Key Takeaways

- Relative Strength: Compare stock vs. index. It trades based on outperformance or underperformance.

- Absolute Momentum:Trade based on a stock’s own past returns.

- Cross Asset Momentum:Use momentum across asset classes for diversification.

- Sector Momentum: Invest in top-performing sectors, rotate with market cycles.

- Breakout Strategy: Trade stocks breaking key support/resistance levels.

When it comes to trading in the trending market, the best way to gain from the momentum is to implement momentum trading strategies.

Momentum trading strategies help in identifying stocks that exhibit further momentum and ride the trend.

Momentum trading refers to entering a stock position as the price starts moving in either direction. It also helps in exiting the stock as soon as it starts declining.

In this blog, we will discuss five momentum trading strategies for gaining from the ongoing momentum in stocks or indices.

Table of Contents

5 Momentum Trading Strategies

Here are the 5 Momentum Trading Strategies-

1. Relative Strength Momentum

Relative Strength Momentum is one of the momentum trading strategies that helps identify stocks that have been outperforming the market or benchmark.

The RS Indicator helps to identify the strongest and weakest securities or asset classes within the financial market. Stocks that display strong or weak RS over a given period tend to continue. RS analysis can be applied to domestic or international stocks, stock indexes, fixed-income indexes, currencies, commodities, and other asset classes.

In the above daily chart of Reliance India Ltd, we have plotted the RS line (blue line) compared to the Nifty 50 for the last 50 periods.

When the RS line crosses above 0, the stock outperforms the Index, and when it crosses below 0, the stock is underperforming the Index. So, from the above chart, we can see that on 11th March, the RS line crossed the 0 line when the bearish phase of the stock started. This shows that the stock is getting weak and underperforming the Index as prices decrease.

Traders can short, ride the downtrend and gain profits until the RS line exceeds the 0 lines.

2. Absolute Momentum

A strategy known as absolute momentum assesses a security’s price in relation to its past performance. Trading using this strategy means that a trader should sell when the momentum is negative and purchase when it is positive.

A momentum trader might buy more shares of a stock, for instance, if its 12-month momentum is noticeably positive. In contrast, if the 12-month momentum was negative, a trader would short-sell shares.

3. Cross Asset Momentum

Additionally, traders can create cross-asset momentum trading strategies with passive exposures to the bond and equity markets and produce sizable, positive monthly alphas.

A diversified cross-asset momentum portfolio produces a Sharpe ratio that is about 70% higher than that of a similarly diversified buy-and-hold portfolio and 45% higher than that of an equally diversified time series momentum portfolio.

This is a momentum trading strategy in which the traders Identify the period to evaluate momentum (e.g., 3 months, 6 months, 12 months). Calculate the total return of each asset over the lookback period and Rank the assets based on their momentum, typically focusing on those with the highest positive momentum.

4. Sector Momentum Strategy

Finding and investing in market segments that are performing well at the time with the hope that this momentum will continue is known as a sector momentum strategy. This is one of the momentum trading strategies that takes advantage of the successful sectors’ propensity to continue outperforming throughout the short to medium term.

Traders can make a list of the sectors to watch. Technology, healthcare, finance, energy, consumer discretionary, and the industrial sector are among the frequently cited examples.

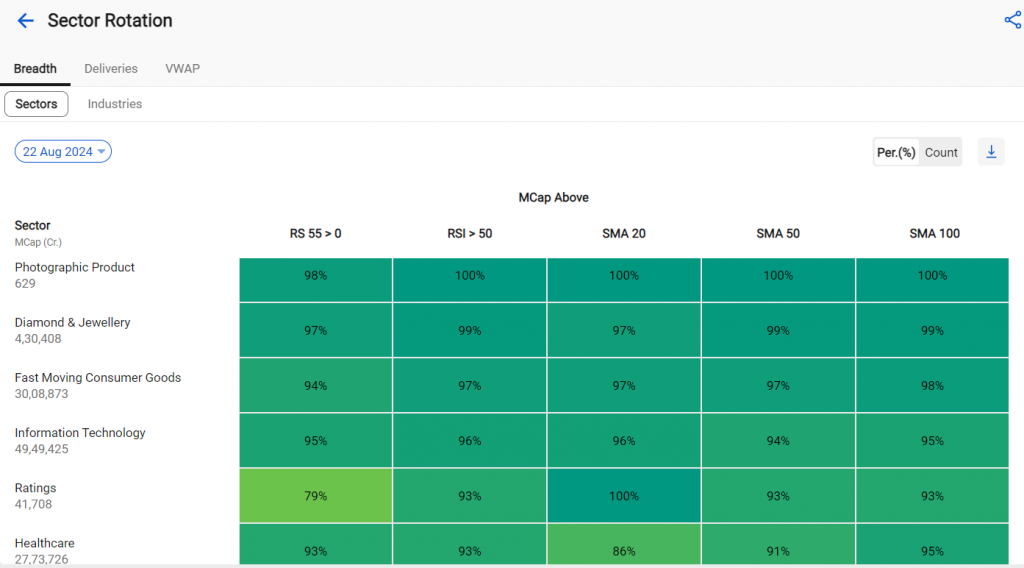

Sector rotation is a top-down investing strategy involving moving money from one industry sector to another in anticipation of different business cycle stages to beat the market.

It is just like the tactical asset allocation strategy, but instead of shifting asset classes and liquidity, money moves according to the expected performance of sectors. The prediction of Sector rotation is plausible because the market moves in reasonably predictable cycles, and a specific set of industries dominates a given market cycle.

5. Price Momentum Trading Strategies– Breakout Strategy

Breakout stocks are those shares that move beyond their support or resistance level. A key concept in technical analysis, i.e., breakouts, can indicate that a stock is about to make a major move.

So, if a stock moves above its resistance level, it will generally continue to make a sustained upward move. If it goes past its support level, it may continue on a bear run.

Support and resistance levels are often considered ‘stronger’ if a stock hits them multiple times. In turn, stocks that break through these ‘stronger’ levels usually show significant moves.

Stocks are not the only assets that break beyond support and resistance levels. Any financial asset, be it commodities, forex, or cryptocurrencies, can have breakouts from necessary support and resistance levels.

Frequently Asked Questions (FAQs)

What is the best momentum strategy?

Momentum trading is the practice of buying a stock as soon as its price starts to rise and selling it as soon as it starts to fall. This approach is predicated on the observation that stock prices frequently move in a single direction for extended periods of time and do not accurately reflect their underlying value.

What is high momentum stocks?

A stock with strong and consistent price movement in one direction over a brief period of time is considered to have high momentum.

Is momentum trading a profitable strategy?

Trading momentum can be beneficial, particularly for traders who are able to see trends quickly and take appropriate action. However, because market conditions can change quickly, it necessitates thorough analysis, prompt decision-making, and risk management.

Conclusion

It’s critical to realize that there is a significant amount of risk involved in momentum trading. Essentially, you are choosing to invest in a company or ETF based on what other market players have just purchased. There’s no assurance that the price will rise in response to continued buying demand. For instance, a development in the news could affect how investors see the market and trigger widespread selling. Alternatively, given that a large number of investors already have long positions in the stock or ETF, it’s probable that profit-taking on current holdings will overwhelm the entry of new buyers and drive prices lower.

helpful