No one probably feels like losing money in the stock market. In the market, the pain of losing money is much greater than the happiness of earning some. If you’re thinking of making an investment in the stock market but worried about ending up with a loss or the very thought of loss upsets you, you shouldn’t invest in the stock market. Through this article, we will help you understand how the market works and why prices go up and down. Moreover, we will also discuss how to start with the stock market for the novice, for trading and investment perspective.

What comes to your mind when you listen to the word “stock market”?

The answer to this question would be quite different to people based on their level of understanding on the market.

If you ask me, what comes to my mind, here’s a small list-

1. Money

2. Trading screen

3. Warren Buffett

4. Profit and loss

5. Excitement and many more

Before going deep into this, let’s start with the very basics of the stock market.

What is the stock market?

The stock market is a mechanism in which the shares of publicly traded companies are issued, bought and sold. It is one of the most important parts of the free market economy. The stock market helps your small money grow into big sum and become wealthy without involving the risk of starting a business. To many people, the stock market is nothing more than a gamble, but it isn’t actually a gamble.

Say you take Rs 500 to invest in the stock market. One roll of a dice, where on your win you gain Rs x and in case of loss, you lose the entire Rs 100. While if you invest in a stock market, it’s hard when you will lose all your money unless there’s a serious problem with the company like in the case of Kingfisher Airlines and there’s nothing much to explain in this regard.

Also Read: How to Invest in Shares: A Beginner’s Guide

How does a stock market work?

The rise or fall in the stock prices is determined by a number of factors which include demand and supply, political or social unrest, media, availability of suitable alternatives, the opinion of renowned and big investors like Rakesh Jhunjhunwala, natural disasters, etc. These factors along with suitable information help create a bullish or bearish sentiment in the economy.

Source: http://www.technicalanalyst.co.uk/

Accordingly say if the number of buyers is more than sellers, stock prices will certainly go up. Similarly, the stock price will tend to fall if numbers of sellers exceed the number of buyers.

What makes the stock market so unpredictable?

Let’s explain this discussion with an example. Say the stock prices have been rising for several years so few investors will sit on the sidelines holding cash and waiting for the opportunities to go short. But the point is how to judge exactly when the selloff will take place. The important question here is that if you are on the sidelines, how to understand when to invest in the stock market? However, if you are already in the market, how to judge when to exit the position. If making a prediction about the market were so easy, then these questions would have been answered easily but actually, it’s not the case.

Now since we are done with the basics of the stock market, let’s understand how a novice can start with the stock market-

When is the right time to invest in the stock market?

Are you willing to learn or planning to build your career in the stock market?

So what are you waiting for?

If you are concerned about your age to learn in markets, let me tell you that there is actually no age bar to learn and invest in the stock market.

There’s a famous quote by Martin Luther King (Jr) which says-

The time is always right to do what is right.

Let me take two examples to show that there’s actually no age to do anything in life-

The first example is of Harland David Sanders (the man behind the KFC), who started his career in his 40’s and he franchised his secret recipe “Kentucky Fried Chicken” at the age of 62. Soon after that, he got very successful.

The next example is of legendary investor, Warren Buffett who started his career at the age of 11. If you are new in the field of the stock market, you must know or have heard about Warren Buffett. He is a renowned investment guru and one of the most respected and richest businessmen in the world.

Warren Buffet said-

These two examples prove that there is actually no age to do anything in life.

How to start with the stock market for a novice?

1. Start with Warren Buffett’s letters to shareholders (which is like a bible to investors). It may so happen that you face a problem with some aspects of the letters but these letters are supposed to be read and re-read again and again to keep gaining the wisdom and knowledge from it.

Download the shareholder’s letter of Bershire Hathaway (Warren Buffet’s company).

2. As a novice, you should read business newspapers like Economic Times, Business Standards, Mint, etc, and watch business channels like CNBC, Zee Business, etc before you actually invest in the stock market.

