Nifty started the January Future and Options series with strong gains backed by positive global cues and banking stocks. Public banking space witnessed strong move ahead of FM Nirmala Sitharaman’s meeting with PSU bank chiefs on December 28.

Nifty Hourly

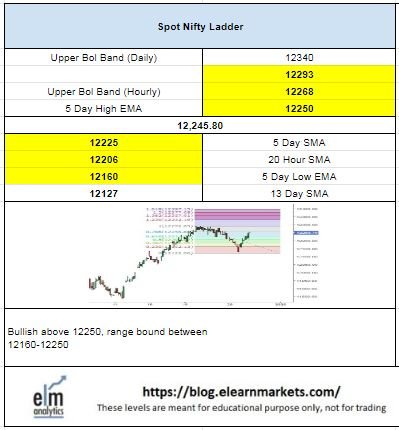

In the hourly chart, Nifty broke the hourly resistance of 12230 and ended above 12250 levels. Technical parameters including CCU, RSI, Stochastic and MACD look positive since most of the parameters including Stochastic and CCI are trading in the overbought territory.

Probable support in the short term comes at 12220-12230 and next support at 12150. Probable resistance on the upside comes at 12280-12300.

Nifty Daily

The index bounced right from 38.2% Fibonacci retracement and RSI bounced from 55 levels which suggest strength as of now. Nifty is trading very close to the lifetime high area and breakout above the high may lead to further short term momentum.

Technical parameters looks positive in the daily timeframe too since RSI and CCI are trading close to the overbought territory and Stochastic is already in the overbought zone.

Nifty Daily chart

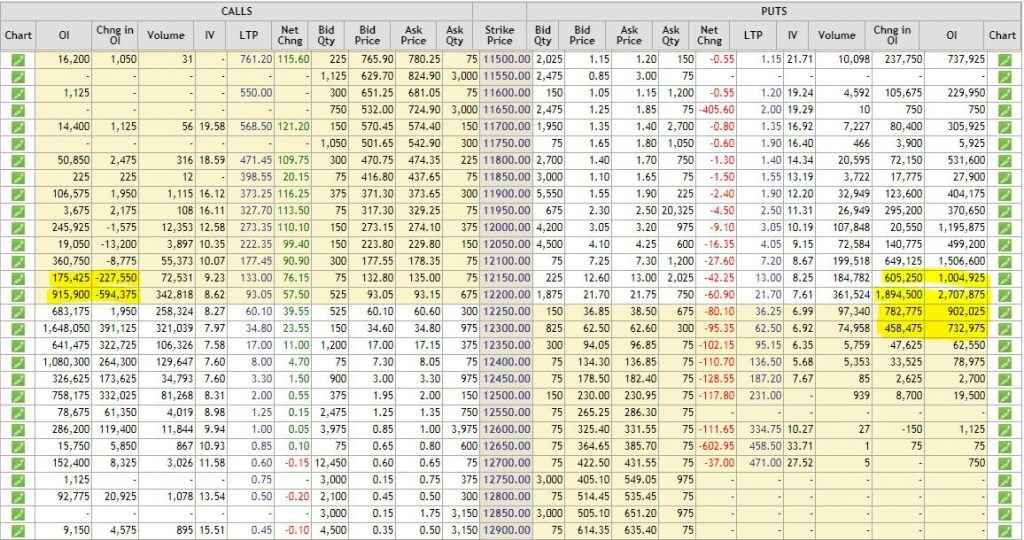

Open Interest data of Nifty at strike of 11200 and 11250 on the call side witnessed shredding of OI along with good OI additions on the put side which suggest strength in the index.

Nifty Weekly

In the weekly chart, Nifty looks strong as per technical parameters and trading very close to the all time high area. Further momentum to be seen only above the swing high till then likely to see short term consolidation in the index.

Probable resistance as per the upper trend line comes at 12400-12450 which is likely to act as a crucial resistance as of now. Breakout above 12500 may lead to steep move in the index. Probable support comes at 11900-11950 in the weekly chart.

really very helpful informattion

for analysis and stock actions

Hi,

Thank you for Reading!

Keep Reading!