Understanding Options Trading Vs. Intraday Trading: The stock market is a very dynamic environment that constantly changes and offers several trading possibilities to individual traders.

However, because there are various trading techniques available, the question of which trading strategy is better emerges. Two of the well-known trading types that are frequently employed by traders are options trading and intraday trading.

In this blog, we will compare options trading vs intraday trading to determine which is the more effective trading method for people.

What is Options Trading?

Options are a particular kind of derivative contract wherein two parties agree to buy and sell the underlying asset at a certain price in the future. In this case, the buyer of the options contract has the choice, but not the obligation, to execute the options contract.

The option contract buyer must give the option seller a premium in exchange for this benefit. Additionally, the seller has a duty to uphold the agreement.

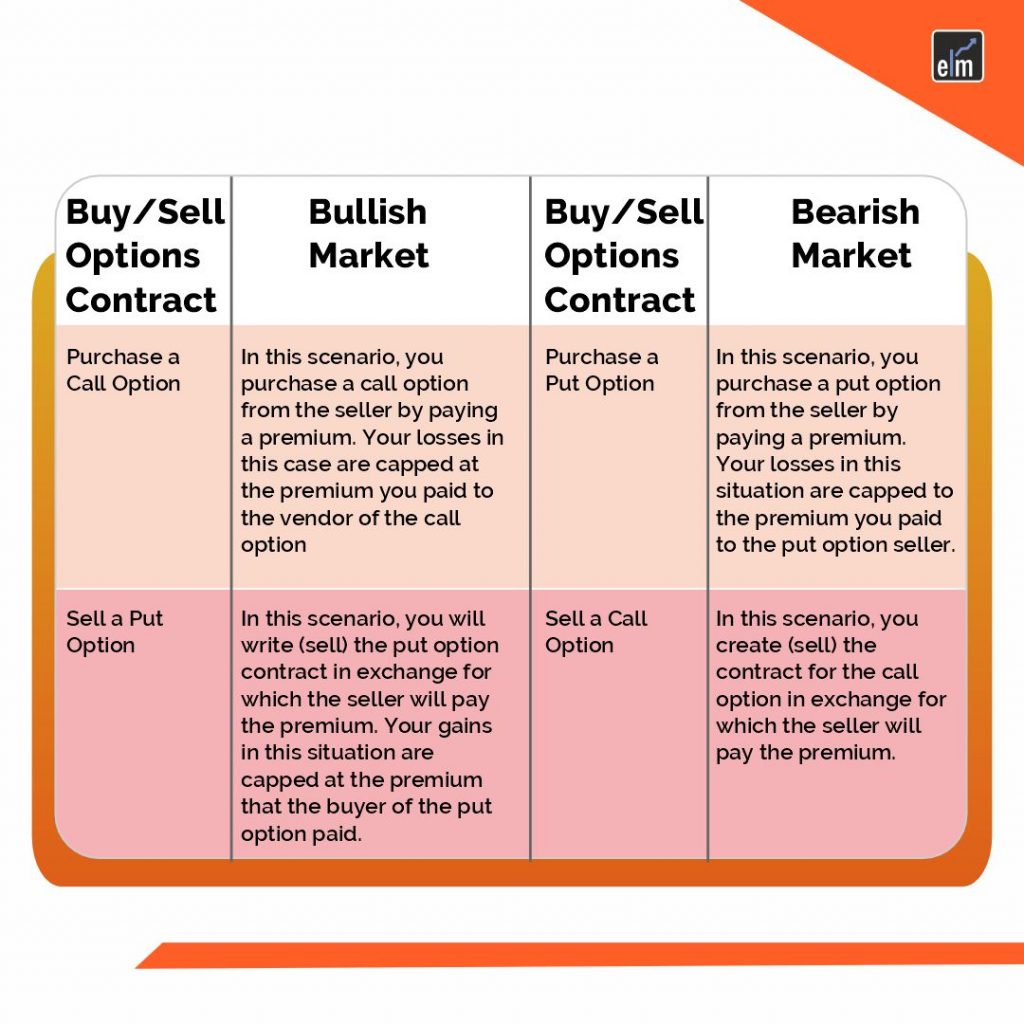

Depending on how they feel about the market and the call and put options in the options contract, traders can take one of four positions

Advantages

- Buyers have a limited risk and an unlimited upside: If you purchase a call or put option, the maximum loss you may sustain is the premium you paid to the option seller. If the buyer makes a good decision, there are limitless opportunities for profit.

