Nifty close 10361.3: Nifty ended the session on a flat note but with closing above 10350 level. As mentioned in yesterday’s Tech table, it respected both the support of 10345 (made low of 10345.9) and resistance of 10391 (made high of 10393).

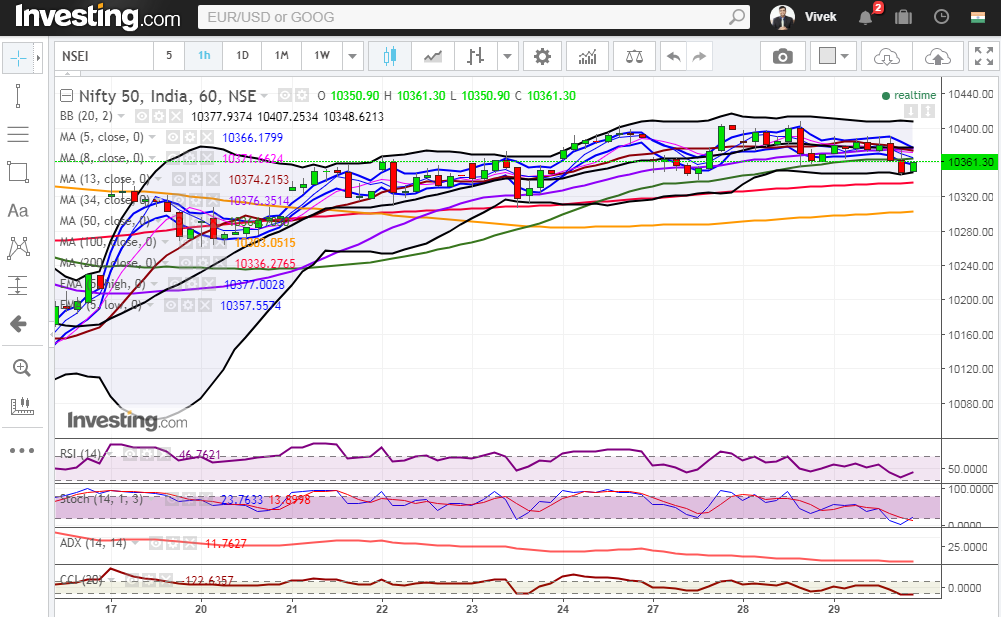

Hourly Technical:

In the hourly chart, Benchmark indices opened flat but witnessed a mild correction in the second half of today’s session. . The probable support in the hourly chart comes at lower Bollinger line (presently at approx. 10348.6), 200 Hour moving average (presently at approx. 10336.3) and 100 Hour moving average (presently at approx.10303.1).

On the upside, Nifty may face resistance at Upper Bollinger line (presently at approx.10407.3).

Hourly Stochastic and CCI are in the oversold zone but RSI is still in the normal zone. Moreover, ADX is downward sloping suggesting a loss in downside momentum. Overall Nifty remained neutral in the Hourly time frame.

Figure: Nifty Hourly Chart

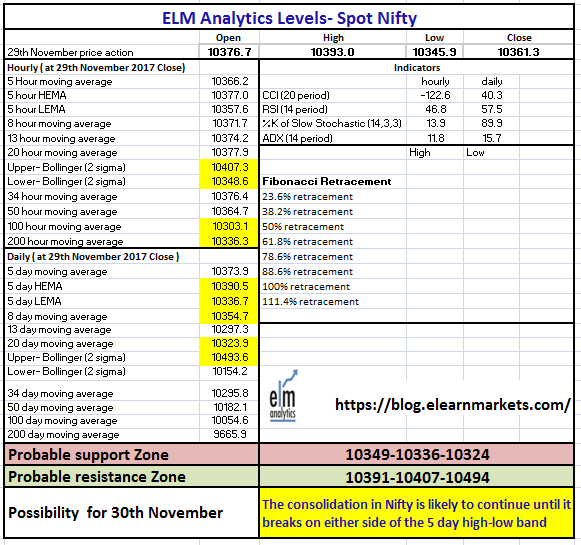

Daily Technical:

In the daily chart, the consolidation continues in a range of 10340-10400 for the last six consecutive sessions and it is likely to continue as long as it stays in the 5 day high-low band.

The probable support in the daily chart comes at 8 DMA (presently at approx.10354.7), 5 Day Low EMA (presently at approx.10336.7) and 20 DMA (presently at approx.10323.9).

On the upside, Nifty may face resistance at 5 Day High EMA (presently at approx.10390.5) and upper Bollinger line (presently at approx.10493.6).

Daily Stochastic is in the overbought zone while RSI and CCI are still in the normal zone. Overall, Nifty remained neutral to bullish in the daily timeframe.

Figure: Nifty Daily Chart

Figure: Nifty Tech Table

Watch the video below to know about how to analyze the above matrix:

BOTTOMLINE

You can use Stockedge to get cutting edge over others in both short-term trading and investing. Here, you not only get data at one particular place but can also create your own combination scans based on your own technical and fundamental parameter.