Bar Patterns are short-term patterns that are useful for timing our trades and finding logical stop-loss points.

The bar patterns are similar to the candlesticks patterns and every price action trader should know the same.

One should note that the bar patterns play an important role when they appear at a strong uptrend or downtrend i.e. near the end of the trend.

Like candlestick patterns, bar patterns are also short-term patterns and they can indicate a reversal of the prices of the stock to another direction.

Bar patterns can be used in any timeframe, say 5 minutes, 15 minutes, hourly, daily, weekly, monthly and so on.

The larger the timeframe the greater is the importance of bar patterns in terms of the magnitude of the upcoming move.

Below are the 7 Bar Patterns that every price trader should know:

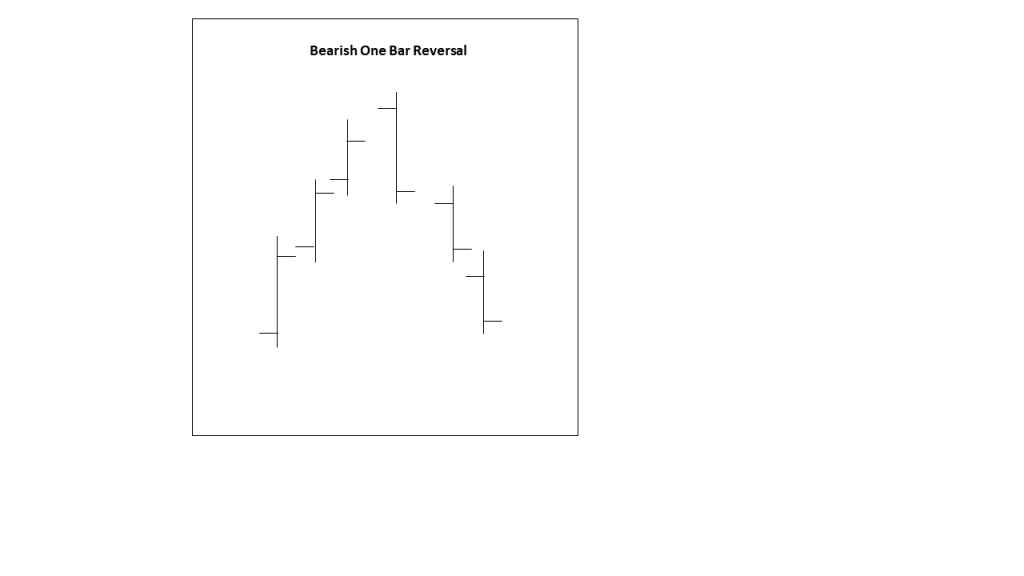

1. One Bar Reversal:

One Bar Reversal also known as the reversal bar, climax, top or bottom reversal bar or key reversal bar.

A bullish key reversal bar occurs when the price opens below the low of the previous bar and closes above its high. Whereas, a bearish key reversal bar is formed when the price opens above the high of the previous bar and closes below its low.

Key reversal bars usually open with a price gap. As we rarely find gaps within intraday time frames, key reversal bars are mainly formed in the daily and above time frames.

It is sometimes preceded by a gap or an opening gap and the length of the bar is not as intensive as a spike.

This pattern occurs in reverse at the bottom. After the bar formation, a series of higher highs or lower lows occur which proves that the reversal to either direction has taken place.

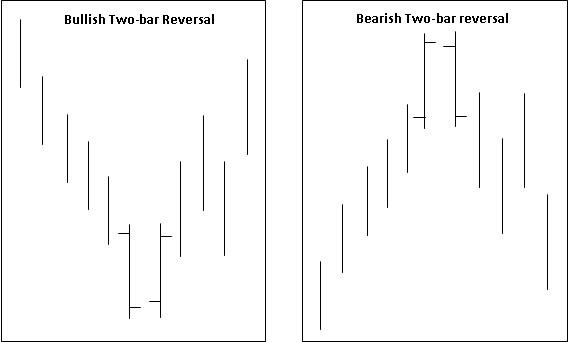

2. Two-Bar Reversal:

The two-bar reversal is also known as the Pipe formation which occurs at the end of the trend either upward or downward trend.