3. Start reading books like-

a. One up on Wall Street by Peter Lynch

b. The Intelligent Investor by Benjamin Graham

c. Learn to Earn by Peter Lynch

Two important tips to keep in mind in the stock market are as follows-

i. Start early

ii. Money management techniques

Once you gain a basic understanding of the market, we’ll move on to the next level.

Beginner’s Checklist for Stock Market

Stock Market for trading minds

If Charts and Technical patterns interest you, it seems that you are drawn towards Technical Analysis. So if you are new to this field, here are few guidelines you can follow to build your base in Technical analysis.

1. Read Good Books

Start with good books on Technical Analysis like-

a. Reminiscences of a Stock Operator (By Edwin Lefevre)

b. Trading for a living (By Alexander Elder)

c. Technical Analysis of the Financial Markets (By John J Murphy)

d. Japanese Candlestick Charting Techniques (By Steve Nison)

e. Encyclopedia of Chart Patterns (By Thomas Bulkowski)

2. Learn Technical Analysis

If you are willing to learn technical analysis from very basic, you can take up a course at Elearnmarkets. Check about the Technical Analysis Course certified by NSE Academy.

Moreover, you can also go through the study material or videos in google to develop an understanding of technical analysis.

3. Read articles and blogs

You can regularly go through good blogs or articles or videos like-

a. StockCharts

b. Tradeacademy

4. Virtual trading is important

Paper trading is a good way to track your performance and understanding on the subject. Moreover, you can use Moneybhai by Moneycontrol for virtual trading. This process is very important before you start to invest in stock market.

5. Market Psychology

Psychology plays a very important role in trading just like in a game of chess or in athletics. As a trader progresses from novice to expert, the understanding of both individual and crowd psychology becomes extremely relevant to become a successful trader apart from gaining the basic knowledge like chart patterns, risk management, market structure etc. With the market becoming extremely competitive day by day, traders are facing a lot of challenges which are sure to test their skills and limit of their psychologies.

Also Read: Mastering Trading Psychology and Money Management to Trade Effectively

6. Follow good traders

Start following good traders in the world. Read about them, their trading strategies, their books, etc and it will surely benefit you in your trading career in the long run. Some of the well-known names in the industry are as follow-

a. Paul Tudor Jones

b. Jack Swagger

c. Alexander Elder

d. Martin J Pring

e. John J Murphy

7. Opt for a Professional degree

You can opt for CMT course, to gain specialization and detailed knowledge on technical analysis.

Stock Market for Investment minds

1. Books should always be the first step

Someone has rightly said-

“Books are one’s best friend”

Some of the good books on fundamental analysis are as follows-

1. The Intelligent Investor by Benjamin Graham

2. Competitive Strategy by Michael Porter

3. The Essays of Warren Buffett by Lawrence Cunninghan

4. Buffettology by Mary Buffett and David Clark

2. Education is important

Fundamental Analysis is a vast subject that starts right from reading Annual Reports and sector reports to analyzing financial statements to the valuation of the company. It’s better to get proper education on fundamental analysis, equity valuation, and financial planning.

3. Read annual report of companies

There can be no better piece of information about a company than annual reports. It may look like a collection of pages which companies send at the end of the year and reading it may seem to be a time-consuming and boring job. However, it is a very valuable piece of information about a particular company. In the annual report, the company’s management discusses the important aspects about the company like industry performance, its vision for the long term, opportunities and threats faced by the company, the company’s historical performance, etc.

Some of the important things which we need to focus on while reading the annual report includes-

a. Chairman’s letter

b. Financial highlights- It gives a snapshot of the performance of the company.

c. Director’s report and MD&A section

d. Financial performance- It provides 10 years summarised track record

e. Financial statements

Few of the important areas where we should focus while reading annual and comparing the annual reports:-

i. Debt scenario of the company

ii. Salaries drawn by the key personnel of the company

iii. Actions by the leading shareholders of the company

4. Read good blogs and magazines

Blogs are a good source of learning in today’s era where we are so busy with so many works. Reading blogs or articles helps you gain a lot of understanding on the subject and build a storehouse of knowledge. Some of the blogs you can start with are given below-

5. Make idol and follow

There are so many learned investors across the globe whom you can follow and learn from them. Read their biographies or autobiographies, their lessons, and investment techniques. Some of the well-known investors whom you can follow are as follows-

a. Warren Buffett

b. Charlie Munger

c. Jim Rogers

d. George Soros

e. Rakesh Jhunjhunwala

6. For specialization

You can opt for CFA course, to gain specialization and detailed knowledge on fundamental analysis.

