of stocks in the Indian stock market have low liquidity and are speculative.

The stock market investors are interested in investing in the penny stocks as they are low prices; they believe prices can double easily and because of a good convincing narrative.

But before investing in penny stocks, an investor should note that several key factors affect the way these stocks are traded and should have a solid understanding of the inherent risks that follow.

So, in today’s blog, we will discuss what penny stocks are and how should you pick the best penny stocks to buy for investing-

What are Penny Stocks?

Penny stocks are stocks of those companies which trade with a low share price and are issued by those companies whose market capitalization is less than 100 crores. But one should note that every stock having a low price does not mean that it is a penny stock. The company’s market capitalization should be small and less than 100 crores. One should note that the classification for the US and that of the European market would be different.

For example, Vodafone Idea Ltd. trades around Rs. 13, but it is not a penny stock as the company market capitalization is around 31,500 crores.

Let us discuss a case study on a penny stock:

A Case Study on Penny Stocks

Vakrangee Softwares Ltd: A little-known stock was capturing all the headlines back in January 2018. It made headlines because its market capitalization had surpassed 50,000 crores.

The market capitalization of the tiny software company was larger than that of corporations with revenues and profits about four to five times that of the tiny software company.

Vakrangee’s investors rubbed their hands with delight. After all, in just two years, the stock had become a ten-bagger. Vakrangee was UIDAI’s largest enrollment agent at the time, with over 50 million Aadhaar enrolments completed.

It was investigated by a market regulator for allegedly manipulating the price and volume of its own stock on the Bombay Stock Exchange (BSE) and the National Stock Exchange (NSE). According to reports, a group of 22 clients were linked.

What are factors to consider when picking the right Penny Stocks for Investing?

Below are the factors one should check before investing in any penny stock:

1. Price Behavior

So, price behaviour is one of the ways to judge whether the price is becoming strong or not. But for identifying a good penny stock, price behaviour is not enough. One should look at other factors as discussed below.

2. Changes in Business

One should also note what the changes in the business are? Is the company doing an expansion? Or has the management changed? Or whether revenues are growing?

So, the impact of all these things can be seen on performance. So, if we find out companies around the performance of its business that is a penny and any type of recovery can be seen.

3. Fundamentals of the Company

Also, checking the fundamentals of the company is essential. Below are some of the essential fundamentals that one should check before investing in any company:

4. Market Capitalization

First of all, one should check the company’s market capitalization to know whether the stock falls under the small market capitalization criteria. We have taken an example of California Software Company Ltd:

As we can see, this company’s market capitalization is below Rs. 100 crores i.e. 63.37 crores. So it is a penny stock.

5. Net Sales/EBITDA

We should check whether the Net sales and EBITDA of the company is rising or not. As in the case of California Software Company Ltd., we can see both increasing as shown below:

6. Shareholding Pattern:

Also, we should check whether the promoter of the company is increasing or not and who is the non-institutional investing in the company.

7. Cash from Operation

We should also check cash from operations from which the company is generating its business, so in the previous quarter, the company generated cash from operations in this case:

8. Company’s Website

You also need to study the company’s website a little bit as it will give you an idea of whether the company is genuine or is it a shell company?

Shell company means it’s not a company. It is only making us feel about its presence.

9. Management of the Company

Checking the company’s management is one of the most significant criteria for investing in penny stocks. Therefore, one should doubt that company that does not have details of its management on its website.

Typically, good management has a LinkedIn profile on the page. If there is no LinkedIn here, then we can doubt that company.

Advantages and Disadvantages:

