The tax planning deadline for the fiscal year 2023-2024 is just a few days away, on March 31, 2023. If you have not yet completed your tax planning, do so now.

When you only have a few hours to complete the task, it may appear too difficult. But all is not lost. Each of us has some prior commitments, such as home loan repayment, insurance premium payment, tuition payment for children, and contribution to the employee provident fund. In addition to these expenses that qualify for income tax deductions under Section 80C, you can make new investments.

The clock has begun to tick for those who have yet to make tax-saving investments to claim deductions of up to Rs 1.5 lakh under Section 80C.

Make a point of starting now rather than waiting until the last minute. If you treat tax planning as a separate exercise rather than an integral part of your overall financial planning strategy, you may end up making costly mistakes in the future.

However, in this last-minute rush, there is a risk of making mistakes that will cost you in the long run. So, here are some of the mistakes that must absolutely be avoided:

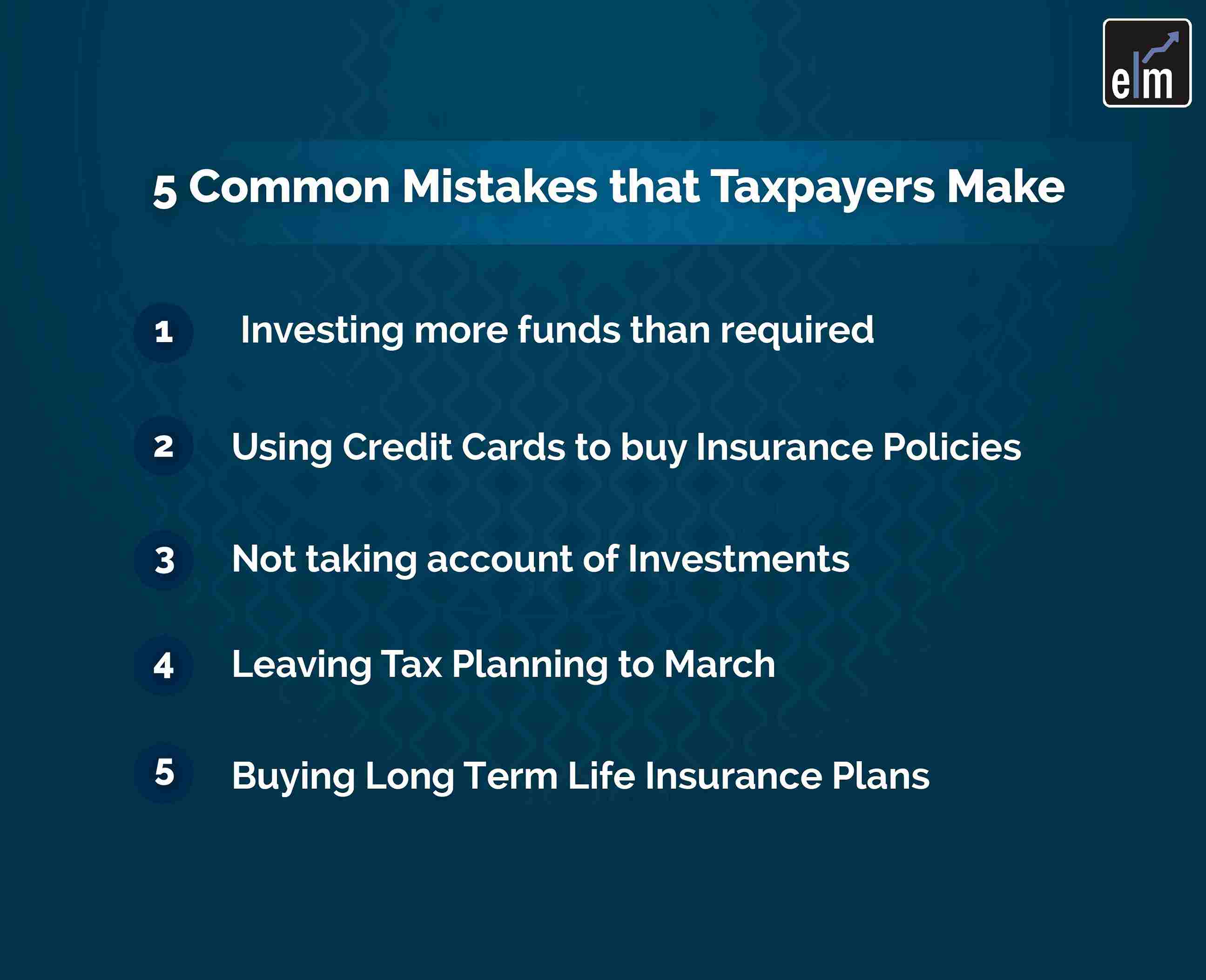

5 Common Mistakes that Taxpayers Make in Tax Planning

1. Investing more funds than required

In a last-minute panic, you may engage in panic investing or pool more money in tax-saving investments than is necessary.

This has only a negative impact on future financial goals. So, it’s best first to assess the taxes you’ve already saved in the form of house rent, education loans, home loans, and so on, and then invest only the remainder.

To calculate this total investment amount, experts recommend using a reliable online calculator or consulting with a tax specialist.

2. Using Credit Cards to buy Insurance Policies

If you did not begin tax planning earlier in the year, you might face a liquidity crisis on the one hand and a March deadline to complete the exercise on the other.

This could compel some low-income taxpayers to use their credit cards to purchase life insurance policies, for example. You may have to pay a high price later on. “This could put you in debt.” Credit cards have a high monthly interest rate of 3-4 percent.

Even today, many people are unaware that paying only the minimum balance is insufficient”. It is best to use a credit card as a spending tool rather than a borrowing tool – and only when you are confident that you can repay it.

3. Not taking account of Investments

Do you really need to start saving money on taxes right now? If you scrutinize your portfolio, you might not even need to. Confused? This is what we mean.

If you are a salaried employee, your employee provident fund (EPF) contribution will cover a significant portion of this limit. Some taxpayers end up making tax-saving investments to exhaust the Rs 1.5 lakh limit without first determining whether they need to make any at all.

4. Buying Long Term Life Insurance Plans

Though this is a common occurrence during tax season, life insurance agents appear to be working overtime to sell traditional endowment policies this time of year. What’s the reason? The budget proposal for 2023 is to tax income earned on such policies at maturity if the total annual premium paid exceeds Rs 5 lakh.

Simply put, maturity proceeds from such policies purchased after April 1, 2023, will not be completely tax-free under Section 10(10D).

It’s easy to fall for such pitches, especially if you’re pressed for time, because agents promise to handle all the paperwork with minimal inconvenience.

However, remember that investment-cum-insurance policies have longer tenures and recurring premium payment commitments that you may not be able to meet in future years.

You can also join our course on Online NSE Academy Certified Capital Market Professional (E-NCCMP)

5. Leaving Tax Planning to March

The biggest mistake you must avoid next fiscal year is completing the tax-saving exercise in March rather than early in the year. Deferring the task until the end of the year introduces a number of complications. For one thing, you might not have enough money in March to make a large investment all at once.

Bottomline

If you haven’t completed your tax planning for the fiscal year 2022-23 yet, you should do so immediately. You only have a few days left. However, beginning with the next fiscal year (April 1, 2023), make sure you begin your tax planning as soon as the year begins.

We hope you found this blog informative and use the information to its maximum potential in the practical world. Also, show some love by sharing this blog with your family and friends and helping us spread financial literacy.

Happy Investing!