It’s an EMI world. Whenever we talk about loans, the first thing that crosses our mind is loan EMI calculation. The abbreviation, EMI stands for Equated Monthly Installment.

An equated monthly installment (loan EMI calculation) is the sum that the loan borrower pays every month to repay the money borrowed on a particular date in each calendar month.

The loan amount along with the accrued interest is divided equally over a period which is the loan tenure. The number of loan EMIs is equal to the number of months in the loan repayment tenure.

Formerly, a limited range of products, says personal loans or home loans, and alike loan products were available on EMI. But now the scenario has completely changed. The E-commerce world has now so much to offer.

| Table of Contents |

|---|

| What is Loan EMI Calculation? |

| Loan EMI Calculation Using Mathematical Formula |

| Loan EMI Calculation via excel sheet |

| EMI Online Calculator |

| Bottomline |

From household appliances to electronic gadgets, it’s all online. Apart from this radical change, one of the significant effects is on the affordability of products through EMI option.

Merchants now offer reasonable installment amounts, which defers the lump sum paid and breaks it into a number of installments over a certain period.

Simple, isn’t it?

But do you know what does EMI means? What does it constitute? What if you want to calculate the EMI of your loan product?

Let us answer all these questions here and make it both sound and read simple for you.

What is Loan EMI Calculation?

Let us first understand the acronym “EMI” in simple terms. EMI stands for equated monthly installment. Equated means the same in value, monthly means every month, and installment means the amount due.

Hence, an Equated Monthly Installment (EMI) means a certain amount to be paid by the borrower to the lender for the predetermined period on a monthly basis.

EMI depends on three components – loan amount, tenure of the loan, and rate of interest. The number of loan EMIs you need to pay and the number of installments is inversely proportional to each other.

For example – Mr. X wants to purchase a mobile phone online worth Rs. 15000.00 wherein the EMI mentioned is Rs. 1400 per month.

In case Mr. X purchases it on loan EMI, then he will be required to pay Rs. 1400 per month for approximately 11 months (Rs. 15000/ 1400 = 10.71 approx ~ 11 months). This is how EMI works in this case.

Basically, EMI is a contemporary version of the loan, wherein the pinch of lump sum payment is deferred and is broken down into parts to be paid over a period of time.

Loan EMI Calculation Using Mathematical Formula

EMI = [P x R x (1+R)^N]/[(1+R)^ (N-1)],

In this formula the variables stand for:

EMI – the equated monthly installment

P – the principal or the amount that is borrowed as a loan

R – the rate of interest that is levied on the loan amount (the interest rate should be a monthly rate)

N – the tenure of repayment of the loan or the number of monthly installments that you will pay (tenure should be in months)

The same formula is used in an EMI calculator to provide you with the correct EMI payable within seconds.

Let us consider an example to understand the loan EMI calculation in a better way,

For example, you have taken a personal loan of Rs. 5 lakhs for 2 years at an interest of 20 % p.a.

The first thing that you need to do is, convert the annual interest rate into a monthly rate and the tenure into months.

To calculate the monthly interest rate, divide the annual interest rate by the number of months in a year, i.e. 12, so the monthly interest rate is 20/12 = 1.66% per month

The 2-year loan tenure must also be converted into months (i.e.12X2=24 months) before integrating into the formula

We have three variables with us which we can integrate into the formula as follows:

EMI = [P x R x (1+R)^N]/[(1+R)^N-1]

EMI= [5,00,000 x 1.66/100 x (1+1.66/100) ^ 24 / [(1+1.66/100) ^ 24 – 1)

EMI= Rs. 50, 895

The Loan EMI calculation formula is universal and can be applied to different loans. The variation in EMI value depends on the three key variables, i.e. the loan amount, the interest rate and the loan tenure.

The EMI is directly proportional to the loan amount and interest rates. It implies that with an increase in amount and interest rate, the EMI on the loan also increases.

Whereas, the EMI is inversely proportional to the tenure of the loan. It means that though the amount of paid interest increases with longer tenures, the EMI payments decrease if the loan is repaid over a longer time period.

