What is Prompt Corrective Action(PCA)?

Prompt Corrective Action (PCA) framework is a tool by the Reserve Bank of India to for taking direct action on weak and troubled banks, so as to avoid banking failures which is negative for the health of the economy.

RBI brings banks under the PCA framework whenever they breaches the stipulated risk thresholds in the identified areas of monitoring, which includes capital, asset quality (net Non-Performing Assets ratio) and profitability, to ensure that corrective measures are taken in proper time and the banks are saved from going bust.

The main aim of the framework is to strengthen the financial health of the banking system by encouraging banks to abstain from riskier activities, improve operational efficiency and to focus on conserving capital. It gives RBI an opportunity to engage closely with the banks’ management to secure their financial health.

When is Prompt Corrective Action invoked?

RBI evaluates three parameters before bringing a bank under the ambit of Prompt corrective action. The three parameters include two types of restrictions- mandatory and discretionary.

Restrictions on dividend, branch expansion, director’s compensation fall under mandatory restriction while curbs on lending and deposit are the discretionary restrictions.

The mandatory actions are essential to restore the financial health of the banks while the discretionary actions are taken by the RBI depending upon the profile of the bank.

The parameters that invoke corrective action from the central bank are:

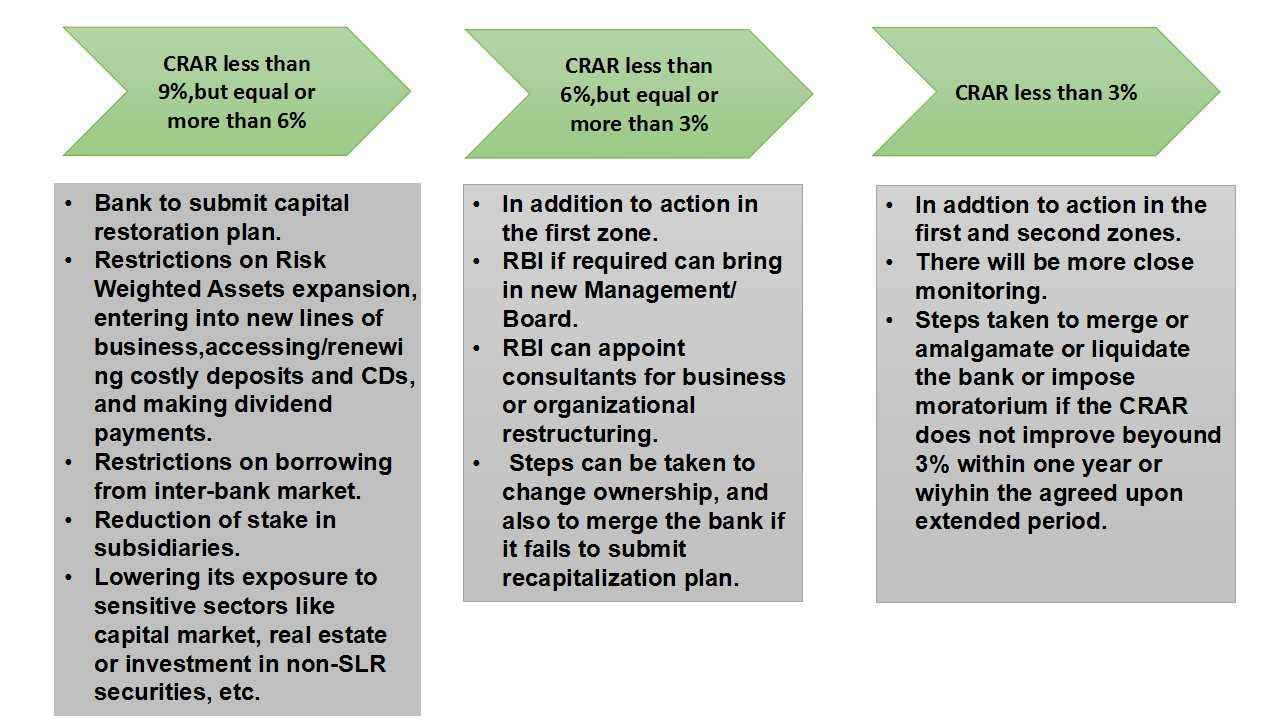

(i)Capital to Risk weighted Asset Ratio (CRAR) – It measures the financial strength of a bank. A bank with a CRAR above 9% is considered financially healthy and will be able to withstand any crisis. Any bank with a CRAR less than 9% slips into the ambit of PCA. The following explains the trigger points along with structured and discretionary actions that could be taken by the RBI whenever the CRAR of a bank slips below 9%.

