An investment approach called asset allocation assists you in determining the proportion of various asset classes in your portfolio so that your investments match your goals, time horizon, and risk tolerance.

Put another way, the way you divide up the assets in your portfolio and distribute them helps you balance risk and seek the most return within the time frame you have to meet your investment objectives.

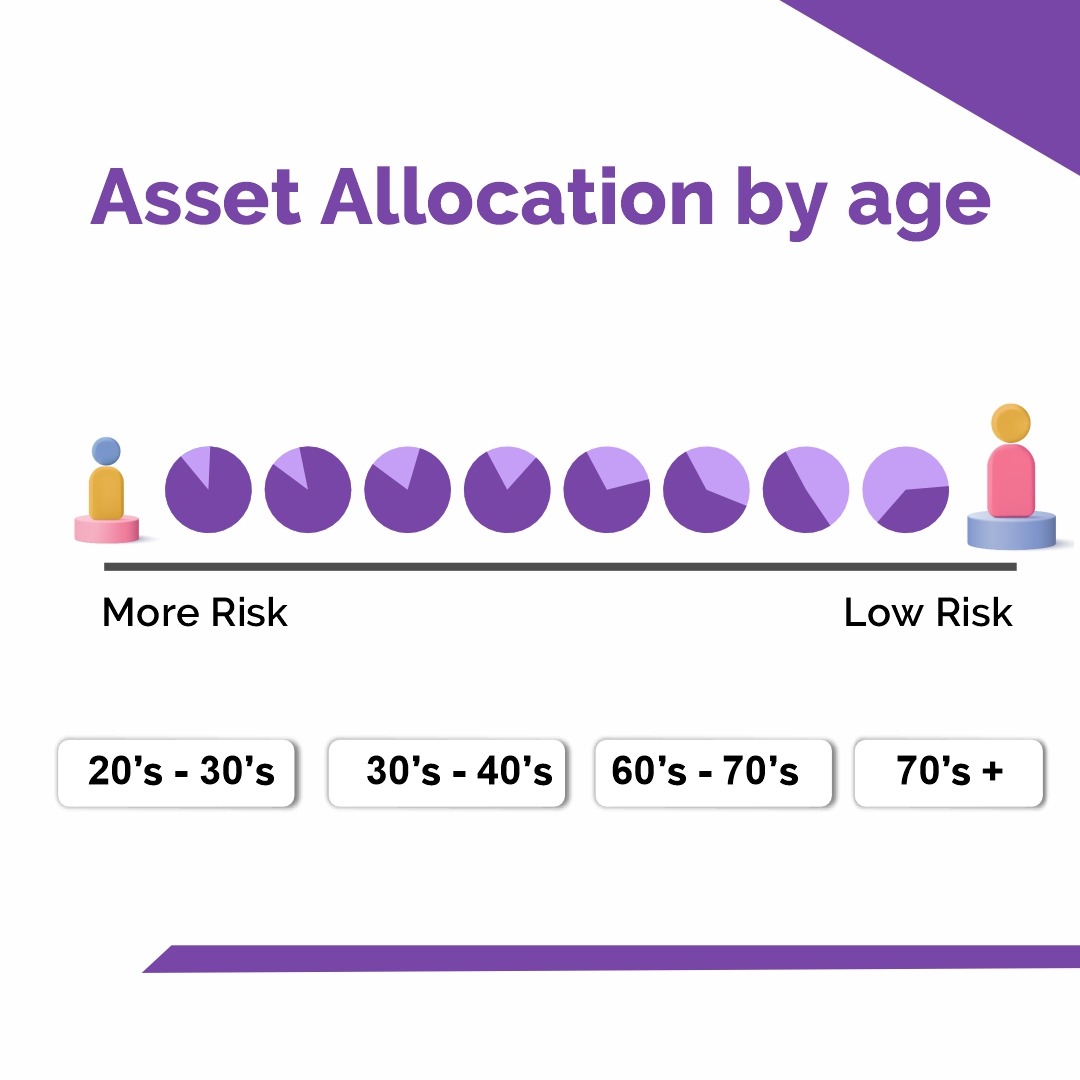

As you become older, your asset mix will probably change. Since stocks have the highest potential for growth, you may wish to own more of them when you’re younger and have a longer time horizon. Additionally, you will have several years to weather market turbulence thanks to that extended time horizon.

But as you age, you’ll probably want to adjust your asset portfolio. As you get closer to retirement age and the time when you’ll need to take out a loan from your savings, you might wish to move a portion of your retirement assets from riskier investments like stocks and bonds to safer investments like bonds and cash equivalents.

How should your portfolio be configured to get the optimal asset allocation by age? What you need to know about asset-based asset allocation is as follows.

Table of Contents

What Is Age-Based Asset Allocation?

Investment consultants once advised investors to use a rule of thumb that involved deducting their age from 100 to determine the percentage of their portfolio that should be invested in stocks. What kind of asset allocation adheres to the principle? A 30-year-old may invest 70% of their portfolio in equities, compared to a 60-year-old’s 40%.

However, some industry experts and advisors now advise investors to maintain a more aggressive asset allocation for a longer period of time as life expectancy continues to rise, especially for women, and people depend on their retirement savings to cover the cost of longer lifespans (and potential healthcare expenses).

According to the new way of thinking, you should deduct your age from 110 or 120 in order to keep your stock allocation more aggressive.

Then, a 30-year-old’s portfolio allocation might be 80% stocks (110 – 30 = 80), while a 60-year-old’s portfolio allocation might be 50% stocks (110 – 60 = 50), which is a little more aggressive than the 40% allocation previously mentioned.