Loan EMI Calculation via excel sheet

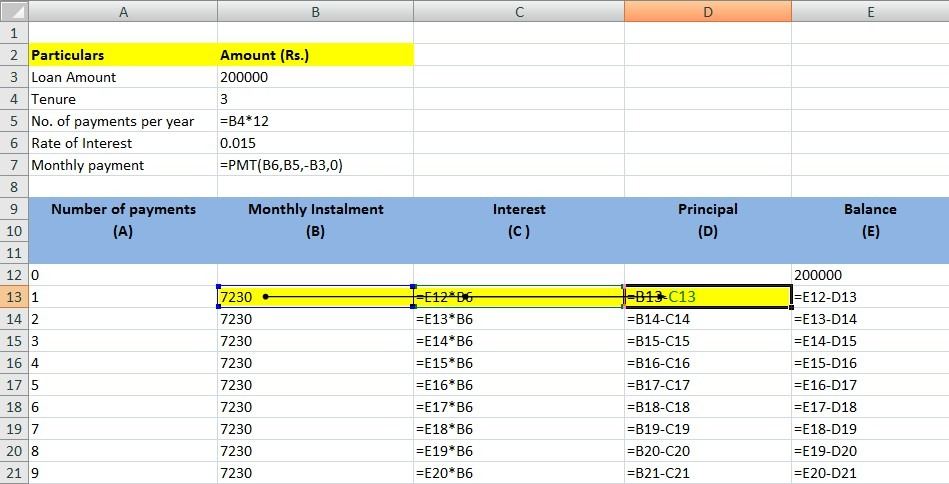

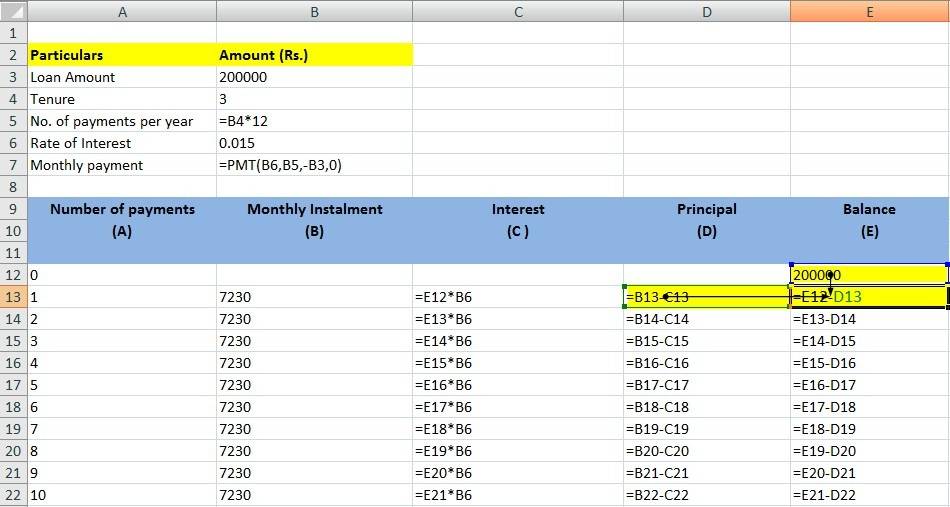

It is very simple to calculate loan EMI in the excel sheet following the below steps, as shown in the snapshots taken:

Learn excel in detail with Advanced MS Excel by Market Experts

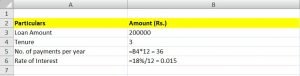

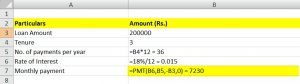

Example: In the following example, we will calculate the amortization schedule of loan repayment through an excel sheet along with the formulas mentioned below:

By feeding the information in the formula, as mentioned, you derive the monthly installment payable. In this case it amounts to Rs. 7230.48 ~ Rs. 7230.00

