An employed friend working in a recognized company asked me “Why is it that we can contribute only 12% of our basic salary to the Employee Provident Fund for retirement. What if we need more when we retire?” I replied him yes we can contribute more than 12% of our basic salary voluntarily by opening up Voluntary Provident Fund (VPF).

The most talked about topics among youngsters, when it comes to investing is Retirement planning. Nowadays there are plenty of investment options available such as mutual funds, bonds, equity, PPF, VPF, ULIP etc. in which one can invest for their retirement.

Voluntary Provident Fund is an excellent tax saving fund. In recent, Voluntary Provident Fund has become one of the most popular saving options especially among the employed sections of the society.

Let us discuss about it in details:-

What is Voluntary Provident Fund (VPF)?

Voluntary Provident Fund is the extended version of Employee Provident Fund. Here the subscriber can retain control to the periodic assigning of a specified amount of funds to his/her provident fund, voluntarily. It also helps the subscriber to build savings portfolio and provides long term savings options.

Usually in Employee Provident Fund, one has to pay 12% of his/her basic salary towards its account but in this a subscriber can pay 100% of his salary, voluntarily. This contribution is known as the Voluntary Provident Fund. But it is a mandate to pay more than 12% of the salary in the Voluntary Provident Fund.

To start investing for your retirement, you can take assistance of Kredent Money App.

Benefits of investing in Voluntary Provident Fund

The benefits of investing in Voluntary Provident Fund are as follows:

- Voluntary Provident Fund is a safe and trustworthy investment as it is managed by the Government. It is a safe investment option except for the risks involved in long term investment options.

- It is easy to apply as the employee just has to raise a request to his HR for opening the account. The employee has to fill up a simple Voluntary Provident registration form. The account can be opened at any time of the financial year.

- VPF is known for its high yields.

- In Voluntary Provident Fund, the amount can be withdrawn at the retirement or at the end of the current employment.

- The amount contributed to the VPF account is eligible for deduction if it is more than Rs 1 lakh. But the income which is generated through interest is non-taxable provided that the amount generated is not more than 9.5%.

- This fund can be easily transferred from one employer to another. Therefore change of jobs will not affect the benefits from VPF.

