Bengali: এই ব্লগটি এখানে বাংলায় পড়ুন।

The short-term traders often end up naming their loss-making trades as “Investments” because they lack the discipline to cut their losses. This is one of the very big mistakes which people commit in the stock market. So it’s very important to stick to your discipline. This is not an appropriate way of making long-term investments. Want to learn about where to invest, how to invest, when to invest? Know all the answers with the NSE Academy Certified Equity Research Analysis course on Elearnmarkets.

Following are the few important points which an investor should keep in mind before making a long-term investment:

(Source: www.millionairedowntheroad.com)

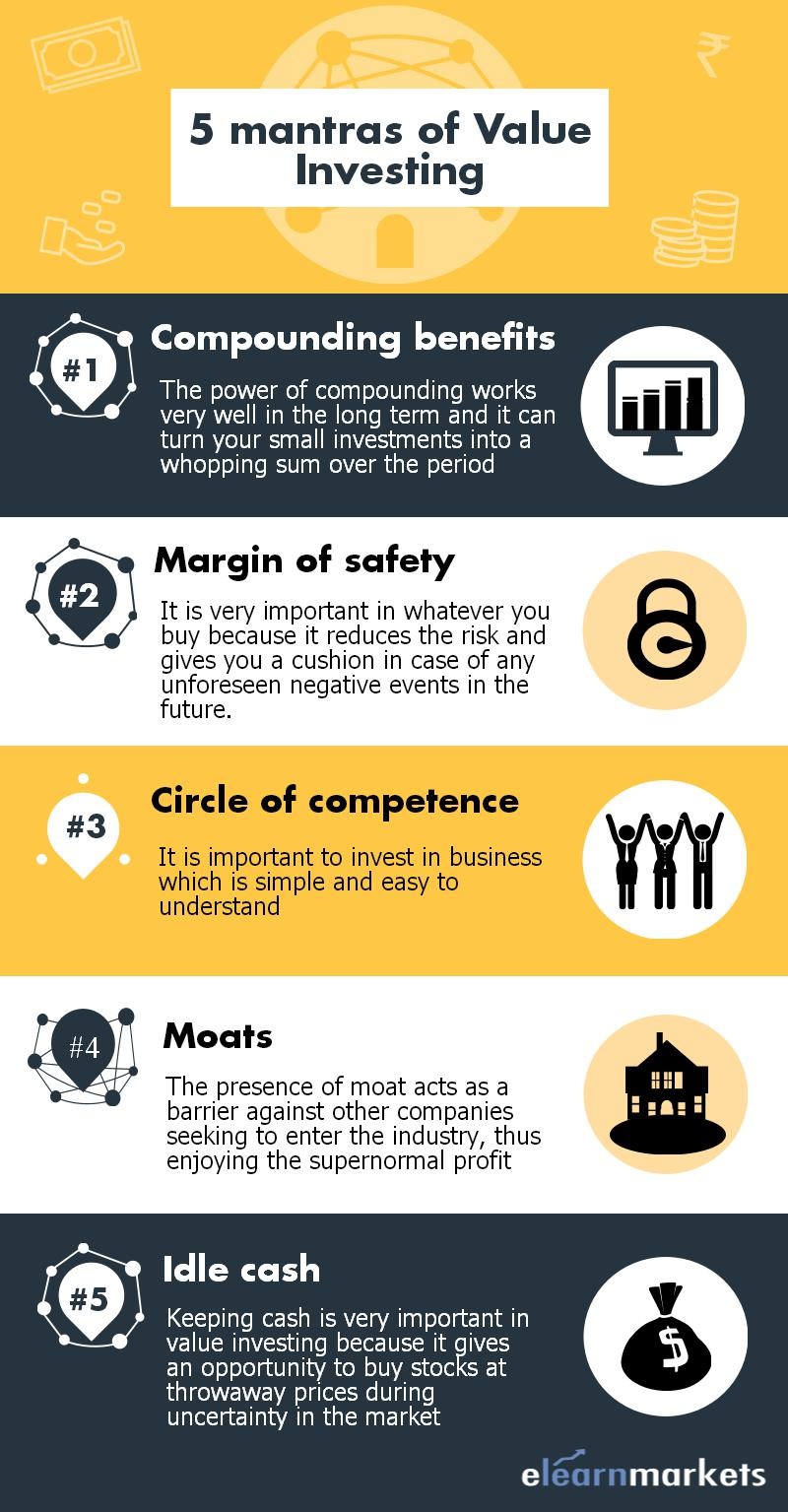

Powerful Mantras of Value Investing

1. Power of compounding

Investors like Warren Buffett, Charlie Munger, Rakesh Jhunjhunwala etc always believe in long term value investing because they understand the power of compounding. Equities over a long term time frame have always outperformed the broader asset class. As Warren Buffet says-

Our favourite holding period is forever.

The benefit of compounding works very well for long term investments. Say if someone invests $1 today compounding at an annual rate of 20% p.a. will result in $15.41 in 15 years, $38.34 in 20 years and $95.40 in 25 years. We can clearly see that more is the number of years, the better is the result from compounding.

Know More: How Does Power of Compounding Work

If you aren’t thinking about owning a stock for 10 years, don’t even think about owning it for 10 minutes – Warren Buffett.

(Source: www.azquotes.com)

2. There should be a margin of safety

There should always be a margin of safety in whatever you buy because it reduces the risk and gives you a cushion in case of any unforeseen negative events in the future.

It’s far better to buy a wonderful company at a fair price than a fair company at a wonderful price – Warren Buffett.

So, it’s always advisable to buy a stock below its intrinsic value in order to get the margin of safety. Even the finest business could be a bad investment if bought at a huge premium.

(Source: www.azquotes.com)

3. Invest in a business you understand i.e. it should be in your circle of competence

It is very important to invest in a business which is simple and easy to understand. The reason is understanding the business well can help you identify any trouble lying on the way. So the chances of losing will be very minimal which is a very important aspect of investing and as Warren Buffet says-

Rule No. 1: never lose money; rule No. 2: don’t forget rule No. 1

(Source: www.azquotes.com)

4. Look for companies with a moat

Always try to invest in companies with moat i.e. with some competitive advantage which may be due to barriers to entry, brand name, pricing power etc.

The presence of moat acts as a barrier against other companies seeking to enter into the industry and thus enjoying the supernormal profit.

Companies like Colgate, Pidilite, Ajanta Pharma, Kitex garments, Page industries etc are amongst the companies with a moat which are listed in the Indian Stock Exchange.

5. Keeping the idle cash

Keeping cash in hand is a very important aspect of value investing because, given the high volatility in the equity market, there are times when the stocks are available at throwaway prices.

There’s a very famous quote-

Buy when there’s blood in the streets, even if the blood is your own

So in order to buy at those times, it is very important to have cash with you.

Also Read: Holding Cash- an important decision

Bottomline:

We hope that the above write up has helped you to get a brief idea of the 5 important mantras of value investing.

You should develop your own value investing style rather than imitating the investment style of any famous value investor.

Happy Learning!!