It’s not that you have to be a certified financial planner or even a finance professional to manage your finances. You just need to follow few simple rules or steps to be your own financial planner.

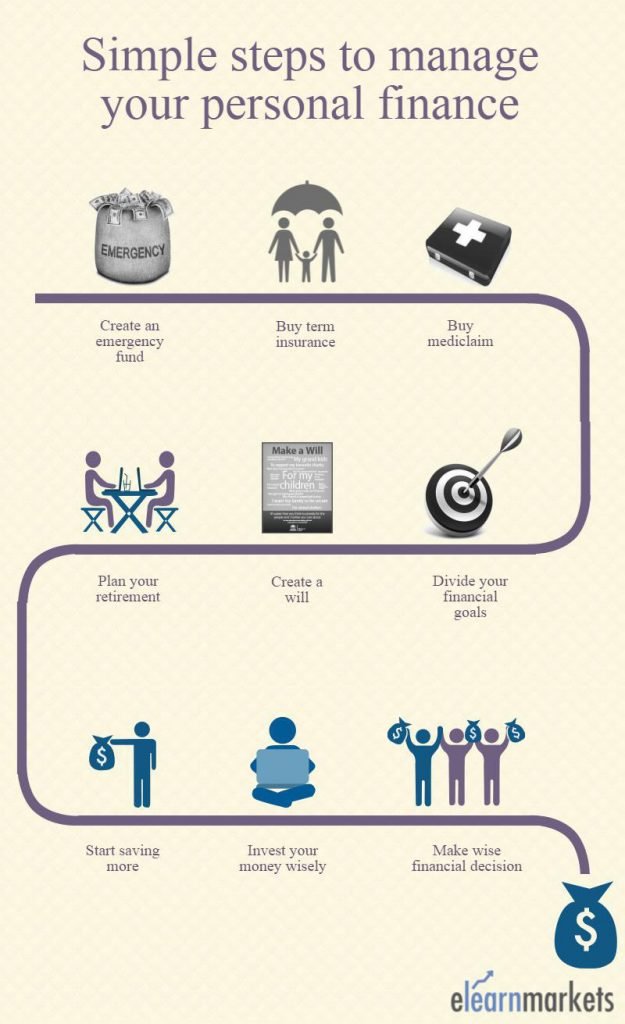

10 easy steps to manage your personal finance

1. Create an emergency fund

It’s very important to create an emergency fund since the future is uncertain and we don’t have any control over it.

Ideally, this fund should comprise of around 6-9 months of your monthly household expenses.

In case you want assistance

Say if your monthly household expenses come to Rs 20,000, so you should save a minimum of Rs 120000 as an emergency fund.

Make sure that you use this fund only in case of an emergency like job loss, major illness etc.

Keep the funds in an insured bank account so that they will be protected and easily available in case of need.

2. Buy term-insurance (especially if you have dependants)

The best thing about term insurance is that it’s very inexpensive as compared to other insurance plans.

Say a person of 23 years of age wants to make an investment cover worth Rs 67,50,000, so he needs to pay an annual premium of approximately Rs 7000 (provided the person is not a tobacco user), which comes to Rs 19/day.

Term insurance is highly recommended if you are the sole earning member of your family and you have dependents under you.

Also Read: Is Term Insurance A Right Choice For You?

3. Buy mediclaim

Someone has rightly said that ‘health is wealth’.

So follow a healthy lifestyle since healthy you leads to healthy bank account.

I personally know few people who have wasted a lot of money on their health issues.

Buying a medical insurance is a must for all your family members.

If you can not afford to get every family member covered, then at least buy coverage for those who are above 30 years of age.

4. Start saving more

Savings is a must to fulfil all your needs and it is a first step in accomplishing your financial goal.

Often people follow a wrong approach as they keep spending their money generously and are left with no cash at the time of need.

The right approach would be to take out savings from your income and whatever left should be employed for expenses, which is just the opposite general crowd follows.

