Free Cash Flow tells us how much cash the company is generating after the payment of things such as taxes, payrolls, equipment, buildings etc.

Free cash flow is an important measure for understanding the profitability of a business. It’s difficult to manipulate and it tells us a better story of a company than other commonly used metrics like net income.

Free cash flow can be used by the company in many ways such as paying down debt, business expansion, or paying additional dividends to their investors.

It is an important fundamental parameter that investors should understand while doing a fundamental analysis of the company in which they want to invest in.

In this blog, we will help you in understanding the basics of Free Cash Flow and how important it is when it comes to analyzing a company for investment.

What is Free Cash Flow?

Free cash flow is referred to as a firm’s cash flow after the payment of all its debt and other financial obligations.

It measures how much cash a firm is generating or is left with once the amount of working capital, as well as capital expenditure, is accounted for.

In other words, it tells us how much cash is available for repaying the creditors and rewarding investors in the form of a dividend.

This cash can also be utilized for expanding the scale of business, reducing debt etc. Thus, Free cash flow is an important measurement for analyzing a company’s financial health and performance.

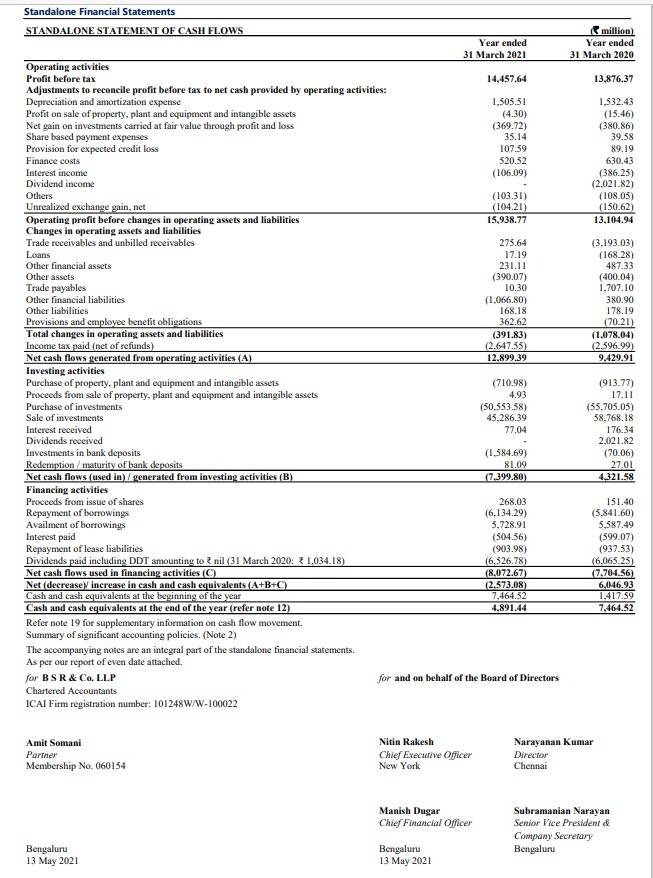

Below is an example of the statement of cash flows of Mphasis Ltd:

Calculation of Free Cash Flow:

For calculating free cash flow, one needs to refer to the company’s cash flow statement. The calculation of free cash flow excludes the non-cash expenses that are recorded in the income statement.

It also includes expenses that are pertaining to equipment and change in working capital.

The most used formula for calculating the Free Cash Flow is as follows –

FCF = Operating cash – Capital expenditure

If you’re analyzing a company that doesn’t show its capital expenditures and operating cash flow, then there are other formulas that will determine the free cash flow, such as:

- Free cash flow = sales revenue – (operating costs + taxes) – required investments in operating capital

- Free cash flow = net operating profit after taxes – net investment in operating capital

Types of Free Cash Flow:

Below are the types of Free Cash Flows:

1. Free Cash Flow to Equity:

Free Cash Flow to Equity also known as the “Levered Free Cash Flow” is calculated from the statement of cash flows by taking operating cash flow reducing capital expenditures and then adding net debt issued or reducing the net debt repayment.

This includes interest expense that is paid on debt and net debt issued or repaid. Thus it only indicates the cash flow that is available to equity investors.

Free Cash Flow to Equity is also used in financial modelling for determining the equity value of a firm.

2. Free Cash Flow to the Firm:

Free cash flow to the firm (FCFF) shows the amount of cash flow from operations that is available for distribution after accounting for depreciation expenses, working capital, taxes, and investments.

It measures the profitability of the company after all expenses and reinvestments. It is used as a fundamental parameter to compare and analyze the financial health of a company.

It considers all cash inflows such as revenues, all-cash outflows such as ordinary expenses, and also all reinvested cash for growing the business. The amount of money that is left over after conducting these operations shows a company’s Free cash flow to the firm

For a detailed explanation on the calculation of Free Cash Flow to the Firm, please read our blog on Free Cash Flow to Firm (FCFF)

Difference between Free Cash Flow and Free Cash Flow to the Firm:

One of the main differences between Free Cash Flow and Free Cash Flow to the Firm is that Free Cash Flow includes the interest expense of the company whereas the latter excludes the interest expense and estimates what taxes would be without the interest expense.

Significance of Free Cash Flow:

Free cash flow helps in indicating the overall health of a company.

Companies that have positive free cash flow have enough funds for paying their bills and debts.

A company with consistently rising free cash flow generally does well and may expand in the future.

A company with low or consistently falling free cash indicates that there is little money left after covering the bills.

Cash Flow Scans in StockEdge:

There are cash flow scans available in StockEdge which help the investors to analyze the financial health of the companies:

We can check from the below list which companies have consistently increased free cash flow per share:

Advantages:

Below are some of the benefits of free cash flow for:

- Investors: Investors use this fundamental parameter to analyze those companies which show growth. It helps them to determine if a company is paying dividends or not.

- Creditors: Free Cash Flow helps the creditors for analyzing a company’s repayment capability. It also helps to decide whether to sanction a loan to a company.

- Business partners: Individuals who want to join a partnership business model often gauge a company’s FCF for estimating the viability of their operations before making a final decision.

Limitations:

Capital expenditure varies among industries. Thus, one needs to measure the Free Cash Flow of a company for a longer period based on the sector to which it belongs.

A high free cash flow may also indicate that the company is not investing much in its venture. Whereas a low free cash flow does not always mean that a company has poor financial standing. It can also signify expansion and growth.

Bottom line:

Thus, we can conclude that free cash flow is an important parameter for measuring a business’s profitability as well as efficiency. Investors and analysts should also analyze other financial measurements for analyzing the financial health of a company. Working on cashflows become even more easy when you have a command on Excel. You can join our advanced excel classes and enhance your skills.

You can also learn Stock Valuations and analysis from our valuation course.

Happy Investing!

For more Cash Flow related queries visit web.stockedge.com