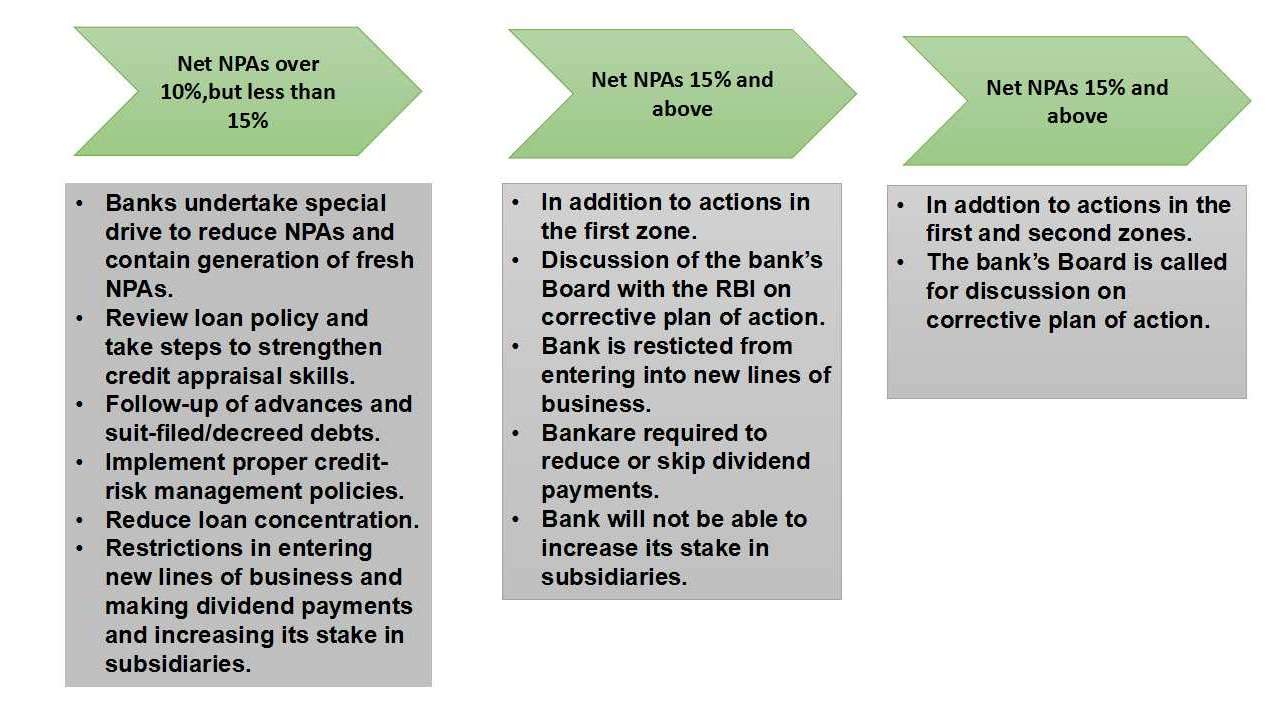

(i)Net Non-Performing Assets (NPA) – This parameter assess the asset quality of a bank. If the NPA percentage exceeds 6%-9% then the bank is considered to a troubled bank and slips into the ambit of PCA. The following explains the trigger points along with structured and discretionary actions that could be taken by the RBI whenever the Net NPA of a bank exceeds 9%.

