The ability to sell anything which you don’t actually own is a very unique part of the stock market and many people really wonder that something like short selling really occurs.

It has helped traders to manage their losses due to market risks or other dangers like corporate actions and dividends.

Even short sellers play a very important role in the market.

| Table of Contents |

|---|

| What is short selling? |

| What does short sell imply? |

| How does broker get the stock? |

| Why we should do short selling? |

| Bottomline |

They help in creating a healthy and efficient market in various ways including the formation of a contrarian view, adding liquidity and also help in price discovery mechanism.

This write up aims at discussing the important concepts of short selling, from where does the broker gets the stock, how to proceed with short selling, risks involved and why to short sell.

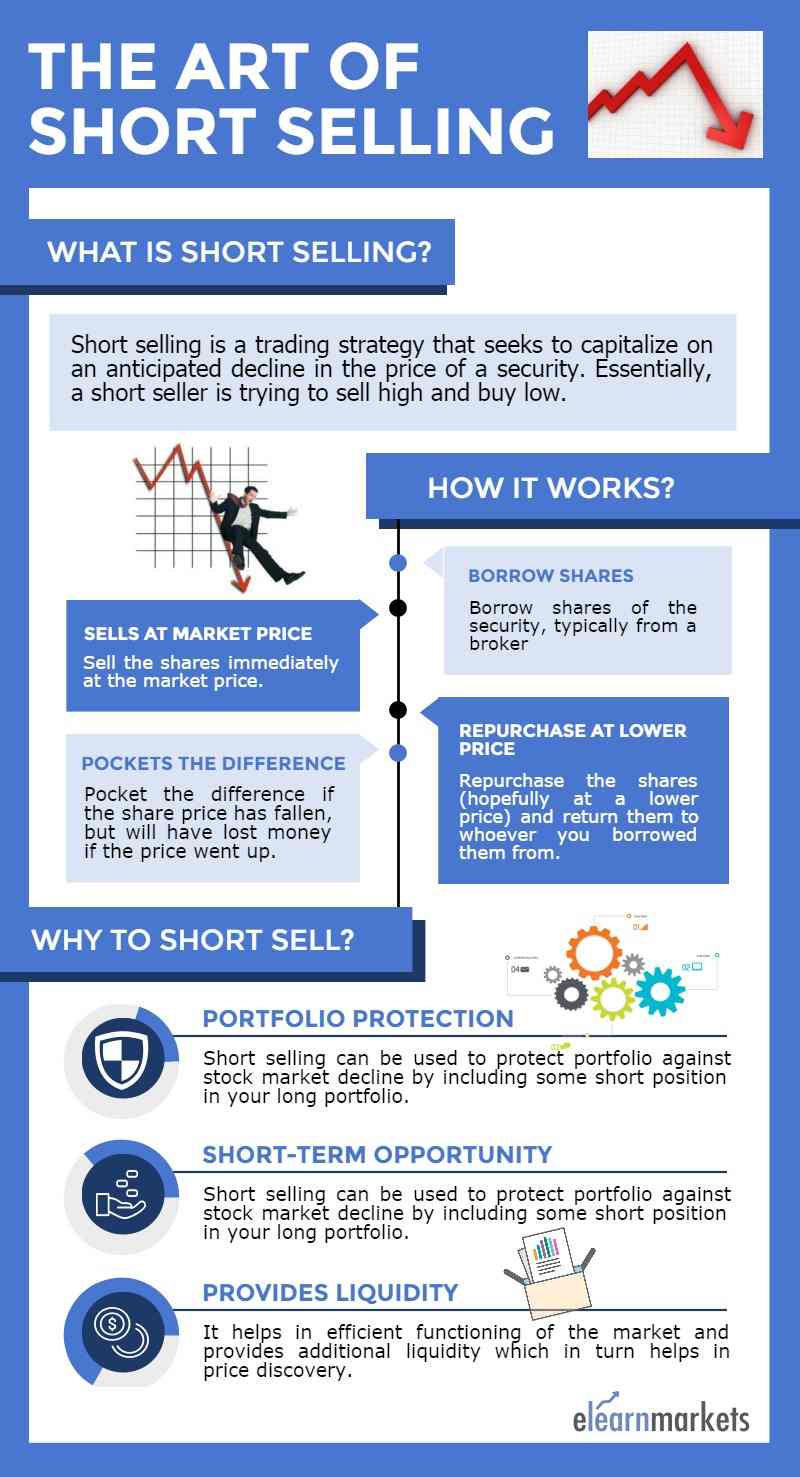

What is short selling?

Usually, we buy an asset and hold it until it rises and gives us a lump sum gains i.e. we buy low and expect to sell high.

But at times, we come across stocks which supposedly should go down due to any reasons either based on any news or technical parameters.

How to deal with such stocks?

Wouldn’t it be nice that if you are to gain from a fall in stock unlike gain in price?

Well, there is a way to make a profit from falling prices and the mechanism is known as short selling.

However, there are certain pitfalls and higher risks associated with short sell which you must take care of.

Hence it is very important to understand the entire mechanism before diving into it due to the complications involved in it.

What does short sell imply?

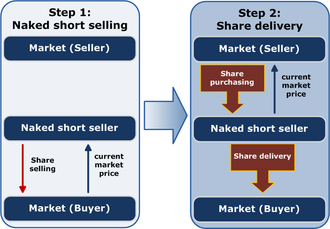

An individual who is supposedly selling a stock which he doesn’t own is said to be a short seller.

A short seller sells a stock which he feels will decrease in value.

He actually doesn’t own the stock before selling; rather he borrows it from the person already holding it.

Later on, when the price comes down as per his expectation, he again purchases the stock and returns back to cover up the loan. Hence, he makes a profit in the entire process.

Learn to trade like winner with Trading for Living course by Market Experts

The ultimate goal whether you short sell a stock or you go long on a stock is still the same i.e. “Buy low and sell high”.

