- What is Securities Transaction Tax (STT)?

- How Does STT Work?

- How is STT Calculated?

- STT Rates Before vs After Union Budget 2026

- STT and Its Connection with Income Tax

- Union Budget 2026: STT at a glance

- Why Did the Government Increase STT in Budget 2026?

- How Budget 2026 STT Changes Will Affect Traders?

- Conclusion

- Frequently Asked Questions (FAQs)

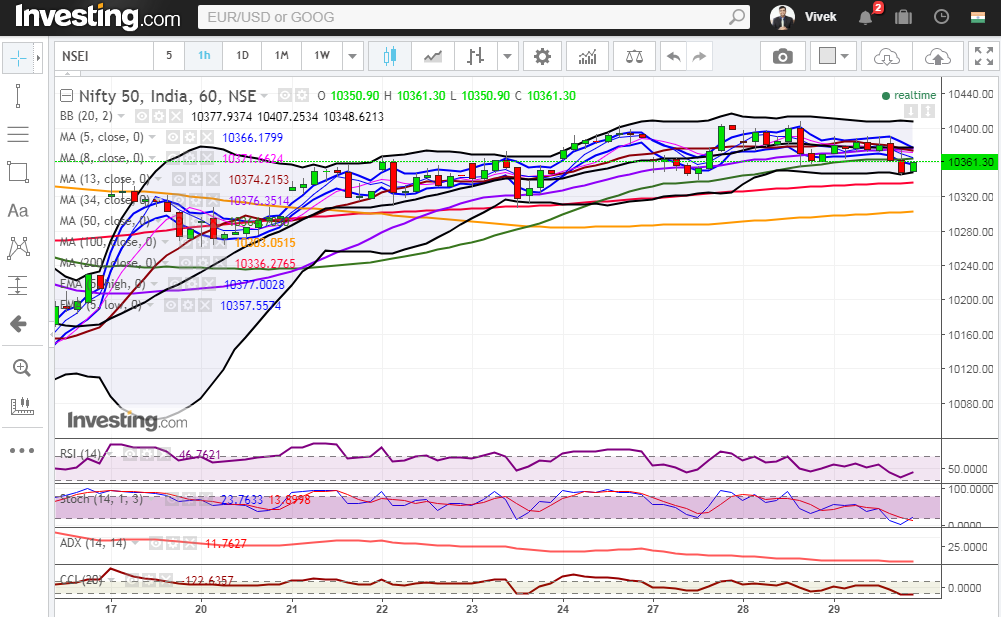

February 1, 2026, a Sunday that Indian traders won’t forget anytime soon. For the first time ever, markets were open on a weekend for Budget Day.

What followed wasn’t the celebration the government probably hoped for. The Sensex crashed over 1,000 points. Nifty tanked nearly 300 points.

Why? The reason is the Union Budget 2026.

It had just dealt a blow to derivatives traders with a hike in the Securities Transaction Tax. The Union Budget 2026 hit traders like a cold splash of water.

Instead of the relief many were hoping for, the government raised the Securities Transaction Tax, and derivatives traders (especially futures & options players) felt it first.

Markets reacted immediately. Sharp index falls on Budget Day and strange volume behaviour as traders scrambled to rework positions.

If you trade actively, day trading, swing trading, or derivatives, then it changes your cost base and can chew into profits fast. Whether you’ve been trading for years or only opened your first account recently, you’ll want to understand what this means for your strategy.

What is Securities Transaction Tax (STT)?

STT is a tax charged every time you trade on a stock exchange. Rolled out in 2004, it was meant to make sure trades on exchanges are taxed properly and to discourage off-market deals. The key thing to remember is STT applies to every trade, win or lose, and is taken at source; you don’t calculate it, the exchange does.

Why traders care (and should care) about Securities Transaction Tax

- It’s unavoidable as STT is deducted automatically by the exchange at the time of the trade.

- It hits every trade; profit or loss doesn’t change whether STT applies.

- Different for different segments like delivery trades, intraday trades, and derivatives, each have their own rates, and the recent hike targeted derivatives harder than other segments.

- No exemption here, unlike other taxes, you can’t claim deductions or offset STT against capital gains.

How Does STT Work?

It’s straightforward. When you trade, STT gets calculated as a percentage of your transaction value and deducted instantly. Your trading platform shows total charges before you confirm the order.

For equity delivery, you pay STT on both buying and selling. Intraday trades attract STT only on the sell side. Derivatives are where costs really add up, especially after Budget 2026.

How is STT Calculated?

Formula: STT = Transaction Value × STT Rate

For instance, trading equity worth ₹1,00,000 at 0.1% STT means you pay ₹100.

But in derivatives, things get expensive fast. A single Nifty futures contract is valued around ₹16 lakh. Even small percentage increases translate to significant amounts in rupees. Most traders don’t realize how much they’re paying until they review their annual statements.

The Securities Transaction Tax appears as a separate line in your contract note. It’s easy to overlook initially, but over time, especially with the new rates, it becomes one of your biggest trading expenses.

STT Rates for Different Securities

STT depends on what you trade and how you trade:

- Equity delivery: 0.10% on both buy and sell.

- Equity intraday: 0.025% on the sell side only.

- Equity mutual funds (redemption): 0.001%.

- Futures & Options: the Budget 2026 changes hit this bucket hardest.