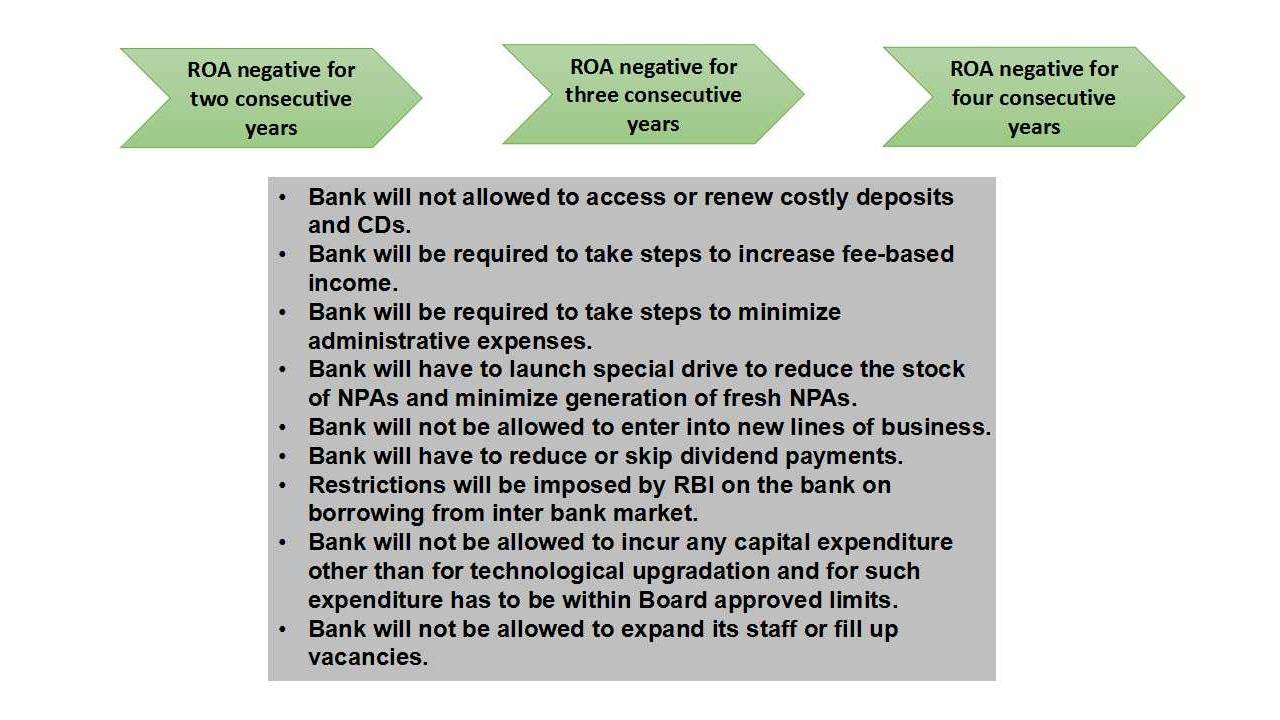

(iii)Return on Assets (RoA)-This parameter assesses the profitability of the bank.RBI considers ROA as the benchmark for profitability. If the ROA of a bank falls below 0.25% the bank slips into the ambit of PCA. The following explains the trigger points along with structured and discretionary actions that could be taken by the RBI.

A bank is brought under the PCA framework based on the Audited Financial Results and the Supervisory Assessment performed by the RBI. The provisioning helps the banking system to withstand crisis, and early recognition of the problem leads to timely and orderly corrective measures.

Benefits of Prompt Corrective Action

- PCA is essential for safe guarding the overall financial stability of the banking system.

- It is essential for revival of weak banks and undertakes deeper reforms needed for long term viability and sustainability of the business model of these banks.

- It serves as a safeguard tool if other enforcement actions are delayed. The 90 day closure provision under PCA facilitates an orderly resolution.

- It help banks to lower gross Non Performing Asset growth at the same time maintaining the growth in advances and deposits, reducing riskiness of assets and focusing on better rated assets.

- Under extreme conditions, it empowers state banking regulators to close critically undercapitalized banks and provide a road map for doing the same.

- It also encourages banks to hold more capital to minimize the possibility of triggering mandatory supervisory action and to abstain from riskier activities so as to make the balance sheet stronger.

