You must have seen stock symbols and the prices moving constantly in green or red lettering on a business news channel or on the huge billboard outside the Bombay Stock Exchange. These are known as stock quotes.

A stock market quote gives us the price, important information, and recent trading activity about a specific stock as quoted on an exchange.

When reading a stock market quote, it’s important for the traders to understand the different stock symbols, numbers, and abbreviations that make up a stock quote.

In this blog we will discuss in details what is stock quote and how does it works:

| Table of Contents |

|---|

What is a Stock Quote?

Stock quotes give us important information about a specific stock’s ongoing trading activity on a given exchange i.e National Stock Exchange (NSE) or Bombay Stock Exchange (BSE).

During the trading session, traders can see both the prices i.e what buyers are willing to pay (bids) and what sellers are willing to offer (asks), along with other information.

These quotes help the buyers as well as the sellers to find each other and to place an order.

How does Stock Quote work?

With the bid and ask prices trades e can see various terms like price, market cap, open, high, low, close, key ratios, traded quantity, etc. which we will be discussing in details below:

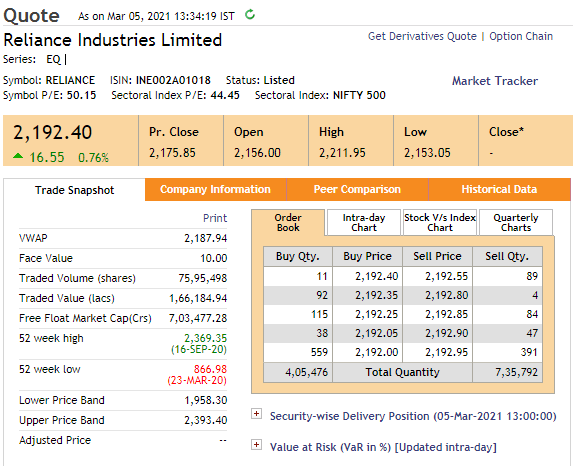

The above is an example of Reliance’s stock quotes.

Here we can see the stock details like the closing price of the previous trading day, open, high, low and closing prices can be known through looking at the stock quotes.

- Open: This indicates the stock’s opening price which is quoted as the hundredths of a cent.

- High: This is the highest price the stock went during the trading session.

- Low: This is the lowest price the stock went during the trading session.

- Last (or close): This is the last or the closing price of the stock traded on that day

- Change: This is the difference between the last traded price and the previous day’s price.

- 52-week high and low (or range): These indicate the highest and lowest price at which the stock traded during the previous 52-week.

- Stock symbol (SYM): This indicates the stock name and the stock ticker symbol. We can see from the above image, the symbol for Reliance Industries Ltd. is RELIANCE.

- Earnings per share (EPS): This indicates the net earnings of the company which is divided by its total number of shares.

- Price-to-earnings ratio (P/E): This indicates the price of the stock that is divided by its EPS which helps the investors to compare stock prices to other companies.

- VWAP (volume-weighted average price): It shows the average price at which the stock is traded in a day that helps traders to know the price movement of the stock.

- Face value: This is an amount that is used to calculate the stock’s value.

- Trading volume: It indicates the number of shares traded during the trading session.

- Order book: It gives us complete details of buy price and sell price of the stock, and also the total quantity of shares sold.

What do Stock Quotes tell you?

Once we understand how to read a stock quote, we can make good trading decisions.

With the above data, we can learn how to analyze a company and make better predictions about a stock’s performance.

Traders should note that the quotes are delayed on many free internet sites are delayed so they can directly check them from NSE official web

Traders can put stocks in which you’re interested in a watch list and track them.

Tracking these stock quotes and data helps in identifying stocks that meet your trading criteria also allows you to detect patterns that can help you to make your trading decisions.

Happy Investing!