Banking terms and concepts can sometimes be challenging to understand even for industry professionals. Most of us have seen monetary policy in the past where we often come to hear that there has been a change in CRR, SLR, Repo rate, Reverse repo, rate, and so on.

But still, some people are not clear about these terms.

However, since banking is a significant part of our business and personal life, it is useful for consumers to learn some common banking terms as it can help you to secure and manage your account in a better way.

Essential Banking Terms You Need To Know:

Let’s understand some of the banking key terms-

Download to secure your bank Account – Banking Awareness Book for Beginners

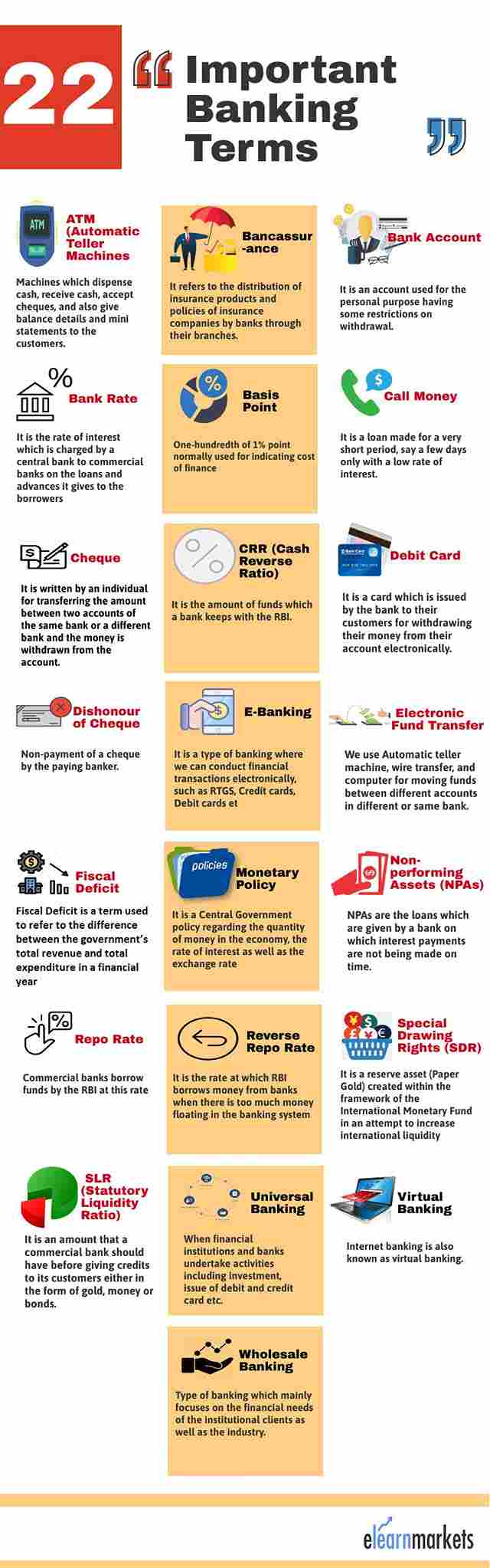

1. ATM (Automatic Teller Machines): Machines that dispense cash, receive cash, accept cheques, and also give balance details and mini statements to the customers.

2. Bancassurance: It refers to the distribution of insurance products and policies of insurance companies by banks through their branches.

3. Bank Account: It is an account used for personal purposes having some restrictions on withdrawal.

4. Bank Rate: This banking terminology means the rate of interest which is charged by a central bank to commercial banks on the loans and advances it gives to the borrowers.

Suggested Read: How to Open a Bank Account?

5. Basis Point: It is one of the important banking terms that is used for indicating the cost of finance.

6. Call Money: It is a loan made for a very short period, says a few days only with a low rate of interest.

7. Cheque: Cheque is written by an individual for transferring the amount between two accounts of the same bank or a different bank and the money is withdrawn from the account.

8. CRR (Cash Reverse Ratio): It is the number of funds that a bank keeps with the RBI.

9. Debit Card: It is a card that is issued by the bank to their customers for withdrawing their money from their account electronically.

10. Dishonour of Cheque: Non-payment of a cheque by the paying banker.

11. E-Banking: It is a type of banking where we can conduct financial transactions electronically, such as RTGS, Credit cards, Debit cards, etc.

12. Electronic Fund Transfer: We use an Automatic teller machine, wire transfer, and computer for moving funds between different accounts in the different or same banks.

13. Fiscal Deficit: Fiscal Deficit is a term used to refer to the difference between the government’s total revenue and total expenditure in a financial year.

14. Monetary Policy: It is a Central Government policy regarding the quantity of money in the economy, the rate of interest as well as the exchange rate

15. Non-performing Assets (NPAs): Bank NPAs are the loans that are given by a bank on which interest payments are not being made on time.

16. Repo Rate: Commercial banks borrow funds from the RBI at this rate. Repo rate is one of the major banking terms

17. Reverse Repo Rate: It is the rate at which RBI borrows money from banks when there is too much money floating in the banking system

18. Special Drawing Rights (SDR): It is a reserve asset (Paper Gold) created within the framework of the International Monetary Fund in an attempt to increase international liquidity

19. SLR (Statutory Liquidity Ratio): SLR is one of the most important banking terms. It is an amount that a commercial bank should have before giving credits to its customers either in the form of gold, money, or bonds.

20. Universal Banking: When financial institutions and banks undertake activities including investment, issue of debit and credit card, etc.

21. Virtual Banking: Internet banking is also known as virtual banking.

22. Wholesale Banking: Type of banking that mainly focuses on the financial needs of the institutional clients as well as the industry.

I hope that next time you see the monetary policy, you are in a better position to understand the above banking terms.

Dear Author,

Thank you for writing this article, it is very informative and useful. As per my experience there is a vital difference between educated and being financial educated. The article written by you will make people financial educated.

Regards,

Abhishek