There are so many things to learn from nature around us, but we just need to have an open mind to look through them. One of such example I have used earlier in my blog is on the concept of margin of safety where I took an example of an overbridge to explain the term. Say at a certain point, the maximum load which will pass through a bridge is 8000 tonnes, but it is made to carry weight up to 20000 tonnes, thus providing a cushion in case of an abnormal situation.

After an earthquake which took place today in the early morning, has shook my brain to ideate some investing lessons. I have basically compared an earthquake with a market crash and here’s a list of lessons which you must take into consideration.

1. Never panic– Some of the casualties which take place during an earthquake is simply due to panic, which lead people to take abnormal or illogical decisions. So it’s better to calm down and seek a right set of actions which includes crawling under heavy furniture or standing against the wall and stop rushing for outdoors. Whether it’s an earthquake or a market crash, the golden rules are -”never panic”.

Most of the harm which is caused during a market crash is just that people rush to sell their stock without giving a single thought. Mass selling further worsens the situation which contributes to further decline. Hence the best advice would be to stay calm.

2. Be prepared– Future is uncertain and hence we do not know when will an earthquake or a market crash is going to take place. These situations do not always happen, but it may come, hence it’s better to take some precaution. For instance, you can use an earthquake proof tmt bar while constructing your building or can create bunkers in your homes so as to rescue in case of emergency.

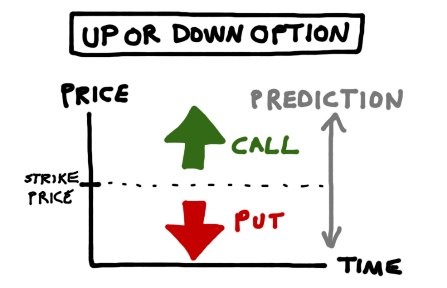

Similarly, it’s always advisable to protect your investment positions by buying put options for the respective stocks in your portfolio. It’s like paying premium for an insurance.

3. Avoid mass media– Whenever there’s an earthquake, people have a tendency of rushing out by seeing others. It’s a very wrong decision since earthquake happens for a few seconds and you might be caught in the midway if it is severe. So the best way would be to use your brain and not act by seeing others.

Similarly, during a market crash, it’s always advisable to take your own judgement rather than getting carried away by the mass media which creates a situation of panic. As a long term investor, these crashes should not affect you, rather it should give you an opportunity to include more in your portfolio at a bargain price.

It teaches us one thing that we need to be optimistic in every situation and keep our ears and mind open to welcome new ideas. Hence, I would suggest that if you are strong in your view, never allow any situation to over-ride your belief and research. Rather add to your portfolio seeing an opportunity until the business conditions are strong

I would like to end today’s blog with a famous quote by Baron Rothschild, who said, “ Buy when there’s a blood in the streets, even if the blood is your own”. .

Stay blessed and keep learning!!