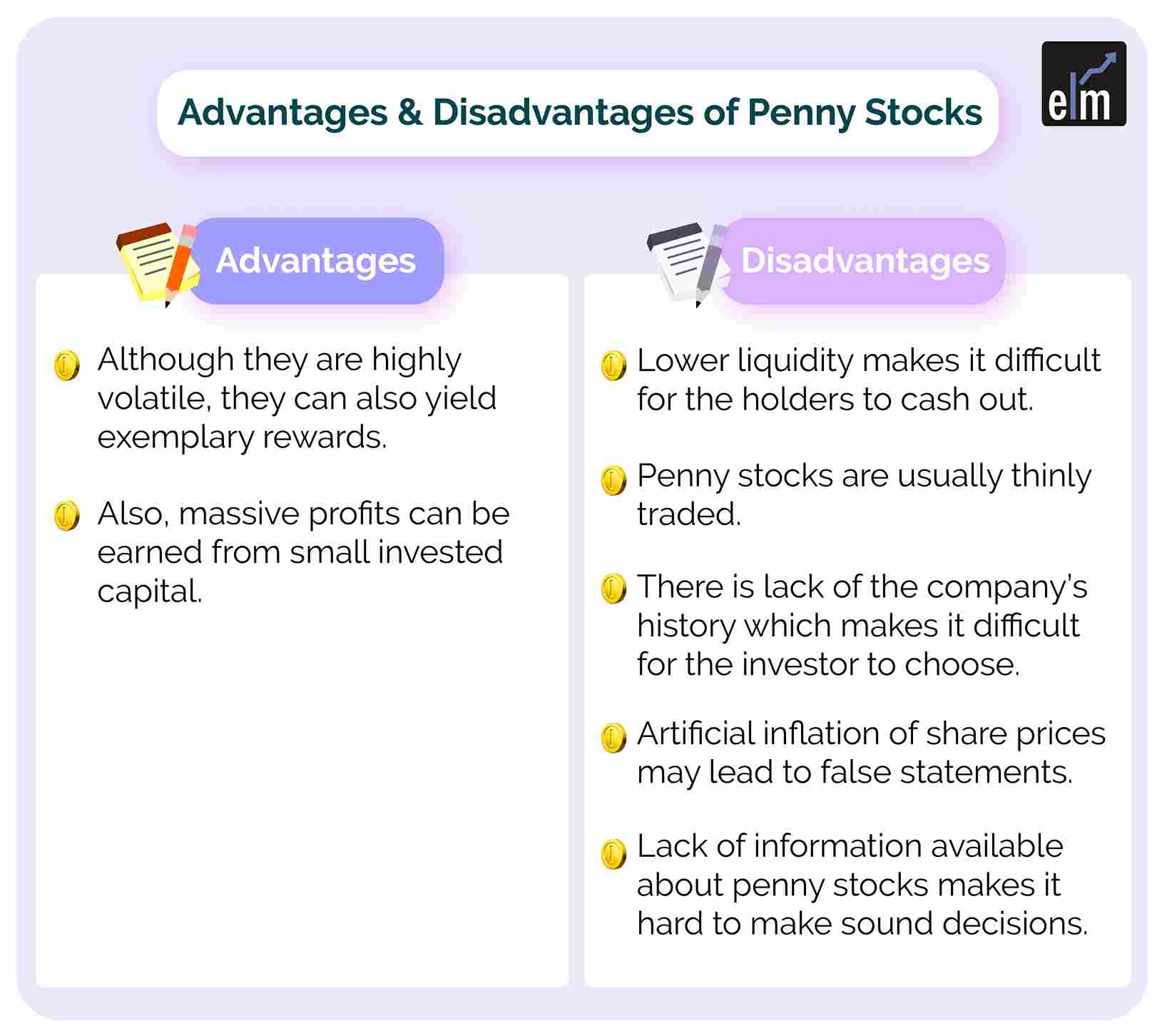

Advantages of Penny Stocks

- Although they are highly volatile, they can also yield good rewards.

- They have the potential of high growth in a short span and thus have become popular choices among investors.

- Also, massive profits can be earned from small invested capital.

Disadvantages of Penny Stocks

- Lower liquidity makes it difficult for the holders to cash out. When an investor wants to sell the shares, he/she might not sell them immediately because of the lack of buyers available in the market.

- Penny stocks are usually thinly traded.

- As there is a lack of company history, penny stocks make it difficult for the investors to choose their purchase as such companies would possess a poor track record or no record.

- Artificial inflation of share prices may lead to false statements regarding the company’s situation, a form of fraud in the microcap stocks.

- When the price is falsely and sufficiently inflated, the people who are ready to commit fraud will dump the shares and record instant profits.

- The lack of information about penny stocks to the public makes it hard to make informed decisions about investments.

Using Combination Scan in StockEdge for finding the right penny stocks

We can also make a combination scan with the help of StockEdge by combining fundamental scans for filtering out strong penny stocks, as shown below:

After creating, we will get a list of stocks that fulfil the above fundamental parameters.

Also, watch our video on How to find the right Penny Stocks

Bottomline

When you find high-quality, fundamentally strong penny stocks with good management teams, patented technologies and proven upside potential, you can multiply your money. We hope you found this blog informative and use it to its maximum potential in the practical world. Also, show some love by sharing this blog with your family and friends and helping us in our mission of spreading financial literacy.

Happy Investing!