The recent lockdown to prevent the spread of COVID-19 has led to financial disruption in the economy including the RBI’s EMI Moratorium facility.

This has led many businesses to pause their operations, especially those businesses that do not fall under the essential services category. This has caused many small businesses and individuals to forgo their stable income sources.

This has led Reserve Bank of India to instruct lenders like Banks, NBFCs and Housing Finance Companies and other financial entities to grant three-month moratorium to all borrowers on their Equated Monthly Installments (EMI) on repayments of term loans and credit card dues.

This was a much-needed abatement for borrowers who may face liquidity issues amid the financial disruption caused by the pan India mandated lockdown.

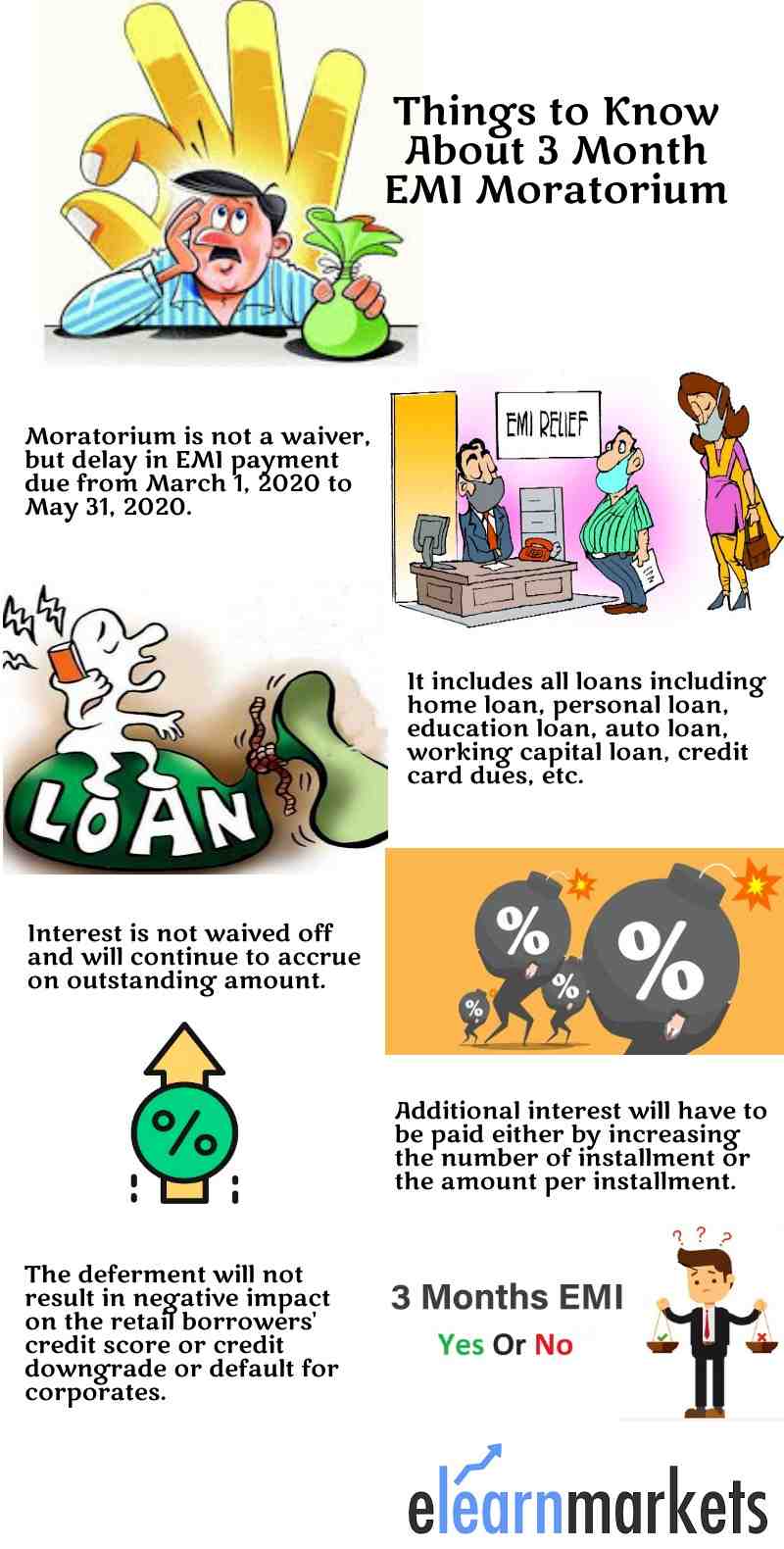

But remember, Moratorium is not a waiver.

So, what is moratorium all about, let us take a closer look.

Basically, a moratorium simply means an authorized or legally sanctioned period of delay or waiting. And in this case, it is on the payment of principal and interest on loans and credit card dues either for Individuals or for Institutions.

So, it is not a waiver, it simply means that if a borrower avails of this three- month breather, in this case between March 1,2020 and May 31, 2020, he would still have to pay the due amount after the moratorium is over.