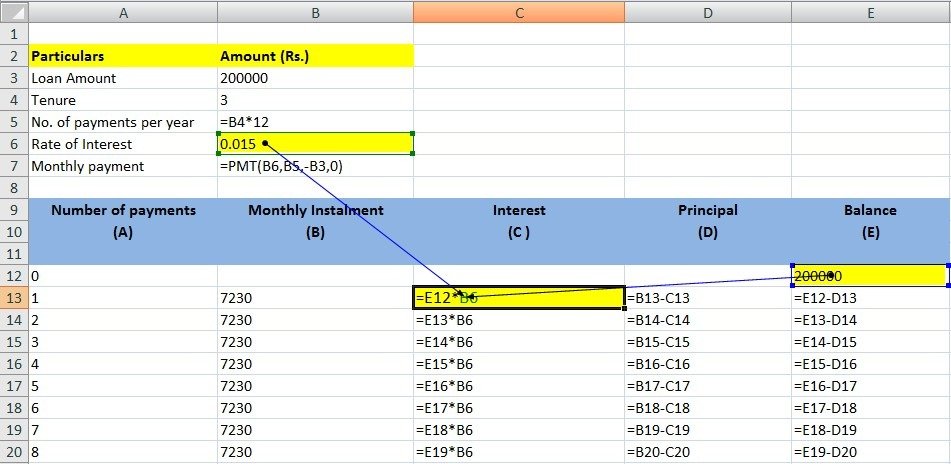

After we get monthly installment amount, we now calculate our amortization table, which signifies the schedule of payments to be done by the borrower.

In the table given above, let us first understand the columns mentioned:-

(A) – Number of payments to be made, which is 36 months or 3 years in this case. The total number of months are taken herein, as we are calculating the monthly installment payment amount.

(B) – Monthly installment, as calculated above, which remains constant through the tenure.

(C) – The interest component is calculated as below. The highlighted portions show the formula placed in excel sheet.

(D) – This column is the principal component which is calculated as shown below – [(B) – (C)], as highlighted below:-

(E) – This column is the balance outstanding which is calculated as shown below – [(E) – (D)], as highlighted below:-

By following the above steps you will be able to calculate the entire series of payments to be made by you in the period of 36 months.

Learn from Experts : Advanced Excel Tutorial Online

Also, you will see that in the 36th month, the balance left is copied to the principal column and the difference between monthly installment and the principal is mentioned in the interest column. In this way, all dues are settled at the end of the contracted period.

To know EMI calculations in excel in more details: you can watch the video below:

EMI Online Calculator

Apart from the excel calculation, there are many online sites that help you calculate loan EMI by merely entering the amount of the loan product.

For example: Click on this link, the following window will appear on the screen, wherein you need to enter the loan amount, tenure and the rate of interest.

Source: HDFC

Let us take the previous example, in which Mr. X takes a personal loan of Rs. 5,00,000 for a period of 3 years with an interest of say, 12% p.a. The monthly EMI through the above calculator will be:

Source: HDFC

Bottomline

Now we can say – Simple, it is!

By this time, you already know what an EMI is, constituents of EMI, practical approach to loan EMI calculation in excel as well as online.

Apart from these, you must also know that the amount of EMI may differ under two similar circumstances.

This may be due to the system of calculation followed – flat-rate system or the reducing balance system.

So now you are all set to choose the best EMI option that will fit into your budget and make a predetermined schedule of expenses basis the schedule of payments learned above.

In the end, let me ask you a simple question “Is EMI option a healthy affair”?

While learning these concepts, you need certain technical skills. One of the most important is good MS Excel skills. You can learn ms excel full course in hindi on platform and enhance your skills.

Use our Home Loan Calculator today to estimate your EMI, compare options, and take control of your finances

Happy Learning!

Your calculation is wrong. R should be divided by 12 and not 36. Confirm and rectify?

Hello Sunanado,

Thank you for your comment.

It was an inadvertent mistake on our part, it has been rectified now.

You can read related blogs

Happy Reading!!

The article is quite useful for those who want to learn how to calculate EMI for certain loan and certian EMI.

I may draw your attention to your calculation shown in the article.

For a loan of Rs. 500,000, for 2 years, the EMI calculated was shown to be 50,895. However, when I calculate, it comes out to be Rs. 25444 per month. So, there seems to some calculation error from your side. You may please check and make corrections, accordingly.

Nice article! Thank you for sharing.

Hi,

We are glad that you liked our post.

Thank you for Reading!