STT Rates Before vs After Union Budget 2026

| Security Type | Old Rate | New Rate (from April 1, 2026) | Percentage Increase |

| Futures | 0.02% | 0.05% | 150% |

| Options Premium | 0.10% | 0.15% | 50% |

| Options Exercise | 0.125% | 0.15% | 20% |

| Equity Delivery | 0.1% (buy & sell) | 0.1% (unchanged) | 0% |

| Equity Intraday | 0.025% (sell side) | 0.025% (unchanged) | 0% |

Let’s understand the real impact of Securities Transaction Tax with examples:

If you generate ₹10 lakh options premium turnover, you now pay ₹1,500 in STT instead of ₹1,000, an extra ₹500 per ₹10 lakh turnover.

For futures traders, the pain is worse. Previously, a ₹10,000 contract value meant ₹2 in STT. Now it’s ₹5 in Securities Transaction Tax. Sounds small? If you trade 20 lots daily, that extra cost compounds quickly over a month.

Active traders generating crores in annual turnover will see their Securities Transaction Tax bills jump by lakhs. For someone already operating on thin margins, this could be the difference between profit and loss.

STT and Its Connection with Income Tax

Many traders get confused here. Securities Transaction Tax and income tax are separate. Paying STT doesn’t exempt you from paying income tax on profits.

You cannot deduct Securities Transaction Tax from your capital gains calculation. Made ₹1 lakh profit and paid ₹5,000 in STT? That doesn’t shrink your taxable gain; you still pay capital gains tax on the full ₹1 lakh.

If you’re an F&O trader, there’s a slightly different rule. STT paid on F&O trades can be treated as a business expense when you calculate your business income. But don’t get cute, you cannot use F&O STT to offset capital gains from other segments like equity delivery.

Watch this Face2Face to learn the right way to make money in F&O

Union Budget 2026: STT at a glance

Finance Minister Nirmala Sitharaman announced changes on February 1, 2026. These are the headline moves (effective April 1, 2026):

- Futures STT: 0.02% → 0.05% — a 150% increase.

- Options (premium) STT: 0.10% → 0.15% — a 50% increase.

- Options (exercise) STT: 0.125% → 0.15% — a 20% increase.

- Equity delivery & intraday STT: unchanged.

The government clearly aimed the hike at derivatives; it’s a targeted nudge to cool down F&O speculation.

Why Did the Government Increase STT in Budget 2026?

Officials gave three clear reasons for increasing Securities Transaction Tax:

- Curb excessive speculation. Policymakers are worried that retail traders treat F&O like a quick bet without understanding the risks.

- Protect retail investors. SEBI research (FY25) reportedly shows that a large majority of F&O participants lost money. The message is make risky trading more expensive to discourage casual players.

- Reduce systemic risk. Higher costs on high-frequency/leveraged play can slow wild intraday churn and (in theory) stabilize short-term volatility.

Why this matters to you

Higher STT = higher cost per trade.

For low-margin, high-frequency strategies (options scalping, heavy futures flipping), this erodes edge fast. For positional traders, the hit is smaller per trade but still real over time.

In FY25, higher costs supposedly discourage casual speculation.

Increasing Tax Revenue: The government collected ₹53,000 crores from STT in FY25. With this hike, collections are expected to grow substantially.

But the problem is, if a higher Securities Transaction Tax reduces speculation, why did loss-making traders increase from 89% to 91% after previous STT hikes? The logic doesn’t hold up. Education would work better than just making trading more expensive for everyone.

How Budget 2026 STT Changes Will Affect Traders?

High-Frequency Traders: Taking 20-30 trades daily? Your costs just skyrocketed. STT could now eat 2-3% of annual turnover.

Option Trader- Several changes are necessary for active position management. The cost of every change has increased, making premium collection tactics more difficult.

Small Capital Traders: Trading with ₹50,000-₹1 lakh? Every rupee matters. Your breakeven just moved further away.

Futures Traders: Facing the steepest 150% increase. A contract costing ₹325 in STT now costs over ₹800.

Who’s less affected? Long-term equity investors and intraday equity traders, their rates haven’t changed.

Conclusion

The Securities Transaction Tax hike is a reality check for traders. Derivatives just got significantly more expensive from April 1, 2026.

Active traders need to rethink strategies. Your old breakeven calculations don’t work anymore. You need to be more selective, taking only high-probability trades.

The government claims it’s protecting investors. But many feel this is more about revenue than protection. If protecting investors was the goal, wouldn’t better education make more sense than blanket cost increases?

Whatever the intent, the impact is clear; casual F&O trading is becoming unviable. And perhaps that’s not entirely bad. Serious traders who manage risk properly will adapt. Those treating it like a lottery might finally step back.

Read: Guide to Filing Taxes Under the New Income Tax Act Effective from April 2026

Frequently Asked Questions (FAQs)

1. Which fund is exempt from STT?

Debt mutual funds are exempt from STT. When you redeem debt fund units, no Securities Transaction Tax applies.

STT only covers equity shares, equity-oriented mutual funds, and derivatives. Equity-oriented mutual funds (65%+ equity) do attract STT, but at just 0.001% on redemption.

2. Is STT a direct or indirect tax?

STT is a direct tax charged on your transaction.

Unlike GST (an indirect tax that can be passed on), STT is borne directly by whoever makes the trade. The exchange collects it automatically and transfers it to the government. There’s no way to shift this burden elsewhere.

3. Can STT affect the overall returns of traders?

You generate ₹50 lakh annual turnover in options. At 0.15%, that’s ₹75,000 in STT. If your gross profit was ₹2 lakh, STT ate up 37.5% of it. For traders who were barely breaking even, increased STT can literally turn them from profitable to loss-making. This hits hardest on high-frequency strategies like scalping. Track your contract notes for a year, and you’ll be surprised how much goes toward Securities Transaction Tax. For many traders, it’s the second or third-largest expense after brokerage. With Budget 2026’s hike, that impact just got much bigger.