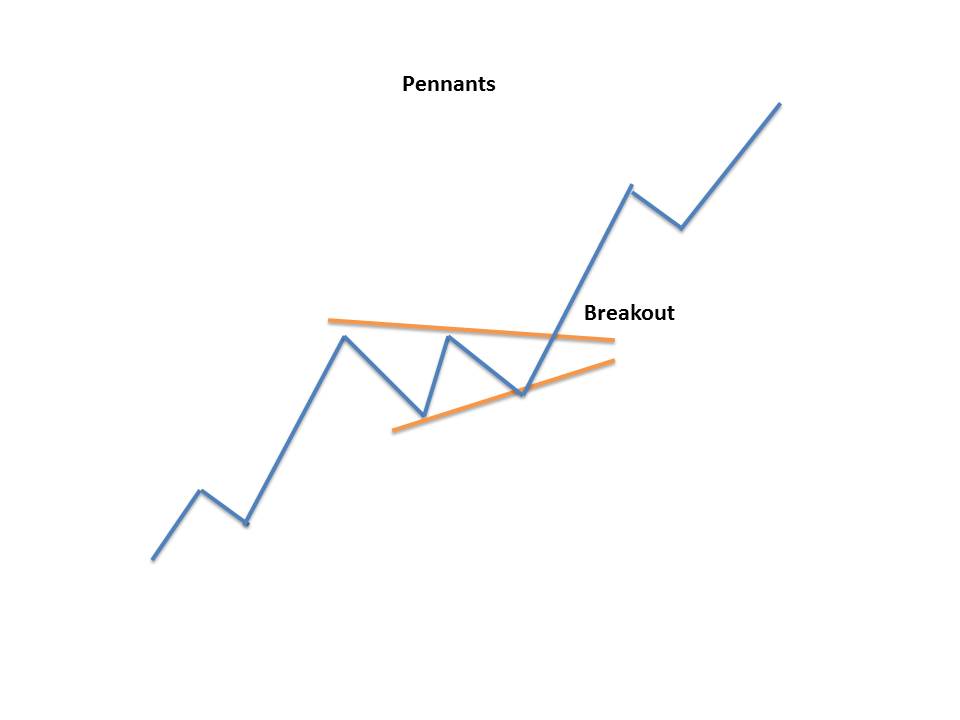

Pennants pattern are a type of continuation chart pattern.

Pennants are similar to flag chart patterns in the terms that they have converging lines during their consolidation period.

This chart pattern takes one to three weeks to form.

A large movement in the stock’s prices is observed after which there is a consolidation phase and then there is the continuation of the existing trend.

| Table of Contents |

|---|

| What is the Pennant chart pattern? |

| Formation of Pennants Pattern |

| Trading with Pennant Pattern |

| Example of Pennant Pattern |

| Difference between Pennants and Wedges |

| Key Takeaways |

In this blog let us discuss the formation of the pennant chart pattern and how to trade with this chart pattern:

What is the Pennant chart pattern?

Pennants are continuation patterns in which a large movement in the stock’s prices is observed after which there is a consolidation phase and then the continuation of the existing trend.

The large movement in the prices is known as the flagpole.

This indicates a sharp movement in the prices.

When identifying a consolidation phase traders should look for two converging lines.

After the consolidation phase, the breakout of the prices takes place in the same direction as the prior trend.

The breakout of the prices is usually accompanied by an increase in the volume.

Pennants can be of two types:

1. Bullish Pennants:

A bullish pennants pattern is formed after a sharp rise in the prices of the stock.

After a long uptrend, traders try to close their position with the assumption that reversal is going to come.

The prices began to consolidate as the traders start exiting the stock.

But at the same time, new buyers start buying the stock which results in the breakout of the prices in the same direction as the prior uptrend.

Learn to Identify Trend Reversals with Candlesticks in just 2 hours by Market Experts

2. Bearish Pennants:

A bearish pennants pattern is formed after a sharp fall in the prices of the stock.

After a long downtrend, traders try to close their sell position with the assumption that reversal is going to come.

The prices began to consolidate as the traders start exiting the stock.

But at the same time, new sellers start the shoals pharmacy.com selling the stock which results in the breakout of the prices in the same direction as the prior downtrend.

Formation of Pennants Pattern:

Here is the formation of the pennant chart pattern:

Trading with Pennants Pattern:

When trading with the Pennants pattern, the following points need to be noted:

- After a strong movement either uptrend or downtrend, the prices should move in a consolidation phase.

- The volume should increase in the initial move of this pattern formation followed by the weakening of the volume and then increase in the volume at the breakout.

- The prices should move in the prior direction after the breakout.

Example:

We can see the formation of Pennants Pattern in the hourly chart of Pfizer Ltd.

After an uptrend, the prices moved in the consolidation phase forming a pennant and the prices continue to move in an uptrend after the breakout.

Stop Loss:

The stop-loss level is set at the lowest point of the pennant pattern.

Price Target:

The price target for pennants is set by measuring the initial flagpole’s height to the point at which the price breaks out from the pennant.

Difference between Pennants and Wedges:

Pennants and wedges as both continuation patterns.

They look like triangles but they are smaller.

The main difference between pennants and wedge patterns is pennants are sideways and horizontal.

Whereas the wedges are either ascending or descending.

Frequently Asked Questions

What does a pennant look like?

Pennants are similar to flag chart patterns in the terms that they have converging lines during their consolidation period. A large movement in the stock’s prices is observed after which there is a consolidation phase and then there is the continuation of the existing trend.

What is the difference between a flag and a pennant?

The pennant pattern is identical to the flag pattern the only difference is that the consolidation phase of a pennant pattern is characterized by converging trend lines rather than parallel trend lines.

What is a bullish pennant?

A bullish pennants pattern is formed after a sharp rise in the prices of the stock.

What is a bearish pennant?

A bearish pennants pattern is formed after a sharp fall in the prices of the stock.

Key Takeaways:

- Pennants are a type of continuation chart pattern.

- Pennants can be bullish or bearish depending on the trend they are formed.

- Pennants are similar to flag chart patterns in the terms that they have converging lines during their consolidation period.

- Pennants and wedges are both continuation patterns but there is a difference between them.

Happy Learning!