Fibonacci Retracement levels help us to identify reversal areas thus helping us in identifying entry points or exit points after a pullback.

Some of the traders use this technical indicator sometimes while others traders use it regularly.

It does not how often the traders use retracement levels, but it is important to use it correctly every time we trade.

Here are some of the mistakes that traders should avoid while trading with Fibonacci.

1. Not keeping Reference Points Consistent:

One should keep the Fibonacci reference points consistent when they draw retracements levels on the charts.

So, when drawing the it on the charts one should draw if from the lowest price of a trend through the top of a trend and from the lowest price of the trading session to the highest price of the close of a session.

This means one should take Fibonacci reference points from candle body to candle body and from shadow to shadow.

The wrong reference points lead to incorrect analysis.

Traders often make mistakes when they draw it from a candle wick to the candle’s body.

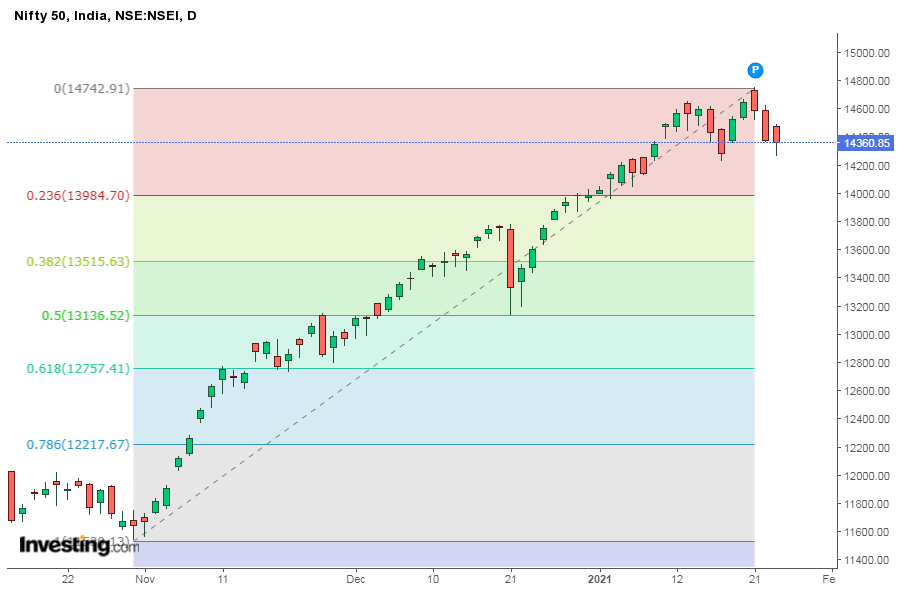

Below is an example of how Fibonacci levels should be drawn on the charts.

From the above Daily chart of Nifty 50, we can see how Retracement levels are drawn from the lowest wick to the highest wick through the uptrend.

2. Ignoring Long Term Trends:

Novice traders try to pullbacks in the short term without looking at the longer trend.

The short-term traders make mistakes by this narrow perspective.

The traders can apply it by looking at the long-term trend in the correct price direction of the momentum and this will help in picking trading opportunities.

3. Relying on Short Term Trends:

There is a lot of volatility in day trading because of this retracements are not that effective in a short timeframe as compared to the longer term.

Retracement levels are less reliable in the shorter timeframes.

Volatility can often change support and resistance levels which makes it difficult for the traders to pick or choose which support and resistance levels can be traded.

Also in the short-term timeframe, spikes and whipsaws are also very common.

This makes it difficult for the traders to place stop-loss or to book profits when using the retracements levels for short-term trading.

4. Using Fibonacci Alone:

Fibonacci is a reliable trade setup but one should not trade without confirmation by other technical indicators.

Traders can apply other technical tools like RSI or stochastic oscillators that will help in confirming the trade opportunity and also increase risk-reward ratio for a good trade.

Traders can also use candlestick patterns when confirming the trading signals given by the retracement levels.

To learn more about Fibonacci you can check out Technical Analysis Made Easy

Key Takeaways:

- One should keep the Fibonacci reference points consistent when they draw Fibonacci retracements levels on the charts.

- The traders can apply Fibonacci retracements by looking at the long-term trend in the correct price direction of the momentum and this will help in picking trading opportunities.

- Fibonacci is a reliable trade setup but one should not trade without confirmation by other technical indicators.

- Retracement levels are less reliable in the shorter timeframes.

Happy Learning!