In the bottom bar pattern, the first bar usually closes in the lower half of the bar indicating a bearish bar and the second bar closes near its high indicating a bullish bar.

In the top bar pattern, the first bar usually closes near its high indicating a bullish bar and the second bar closes near its low indicating a bearish bar.

Usually, high volume can be seen in both the bars although it is preferably higher in the left bar than the right bar. The second bar should be slightly longer than the first bar.

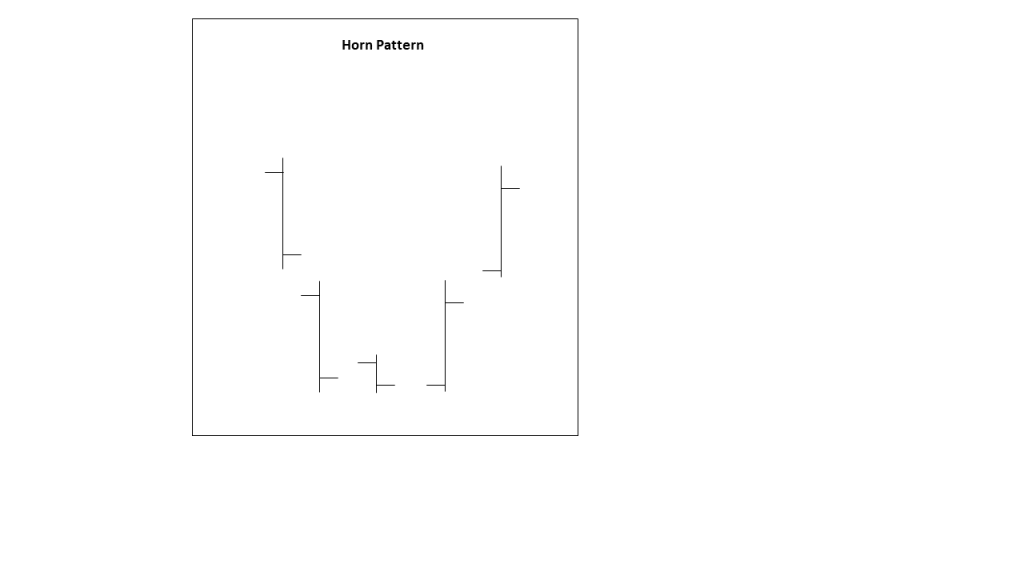

3. Horn Pattern:

This pattern is almost similar to the pipe pattern except that a smaller bar separates the two lengthy bars.

The two long bars act as the horns. This formation is more reliable with weekly bars and has the same characteristics as the pipe.

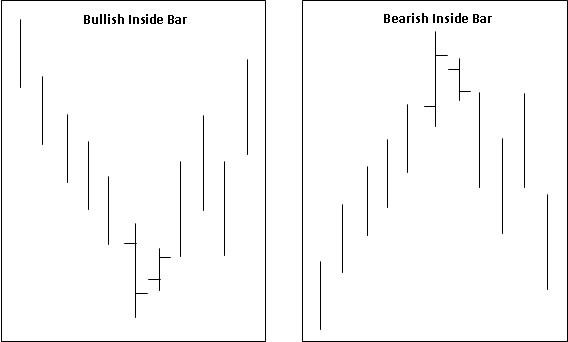

4. Inside Bar Pattern:

An Inside Bar is a bar with a range that is smaller than the previous bar range which is similar to the Harami candlestick pattern.

This pattern is more reliable when it is formed at the end of the uptrend or downtrend rather than in the congestion area.

Usually, the first bar has more volume than the second bar, although the volume increases as the subsequent bars are formed when the short-term reversal takes place.

A Bullish Inside Bar takes place after a decline, the first bar is a tall bar and the closing price is below the opening price and the second bar is within the range of the first bar having a closing price more than the opening price.

Similarly, a Bearish Inside Bar takes place after an uptrend, the first bar is a tall bar having a closing price more than the opening price and the second bar is within the range of the first bar having a closing price less than the opening price.

