Company Analysis? Now, this is a really important topic to discuss if you are looking to create long-term wealth out of stocks. For long-term wealth creation, it is extremely important to understand the company you are going to invest in.

This entire process of giving a refined look to a company is known as Fundamental Analysis and this is one of the best ways to understand how investors evaluate a company for long-term investment. Or else just get to an overall idea on the topic, Read on!

Why do you do company analysis?

Now, obviously, you know the answer, it is because the annual reports and the financial statements help you in evaluating the performance of the company so that you can select good stocks for your portfolio.

Now what do these good stocks look like and what are the criteria?

Suggested read: Stock selection criteria – follow the fundamental way of selecting a stock

Now let us quickly come to the most important part of the blog:

Steps in the company analysis process

1. Identify company and industry’s economic characteristic

We need to start off by knowing about the company and the industry it operates in.

Suppose we want to invest in Dabur.

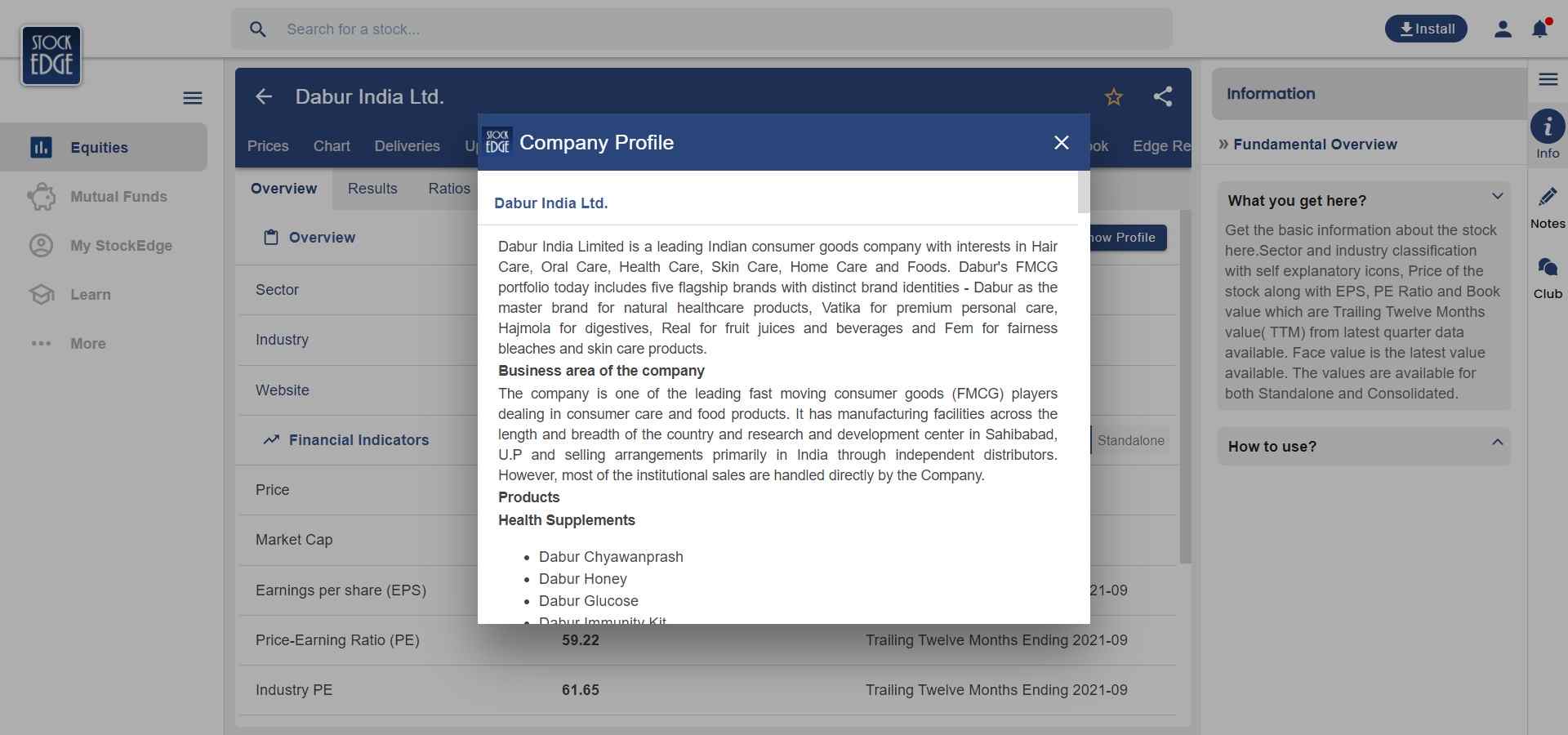

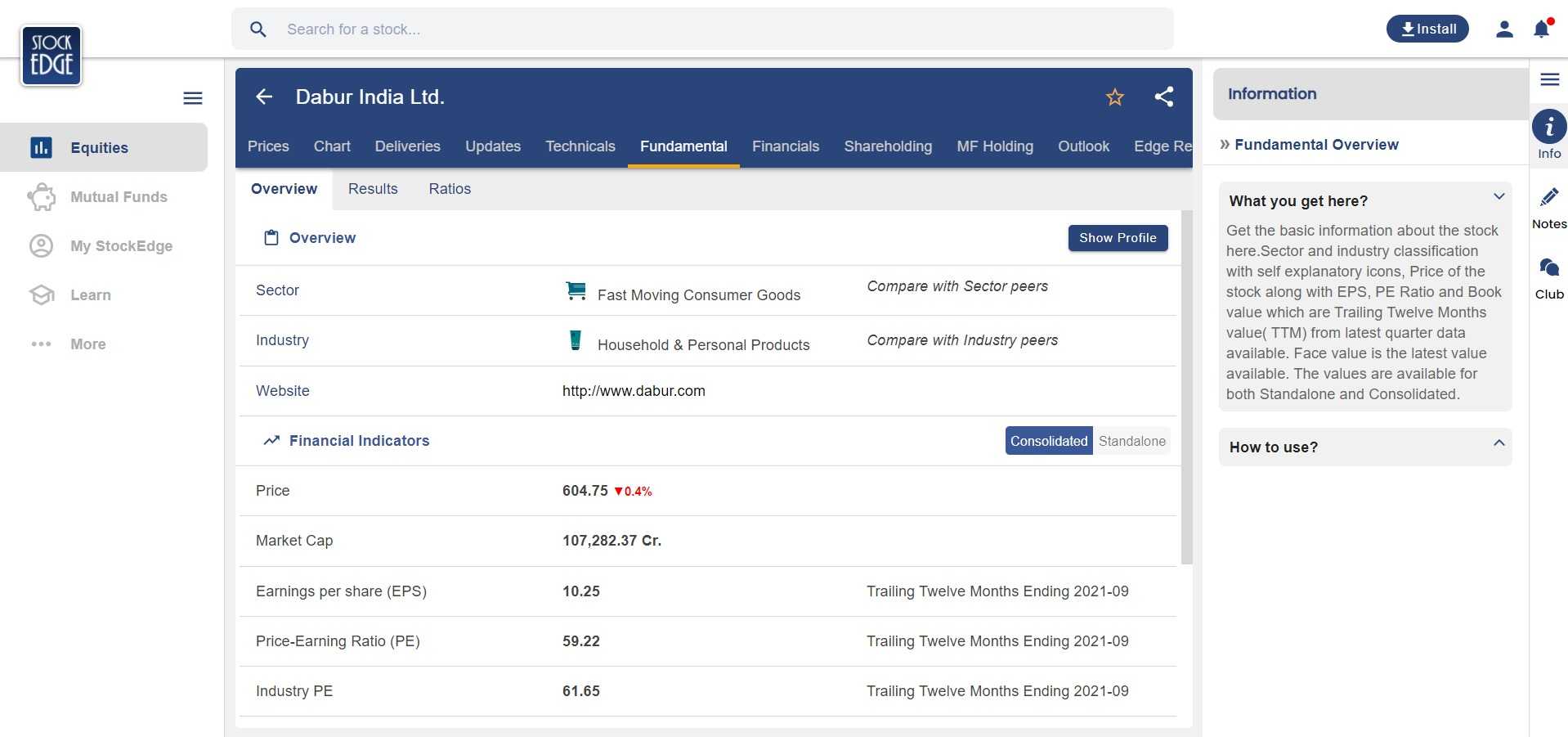

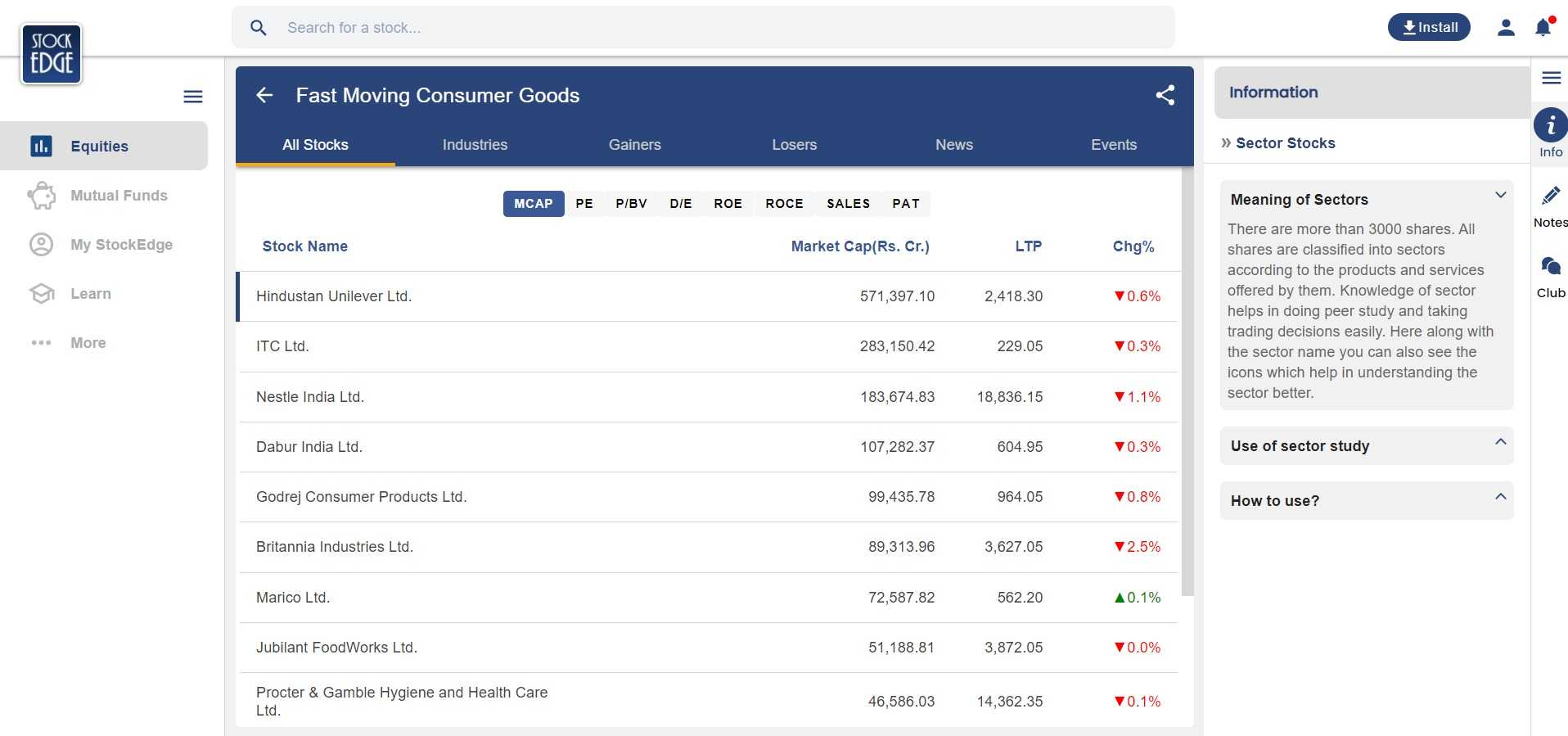

So to be quick enough, you can use the Stockedge app.

Here, type the name of the company, and go to the “Show Profile” section in the Stockedge app. Also, we will get the details of the company in the “About” section on the company’s website.

Here, we will get a brief idea of the past as well as the present situation of the company, the places and the number of manufacturing facilities the company operates, and also some briefs about the sector, here, FMCG.

This step will help us in getting an idea as to which part of the value chain does the company fits in and its closest competitors which might be operating in that area.

2. Identify and know about the products and/or services

After getting to know the overview of the company, we need to go through its products and services which it offers to its customers.

