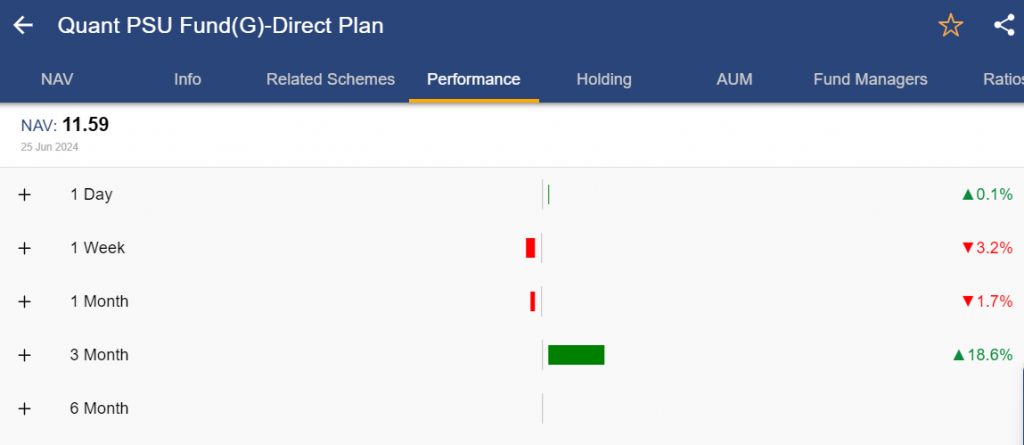

There has been a lot of buzz around Quant Mutual Funds, which is under inspection for suspected front-running.

The NAV in mutual funds managed by Quant has also fallen; for instance, the Quant PSU Fund saw a decline of 3.2% in a week, as shown below:

Net asset value (NAV) plays a crucial role in determining the value of a mutual fund’s per unit.

But how does it determine this value?

NAV takes into account the total assets minus liabilities divided by outstanding shares held by a fund.

Companies and business entities use the difference between assets and liabilities to calculate their net worth.

We apply NAV in mutual funds to know the value per unit.

In this blog today, let us talk about what is nav in mutual funds and why it matters-

Table of Contents

What is NAV in mutual funds?

Net Asset Value (NAV) in mutual funds refers to the value per unit of a mutual fund on any particular day.

Suppose a mutual fund owns stocks of various burger food chains around the country.

Assets: The mutual funds have invested in shares of multiple companies that sell burgers.

For example, all these shares are valued at 200 crore.

Liabilities: Other costs, such as office costs and management charges, might also be incurred.

For example, all these liabilities amount to 20 crore.

Shares: So currently, there are 2 crore shares available for investors offered by that scheme.

So, the NAV per Share will be

Net Value: We will subtract the liabilities from the assets (200 crore – 20 crore = 180 crore).

NAV per Share will be 180 crore / 2 crore shares = 90 per share.

So, the NAV per share in this example is 90

Importance of NAV in Mutual Funds Investing

Let us discuss some of the reasons why NAV in mutual funds is considered an important factor while investing:

1. It indicates the Intrinsic Value

NAV in mutual funds represents a mutual fund’s holdings’ fair value per share at a given date.

This shows us the intrinsic value of per share.

2. It helps in Decisions Making

It allows us to compare the market price with NAV.

We can then determine if we are buying a share at a justifiable cost or not.

3. It aids in keeping track of performance

By tracking the NAV, we can see how well the mutual fund has been performing.

An increasing NAV signals that its assets are appreciating, while a decreasing one implies asset depreciation.

4. To Compare Different Funds

When comparing different mutual funds, it is advisable to analyse their NAVs before deciding which one to invest in.

5. It Helps Avoid Expensive High Cost

From this information, we can avoid the high expenses associated with that fund.

Since we know that NAV is not a market price, a disparity between these two values might show high costs related to such a fund.

What is the Net Asset Value Formula?

The Net Asset Value (NAV) of a mutual fund can be calculated using a simple formula:

As discussed in the above example, the NAV is (200 crore – 20 crore = 180 crore)/2 crores, i.e. 90 in our example.

How do you calculate NAV for different types of mutual funds?

- Open-End Funds– Open-end funds’ net asset value calculation is done by deducting the closing market value of assets minus liabilities and dividing it with outstanding shares. This must be done on a daily basis. Therefore, this implies that many investors can buy or sell at NAV every trading day.