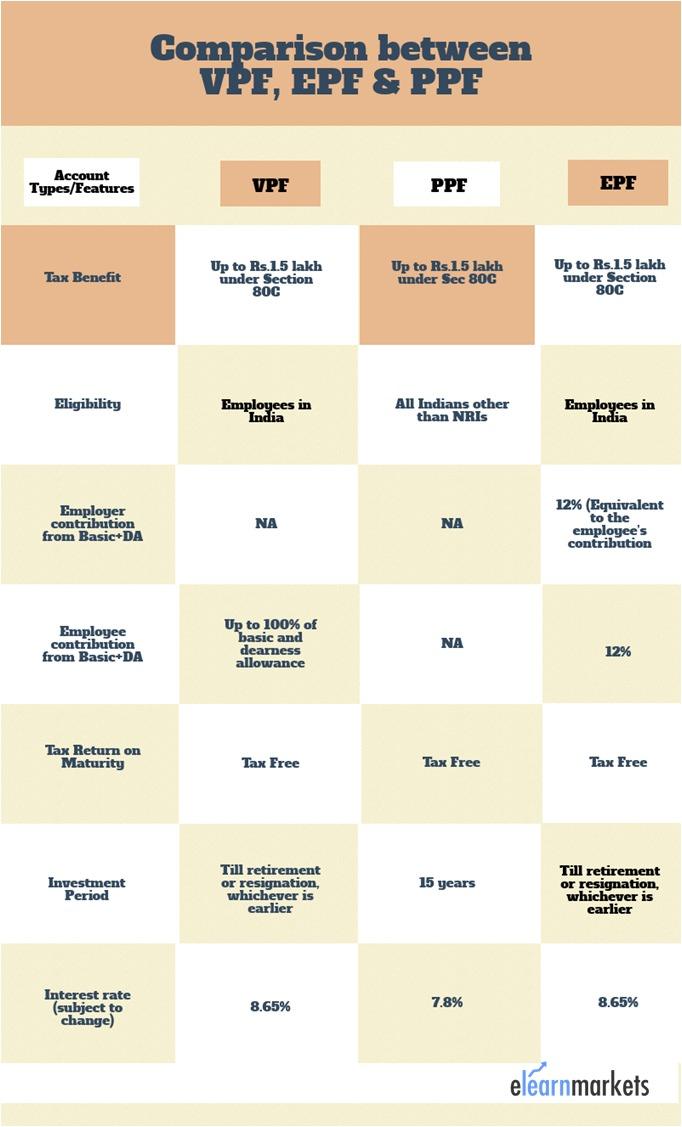

VPF vs PPF vs EPF: Which one is better?

Eligibility criteria for VPF

Voluntary Provident Fund is exclusively for those who are employed and receive their pay through salary account. People who are working in unorganized sectors including non-salaried can open up Public Provident Fund through local banks.

How does VPF Scheme Works?

Voluntary Provident Fund is only available only for resident salaried employees. Lets see how it works:

- The maximum amount which can be contributed towards the VPF account is 100% of the basic salary.

- In order to subscribe, the employee has to ask his/her employer in writing for further deduction of their salary.

- This can be done during any time of the financial year

- The form can be easily filled, signed and submitted to the company.

- The form contains details about the amount to be contributed and personal information.

- One is not allowed to discontinue investment in VPF within one financial year.

- In case the money is withdrawn within 5 years, the amount when withdrawn is liable for taxation.

- Employers should encourage their employees to start investing in VPF scheme at the beginning of the year.

- The interest amount is taxable if the offered rate is more than 9.5%.

- This scheme in only offered for salaried employees.

- The rate of interest of this scheme is of floating basis thus every year the interest rate changes.

- It is a good scheme for the investors who are looking for long term investment.

- It is an ideal scheme for those investors who are approaching retirement.

VPF Account Interest Rates

The Voluntary Provident Fund fetches exactly the same interest rates as Employee Provident Fund:

- If the company has more than 20 staffs than the 12% of the gross salaries is deducted monthly and contributed towards the Employee Provident Fund and the same will also be for VPF

- VPF is considered as the extra contribution made for the employee’s Employee Provident Fund above the compulsory 12 %.

- The rate of interest offered by VPF is same as EPF that is 8.75% annually at present.

- The government reviews the interest rate of VPF annually.

- Unless the interest rate goes beyond 9.25%, the income accumulated by the interest cannot be taxed.

VPF Calculator

VPF calculator is easily available online by which one can calculate how much money must periodically be invested to attain the target. One has to utilize the following inputs to calculate his voluntarily PF payment strategy:-

- Monthly salary

- Percentage of Monthly salary to be contributed

- Monthly contribution to EPF

- Interest Rate

- Current EPF balance

- Employer’s contribution to EPF

VPF Registration Form

There is no such specific registration form for VPF. An individual who is interested to invest in VPF account must intimate this to Company’s HR and he/she will convert the EPF account to VPF account but the individual must be registered with the Employees’ Provident Fund Organization of India. The process of opening VPF is:-

- Employee requests his/her company for more reductions from his salary.

- The employee fills up the KYC form and signs and forwards the same to his/her HR department.

- When this form is received by the employer, he/she will upgrade it from EPF account to VPF account.

Tax Benefits from VPF Scheme

As said earlier VPF is the most effective tax saving scheme in India. According to the regulations, one can enjoy tax break of up to Rs. 1 Lakh. However the contributions to the VPF account is considered from the employee’s pre-tax income. The income which is derived from the interest received from VPF account is not taxed unless the interest rate matches or exceeds more than 9.5%. The withdrawal is tax free if the amount is not withdrawn before 5 years.

How to start investing in VPF

Investing in VPF is extremely simple. The employee has to write to his/her HR team and request them to contribute more percentage of salary to Employee Provident Fund. This can be done at any time of the financial year. The employee can start investing by submitting the following documents.