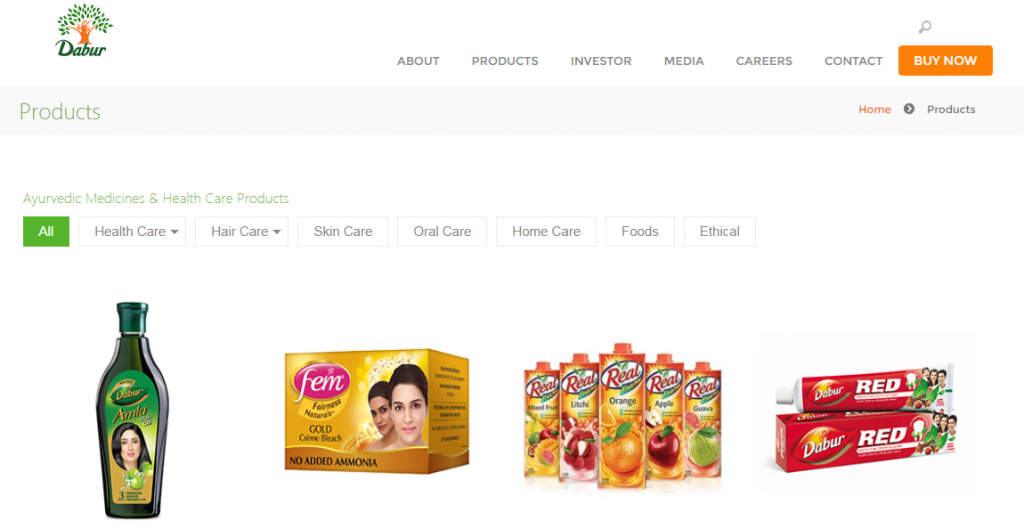

For that, we can again visit the “Show Profile” section in the Stockedge app or we can visit the “Products” section on the company website.

Suppose we want to know about the products ‘Dabur’ manufactures and sells, we can just log on to the website and under ‘Products’ section we will see the verticals it is present in like, Healthcare, Home and Personal care and Foods category.

We have to also look at the nature of the product being offered by the firm, uniqueness of the product, demand and supply dynamics, brand awareness in the geographical area it is present in.

The market shares and to which market by geography it caters too.

For example, IRCTC is the only company that offers a platform to book online railway tickets for travelers. There is no competitor for this type of service in India which is a big positive for the company.

Whereas taking on any Auto company such as Maruti Suzuki, which offers cars of various segments to its customers. Herein, there are a lot of players and the company has to fight to retain its market share.

This is how we analyze the products or services offered by the company.

3. Understanding the risks and concerns about the company

Every business and industry carries its own set of risks and concerns which might impact the performance and profitability of the company.

So, as an investor, it is very important to get an idea as to the risks the company is exposed to in case of any eventualities.

For example, crude oil is an important component in the manufacturing of paints which constitutes around 55% of the raw materials, so the fluctuations in the crude prices will likely impact the EBITDA and the margins of the company manufacturing paints.

So we need to check and analyze, to which extent will that particular risk affect the business and can the company overcome it.

For example, Currency volatility is an important risk for the IT industry as it generates the majority of the revenues from other countries. Here we need to check that how and to what extent will currency appreciation or depreciation impact the company’s performance.

The Company’s Annual Report also contains the risks and concerns that the company is exposed to.

We can get it under ‘Management Discussion and Analysis, where it will list the risks which the company might face in its operations along with the steps it is taking to overcome those situations.

4. Analyzing the Financial Statements:

This is one of the most important steps in the process to analyze a company.

The financial statement gives us the actual quantitative picture of any company which is an important part.

When evaluating the Income Statements, we check on the margins, the top line, and the bottom line.

To do it the least possible time, you can check the fundamentals using the Stockedge app, to get a visual idea of the trend of the revenues, the EBITDA as well as the PAT growth of a company.

From the Balance Sheet, we get an idea as to how strong the company financially is.

Cash Flow Statements gives us a thorough picture of the Cash balance which is generated from the company’s operating, investing, and financing activities. It helps in understanding the firm’s liquidity position.

Finally, it is also important to go through the ratios in a comparative manner, in relation to the past periods or relative to the other players in the industry.

Fundamental Analysis Factors affecting company analysis

1. Qualitative Factors

These factors take into consideration the business model, competitive advantage, Management, and Corporate governance.

Under the business model, we need to see what the company does, what does it sell along the prices at which it sells.

Let’s say, for example, HUL is an industry leader in the FMCG space which knows how to tackle economic downturns.

When the consumption slowdown happened in the late FY19 and the early FY20, most of the FMCG company’s revenues and profitability were impacted, wherein HUL was able to report stable growth which was due to its presence in a wide range of products in the FMCG which no other company had.

