Key Takeaways:

- Appears after an uptrend and consists of three consecutive bearish candles, each opening within the previous body and closing lower

- 1st candle shows the first sign of selling pressure, closing near its low

- 2nd candle confirms bearish momentum by opening within the first and pushing further down

- 3rd candle seals the shift in sentiment, extending losses and closing near its low again

- Traders use it to spot trend reversals and shorting opportunities, but wait for confirmation to avoid bull trap pullbacks

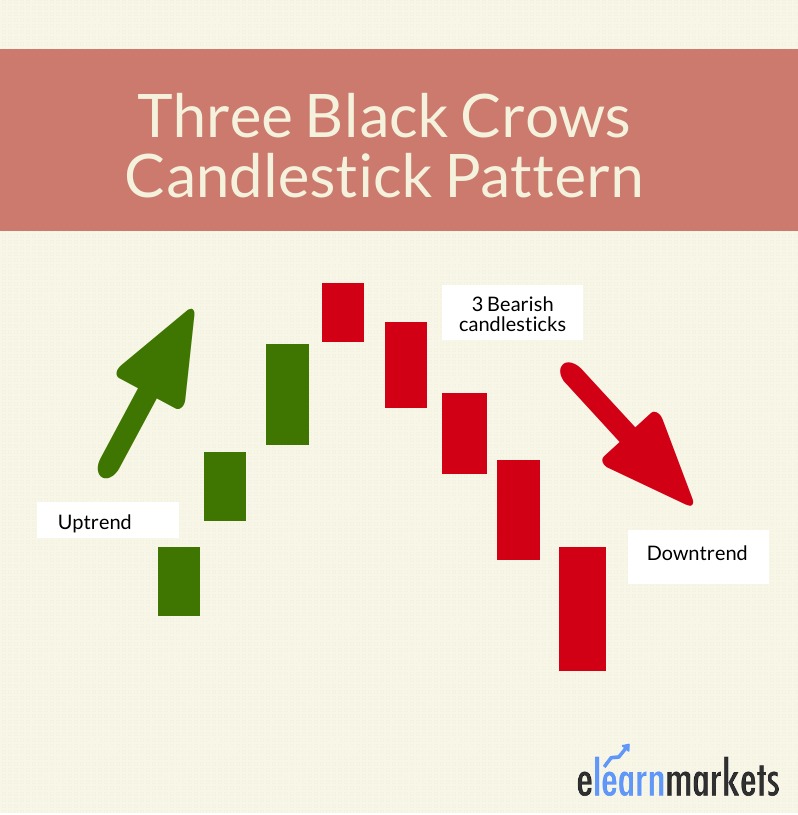

The Three Black Crows pattern is a bearish reversal pattern that consists of three bearish long-bodied candlesticks.

Each of the three candlesticks should be long-bodied bearish candlestick; each candlestick’s opening price should be lower than the previous candlestick’s opening price.

It is a bearish reversal pattern; therefore, it should be considered only when it appears after an uptrend.

The Three Crows pattern signals weakness in an ongoing uptrend and the potential reversal to the downtrend.

Let us discuss in detail how we can trade with this bearish reversal candlestick pattern:

What is the Three Black Crows Candlestick Pattern?

Three Crows pattern is a multiple candlestick chart pattern that is used to predict reversal to the downtrend.

This candlestick pattern is formed when the bearish forces come into the action and make the prices fall for three consecutive days.

Traders should take a short position after this bearish candlestick pattern is formed.

Traders can also take the help of volume and technical indicators to confirm the formation of this candlestick pattern.

Formation of Three Black Crows:

Here is the Formation of Three Crows pattern:

How to trade with this Three Black Crows Pattern ?

Let us discuss how to trade with this candlestick pattern step by step:

1st Candle:

The first candlestick of this pattern should be long bodied bearish candlestick and must be formed as the continuation of the ongoing uptrend.

A bearish candle means that the closing price should be lower than the opening price as the bears are trying to make the prices fall.

2nd Candle:

The second candlestick should also be a bearish candle. It can be long or short bodied.

The opening price of this candlestick should lie within the real body of the first candlestick i.e should be in between the midpoint or the closing of the first candle.

The second candle should not break the high of the first candlestick.

3rd Candle:

The third candlestick should also be a bearish candle. It can either be a long or short-bodied candle.

The opening price of this candlestick should lie within the real body of the second candlestick i.e should be the midpoint or the closing of the second candle.

The third candle should not break the high of the second candlestick.

One should note that these three candlesticks can be Bearish Marubozu.

A Bearish Marubozu candlestick pattern is a long-bodied bearish candlestick in which the closing price is the low price and the opening price is the high price for that day.

There are no shadows in the Bearish Marubozu.

Example:

Below is an example of daily chart of Phillips Carbon Black Ltd. that shows us how Three Black Crows Candlestick pattern is formed after an uptrend and the trend got reversed to downtrend after the formation of candlestick pattern.

