Do you want to trade or invest in the stock market but are unsure about how to start and stock market timings?

Knowing how the Indian stock market timings operate is important as well as having the appropriate knowledge, which is essential to succeeding in the financial markets.

No matter how knowledgeable you are about the financial markets, your investment plan can be dramatically impacted by studying the stock market timings.

Fortunately, India’s stock market hours are the same across the entire country, so you can buy, sell, or invest in shares during market hours from any location in India.

The usual trading hours of the Indian stock market are from 9:15 am to 3:30 pm, Monday through Friday, with a pre-opening session starting at 9 am. To find out how these timings could impact your trading and investment, keep reading.

Table of Contents

What are the Stock Market Opening and Closing Timings?

All of India’s major stock exchanges have the same trading hours or timings. Traders can purchase, sell, or invest in shares using the information relating to share market timings. Whether you wish to trade on the BSE or the NSE, India’s two main stock exchanges, the timings are the same.

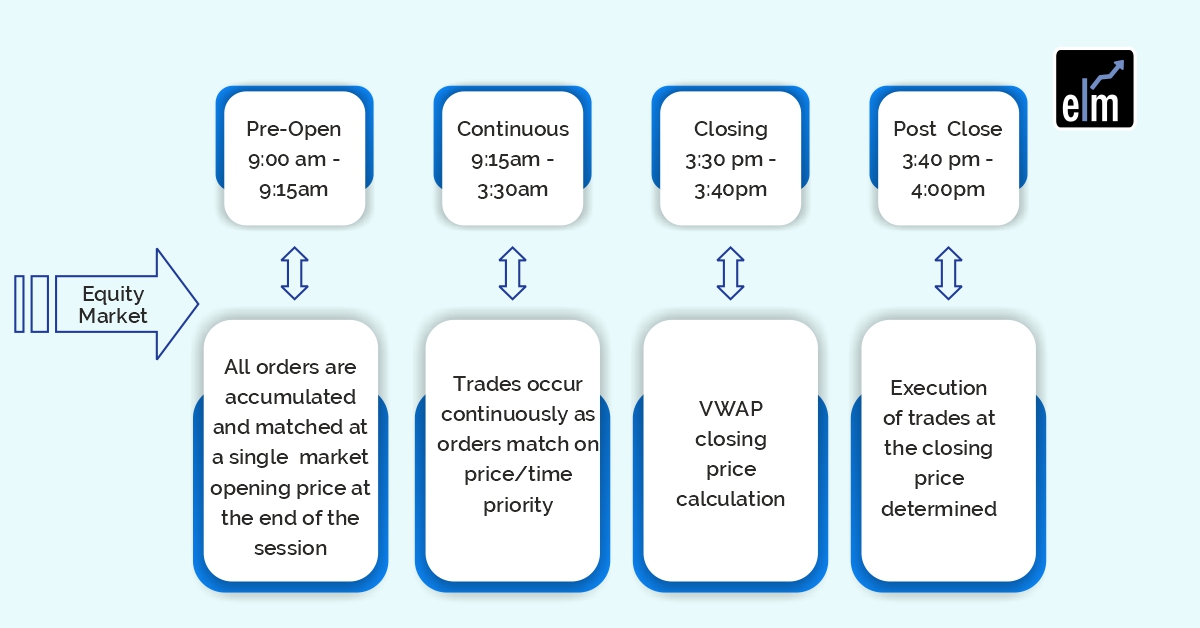

Stock market opening time is at 09:15 AM and stock market closing time is at 03:30 PM according to conventional share market hours. The three components of the stock markets’ total operational hours are as follows.

Let us different timing segments and how you can trade within that segments:

How you can trade in different stock market timings?

Regarding the schedules of the Indian stock market, there are three distinct trading sessions:

1. Pre-Opening Session

The duration of this session is from 9:00 am to 9:15 am. During this time, any securities may be bought or sold by order. It can be divided into three sessions further:

a. 9:00-9:08 am

Orders for any transaction may be put in during this time of day when the Indian stock market opens. When actual trading starts, the order entry is given preference because these orders are cleared off first. Investors benefit from the ability to modify or cancel any orders placed during this period because orders cannot be entered after this 8-minute window during the pre-opening session.

b. 9:08-9:12 am

When the Indian stock market opens at this time of day, any transaction can be ordered. Order entry is given preference when trading really begins since these orders are wiped off first. Orders cannot be entered after this 8-minute window during the pre-opening session, therefore investors benefit from the ability to change or cancel any orders placed within this window.

During a typical session of the Indian stock market timing, price matching orders are crucial in establishing the price at which the securities are traded. The benefits of changing an existing order, however, are not accessible at this time.

c. 9:12-9:15 am

Pre-opening and regular Indian share market hours are transitioned during this time. During this time, no more transaction orders may be made. Additionally, wagers already placed between 9.08 and 9.12 a.m. cannot be cancelled.

2. Normal Trading Session

The continuous trading session occurs throughout this time, which is from 09:15 AM and 3:30 PM. You are free to trade throughout this session, place orders to buy or sell stocks, and change or cancel those orders at any time. A bilateral order matching technique is used during this window. It follows that each sell order is matched with a buy order that was placed at the same stock price, and vice versa, with each buy order and each sell order

3. Post-Opening Session

This session starts at 3:30 PM after the regular trading session ends. There are two parts to the post-closing session, which lasts until 4:00 PM.

a. 3:30-3:40 pm

The closing price is determined by taking the weighted average of prices for securities traded on a stock exchange between 3 and 3.30 p.m. Weighted average prices of listed securities are taken into consideration for calculating the closing prices of benchmark and sector indexes like Nifty, Sensex, S&P Auto, etc.

b. 3:40-4 pm

Bids for the next day’s transaction might be placed at this time after the stock market closes. If sufficient buyers and sellers are present in the market during this time, bids submitted during this period are confirmed. Regardless of fluctuations in the opening market price, these transactions are executed at the agreed-upon price.

Bottomline

For investors like you, the procedure is far less stressful when you know the best times to trade on the stock market. The regular timings make it easy for traders to place orders at the appropriate moments by their methods.

Learn how to trade in the stock markets through our course on Stock Markets Made Easy

Frequently Asked Questions (FAQs)

How do you trade when the market opens?

The Gap and Go approach, a momentum-based strategy that tries to profit from stocks gapping up on favourable news and continuing up when the market opens, is one of our favourite techniques to trade during the open.

How do you share market open and close times?

Before 09:15 AM, there is a pre-opening session, and after 3:30 PM, there is a post-closing session. These hours apply regardless of whether you intend to trade on the BSE or the NSE, India’s two main stock exchanges. The market opens for regular trading at 9:15 AM and closes at 3:30 PM.

Can the retail traders trade after 3.30 pm?

From 3:40 to 4:00 PM, the post-market or closing session is active, and only market orders are accepted. Post-market orders are similar to pre-market orders in that they are only permitted for the equities segment.

Can the retail traders buy shares at 9 am?

Orders for any transaction may be put in during this time of day when the Indian stock market opens. When actual trading starts, the order entry is given preference because these orders are cleared off first. The trading day on the Indian stock market runs from 9:15 AM to 3:30 PM. The pre-open market period for the Indian markets begins between 9:00 and 9:15 a.m. In India, pre-open market sessions started in 2010.