The Monetary Policy Committee (MPC) of the Reserve Bank of India (RBI) will meet for three days starting Tuesday. The results of the second bi-monthly RBI policy meeting of FY24, which is taking place from June 6 to 8, will be made public on June 8.

The Reserve Bank of India (RBI) controls the money supply in the economy by controlling interest rates. This is done by increasing or decreasing the interest rates.

RBI is the Central Bank of India. One of the responsibilities of every country’s central bank is to set interest rates. So, monetary policy is a tool by which they control the money supply.

So, in today’s blog, let us discuss what RBI Policy is and what the street is expecting with this week’s RBI Policy:

What is RBI Policy?

By regulating interest rates, the Reserve Bank of India (RBI) manages the money in the economy. This is accomplished by raising or lowering interest rates. The Indian Central Bank is known as the Reserve Bank of India. Setting interest rates is one of the duties of each nation’s central bank. So, one tool they use to manage the money supply is monetary policy.

The RBI must balance growth and inflation when determining the interest rate. Therefore, if interest rates are high, borrowing costs will also be increased, and if corporations find it difficult to borrow money, they will be unable to expand. Businesses that fail to succeed experience a slowdown in the economy.

When interest rates are low, however, borrowing is simpler. As a result, more money ends up in the hands of businesses and customers. With more money comes more spending, which causes retailers to mark up their goods and services, which causes inflation.

Therefore, the RBI must take into account all the variables and set a few key rates in order to achieve balance. Economic chaos can result from any inequity in these rates.

Understanding the Role of RBI to Protect Your Financial Future.

