The Santa Claus Rally is a phenomenon that quietly affects the financial markets with its cheery aura and sparkling lights as the holiday season approaches.

Imagine a scenario in which stock prices soar in the latter weeks of December and early January, providing investors with a surprise benefit.

A Santa Claus rally is an extended period of rising stock prices around December 25, the day of the Christmas holiday. While some predict that these rallies start on Christmas Day and continue until January 2, the majority believe that they occur in the week before the holiday.

There are a number of theories to explain a Santa Claus rally, such as investing in Christmas bonuses, end-of-year tax considerations, and a general sense of optimism and seasonal cheer on Wall Street. Retail investors, who typically have a more bullish outlook on the market, handle the market around this time of year, while some institutional investors close their books and take a vacation.

Let’s unwrap this seasonal enigma and discover whether the Santa Claus Rally is a market trend that investors can truly count on or if it’s just another holiday myth. After all, ’tis the season for surprises, and the financial markets are no exception.

What is the history behind Santa Claus’s rally?

Yale Hirsch started the Stock Trader’s Almanac in 1968 after researching the trends and history of the stock market. The public was first exposed to statistically foreseeable market phenomena through the almanack, including the “Santa Claus Rally,” the “January Barometer,” and the “Presidential Election Year Cycle.”

The S&P 500 has historically demonstrated higher stock prices throughout these seven days, 79.2% of the time.

Data from the 73 years between 1950 and 2022, as provided by the Stock Trader’s Almanac, revealed that the S&P 500 increased by 1.4% on 58 occasions, or around 80% of the time, during Santa Claus rallies.

What causes the Santa Claus Rally?

Although there are several explanations for the stock market’s advances throughout the course of the seven-day trading session, there isn’t one obvious reason why the Santa Claus rally occurred. Among them are:

- Since institutional investors take a week off the week following Christmas, trading activity is often low. Retail investors, who are typically more positive, can have a greater impact on the market, and it can be more volatile.

- The January effect, which occurs when investors buy stocks ahead of a predicted January gain, may be the result of reinvesting funds following December tax loss harvesting.

- By the end of December, investors might have already started reinvesting tax loss harvesting funds.

- The week that falls between Christmas and New Year’s can provide a feeling of hope and optimism for the upcoming year.

- People get money to invest in the stock market through end-of-year bonuses and gifts given during the holidays.

- The Santa Claus rally becomes a self-fulfilling prophecy once it has widespread recognition. People will invest appropriately if they think it’s real.

Does the Santa Claus rally occur in the Indian markets?

The Santa Claus rally is a lesser-known occurrence in India, despite the fact that it occurs worldwide. However, in recent years, the final week of December has also seen a slight upward tendency in the Indian stock market.

