You must have heard about moats if you are into investing for about sometime or have gone through Warren Buffett’s letters to shareholders. Want to know more about Moats? Enroll in: NSE Academy Certified Equity Research Analysis course on Elearnmarkets.

Read More: Top 5 investing lessons from Warren Buffett’s shareholders letters 2016

Let’s understand in brief what is moat all about?

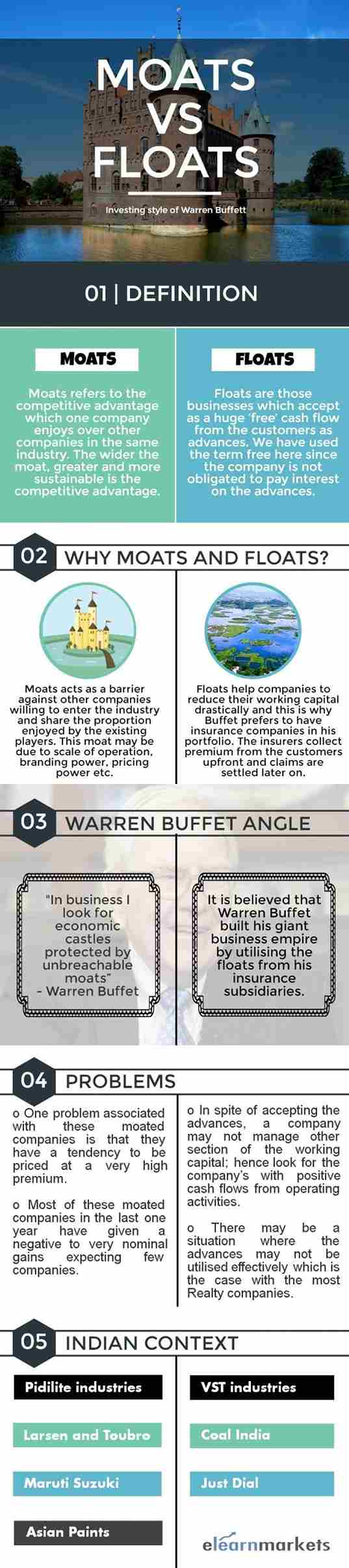

Moats

The term ‘moat’ was first coined by the legendary investor, Warren Buffett.

It refers to the competitive advantage which one company enjoys over other companies in the same industry.

The wider the moat, greater and more sustainable is the competitive advantage.

In short, moat acts as a barrier against other companies willing to enter the industry and share the proportion enjoyed by the existing players.

This moat may be due to the scale of operation, branding power, pricing power etc.

Some of the moated business in the Indian context includes Asian Paints, Pidilite industries, Titan, Nestle India, Maruti Suzuki, Larsen and Toubro etc.

One problem associated with these moated companies is that they have a tendency to be priced at a very high premium.

If we talk about the performances of these moated companies in the last one year, most of them have given a negative to very nominal gains expecting few companies

Hence, just don’t run blindly before the moats. However, margin of safety is an equally important aspect to consider.

Moreover, another point you should consider from time to time is that whether the moat is still intact with the business or is worsening over time.

Now let’s understand what are floats?

Floats

You may be familiar with the term float if you know Warren Buffett and his company Berkshire Hathaway.

It is believed that he built his giant business empire by utilizing the floats from his insurance subsidiaries.

However, the float is relevant in the insurance business until the cost of float is lower than interest rate prevailing in the market.

Warren Buffett is his letters to shareholders (2002) wrote-

Float is money we hold but don’t own.

In an insurance operation, float arises because premiums are received before losses are paid, an interval that sometimes extends over many years.

During that time, the insurer invests the money.

This pleasant activity typically carries with it a downside: The premiums that an insurer takes in usually do not cover the losses and expenses it eventually must pay.

That leaves it running an “underwriting loss,” which is the cost of float.

An insurance business has value if its cost of float over time is less than the cost the company would otherwise incur to obtain funds.

But the business is a lemon if its cost of float is higher than market rates for money.

Moreover, the downward trend of interest rates in recent years has transformed underwriting losses that formerly were tolerable into burdens that move insurance businesses deeply into the lemon category.

Floats are those businesses which accept as a huge ‘free’ cash flow from the customers as advances.

We have used the term free here since the company is not obligated to pay interest on the advances.

It helps the company to reduce their working capital drastically and this is the reason why Buffet prefers to have insurance companies in his portfolio.

The insurers collect premium from the customers upfront and claims are settled later on.

Warren Buffett in his letter to shareholder (2015) said-

So how does our float affect intrinsic value?

When Berkshire’s book value is calculated, the full amount of our float is deducted as a liability, just as if we had to pay it out tomorrow and could not replenish it.

But to think of float as strictly a liability is incorrect.

It should instead be viewed as a revolving fund.

Daily, we pay old claims and related expenses – a huge $24.5 billion to more than six million claimants in 2015 – and that reduces float.

Just as surely, we each day write new business that will soon generate its own claims, adding to float.

If our revolving float is both costless and long-enduring, which I believe it will be, the true value of this liability is dramatically less than the accounting liability.

Owing $1 that in effect will never leave the premises – because new business is almost certain to deliver a substitute – is worlds different from owing $1 that will go out the door tomorrow and not be replaced.

The two types of liabilities, however, are treated as equals under GAAP.

Some reasons why you need to be careful about floats and just not blindly invest in the stocks for the sake of floats.

Firstly, in spite of accepting the advances, a company may not manage other section of the working capital; hence look for the companies with positive cash flows from operating activities.

Secondly, there may be a situation where the advances may not be utilized effectively which is the case with most of the Realty companies.

Thirdly, look for other important parameters like ROE (which should be high) and interest coverage ratio (should be in a safe zone).

Lastly, avoid the companies strictly with a high cash conversion cycle despite the advances from customers.

One very important aspect with the companies with floats is that the chances of bad debt are hardly there with these companies.

Since they accept cash before the service is given to them, hence it is a very positive aspect of these companies.

Some of the Indian companies with floats include VST industries, Just Dial, Coal India etc.

Bottomline

Both moats and floats are part of the investing style of Warren Buffet and he’s very successful with both the styles.

It is you who need to devise that which style you are comfortable with rather than imitating someone else.

So devise your own investing style and stick to it, no matter what others are saying or doing.

Keep learning!!

The write up on floats is something new to me but it’s very interesting.

Thanks Ankit!

It’s one of the most acclaimed and trusted investing style across the world and you can very well understand the relevance of “floats” since Warren Buffett uses it in his own investing.