Competitive advantage shows the uniqueness of the company from its peers.

The above example, also shows that how HUL has a competitive advantage over others of being present in the lowest category of products to the highest category of products.

If the company is doing something different then it will affect its profitability to a large extent in the long term.

These kinds survive better than their peers.

Management and Corporate Governance generally go hand in hand.

As we know that the management is the people who are driving the company.

HDFC Bank, Tata Group are good examples of strong and ethical management along with good corporate governance where the company takes efforts to inform investors about updates.

It takes into consideration that all the company abides by the regulatory laws and has a long history of reputation in the business.

Thus, it is important to get an idea of the company’s quality of management as to how experienced are they and whether they are guilty of any kind of fraud in the past.

Proper and ethical management will always think about the well-being of the company and its stakeholders.

Sound management will also abide by the rules and regulations set up by the government or the regulators. So, it is very important to have dynamic and ethical management to head an organization.

2. Quantitative Factors

In the quantitative factors, we deal with the Industry growth and the company’s growth along with its peers.

There will be a few times when the company will outperform the industry but also some times when it will underperform the industry.

The fact that the company would be able to outperform its industry or not depends on the growth and size of the company compared to the industry.

The smaller the company, the higher growth is expected out of it and vice versa.

For example, HUL is the industry leader in the FMCG industry, which has grown at 8.48% CAGR over the past 5 years whereas, Marico which is a much smaller player compared to HUL has grown by 18.05% CAGR over the past 5 years. This shows that smaller companies tend to grow faster as they have more room for growth.

Along with these, the other quantitative factors affecting the analysis are the financial statements.

A company with very good growth but with a weak balance sheet can be considered to be a risky investment.

Companies having a large number of competitors in their segment will have more pricing pressure and thus lower margins.

FMCG companies cannot just hike or lower the prices as there are too many competitors which might get affected whereas, in the airline’s industry, only a few players operate which enables them to hike or reduce their prices whenever they want.

Hence, to summarize, in the airline industry the players have pricing power, on the other hand, the FMCG players do not enjoy the pricing power.

This pricing power phenomenon affects the margins. In the FMCG industry margins do not fluctuate much, whereas, in the airline industry the margins do get affected due to the fluctuations in the prices of the fares.

Hence we need to take into account both qualitative as well as quantitative factors in order to get an in-depth understanding of the company.

Methods of Company Analysis

Primarily company analysis can be segregated into two methods:

1. Top Down Approach

In the top-down approach, the investors start analyzing by looking at the macroeconomic factors like monetary policy, inflation, economic growth, broader events before digging deep into the individual stock.

The investor looks for the factors, events prevailing in the market and tries to understand the opportunity that could be derived from it.

2. Bottom Up Approach

In this approach, we start by analyzing the individual companies and then building a portfolio based on the specific attributes.

Investors tend to focus on the micro-economic factors in this method of investing.

How do we evaluate the company fundamentals?

- First we need to have a brief overview about the company’s business model. As discussed earlier, we need to see how the company manufactures and sells its products or services.

From the point of getting the raw materials to selling the products; a series of steps need to be taken.

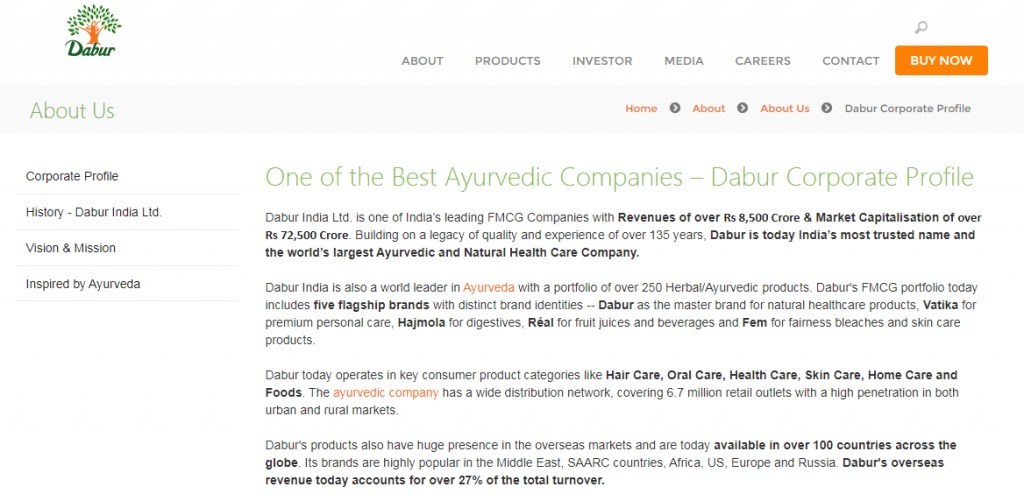

For example, let’s say in the case of Dabur, first, we need to get an idea about the company from the About >> Corporate Profile section.

