In an interesting session as a part of the highly popular Face2Face series, conducted by Elearnmarkets, Mr Vivek Bajaj, Co-founder of Elearnmarkets, invited Mr Mayank Mehraa, a successful stock market Investor, to decode how one should diversify their portfolio in proper companies.

Mr Mayank Mehraa started a research blog in 2015 focusing on Auto Ancillary. He received registration for Individual RIA in 2018 and operated at a limited scale to discover “Product Market Fit”. He launched Flagship Portfolio on a small case in 2020 October and clocked in a ~42% CAGR since, outperformance of 23% per year.

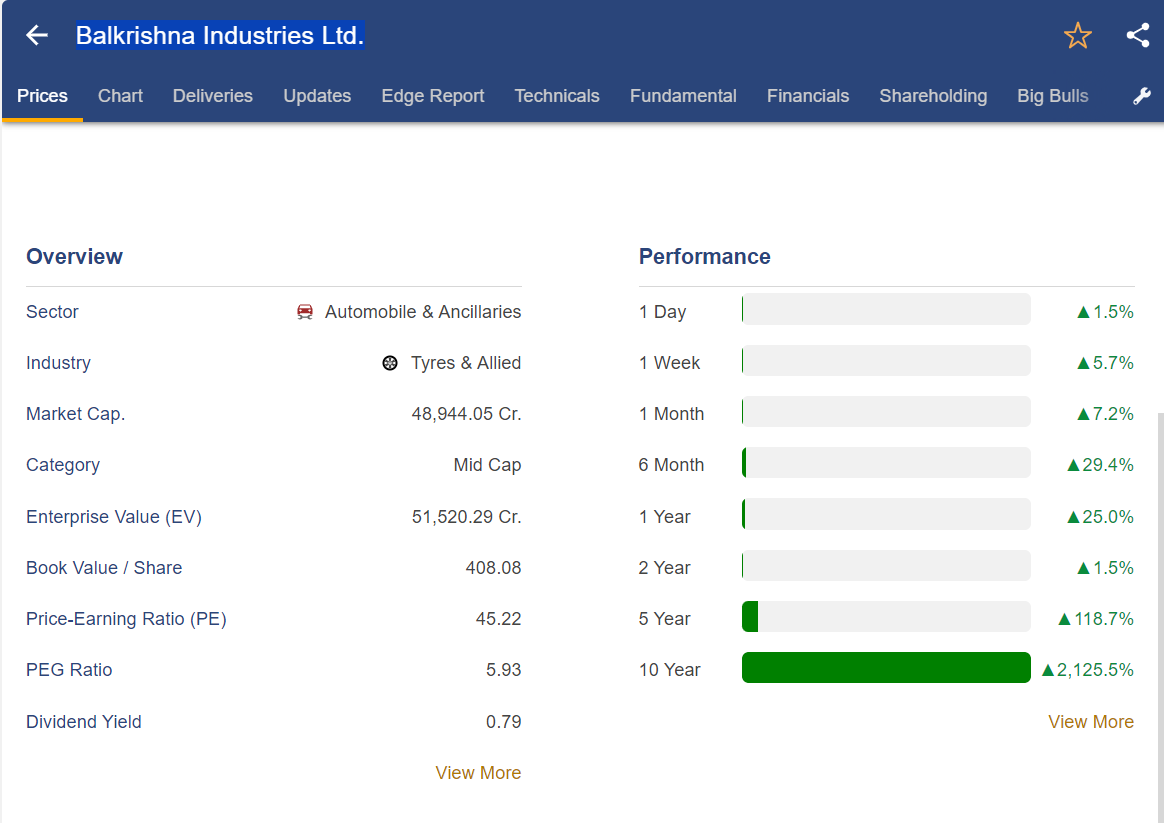

He bought Balkrishna Industries in 2010 for investing which generated a good return and then Minda Industries in 2016. He invested in Nocil in the year 2017, he had the concept of buying only one stock per year because the research technology has changed significantly. In 2018 his portfolio was 80% auto stocks. In that year the auto sector was in bad shape and just then he realised that cyclicality is real. This is the reason he bought Mphasis Ltd. to diversify his portfolio.

Table of Contents

Key Learnings from Stock Market Investment

Concentrated Portfolios make you rich but diversified portfolios keep you rich!

According to Mr Mayank Mehraa concentrated portfolio is dependent on luck and when you buy new stock the probability of the next stock becoming a Multibagger reduces.

For example, if you buy Balkrishna Industries and make multi-bagger returns. Then you can buy another stock of the same sector say Tyre Sector you would not have made that much Multibagger returns as in Balkrishna Industries.

So focusing on only a few sectors is not a great idea as your knowledge will also get saturated if you keep focusing on only one sector. According to the expert-

- Cyclicality is a real issue

- Seasonality will always catch up with you

- Scale becomes a problem

Thus, one should always have a diversified portfolio and not a concentrated one.

Investing Strategy

According to Mr Mayank Mehraa- The Stock Market is a place where you make your money work so you can do other things.Very few people think about their own portfolio and what their allocation looks like. His solution to this is-

There are a lot of investors who just pick up stocks. Suppose there are just two companies which are competing with each other they will not have synergy. So if one company is losing then another company will make a profit. So you don’t enjoy that portfolio level.