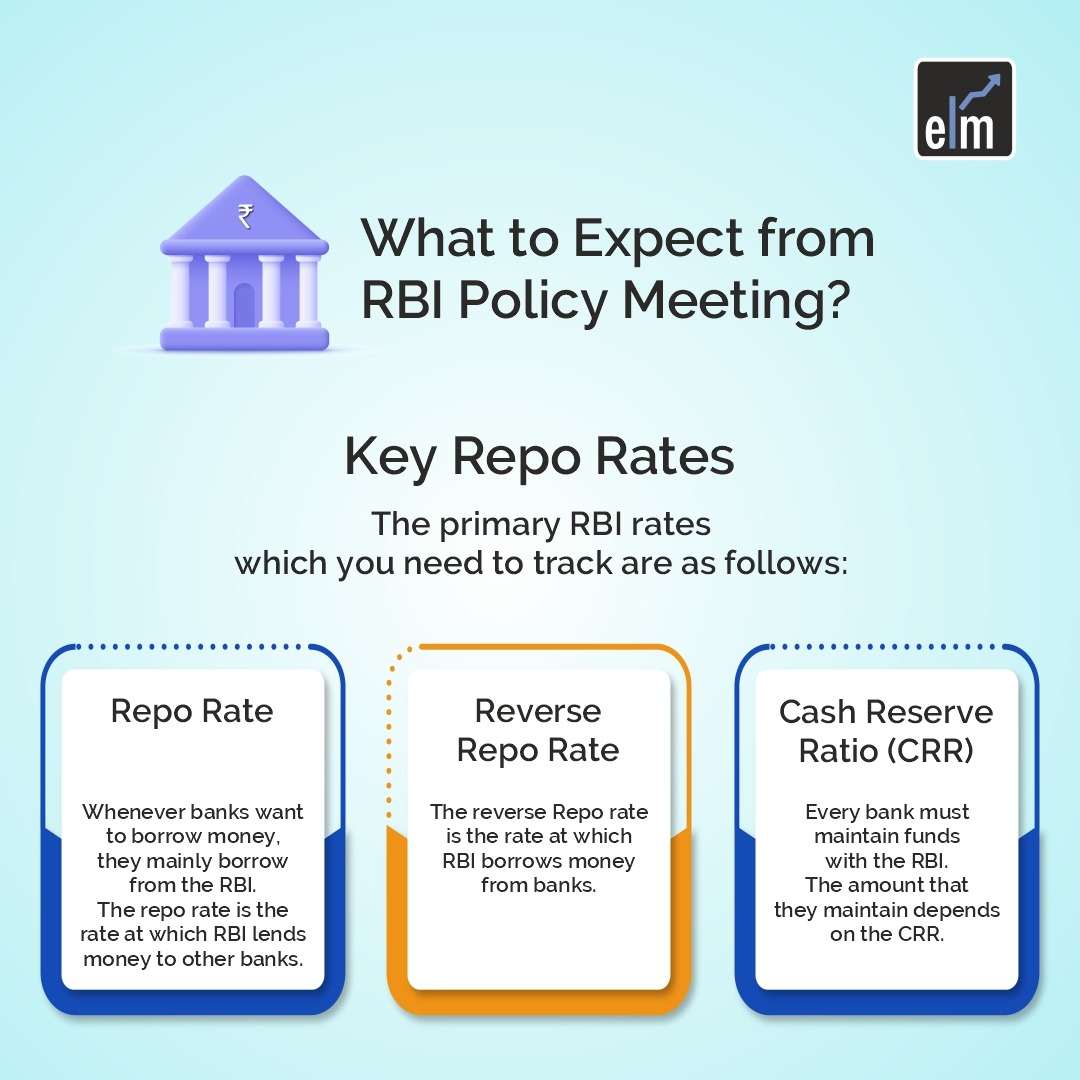

What is Repo Rate?

Monetary policy is vital for managing a nation’s economy and financial markets. The name of this instrument is the repo rate, which stands for “repurchase rate”. The Reserve Bank of India (RBI) uses the repo rate as a benchmark interest rate to ensure the efficient operation of the monetary system.

In conversations about banking and monetary policy, the term “repo rate” is frequently used. The interest commercial banks pay to the RBI for overnight loans secured by those securities is what it refers to.

A crucial tool used by the RBI to manage the monetary base is the repo rate. By altering the repo rate, which determines the cost of borrowing for commercial banks, RBI can alter the interest rates assessed on loans and deposits.

Changes in the repo rate can impact a number of economic variables, including inflation, currency exchange rates, and overall economic growth.

The RBI’s willingness to buy or sell government assets in order to deposit or withdraw money from the banking sector determines the repo rate. The RBI lowers the repo rate to increase the amount of money that is available.

As a result, financial institutions can borrow money from the RBI for less money. The RBI raises the repo rate to deter banks from taking out loans.

What can be expected with this RBI Policy Meeting?

According to consensus, the rate-setting panel headed by RBI Governor Shaktikanta Das will maintain the repo rate at 6.5% despite the nation’s inflation slowing down.

The consumer price index (CPI)-based retail inflation rate decreased to 4.7% in April, which is below the RBI’s 6% upper tolerance limit. March saw CPI inflation of 5.66%.

The RBI MPC stopped the rate hike cycle at its most recent policy meeting in April, keeping the benchmark repo rate at 6.50%. Since May 2022, repo rates have already increased by 250 bps.

You can also do our course on Online NSE Academy Certified Capital Market Professional (E-NCCMP)

In addition, he anticipates the central bank to lower its forecast for FY24 inflation and raise its prediction for GDP growth.

According to a central bank projection made in April, retail inflation was expected to moderate to 5.2% in FY24, while GDP growth was pegged at 6.5%.

Bottomline

We hope you found this blog informative and use it to its maximum potential in the practical world. Also, show some love by sharing this blog with your family and friends and helping us in our mission of spreading financial literacy.

So, what are your expectations regarding the RBI Monetary Policy?

Also, visit our platform to enhance your practical skills with some basic statistics course.

Let us know by commenting below:

Happy Investing!

You can also visit web.stockedge.com, a unique platform 100% focused on research and analytics.