The formula for savings needs to be revisited i.e. it should be-

Expenses= Income-Savings

Say your monthly income is Rs 30000 per month and you are planning to save 30% of your income to fulfil your goal.

So you should cut down on your unnecessary expenses and try to manage the monthly expenses within Rs 21000 (70% of income).

5. Invest your money wisely

Choose a right investment class to invest your money depending upon your risk appetite, after all, it’s your hard-earned money.

Construct a well-diversified portfolio to cut down the volatility or risk by investing in any particular asset class especially in equities which are considered to be highly risky.

Investing in equities is a better option if you are planning to invest for a longer term say 10 years or more.

Power of compounding works very well for long-term investments and it is believed to be “Eighth wonder of the world” by the famous scientist, Albert Einstein.

If you are not capable to invest your money, always seek the guidance of a financial planner or expert.

6. Retirement planning

Retirement planning refers to the allocation of savings for retirement.

The goal of retirement planning is to achieve financial independence.

One should start with their retirement planning as soon they get a job.

The reason being that they just need to save very small sum every month, rather than feeling the pinch all of a sudden after their retirement.

Let’s take an example to understand that how much you should save for your retirement in order to fulfil your retirement goal.

Suppose your present age is 30 years and you are planning to retire at the age of 60.

Your average monthly income stands at Rs 30000 and you plan to build a retirement corpus of Rs 50 lacs.

Say you are planning to invest Rs 5000 every month and it fetches an interest of 6.5% (average current FD rate) p.a.

After 30 years, your money will grow more than 55 lacs.

However, instead of investing the entire Rs 5000 in fixed income securities, invest Rs 3000 in fixed income which fetches around 6.5% and remaining Rs 2000 in equity (assuming it will earn 12% p.a.). This process will build you a corpus of whooping Rs 1 crore.

It’s always advisable that instead of investing your total fund in fixed income security, diversify it among different asset class. You can take the help of compounding calculator to plan out your retirement goal.

7. Make wise financial decisions

You need to think carefully when making a financial decision.

You should be very alert when you are dealing with borrowed money.

Sometimes borrowing money can be a sound choice like you are planning to buy a house, paying for education or any other important purchases.

Be very alert with high-interest debts like credit cards and try to minimise its use as much as possible.

Don’t give a credit card to your kids as it can be more dangerous than giving a time bomb.

An example of a foolish financial decision I came across was of a person who had a home loan of about Rs 15,00,000 costing an interest of about 10%.

On the other hand, he was having a fixed deposit of Rs 8,00,000 fetching just 7%.

Though he could have used the F.D. money to pay partly for his house, he did not do so.

8. Divide your financial goals

You should divide your goals into various time frame including near term, intermediate and long-term and allocate your investments accordingly.

Unless and until there’s a clear vision going forward, the plan appears vague with low visibility.

You should work hard to fulfil your near-term goals which gradually leads to meeting the further longer-term goals.

Moreover, you should be able to quantify the goals so that proper steps are being taken to fulfil it.

9. Create a will

A will is a document that specifies who will inherit your bank accounts, real estate and other property after you die.

For parents, making a will is the single most important thing you can do to make sure your child is cared for by the people you would choose if anything happens to you.

If you don’t want to leave your family in a state of fight or quarrel after you are no more, then do write a will. It’s not that difficult as it seems and it just takes few days to prepare a will.

10. Start with a general personal finance book

Books are man’s best friends and there’s no smart person who doesn’t read a lot.

Even the famous legendary investor Warren Buffett reads more than 4-5 hours every single day and these small lessons have resulted in a powerhouse of knowledge.

To know more about how you can become your own personal financial planner you can watch the video below:

Bottomline:

We would suggest everybody to read personal finance books so as to have at least basic understanding of finance. You can read books like “Personal Finance for Dummies” or “The Richest Man in Babylon” to start with.

However, there will always be few areas like tax planning etc, where you would need the help of a financial planner or some professional help.

But make sure that you understand what you are being offered, do your research and ask questions to understand it properly.

Take care and keep learning!!