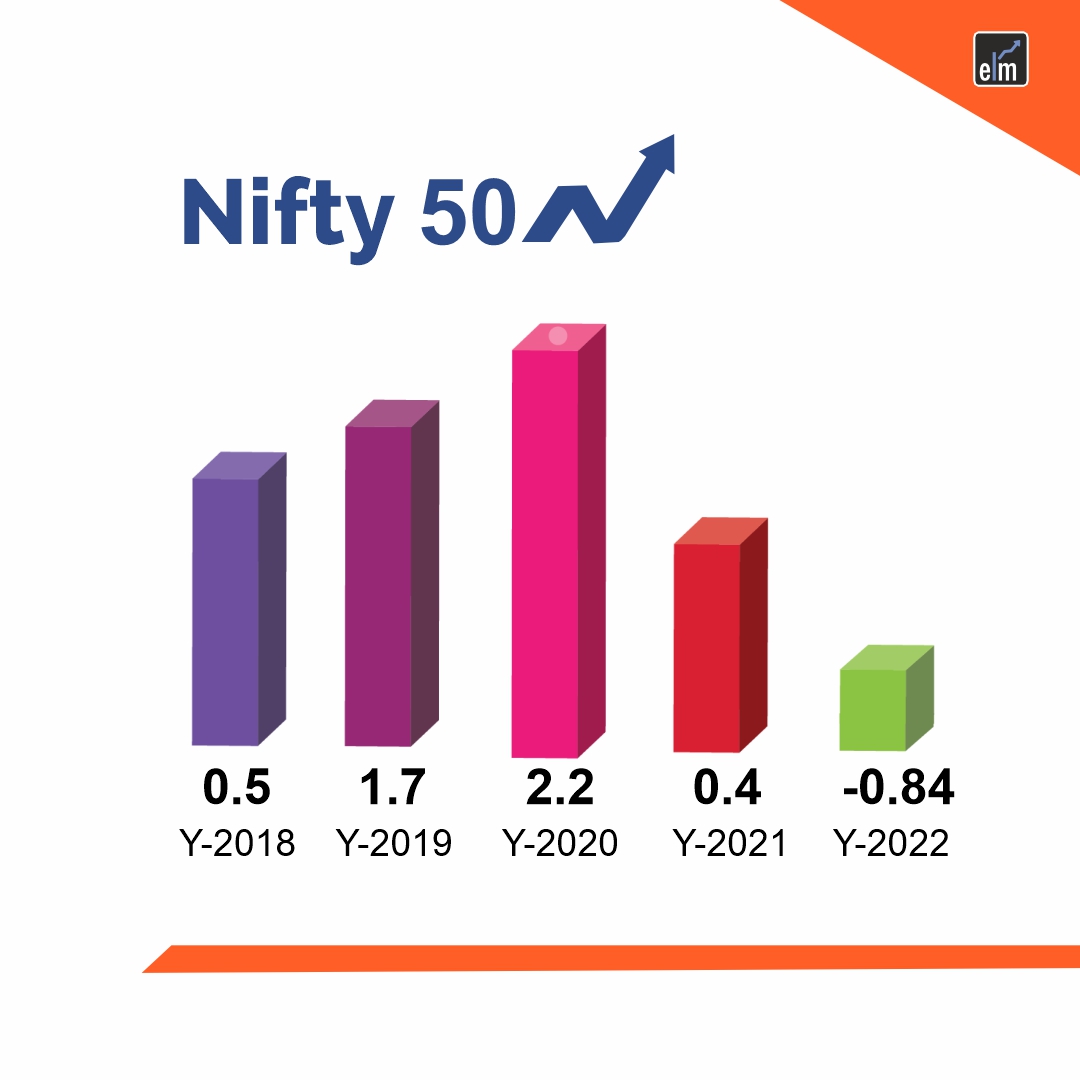

Below is the data showing how in the last 5-year Nifty 50 performed in the last 15 days of December:

Trading Strategies for Investors

Traders look for opportunities to profit from past trends and pay attention to cyclical developments. However, the idea is usually somewhat arbitrary, and the Santa Claus rally is no different. Through position size and stop orders when positions move against them, investors keep an eye on their risk and profit.

While it’s normal to watch the Santa Claus rally, attempting to profit from the phenomena is another story. During this time, investors should be aware of the trading regulations. A stop-loss level and a strategy for what to do if the transaction is neither successful nor stopped out by Christmas are examples of strategies.

Investing in buy-and-hold stocks and retirement savings have no long-term impact from the Santa Claus surge. It’s a headline in the news, but it’s not a reason to get more bullish or pessimistic during the January Effect or Santa Claus rallies.

Conclusion

The price movement during the holidays should be seen for what it is by long-term traders: A coin flip in an environment of low market liquidity that has little to no predictive value for the upcoming weeks. Adjustments to positions at the end of the month or year can result in extremely erratic market movements. Although some analysts view it as the start of the January Effect or a Santa Claus rally, investors should take their personal objectives and risk tolerance into account before following a market trend.

Frequently Asked Questions (FAQs)

What is a Santa Claus rally in the stock market?

Strong purchasing around the Christmas season is referred to as the “Santa Claus” rally.

How often is there a Santa Claus rally?

In the equities markets, the Santa Claus rally has occurred almost 76% of the time since 1950. The spike can be attributed to a number of factors, one of which is that investors are holding off on selling valuable assets until January in order to postpone paying capital gains taxes for an extra year.

What is the Santa Claus rally saying?

The tendency for the S&P 500 index to rise over the last five trading days of December and the first two trading days of January is known as a “Santa Claus rally.” The Stock Trader’s Almanac published the phrase for the first time in the 1970s.