The dues outstanding over the three-months will not vanish from the lender’s list of liabilities. The accumulated amount has to be paid after the moratorium period, i.e., when the three months are over.

So who can give or receive Moratorium?

All commercial banks including rural banks, small finance banks, and local area banks, co-operative banks, all India Financial institutions and NBFCs (housing finance companies and micro-finance institutions), are eligible to choose to offer the relief to all its customers or the select few who have requested for it.

The moratorium is available on term loans including credit cards, agricultural term loans and crop loans along with retail loans including home loans, personal loans, education loans, automobile loan and others.

The RBI has also instructed the lenders to extend the same relief for all working capital loans availed by the businesses.

The RBI has further ensured that the deferment of the payment during the moratorium will not impact the credit score of the individuals or on the credit downgrade or default for corporate.

Understand how the role of RBI can protect your financial future

So what should one do, Pay up or Wait Out?

It will be a prudent call on the part of the borrowers who have the ability to pay the EMI should continue with them rather than deferring, as it will only lead to piling up of their personal debt. And will increase the unnecessary expenses as the savings will generate lower interest in comparison to what he would be paying on the loan.

But in the current challenging situation, borrowers who are struggling to make their ends meet or have an unstable income flow, the moratorium could signal some relief for them.

As once the three months are over, borrowers have to start paying their dues including the piled up interest, which otherwise could impact their credit score.

Moreover, for credit card borrowers, this means taking up additional burden as interest on credit cards is typically on the higher side.

So, what will happen if a borrower chooses the EMI moratorium?

If a borrower chooses the EMI moratorium, it would simply increase his interest cost. No additional penalty will be charged on him but the interest or the EMI amount for the rest of the tenure will go up.

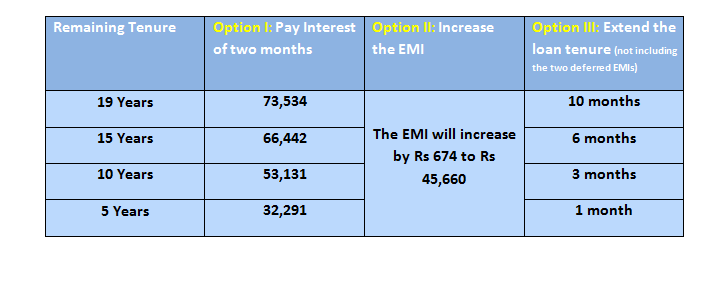

For example, A borrower took a home loan of Rs 50 lakhs at 9% for 20 years. The EMI comes to Rs 44,986. If he wants to skip the next two EMIs (April and May), here is how the moratorium will impact his repayment schedule.

Skipping EMIs can extend the loan by a few months.

Thus, we understand that longer the remaining tenure, the biggest is the impact. This is due to the fact that interest accounts for a major portion of the EMI in the beginning years and then declines as the outstanding loan amount declines.

How to avail the EMI moratorium?

Most of the banks have employed an automated opt-in feature and is conveyed to the customers through an email or SMS.

Few of the lenders have made optional for borrowers to activate the moratorium while others are assuming that their customers are opting in for it.

Now let us see how few of the major Indian Banks have implemented the moratorium:

(I) State Bank of India– The public sector bank is offering automatic deferment of EMI, that is the customers do not have to actively apply for the moratorium.

However, in case of customers have given standing instruction to the bank to debit their EMI every month will have to instruct the bank not to debit the EMIs during these three months, either by visiting their local branch or by sending e-mail from their registered email address.

(II) ICICI Bank– As per the bank, a customer can either choose to “opt-in” or “opt-out” from the moratorium.

For the borrowers who choose the “opt-in” feature, the accrued interest will be added to the principal amount, thus leading to an increase in the loan tenure. And in cases, where extension of tenure is not possible the EMI will get increased.

(III) HDFC Bank– According to the bank customers who had an overdue balance before March 1, 2020, are eligible to avail the moratorium. They can opt-in for the breather either by calling the bank or by submitting a request at the bank’s website.

The loan tenure will get extended for the customers availing this facility.

Key Takeaways:

- The three month EMI moratorium means that the borrowers can skip their monthly loan repayment installment which falls due from March 1, 2020, to May 31, 2020.

- The moratorium offered by the RBI includes all term loans including home loans, personal loans, education loans, auto loans, working capital loans, credit card dues, etc.

- One has to remember that the interest is not waived off and will continue to accrue on the outstanding loan amount.

- This delay in EMI payment will not result in a negative impact on the credit score of the individuals or on the credit downgrade or default for corporate.

- The RBI, with the moratorium, aims to resolve the concerns of loan borrowers with irregular cash flows whose income may have been impacted by the ongoing lockdown.

Happy Learning!

BOTTOMLINE

With no fresh measures to support home buyers reeling under the economic impact of the Coronavirus pandemic, delinquencies in the home loan segment have seen a spike in the past few months. Read more on https://housing.com/news/moratorium-on-home-loan-emi/.