- Closed-end Funds—These are mutual funds that operate under a fixed number of shares listed in the stock exchange upon formation. They do not trade at the same value as their NAV. Sometimes, forces of supply and demand cause deviations from NAV.

- Exchange-Traded Funds (ETFs)—Like mutual funds, ETFs compute their NAV everyday as at the close of market for reporting purposes but calculate intra-day NAV multiple times per minute in real-time.

- Interval Funds– Interval funds are hybrids between open-ended and closed-ended funds. These investments enable investors to redeem their investments back to the issuer within certain periods, e.g., 90 days each year per share at Net Asset Value (NAV).

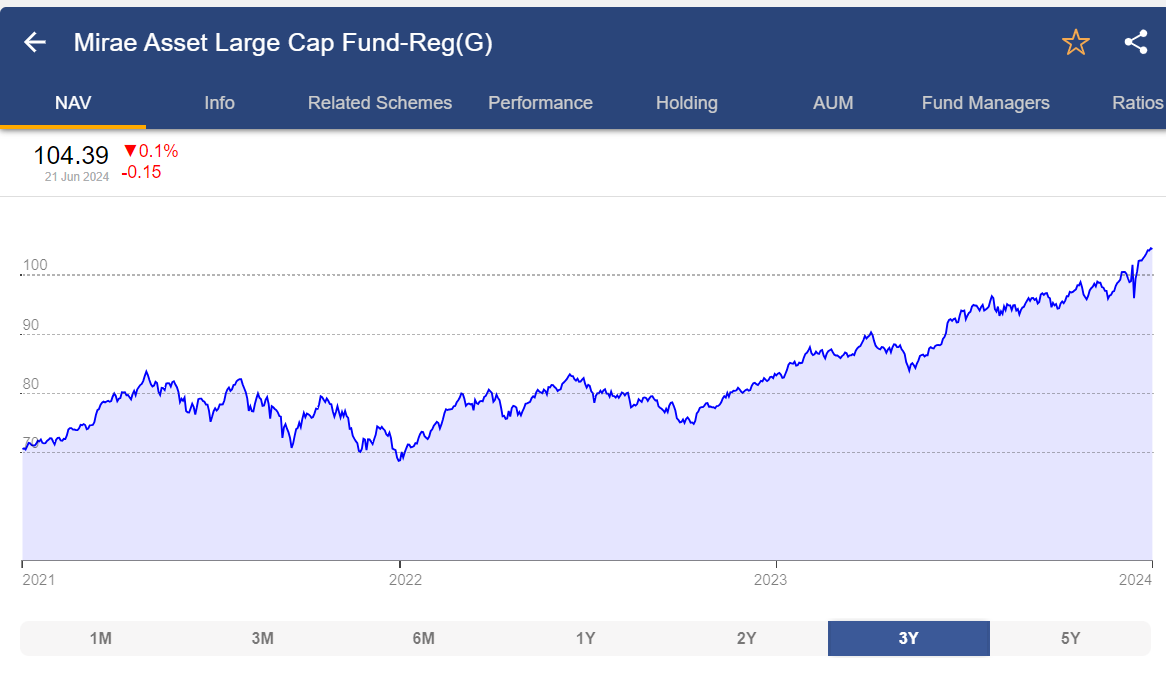

Where can the NAV in Mutual funds be tracked?

There are several ways to track the NAV in mutual funds:

