Before investing in any company, it is essential for us to understand the real worth of its shares. This will be possible if we can calculate the intrinsic value of the share. The process of calculating this intrinsic value is known as share valuation.

Intrinsic value refers to the value which is theoretical in nature. This means that the value is not affected by its market price.

What do you mean by Valuation of Shares?

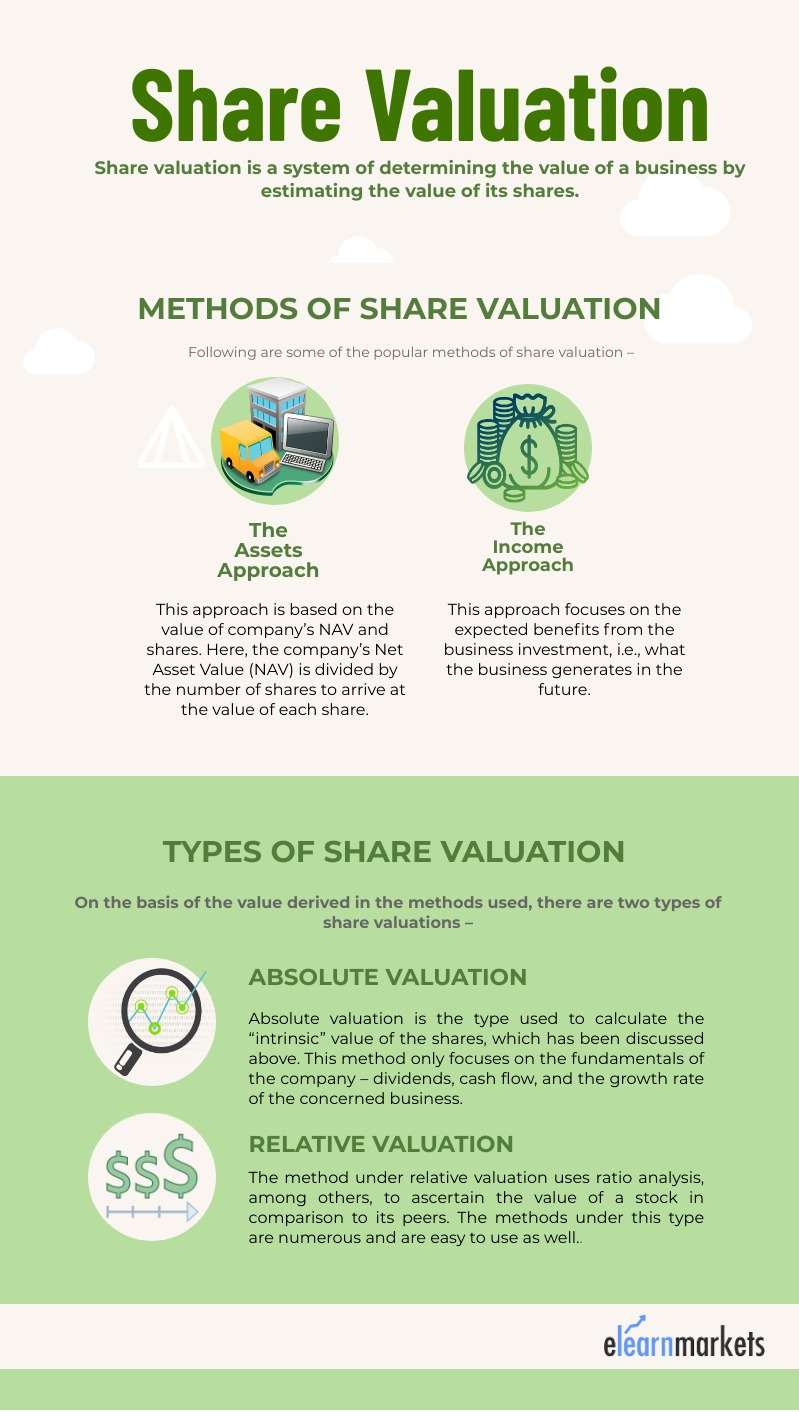

The meaning of valuation of shares is a system of determining the value of a business by estimating the value of its shares.

Suppose you are the CEO of a company, and your company has decided to take over one of its competitors.

So then how do you decide the price at which the shares of the other company must be taken over?

We can even consider buying its shares at the market price (the price at which they’re being traded) if it’s a listed entity, but how do we do so for a private company?

Therefore, in such circumstances, it is better to evaluate the net worth of the company’s ownership through separate methods and assumptions.

This evaluation is known as Share Valuation

When is Valuation of Shares Required?

Now that you are familiar with the definition of valuation of shares, let’s explore the various situations in which the valuation of shares is required and why shares need to be valued.

When a business is being sold to another business;

When a business offers its shares as security to get a loan;

When companies undergo mergers, demergers, acquisitions or reconstruction;

When a company is implementing an Employee Stock Option Plan (ESOP); and/or

When a company plans to convert its shares from preference to equity shares.

What are the Types of Stock Valuation?

On the basis of the value derived in the methods used, there are two types of share valuations –

Absolute Valuation –

Absolute valuation is the type used to calculate the “intrinsic” value of shares, which has been discussed above.

This method only focuses on the fundamentals of the company – dividends, cash flow, and the growth rate of the concerned business.

