The abandoned baby pattern is a multiple candlestick reversal patterns.

This candlestick pattern is similar to the morning and evening star candlestick patterns.

The main difference between this pattern and morning star and evening star is that real bodies and shadows cannot overlap.

Due to this, the abandoned baby pattern is a unique and reliable candlestick pattern.

While this candlestick pattern has a baby in its name the formation of this is similar to the island reversal pattern.

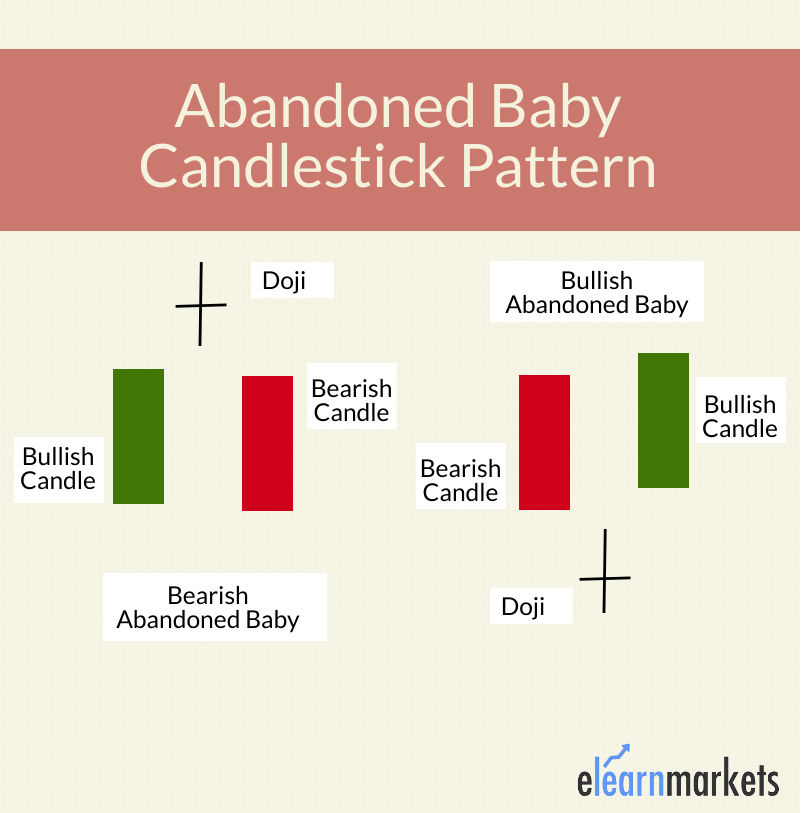

What is Bullish Abandoned Candlestick Pattern?

The bullish abandoned baby pattern signals reversal to an uptrend and is used by the traders to enter a buy position.

It is formed at the end of a downtrend and is composed of three candlesticks.

The first candlestick is a large bearish candle that is followed by a Doji candle that gaps down.

The third candlestick opens higher than the Doji and is usually a bullish candle.

After the formation of this pattern, traders expect that the price will continue to move up and bulls are back into action.

What is Bearish Abandoned Candlestick Pattern?

The bearish abandoned baby pattern signals reversal to the downtrend and is used by the traders to exit a buy position and enter a short position.

It is formed at the end of an uptrend and is composed of three candlesticks.

The first candlestick is a large bullish candle that is followed by a Doji candle that gaps up.

The third candlestick opens lower than the Doji and is usually a bearish candle.

After the formation of this pattern, traders expect that the price will continue to move down and bears are back into action.

Learn to Identify Trend Reversals with Candlesticks in just 2 hours by Market Experts

Formation of Abandoned Baby Pattern:

Here is the formation of Abandoned Baby Candlestick Pattern:

What does Abandoned Baby Candlestick Pattern tell us?

As we have discussed above abandoned baby pattern is a reversal candlestick pattern.

A bullish abandoned baby pattern signals an end of the selling pressure of the bears and the return of the bulls in the market.

On the other hand, bearish abandoned baby signals that bulls are leaving and indicate the return of the bears in the market.

The psychology behind the formation of a bullish abandoned baby suggests that the market has witnessed a significant sell-off in the first candle.

Because of this reason a bearish candlestick is formed.

A Doji candlestick pattern is formed afterward, which confirms that now a market is uncertain as to the opening and closing prices are the same.

In this case, it indicates that the bears are losing their grip and the bulls are taking over the market.

The third bullish candle confirms that the trend has been reversed to an uptrend and also gaps higher from the Doji.

The psychology behind the formation of the bearish abandoned baby suggests that the market has witnessed a significant buy-off in the first candle.

Because of this reason a bullish candlestick is formed.

A Doji forms afterward, which confirms that now a market is uncertain as to the opening and closing prices are the same.

In this case, it indicates that the bulls are losing their grip and the bears are taking over the market.

The third bearish candle confirms that the trend has been reversed to the downtrend and also gaps lower from the Doji.

Trading with Abandoned Baby Candlestick Pattern:

Traders should remember the following points when they trade with this candlestick Pattern:

- The prior trend should be an uptrend in the case of the Bearish Abandoned Baby pattern and the prior trend should be downtrend in the case of the Bullish Abandoned Baby pattern.

- The shadows and real bodies should not overlap with each other.

- The third candle should be in the opposite direction of the first-day candle and also should gap in the opposite direction of the Doji.

Traders can place a stop-loss just below the down shadow of the Doji in the case of a bullish abandoned baby.

Similarly, in the case of bearish abandoned baby traders can place a stop-loss just above the upper shadow of the Doji.

Traders should confirm the formation of this pattern with other trading tools like Fibonacci Retracement, or the moving average.

Key Takeaways:

- The abandoned baby candlestick pattern is a multiple candlestick reversal pattern.

- The bearish abandoned baby signals reversal to the downtrend and is used by the traders to exit a buy position and enter a short position.

- The bullish abandoned baby signals reversal to an uptrend and is used by the traders to enter a buy position.

- Traders should confirm the formation of this pattern with other trading tools like Fibonacci Retracement, or the moving average indicator.

Happy Learning!

I am extremely hsppy about your efforts in educating retail entrants.it gives me lot of interest to lern when to enter in buy /sell. God bless u & takes to u higher & higher. All the best.

Hi,

We are glad that you liked our blog post.

Thank you for Reading!

Thanks for sharing the valuable information.

Hi,

We are glad that you liked our blog post.

Thank you for Reading!

such great information., Thank you for sharing with us..,

Hi,

We are glad that you liked our blog post.

Thank you for Reading!

Very well explained about the things. Keep going.

Hi,

Thank you for Reading!

Keep Reading!

The blog is really good. Thanks for sharing it.

Hi,

Thank you for reading our blog!!

Keep Reading!