Documents required for opening VPF Account

Voluntary Provident Fund is just a subset of EPF and can be easily applied by just requesting to the HR team. Basically the application form is the collection of the details of the employee. For registration, the company has to provide the following documents:-

- Company profile

- Certification of Business Registration including Form D and Form 9

- Forms 24 and 49

- Company Registration Certificate

- Memorandum and Articles of Association

- Other Documents

VPF withdrawal process & withdrawal Forms

Voluntary Provident Fund is famous as money can be easily withdrawn at any time. The depositor can break his/her VPF for following reasons such as:

- Medical treatments which involve treatment cost of employee and his/her family members

- Expenses for higher education and marriage

- Home loan payment

- For the construction or purchase of house

However, it is important to note that tax deduction is only allowed if the money is in the VPF account for at least 5 years. If it is withdrawn before 5 years then it is liable for taxation.

The withdrawal of the funds is only allowed when the employee submits a request letter and form-31 to his/her respective employer. Form 31 is an EPF fund application form which is available on all Government Portals and it can be easily downloaded from the EPFO website.

Apart from the above document, a form has to be submitted containing the details about the employees postal address, EPF account number, bank details and also a cancelled cheque. All the documents have to be attested by the concerned employer.

What is the lock-in period for the VPF and when can you withdraw money?

The lock in period for the VPF is 5 years after which the money can be withdrawn from the account. As discussed above if the money is withdrawn before 5 years, the withdrawn amount will be taxed.

Rules & Regulations governing VPF Scheme

The rules and regulations governing this scheme are simple. The rules and regulations are as follows:

- In VPF an employee can contribute as much as 100% of their gross salary as compared to the Employee Provident Fund

- Only those employees can apply for this scheme, who are working in the companies recognized by the Employees’ Provident Fund Organization of India.

- There are no obligations for the employers to contribute for their employee’s portfolio

- This scheme can be opened up at any time of the financial year

- The interest rate of the this scheme is decided by the Government at the beginning of the year

- The first maturity is paid at the time of retirement or resignation.

- The entire maturity will be taxable if Direct Tax Code comes into effect.

Can I take loan on VPF?

Yes, you can apply for loan on Voluntary Provident Fund subjected to the loan rules of Employee Provident Fund and as discussed above you can also withdraw a part or whole amount from the VPF account. It can be used as any other personal loan but the reason has to be genuine.

How to track my VPF Balance

An individual can track his/her balance just like checking balance in the Employee Provident Fund.

The methods for checking balance are as follow:

- You can give missed call on the number 011 22 901 406

- You can send SMS to 7738299899

- You can login here to check your balance

- You can also install their mobile app and check the balance there.

Frequently Asked Questions on VPF

What amount of money can be withdrawn as loan against VPF account?

An employee can partially withdraw or can also withdraw the whole amount.

In VPF what is the minimum and maximum amount that can be invested?

The minimum amount that can be invested is 12% of the basic salary and the maximum amount that can be invested is 100% of the basic salary.

Bottomline

Employee Provident Fund and Voluntary Provident Fund are both best investing options for retirement. As discussed above Voluntary Provident Fund have certain advantages over Employee Provident Fund.

This is a very informative article. Thanks for sharing.

Hello Garima,

Thank you for connecting with us.

You can read more blogs on retirement planning

Happy Reading!!

If I have exhausted the befit under 80C, there is no benefit for taking additional benefit by way of opting VPF contribution, in such a case, do you think the maturity amount from VPF is still taxable upon commencement of direct tax code?

Hi Sinu,

If the direct tax code comes into effect, the entire maturity amount becomes taxable.

Thank you for reading!

Thank you for sharing this valuable information with us!

Very informative article with tons of knowledge.

I have read the exact statement “The entire maturity will be taxable if Direct Tax Code comes into effect.” in many web sites and blogs. None of them has cared to explain what does that mean. If the entire amount becomes taxable, will not that be double taxation?

Hi,

Double Taxation occurs when income is taxed at both the corporate and personal levels.

Thank you for Reading!!