Key Takeaways

- A business model shows how a company earns profit. It defines what’s sold, to whom, and at what cost. To judge success, look at gross profit, but also check net income and cash flow. That gives a clearer picture.

- Business models guide strategy, marketing, and financial planning. They help attract investors and set long-term direction. Example: A video game company switched to online sales. Lower costs, better profits.

- Types of Business Models

- B2B: Between businesses (e.g., IndiaMart)

- B2C: Direct to consumers (e.g., Avenue Supermart)

- Subscription: Regular payments (e.g., Infoedge)

- On-Demand: Instant service (e.g., MakeMyTrip)

- Pros:

Boosts growth, Builds investor trust, Supports clear planning. - Cons:

May limit change, takes time to build and can become outdated.

Every business or company makes a plan for generating profit. They create a model for identifying products and services to sell, the market they want to target and also take into account anticipated expenses. This is known as business models.

Even if the business is already established or even if it is a new business, a plan needs to be made. Businesses need to regularly update their plans and strategy as they need to take into account the challenges and trends for future models.

What are the Business Models?

The strategy a business uses to turn a profit is referred to as its business model. Understanding the business model meaning is essential, as it outlines the goods or services the company intends to sell, identifies the target customer base, and includes any estimated costs.

Both new and established businesses need strong business models. They aid young, developing businesses in luring capital, hiring talent, and inspiring management and personnel.

Established companies must continuously alter their business models if they are to stay abreast of emerging trends and problems. Business models also assist employees in understanding the future of an organisation they might want to work for and investors in evaluating companies that interest them.

How to Evaluate Succesful Business Models

When developing their business concepts, many organisations frequently underestimate the costs of financing the venture until it turns a profit. It is not sufficient to calculate the costs of a product’s launch. A corporation must continue operating until revenues outweigh expenses.

The company’s gross profit can be used as one indicator for analysts and investors to determine whether a business strategy is successful. A company’s gross profit is its total revenue less its cost of goods sold (COGS).

The efficiency and efficacy of a company’s business model can be determined by comparing its gross profit to that of its main rival or its sector. However, relying only on gross profit can be misleading. Analysts also request access to net income or cash flow. This shows how much actual profit the company is making by taking gross profit and subtracting operating expenses.

Importance of Business Models

The business model helps to target the customer base of the company. It helps in making marketing strategies, and projections of revenues and expenses taking into account the type of Business models and clientele.

Every investor needs to review the business model in order to get knowledge about the company’s competitive edge. Understanding the business model helps investors to have a better sense of financial data.

Evaluating the business model helps the investors to get an overall view of the company’s products, its business strategies and future prospects.

Business Model Examples

For example, let’s take company A which rents and sells video games. So the company is in the business of video games. The company used to make a profit of 5 million after spending 3 million on their inventories for video games. So, the total gross profit margin is 2 million.

The Internet arrived in the market and the company now has to alter its business model by taking into consideration the Internet in order to survive in the market. So as a result the cost of holding inventory and distribution cost also gets reduced. Since expenses reduce profit increases.

Even though with the arrival of internet sales get reduced but the company was able to expand its business as technology helped it to change course.

In a similar way, there are various business models types-

What are Business Models Types?

We will discuss here 4 types of business models:

1. Business -To- Business Models (B2B)

When dealings or transactions take place between two companies or businesses then this type of business model is known as business to the business model.

It has good market predictability and more market stability. Since under B2B sale is made in bulk amount this model leads to lower cost for the businesses.

The best example of this type of business model in India is IndiaMart InterMesh which is a wholesale B2B marketplace. It offers millions of products to its customers which includes consumer electronics, machinery, apparel and many more.

2. Business -To-Consumer Models (B2C)

The business-2-consumer business model is a model that refers to businesses that sell their services or products directly to the consumer who are the end users of the products or services.

There is an ongoing demand for the products as it provides the essential items. This thus eliminates the risk of fluctuation in demand and helps in maintaining consistency in the business. Since direct contact is there with the customers so information is shared with them directly and easily.

Customers are given products at a low price compared to their competitors for the business to run smoothly.

An example of business to consumer model is Avenue Supermart which provides goods directly to its customers.