Relative Valuation –

The method under relative valuation uses ratio analysis, among others, to ascertain the value of a stock in comparison to its peers.

The methods under this type are numerous and are easy to use as well.

What are the Methods of Stock Valuation?

From the various methods of valuation of shares, here are some of the popular methods of share valuation with examples-

The Assets Approach –

The net asset method of valuation of shares is based on the value of the company’s NAV and shares. Here, the company’s Net Asset Value (NAV) is divided by the number of shares to arrive at the value of each share.

The Net Asset Value of a company is the difference between the net value of all the assets and liabilities of a business.

The net value of assets determined has to be divided by the number of equity shares for finding out the true value of the share.

Following are some of the important points to be considered while valuing shares under this method:

All of the assets of the company, including current assets and current liabilities such as trade receivables and payables, provisions, etc. have to be considered.

Fixed assets have to be considered at their realizable value.

Valuation of goodwill as a part of intangible assets is essential to the calculation.

The fictitious assets such as preliminary expenses, discount on issue of shares and debentures, accumulated losses etc. should be eliminated.

The Income Approach –

This approach focuses on the expected benefits from the business investment, i.e., what the business generates in the future.

One of the popular methods under this approach is the Value per Share method.

Here, the value per share is calculated on the basis of the profit of the company which is available for distribution to the shareholders. This profit can be determined by deducting reserves and taxes from the net profit.

You can follow these steps to determine the value per share:

- Calculate the company’s profit, which is available for dividend distribution;

- Obtain the rate of normal rate of return for the relevant industry; and

- Calculate the capitalized value as (profit for distribution*100/rate of return)

- Divide this value by the number of shares.

Share valuation problems and solutions

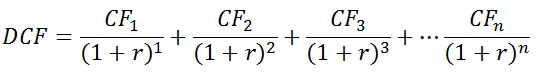

The Income approach takes into consideration the expected future Cash flows of the company.

Also Read: Free Cash Flow to Firm

It can be calculated in the DCF or discounted cash flow method of evaluation of a firm’s fair price.

If the present value is higher than the current cost of the investment, then the investment opportunity should be considered.

If the present value is lower than the current cost of the investment, then the investment opportunity should not be considered.

DCF takes into account the assumptions based on past data which may or may not hold true.

The discount rates or “r” may not be the same throughout the period as it’s influenced by prevailing market rates, debt-equity structure, and income tax consideration.

The Asset approach takes into account the CAPM or Capital Asset Pricing Model to determine how is asset generating growth for the company.

Again the objective of the CAPM model is to estimate a business equity’s (or total net asset) market value or fair value. It values the company from a balance sheet perspective.

Asset-Based Valuation = Fair Value of company’s total assets / Fair Value of company’s total Liabilities

It is difficult to determine the fair value of all the assets owned by the company, and even market value differs greatly from carrying values.

Also Read: How to better analyse a company?

The exercise of measuring the fair value of assets of the business can get complex or subjective and may be over or understated

Both of these methods have their own pros and cons.

Thus we can see many analysts remodeling their assumptions as soon as the results are declared and hence they either cut the price target for the stock or modify it for a better return according to the resulting outcome.

How to Choose the Best Stock Valuation Method

Which method is the most suitable one for share valuation? The answer is not a fixed or easy one.

Each business has different types of qualities, strengths, and rules of valuation.

Therefore, it is better to choose the method on the basis of the information about the company that is readily available to you for the purpose of valuation.

For example, This asset approach can be relevant to manufacturers, distributors, etc… Why?

This is because these businesses often use a huge volume of capital assets, the value of which can easily influence the intrinsic value of the shares.

What are the Factors Affecting the Valuation of a Share?

The factors affecting share valuation primarily include those multiples which are used in the popular methods of share valuation. These include –

The net earnings of the business;

Cash flows and dividends of the business; and

Normal rate of return of the industry.

The influence of these factors depends on whether they are applied to the calculation of the share value.

How do the EPS and P-E ratios affect in valuation of a share?

The earnings-per-share is the ratio of the total earnings available for shareholders to the total number of shares.

This variable is used in the calculation of the P-E ratio, which is another popular method of share valuation.

In simple terms, the higher the EPS, the richer you are as a shareholder.

Further, let us discuss the P-E ratio.

The Price-to-Earning Ratio is a ratio of the market price per share to the EPS.

When it comes to the valuation of shares, a high P-E ratio could indicate that a share’s price is high with respect to its earnings and is possibly overvalued.

Conversely, a lower P-E ratio might indicate that the current share price is lower with respect to its earnings.

There are various other essential valuation ratios that can affect our decisions to make investments.

Read about: Valuation Ratios: The Key Metrics Finance Experts Need To Know

Conclusion:

Whether you are a trader or a long-term investor, the practice of share valuation is vital to your knowledge and success.

Thus traders can use various methods of share valuation to compare stocks of different companies. Long-term investors can evaluate their future prospects via various methods and approach them.

Therefore, it is essential to update yourself with the best methods of share valuation as per your requirements and goals.

You can learn about similar concepts through our business valuation course.

I simply could not depart your site before suggesting that I extremely enjoyed the standard information an individual provide for your guests? Is going to be back often to check up on new posts.