These are some ideas to help you think through your own asset allocation strategy; they are not strict restrictions. Since all people’s financial circumstances are unique, so will each portfolio allocation.

Example of Asset Allocation

What are some instances of asset allocation? Your portfolio may contain 60% equities, 40% bonds, and no cash, or it may have 70% equities, 20% bonds, and 10% cash equivalents. However, the specifics of your asset allocation plan depend on how you determine that ratio because each of these asset classes has a unique level of risk and return in addition to its own unique behaviour over time.

1. Stocks

Stocks typically offer the highest rates of return. However, with the potential for greater reward comes higher risk. Typically, stocks are the most volatile of these three categories, especially in the short term. But over the long term, the return on equities has generally been positive.

2. Bonds

Historically, bonds have provided steadier returns and posed less risk than equities. Generally speaking, bond prices move the other way from stock prices.

Purchasing a bond is equivalent to lending money to a government agency or business. The principal you paid for the bond is refunded to you at the end of its term, and you get regular interest on the money you loan. Investors typically accept lower returns when purchasing bonds because of the security they provide.

3. Cash

The least volatile assets are cash or cash equivalents like money market accounts or certificates of deposit (CDs). However, they usually yield relatively little profit.

Building a Foundation: Early Career (20s-30s)

1. Risk Tolerance and Long-Term Investment

Youngsters should keep in mind that you have more time to recover from market losses or downturns the younger you are. Therefore, it may make sense to allocate a larger portion of your investments to growth funds or funds that employ an active management style if you believe the higher risk and potential for higher returns outweigh the fees charged by these funds.

2. Emphasizing Growth Assets

The popular belief among younger investors is that they should keep the majority of their portfolio in stocks in order to help save for long-term financial objectives, such as retirement.

Having said that, your financial situation might not be entirely stable when you’re young. You most likely haven’t saved much money, you might be changing jobs frequently, and you might have debt to worry about, such as student debts. It can be unsettling to set up a stock-focused, potentially volatile allocation.

Your main investing vehicle may be your employer’s provident fund account, if you have one, or you may have opened an IRA. Exchange-traded funds (ETFs) or mutual funds that contain a variety of companies can be invested in with either account to offer some inexpensive diversification without compromising the

Mid-Career: Balancing Growth and Stability (40s-50s)

1. Adjusting Risk Tolerance

You may be approaching your prime earning years as you approach middle age. In addition, you can have larger savings objectives, like funding your children’s college education, and more financial responsibilities, like mortgage payments, than you did in the past. Positively, you might have at least 20 years left before you consider retirement.

Allocation to Income-Generating Assets

One strategy in the early years of these decades is to think about maintaining a sizable percentage of your portfolio in stocks. Because you may add potential growth to your portfolio and still have several years to ride out any volatility, this could be helpful if you haven’t been able to save much for your retirement.

As you near the conclusion of these decades, you might want to consider adding bonds to your portfolio for stability, depending on when you intend to retire. For instance, at this point, you could want to start by allocating a larger portion of your IRA assets to bonds or bond funds. When compared to mutual funds or other investments, these could yield lower short-term returns.

Nearing Retirement: Preserving Capital (60s)

1. Transitioning to a More Conservative Approach

As you approach retirement age and turn sixty, your portfolio will probably become more heavily weighted toward fixed-income assets like bonds and possibly even cash. This kind of change can help you get ready for the potential that when you retire, the markets might not be doing so well.

2. Capital Preservation and Risk Management

If so, you may be able to use these fixed-income investments to generate income throughout the downturn, allowing you to avoid selling stocks during a down market as doing so would lock in losses and perhaps limit portfolio growth in the future.

Therefore, if you rely more on the fixed-income component of your portfolio, you’ll have more time to invest in stocks before the market recovers.

If you haven’t retired yet, you can still increase your nest egg and benefit from any work match by contributing to your provident fund.

The investment allocation in your retirement account when you were younger probably now favours fixed-income assets as well.

In Retirement: Generating Sustainable Income

1. Importance of Income-Generating Assets

It could seem like you can put your worries about asset allocation behind you after you retire and settle in. However, it’s still crucial to think about your portfolio allocation now, just as it was in your twenties.

2. Balancing Income and Growth

You won’t be contributing to your savings with earned money when you retire because you’ll probably be living on a fixed income.

Since you might live to be 80 or 90 years old when you retire, you should think about accumulating a variety of assets, including equities that could increase in value. Maintaining a modest stock holding may help you keep your spending power and prevent outliving your savings.

That may seem contradictory to the previous recommendation that pre-retirees dedicate a larger portion of their assets to fixed-income investments, but the key distinction is the degree of protection you may desire in the final years before retirement.

Considering the possible decades ahead of you now that you are an official retiree, you might wish to add some growth potential to your portfolio.

Conclusion

Asset allocation has significant strategic consequences for your investments overall while being a rather straightforward concept. Essentially, it is how you split up different asset classes in your portfolio to assist in managing risk. It may seem simple to combine the three primary criteria that affect your asset allocation—goals, risk tolerance, and time horizon—into an asset allocation that works for you, but doing so requires skill and knowledge. Learning is the process of determining the appropriate allocation of assets, just like many other things.

Frequently Asked Questions (FAQs)

How much of your retirement portfolio should be in stocks?

If you’re thirty, for instance, you ought to allocate 70% of your portfolio to equities. Thirty per cent of your portfolio should be in equities if you are 70 years old. But as Americans are living longer and longer, a growing number of financial advisors are suggesting that the formula should be more like 110 or 120 minus your age.

What is 75 25 asset allocation in retirement?

As a fundamental guideline, we have recommended that an investor’s holdings should never be less than 25% or greater than 75% in common stocks, with an inverse range of 75% to 25% in bonds.