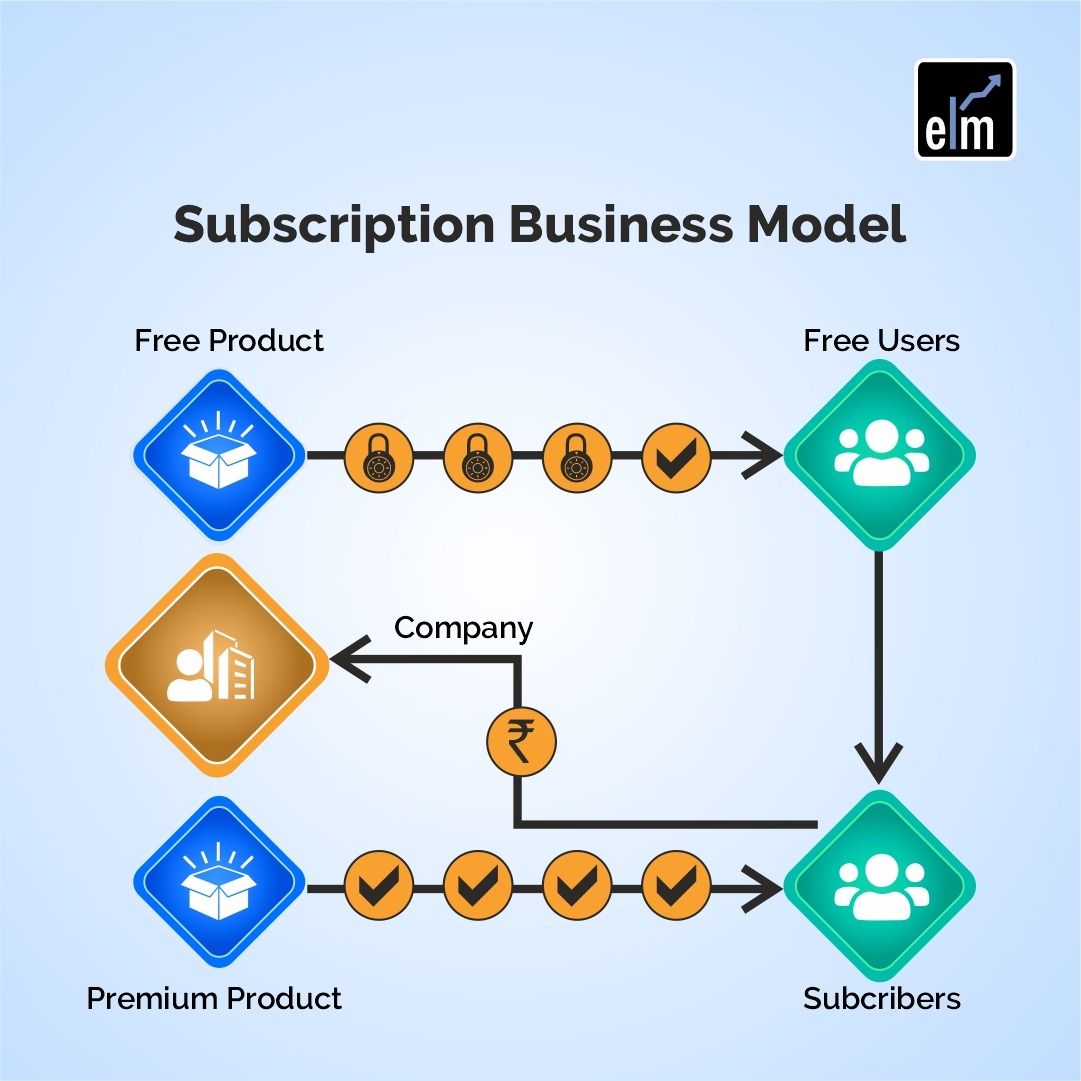

3. Subscription-Based Models

Any application-based businesses or software companies have subscription-based business models. They offer their product as a one-time purchase, in return company earns monthly or annual revenues.

This type of business model allows the company to earn regular income by giving the client the opportunity to pay for the cost of the purchase in 12 equal payments rather than asking them to pay the wholesome amount in one go.

One of the leading examples is Infoedge for this type of business model.

4. On-Demand Business Model

It is the most recent form of model which is made out on the need by answering immediately. This type of business model is prepared in such a way that all the questions will be answered by just a click of a button in seconds.

It is very much convenient and easy for customers as even before customers have visited a particular city they get their hotels or places booked.

One of the examples is making my trip which allows customers to plan the holidays and make the bookings in advance.

Advantages of Business Models

- A good business model gives the company a competitive edge in the industry.

- A strong business model provides the company good reputation in the market place encouraging investors to remain invested in the company.

- Making the business model strong leads to an ongoing business profit leading to an increase in cash reserve and new investments.

- A proven business model brings financial stability to the organization.

Business models have disadvantages as well.

Disadvantages of the Business Model

- Once a business model is created, then it restricts to implementation new ideas for the product.

- Creating a business model is time-consuming as a lot of factors need to be considered.

- There might be a chance that the business model may turn out to be inaccurate.

Apart from the disadvantages, the business model is mandatory to be prepared before starting of a new project.

Bottomline

A business is more than just a place where things are sold. It’s an ecosystem, therefore it needs a plan for who to sell to, what to sell for, how much to charge, and how much value it’s producing.

What an organisation does to consistently produce long-term value for its clients is described by its business model. A company should have a clearer understanding of how it intends to function and what its financial future looks like after developing a business model.

While preparing business and revenue models, one of the most important skills that is required is Ms Excel. Wish to learn it ? That also in Hindi? Then join our ms excel in hindi full course now!

Visit blog: https://blog.elearnmarkets.com/what-are-business-models/

Frequently Asked Questions

1. What is a good business model?

A good business model is one that provides the company with a competitive edge in the industry-leading to good business profits.

2. Why is a business model important?

The business model is important because it provides the investors with knowledge about the competitive edge of the company and provides better insight into the workings of the company. A strong business model leads to cash generation and future expansion.

3. How do you create a business model?

The business model is created by identifying the products and services that will be sold in the market to be targeted like B2B, B2C, subscription-based model or on-demand market.

4. What are the components of the business model?

The business model includes information about the company’s products, its target market and its future prospect related to its business type.

5. What is business modeling?

Business modeling is the process of outlining how a company creates, delivers, and captures value. It covers key elements like target customers, revenue, costs, and operations to guide business planning and strategy.

To get the latest updates about Financial Markets, visit StockEdge