From the above screen, we can notice that every sector is cyclical. However, some fundamentally good industries make money constantly. Some companies are nearly consistent and some are highly volatile as shown below:

PSUs have been outperforming right through but when they move up, they move up constantly like in the past few years they move in a good rally.

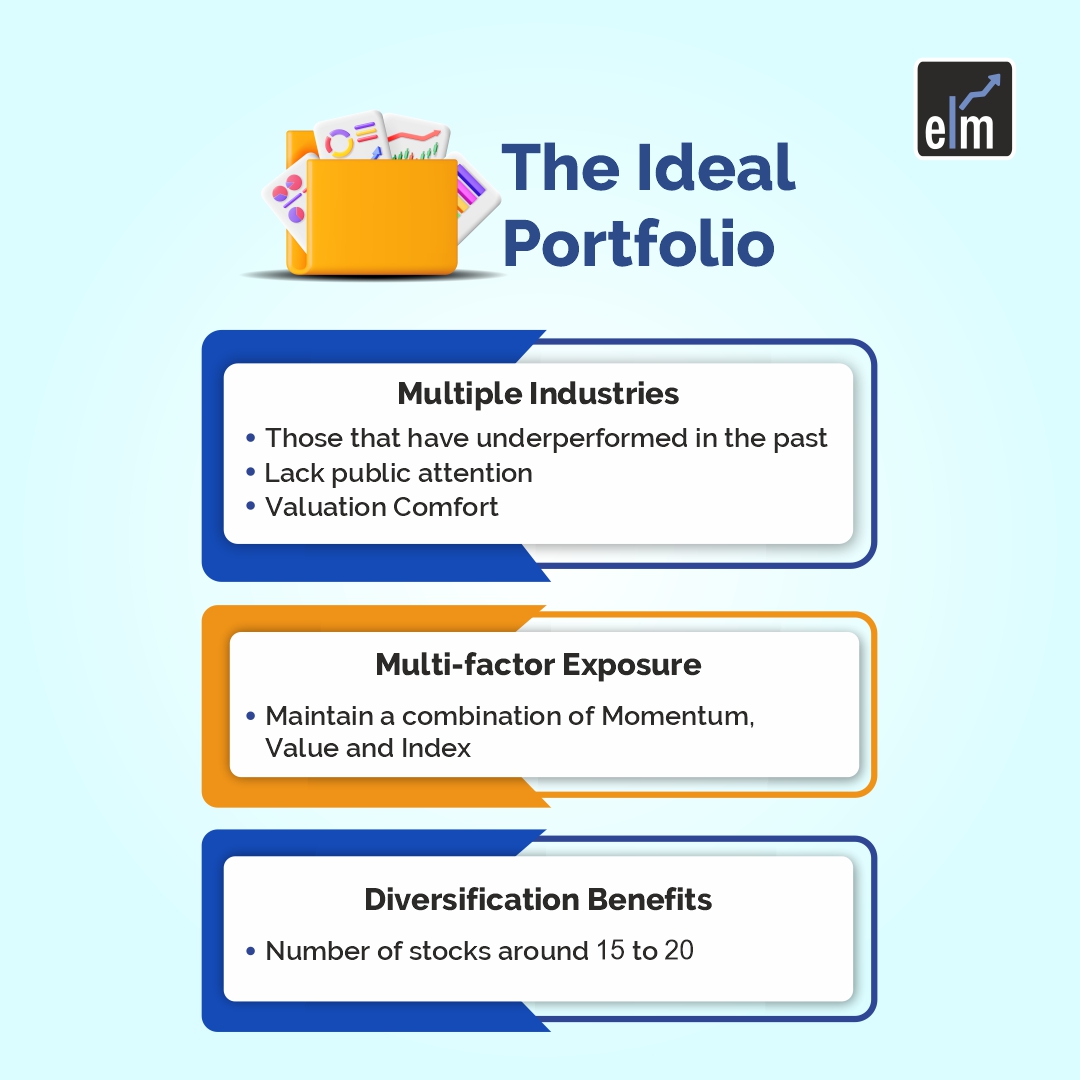

The Ideal Portfolio

The ideal portfolio should consist of:

1. Multiple Industries

• Those who have underperformed in the past- Suppose ITC Ltd. in the past had underperformed but the fundamentals keep getting better.

• Lack of public attention- We should sell Euphoria stocks where the momentum is very high. One should buy stocks

• Valuation comfort

2. Multifactor Exposure

One should maintain a portfolio with stocks having the combination of momentum, value and index.

3. Diversification Benefits

One should try to diversify the portfolio with 15-20 stocks and if you want to diversify more then better to invest in Exchange Traded Funds.

The Sector Advantage

Let us come to the Sector Advantage:

One should first understand those companies having the product fit and then screen the stocks having the margin of safety as we should not invest in those companies having 100 PE.

Then look for those companies having tailwinds analyse the current PE and then diversify the portfolio accordingly. One can invest tons of money in this kind of portfolio.

Lastly, Mr Mayank Mehraa discusses the case study on Balkrishna Industries.

You can watch the full Face2Face Video here-

Bottomline

We can conclude that one should have a diversified portfolio. If one doesn’t not have time to pick fair valuation stocks by their own they should hire a professional for the same.