Banks under Prompt Corrective Action

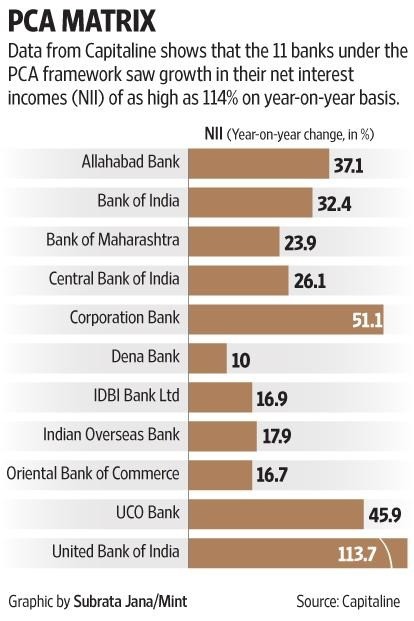

The RBI has brought as many as 11 out of 21 state owned banks and 1 private bank under the PCA framework. The 11 banks under the PCA are: Allahabad Bank, United Bank of India, Corporation Bank, IDBI Bank, UCO Bank, Bank of India, Central Bank of India, Indian Overseas Bank, Oriental Bank of Commerce, Dena Bank and Bank of Maharashtra. Dhanlaxmi Bank is the only private sector bank which remains under the PCA framework. Together, these banks control over 20 per cent of the credit market. As per the latest data, PSU banks have reduced a staggering Rs 2.22 lakh crore from their NPA tallies as loan recovery efforts paid off in the last three and half years.

Outcome of Prompt Corrective Action

- The banks under PCA saw Net Interest Incomes (difference between interest earned and interest expended) rise as high as 114%.

- The banks reported an improvement in their CASA ratio by 37.6%,of this the savings deposits increased to 31.1% .A higher CASA ratio indicates higher cheaper source of funds for the bank, thus helping to improve their NIM.

- A rise in NIM indicates that the PCA banks are moving towards the profitability and over the time may lead to an improvement in the asset quality of these banks.

- Non-performing assets (NPAs) amounted to Rs 3.49 lakh crore for the PCA banks in Q2FY18 as against Rs 3.46 lakh crore in the previous quarter. The NPA ratio increased to 20.5 per cent in March 2018, an expansion of 450 bps and is marginally up to 21% in September.

- Under the PCA framework most of the banks are restricted from lending over the past one year, leading to a contraction of their balance sheet, as the cost remains same but the interest expense rises. In addition to this, recovery is also cost intensive.

- The advances of the banks came down to Rs 16.39 lakh crore in March 2018 from Rs 17.65 lakh crore in March 2017.Thus, in total the asset position of the bank deteriorates.

- Restricted lending has reduced the overall loan books of the banks under PCA.

- Banks are now focusing more on retail loans instead of corporate loans. The banks witnessed a rise of 400 bps in their share of retail loans.

- The share of retail loan raised from 15% in March 2015 to 19% in September 2018 while their share of home loans in retail has climbed from 46% to 61% in the same period.

- Retail Credit makes business sense for PCA banks, as it ensures that the business is widely dispersed among a large customer base unlike in the case of corporate lending, where the risk may be based on a selected few players.

- Rise in retail lending contributes significantly to the development of the economy as it contributes 7% to GDP and 14% to employment in India.

So, RBI’s PCA norms have not really crimped the flow of credit to the economy.

Private sector to gain market share–The PCA framework has imposed lending restrictions on the banks. The market share of private banks remained at 14-15% in the advances and deposits category for a long time, but with the restrictions imposed under PCA many of the private banks have scaled up their business portfolio to expand both retail and corporate lending.

Bottom line

As per RBI, the Indian banking system has high proportion of NPAs in relation to the available capital levels. Imposition of PCA is slowly stabilizing the banks at risk and implementing reforms necessary for long term sustainability of the overall banking system. However, PCA imposes restriction on lending and decreases their size of Interest earning. This reduces the earning capacity of the banks leading to contraction of its balance sheet and deteriorates its overall position.