How to generate Stock Investment ideas?

Once you start making investments in the stock market, the question arises as to how to maintain the flow of investing ideas.

This is one of the important discussions in the investment world. Out of so many companies listed on the exchange, it becomes really difficult to conduct research and decide which companies to invest.

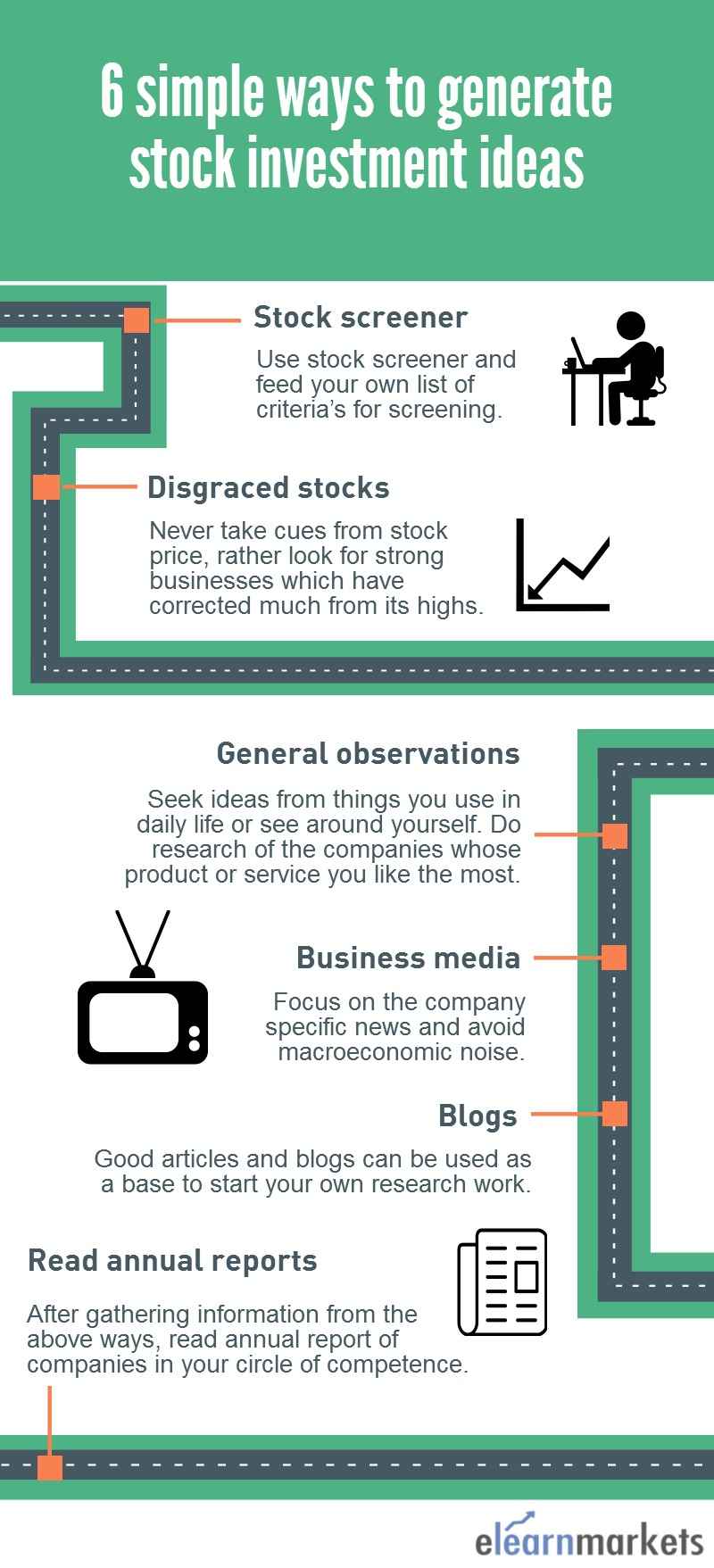

So if you think that it is very difficult to implement practically, here’s a list of ways to generate simple stock investment ideas-

i. Stock Screeners- Use a stock screener and feed your own list of criteria for screening.