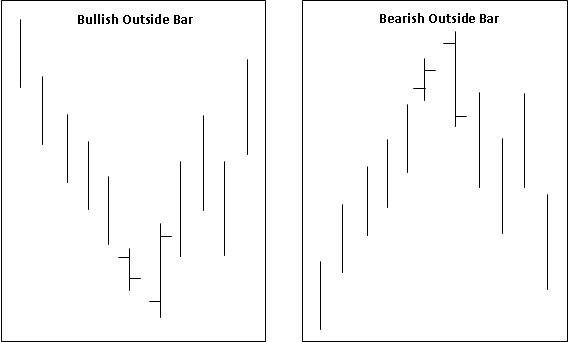

5. Outside Bar Pattern:

The Outside Bar is a bar with a range that is larger than the previous bar range which is similar to the Engulfing candlestick pattern.

This bar pattern is more reliable when it is formed at the end of the uptrend or downtrend rather than in the congestion area.

Usually, the first bar has more volume than the second bar, although the volume increases as the subsequent bars are formed when the short term reversal takes place.

A Bullish Outside Bar takes place after a decline, the first bar is a small bar and the closing price is below the opening price and the second bar a tall bar that has a closing price more than the opening price.

Similarly, a Bearish Inside Bar takes place after an uptrend, the first bar is a small bar having a closing price more than the opening price and the second bar is a tall bar having a closing price less than the opening price.

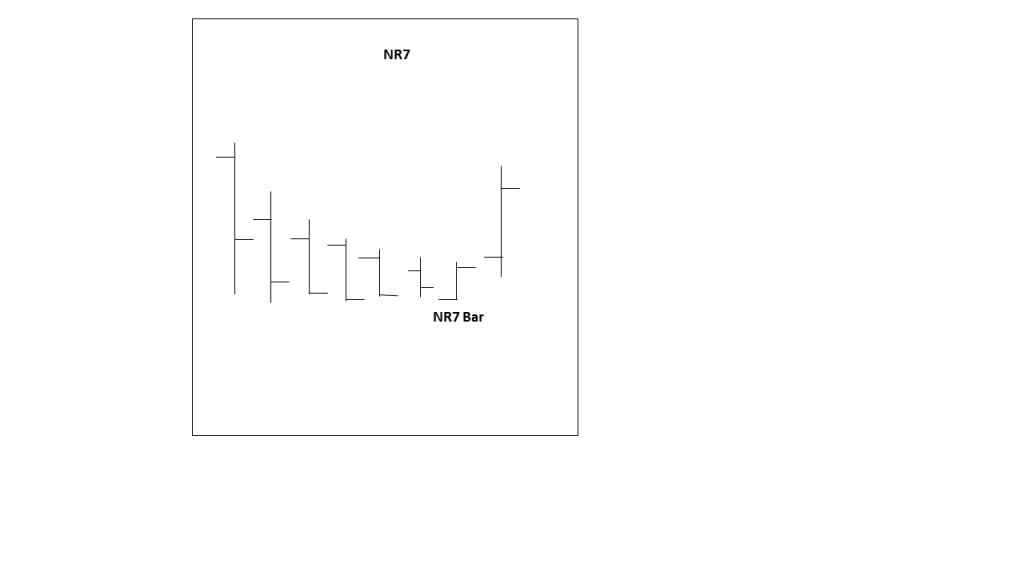

6. Narrow Range 7:

This bar pattern requires seven bars before its formation and the last bar has the smallest bar range within the sequence.

This pattern indicates decreasing volatility as like the inside bar. As the lower volatility comes within the context of seven bars, instead of a single pattern, the NR7 pattern is a stronger sign of decreasing volatility.

However, while the inside bar shows no strength in either direction, the NR7 pattern may drift upwards or downwards which represents a price thrust with decreasing volatility.

As the market alternates between range contraction and range expansion, the NR7 gives the traders a warning for explosive moves.

7. Three Bar Reversal:

A three-bar reversal pattern shows a trend reversal.

The three-bar reversal bar when compared to the other reversal pattern is the most conservative one as it extends over three bars and the third bar confirms that the market has changed its direction.

One should buy above the last bar of the bullish pattern and sell below the last bar of the bearish pattern

Bottomline:

One should note that the indications given by these bar patterns should be confirmed with other technical indicators like Moving Averages, Relative Strength Index etc.

The common strategies for trading with these bar patterns should include volume analysis as volume precedes price and gives confirmation of the signals generated by these bar patterns.

Start volume analysis for free in StockEdge app.

Happy Investing!