But here just the order is reversed i.e. the stock is sold initially and purchased later.

For instance, Mr. Sharma thinks that XYZ company is currently in the overbought zone and he feels that the stock might see a near-term correction.

So he sells 1000 shares at Rs 200 / share.

After some time, the stock goes through a correction and the stock tumbles down to Rs 150 / share.

He then purchases the share back and covers his short position.

In the process, he pockets Rs 50,000 as gain (which is simply the difference between his sale proceed and purchase cost).

How does broker get the stock?

The simple answer to the above question is from customers or Stock Holding Corporation of India.

Short selling is nothing but a marginable transaction.

To go short on any stock, you must open a margin account.

It is the same account you often use if you want to keep your stock as collateral so as to trade in the stock market.

However, before opening such account there is an agreement (It states that you will keep cash or stock as margin) which you need to sign with the broker.

Why we should do short selling?

Portfolio protection-

In case of broad stock market decline, short selling can be used to guard or protect the portfolio against heavy decline. An individual might provide a cushion to his portfolio by including some short position in the long portfolio.

Short term opportunity-

There comes a time in the market when it goes to ridiculously high and becomes overhyped.

So in such a scenario, the market may fall when the reality replaces the hype created in the market. During those period, short sell provides an opportunity to profit from the overprice stocks.

Add liquidity-

It also provides additional liquidity to your portfolio which in turn helps in price discovery. Moreover, it also provides efficient functioning of the market.

Bottomline

Short selling is much different than just owning stocks.

It carries a higher degree of risk, is very complex and also requires a lot of responsibility to do the same.

It is not recommended for beginners.

Though it adds liquidity and provides hedging opportunity, it’s better to avoid unless you are know how to handle it properly.

I’ve recently started a web site, the information you offer on this website has helped me tremendously. Thank you for all of your time & work.