Then, we can get further details about the company’s business model from the Annual Report which is published annually.

The business model analysis includes getting the information of the raw material as to how it is supplied to the retailers.

This step will help us to get an idea of how are the different products manufactured and are supplied to the various suppliers.

- Post getting to know about the business model, we need to check the financials of the company. We will get these from the Profit & Loss Statements. Analyzing the financials and the balance sheet will help us to get an idea of the financial position of the company.

We will get the Financials and Balance Sheet in the Annual Report from where we can analyze the performance of the company compared to the previous fiscal year.

Also, we can get the financials, balance sheet, and cash flow from our own Stockedge app.

Now, the financial analysis should also be done on a comparable approach, like how is the revenue growth, PAT growth, or the margins expansion/contraction compared to the industry leader i.e HUL.

Only then it is possible for us to conclude whether the company fared well or was average. Balance Sheets can be analyzed on a year-on-year change basis.

Cash Flow Statements should also be analyzed on the basis of three activities: Operating, Investing, and Financing activities.

- Finally, we need to compare with these data with the peers which will help us understand about the company from a comparative point of view. This step will help us understand how the company is actually performing compared to the industry players.

For the final comparable analysis, we need to prepare an excel wherein we get the few closest comparables of Dabur which are present in the FMCG industry.

From there we can analyze the revenue growth, PAT growth, margins, and debt levels among others.

We also need to conduct a ratio analysis with the peers which will help us get a fair idea of how does the company operates and also its strengths and weaknesses.

For ratio analysis, we have to write down the ratios we need to compare on an excel sheet and compare it individually with its peers.

For the competitors of Dabur, we can go to Dabur>>Fundamentals>>Sector. This will show us all the players present in the industry. But we need to choose the ones which are the closest ones based on Market cap and business model.

Thus, as we can see that company analysis is a long and tedious process that involves hours of dedicated work.

Analysts are trained professionals who do this day in and day out.

But being a retail investor it is not always possible to give so much time for the analysis.

Thus, that basic investing and accounting knowledge is sufficient to generate moderate returns.

Thus to create wealth you need to find out where to collect data from. Learn how to do the fundamental analysis of a company step-by-step.

Tools for Company Analysis

Thus for collecting data to study deeply about a company you can check out the StockEdge App which has comprehensive data on the company from Technical’s to Fundamentals from options to ratio analysis.

Or you can check out some broker reports on the company from the website researchbytes.com

Once you have planned for the tools to use you are ready to ride on creating wealth for yourself.

Frequently Asked Questions

What’s the difference between company analysis and business analysis?

Company analysis gives the performance of a particular company. It includes all the areas of business in which it is engaged and in all the segments and how they are performing.

On the other hand business analysis is the examination of the business in which the company is engaged and how well it is doing in that context with regard to other companies in a similar business.

What is Company Analysis?

Company analysis is the process by which investors evaluate securities, the company’s profile, profitability, and its products and services for the investment process.

What are the factors of company analysis?

Factors affecting company analysis are qualitative factors and quantitative factors. Qualitative factors are business models, competitive advantage, Management, and corporate governance. Quantitative factors deal with company growth and industry growth along with its peers.

Key Takeaways

Company Analysis is the process of evaluating a company’s profitability, profile, product and services

It’s important for any investor to perform a thorough analysis in order to get a fair view of the company he/she is interested in.

It is important to go through the ratios in a comparative manner, in relation to the past periods or relative to the other players in the industry.

It is important to get an idea of the company’s quality of management as to how experienced are they and whether they are guilty of any kind of frauds in the past.

Cash Flow Statements gives us a thorough picture of the Cash balance which is generated from the company’s operating, investing and financing activities.

We need to take into account both qualitative as well as the quantitative factors in order to get an in depth understanding about the company.

Enroll in Elearnmarkets to avail the courses on Fundamental Analysis.

Exactly what I was searching for, appreciate it for putting up.