ii. Disgraced Stocks- Never take cues from the stock price, rather look for strong businesses which have corrected much from its highs.

iii. General observations- Seek ideas from things you use in daily life or see around yourself. Do research on the companies whose products or services you like the most.

iv. Business media- Focus on the company-specific news and avoid macroeconomic noise.

v. Blogs- Good articles and blogs can be used as a base to start your own research work.

vi. Read annual reports- After gathering information from the above ways, read the annual report of companies in your circle of competence.

Power of Trading and Investment together:

It has been seen that they are able to generate better stock picks if you combine the expertise of both trading and investment. Some of the well-known personalities who have done really well by combining the expertise of both trading and investments are as follows-

a. Paul Tudor Jones

b. Mark Minervini

c. Rakesh Jhunjhunwala

Money Management techniques

Money management is a technique for managing money that encompasses investments, expense control, tracking, budgeting, and taxes and it involves greater control of your incoming and outgoing.

In the field of investment, money management deals with the decision of how much risk an individual should take in case of an uncertain situation. To be more specific, it highlights what percentage or amount of the individual’s wealth should be risked so as to maximize the individual’s utility function.

In the stock market, it plays an important role in every success of a trading system. It has a close link with trading expectancy, which can be defined as the average amount you can expect to win or lose with every rupee at risk.

Let’s take an example that how money management plays a key role in your trading and investment life. Say the probability of profit and loss of all trade stands at 60:40, so using money management a trader can set his average win substantially higher compared to his average loss in order to produce a profitable trading system. On an average basis, say if the win fetches him around Rs 1000 per trade while the losses are limited to Rs 250 per trade, the expectancy stands at-

Expectancy = (Trading system Winning probability * Average Win) – (Trading system Losing probability * Average Loss)

= (0.6 x 1000) – (0.4x 250)= Rs 500 i.e. the net average profit stands at Rs 500 per trade.

In simple words, the mantra of successful money management is to maximize every winning trade and minimize all loss-making trades (regardless your %Loss probability > %Win probability).

Start investment with little money

It’s wise to see investment as something to be started small and then grown. It’s better to start where you are if you have little money or very less capital. However, even if you have a good capital base, it’s better to start small so that any big mistake doesn’t affect you much.

If you are a working professional with little extra money each month after paying off all your expenses, it’s better to start with little money every month. It’s better to start with a SIP every month rather than direct equity if you do not have much idea about markets and have no time to track the markets.

Also Read: Why should we invest in Systematic Investment Plans (SIP)?

Bottomline

We hope that this article helped and guided you in walking on the right track to further learning and decision-making in the stock market. A lot of time, dedication, patience, and effort will be required to become a successful trader and investor. To conclude, the stock market has so much to learn, so the process of learning should never be stopped, and rather it’s important to learn from your mistakes.

Do write us in the comment section if you face any query in any aspect of the financial market.

Stay happy and keep learning!

What a post, I love this and would like suggest to all to read this before investing your money.

Unable to locate NSE Pathsala on NSEINDIA.com

Hi,

NSE pathsala has been discontinued.

Thank you for reading!

Keep Reading!

No doubt it is giving basic Knowledge. Have you any courses for Intemediate people

alredy experienced in Stcokmarket.Please let meknow

Hi,

You can check our course here: https://www.elearnmarkets.com/

Glad to be one of the visitors on this awing website : D.

Thank you so much!!!! Learnt a lot from this post and would surely like to suggest every one.