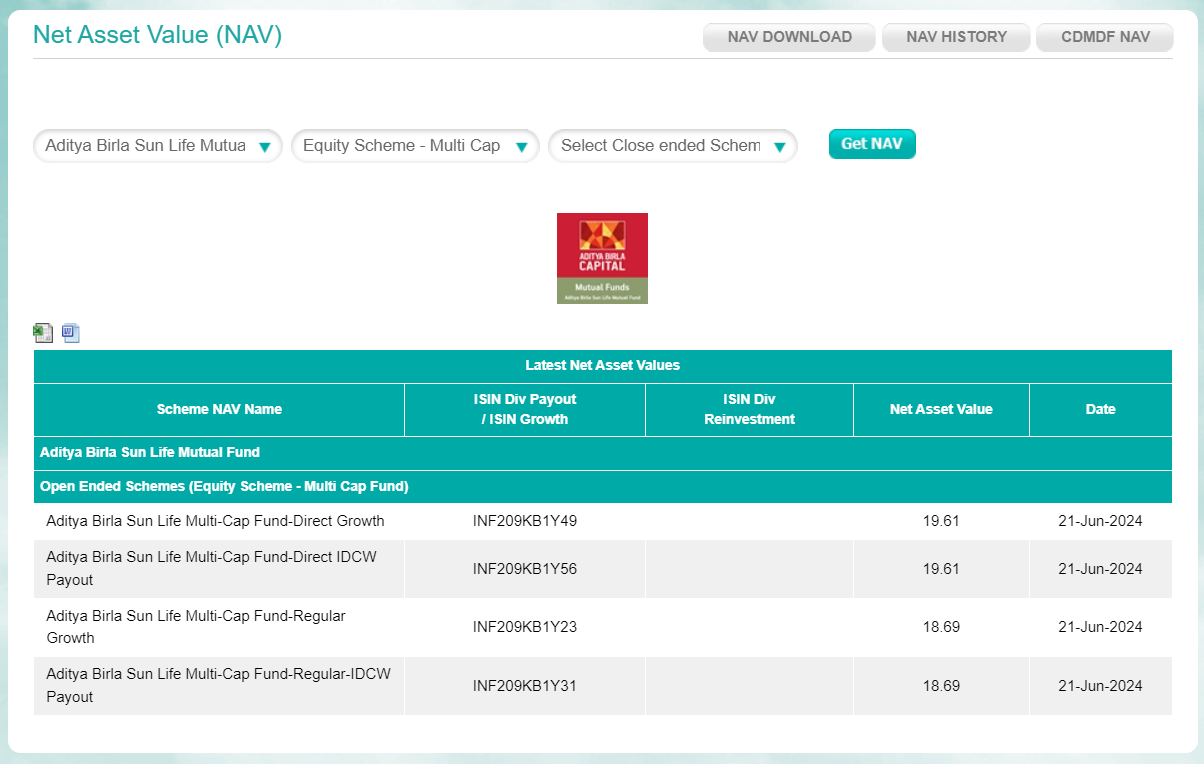

1. Mutual Fund Websites

The majority of mutual funds firms have separate sections marked ‘daily nav’ where they exhibit all the schemes they offer on their sites.

2. Financial Websites & Apps

StockEdge is an example of such financial websites and mobile apps. This website allows you to filter by sector or investment style or search funds by name.

3. Investment Platforms

The platform usually displays in its dashboard the NAVs of the funds that it offers if you invest through any online investment platform or mobile app.

If you want to check it, simply login to your investment account and review the current NAVs of your holdings.

4. Financial News & Media

Some of these financial news sites and publications may sometimes publish articles or market updates along with NAVs for popular mutual funds. Although not an all-encompassing resource on NAV tracking, this can be helpful in keeping up with general market trends.

5. AMFI Website (India)

AMFI website (Association of Mutual Funds in India) also carries a section on nav history and help us in searching NAV of different funds.

How Do Mutual Fund Returns Get Affected by Nav?

The mutual fund returns depend on the difference between unit prices (the amount paid by investors when buying new units) and unit prices at redemption (the amounts received by unitholders upon selling units back to fund).

Thus, the NAV does not directly affect the return on mutual funds

Frequently Asked Questions (FAQs)

Is a higher NAV better or lower?

Good mutual funds do not depend solely on a higher or lower NAV. Different factors like the fund’s performance, investment objectives, and the kind of mutual fund you are dealing with also play a role. Fund performance should generally be evaluated on a historical basis rather than just on NAV.

What is the meaning of NAV? How do I compute NAV?

NAV tells you how much one unit of a mutual fund is worth at present. This is arrived at by dividing the market value of its assets minus liabilities by any outstanding units.

Is equity equal to NAV?

No, Net Asset Value (NAV) is not as same as equity. It’s obtained by subtracting liabilities from a mutual fund’s assets and then dividing by the number of outstanding shares.

How does NAV in mutual funds differ from share price?

While share prices apply to individual stocks, we use NAV for mutual funds instead.

Conclusion

Understanding what NAV in mutual funds mean, will help the investors to make choices based on their current positions in their mutual funds’ securities. This metric is fundamental to measuring performance and evaluating the suitability of investments made over time.