- Option buyers have the option of not executing the contract if the options contracts do not work out favourably for them.

- Low financial commitment: Only the premium paid by the buyer to the seller is needed as a margin when joining an options transaction.

- Payment in advance: When engaging in an options contract, the premium is paid in advance to the seller.

- The seller of the options contract has a greater chance of being correct because of variables like time decay and volatility.

Disadvantages

- Time Decay: The value of the options contract continues to decline as the days till expiration become shorter. As a result, there are fewer possibilities that the buyer will exercise the option.

- While the option seller’s premium is the maximum amount of profit that may be made, the maximum amount of loss that can be incurred is also the maximum.

What is Intraday Trading?

Buying and selling stocks on the same trading day is known as intraday trading. In this situation, stocks are bought to profit from changes in stock indexes rather than being bought as an investment. In order to profit from stock trading, the price changes of the shares are consequently tracked.

For intraday trading, a trading account is opened online. Making it clear that the orders are for intraday trading is crucial when trading intraday. It is sometimes referred to as intraday trading because the orders are settled earlier than the trading day’s finish.

Buying the shares is referred to as taking a long position. An investor who has a bullish outlook for the market will acquire a long position. When a person takes a long position in the market, they become the owner of the shares.

Selling the shares is referred to as taking a short position. With a pessimistic outlook on the market, short positions are taken. When holding a short position in the market, a person will owe someone the shares.

Advantages

- Margin, which raises position size and has a low capital need, is a benefit of intraday trading. It also goes by the name of leverage.

- Due to the use of leverage, intraday traders have the chance to make money even with modest initial outlays.

- Short selling is employed in intraday trading. To put it simply, this includes taking a position when a trader expects the price of shares to decrease. Therefore, a trader can still make money even when the markets are down.

- The capital a trader invests is rarely kept blocked for an extended period of time. For intraday trades, the time frame is one day, and the investor may withdraw their money once the trade has settled.

Disadvantages

- A trader does not have enough time to ride the entire wave because intraday trades close in a single day. The trader may not be able to earn from the transaction if prices don’t change at all occasionally.

- In keeping with the aforementioned logic, a trader might not be able to wait for the price to come around because of the shorter time period and might be compelled to close the position at the end of the day, even if they lost money on the transaction.

- In intraday trading, leverage is used, and if it is not used wisely, it could result in significant losses.

Options Trading Vs Intraday Trading

Let us discuss options trading vs. intraday trading:

- Individuals have four positions from which to choose when trading options. Whereas Individuals have two positions in which they can start an intraday trade.

- Options Trading has a contract-specific monthly or weekly expiration. Before the day’s end, all differences must be resolved in Intraday Trading.

- The price of the contract is influenced by market dynamics and options Greeks. Trading intraday only takes into account market factors.

- Margins needed by the option seller are the amount needed to cover the losses, while margins needed by the option buyer are only the premium price paid. Whereas in intraday trading, individuals can purchase or sell more shares with less capital by using the margins that are available to them as leverage.

Ready to master the art of trading? Explore our comprehensive options trading course for informed decisions. Start your journey now!

Participate in our Expert Webinar on Option Trading Strategies

Bottomline

Each trading strategy has advantages and disadvantages. In order to choose the ideal trading strategy for them, individuals must first understand their goals for trading, their risk tolerance, and their constraints.

You can also check out our Options Trading Made Easy course and improve your trading journey.

Frequently Asked Questions

1. Which is risky intraday or option?

For some traders, intraday trading is dangerous because it entails buying and selling equities on the stock market all on the same day. This is true for both novice and seasoned traders and investors.

2. Is intraday options trading profitable?

A high-risk, high-reward approach is intraday option selling, which involves both buying and selling options on the same day. Selling intraday options may be beneficial if certain requirements are met, including volatility and market circumstances.

3. Is option trading better than regular trading?

Compared to stock trading, options trading can be riskier. It can, however, be more beneficial for the investor than conventional stock market investing if done correctly.

4. Should I avoid option trading?

Trading options can carry higher risk than trading stocks. The investor may, however, benefit more from it than from conventional stock market investment when it is done well. You can also use StockEdge to get a cutting edge over others in both short-term trading and investing.