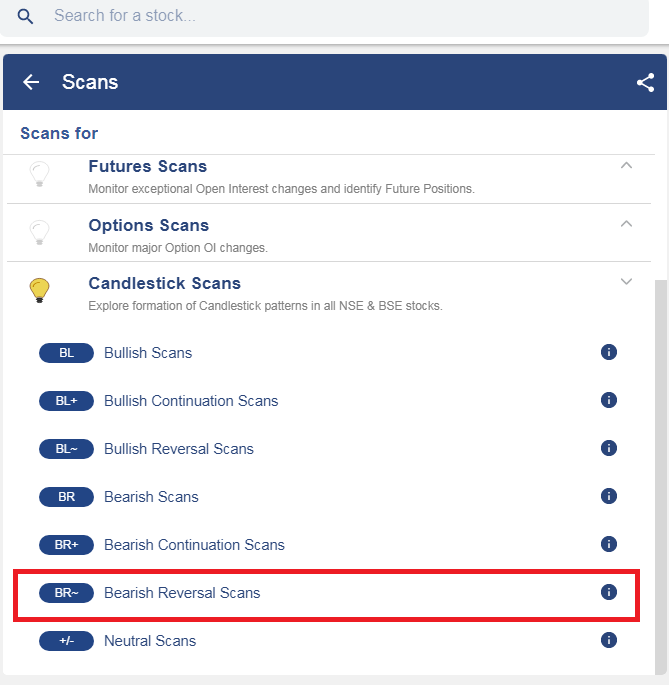

How to use the Three Black Crows pattern in StockEdge ?

You can also use the Three Black Crows Candlestick scans in StockEdge web version

Steps to use Three Crows pattern scans in StockEdge:

Under the “Candlestick Scans” we can see Bearish Reversal scans as shown below:

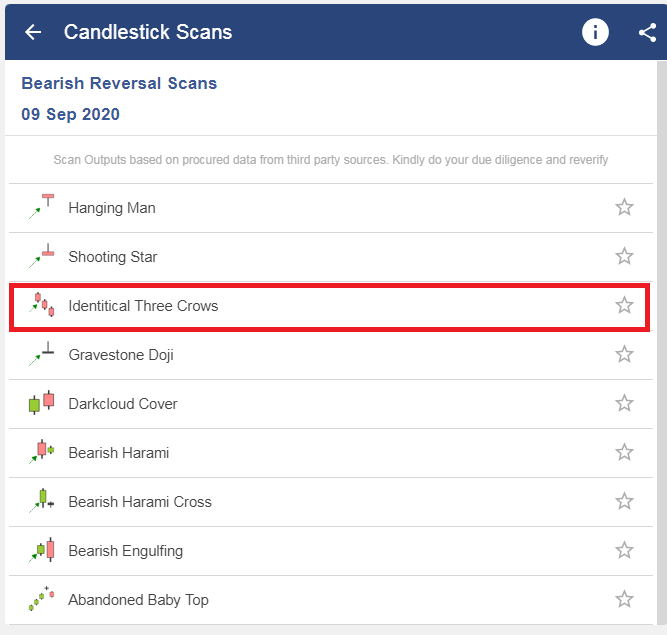

When we click on the “Bearish Reversal scans” we can see “Three Crows Pattern” scan, click on that:

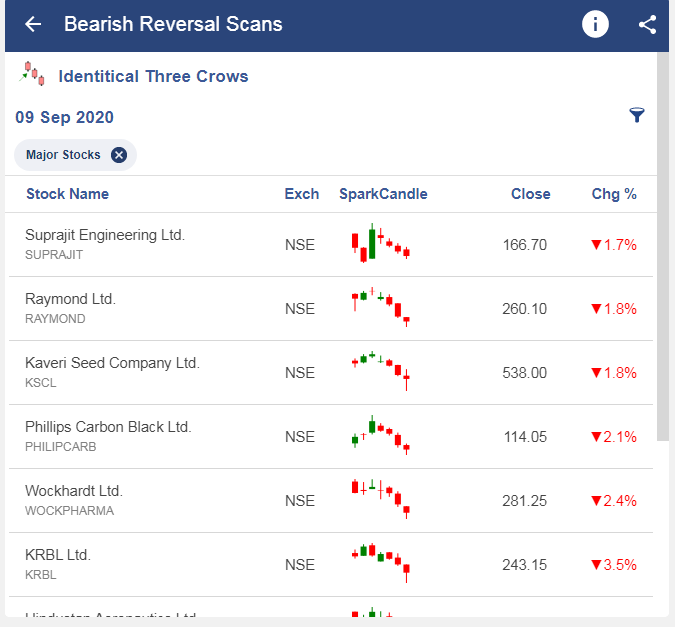

After selecting on it, you will get a list of stocks in which the “Three Black Crows” pattern is formed.

Limitations

As the three crows pattern makes the prices to fall, traders should be cautioned of the oversold conditions that may lead to consolidation before a further move down of the prices.

Traders should also look at other chart patterns or technical indicators to confirm the reversal rather than just using the three black crows pattern exclusively.

Read More- All 35 Candlestick Chart Patterns in the Stock Market

Bottomline

The Three Crows pattern is a bearish reversal pattern that consists of three bearish long-bodied candlesticks. The Three Black Crows is a bearish reversal pattern therefore it should be considered only when it appears after an uptrend. One should note that these three candlesticks can be Bearish Marubozu. Traders can also take the help of volume and technical indicators to confirm the formation of this candlestick pattern.

Frequently Asked Questions (FAQs)

What does 3 Black Crows Indicate?

As a bearish reversal pattern, the three black crows candlestick pattern is regarded as reasonably trustworthy. The three black crows, which are three successive bearish candles at the end of a bullish trend, indicate a change in power from the bulls to the bears.

What is the Success Rate of the 3 Black Crows?

The three black crows may form a consistent pattern that signals an upswing reversal. That does not imply that it is always effective. Although some traders contend that it has an almost 80% success rate, a lot of this will depend on the trading strategy and the context.

A very vital sign, explained in simple language for everyone to understand 👍👍👏👏

it is a piece of helpful information. I understood the concept you explained.

Hi,

Thank you for Reading!

Keep Reading