A friend of mine suggested me-“You should always buy the stock of a good company, irrespective of the price level”

I agree with the first part of the question, however, I am not comfortable with the complete sentence.

I believe this is a very dangerous piece of advice given to someone.

A great company can transform into a great investment, but all great companies may not necessarily be great investments.

Are you confused by the above statements?

Let me simplify!

| Table of Contents |

|---|

| What is Intrinsic value? |

| Intrinsic Value Example |

| Intrinsic Value Calculation |

| Bottomline |

A great company is one which has a combination of various ingredients including good management, generates a good amount of free cash-flows, enjoys pricing power and has low competition.

But a good investment is possible only if it is bought at a reasonable price.

You must be wondering what a reasonable price is.

Let me clarify. There are two terms- Price and Value

Price is something at which the security is currently trading in the market while Value implies the true worth of a security.

Warren Buffet said-“Price is what you paid and value is what you get”

You need to determine the value and compare it with the current market price in order to determine whether a particular security is to be bought and sold.

Say you bought the security at Rs 500 but the real value stands at Rs 1000. In such a scenario, you bought it at a 50% discount to its value, hence it’s a great buy.

It is important to buy a security at a discount to its value since it provides a margin of safety to your investment which acts as a cushion during the period of uncertainties in the market.

Now, let’s understand how to determine the value of a particular business?

What is Intrinsic value?

Intrinsic value also referred to as fundamental value is the actual value of a security as opposed to its market value or book value.

It is a present value of the excess cash that a business can generate in the future and is computed by summing up all discounted free cash flows.

In simple words, Intrinsic value implies the real worth of a business.

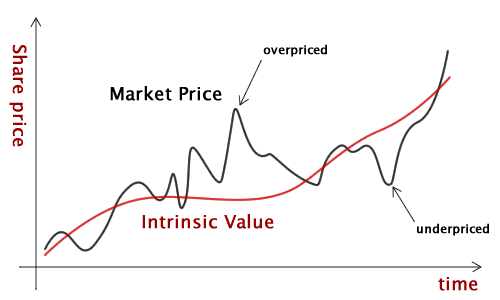

Warren Buffett said – Market Price and Intrinsic value often follow very different paths-sometimes for extended periods-but eventually they meet

A good business is one which generates a lot of free cash flow year on year, while a bad business is one which eats away its cash flow.

Free cash flow is the money left after paying for taxes and interest cost, working capital requirement and for expansion purposes.

Intrinsic Value Example

Say a company lends a sum of Rs 1000 for one year and charges 10% interest, so the total money you receive at the end of one year would be Rs 1100.

Hence the future value of Rs 1000 after one year stands at Rs 1100.

Similarly, the present value of this Rs 1100 that will be owed after 1 year is Rs 1000 as of now.

Isn’t it that simple?

In a similar way, we can calculate the intrinsic value of a share and for that, we need to calculate the present value of cash which the company will generate after 1 year, 2 years, 3 years so-on.

However, there are other methods to measure the intrinsic value of a stock apart from Discounting Cash Flow method which includes Dividend Discount Model (DDM), Residual Income Formula etc.

Intrinsic Value Calculation

The most common method applied in calculating intrinsic value is Discounted Cash Flow, but whichever formula you choose to calculate DCF, calculation of intrinsic value is an important decision as it helps to determine that whether you are paying the right price or not.

Moreover, as an investor, it’s important to pay the right price in order to succeed.

Sometimes by just paying a cheap price for worst business can land up making more money.

Also Read: All that you wanted to know about Calculation of Intrinsic Value

On the other hand, the best of businesses can be a poor investment if you end up paying an expensive price for it.

A simple illustration to demonstrate the relation between the market price and the intrinsic value of a stock.

Hence, knowing the intrinsic value of a stock helps to make out when the stock is underpriced (good time to buy) and when it is overpriced (it’s time to sell).

Bottomline

There is a bit of concern regarding the calculation of intrinsic value about its subjective nature despite the huge popularity. Different people come out with different intrinsic value for the same stock. Anyways the calculation of intrinsic value helps in determining the attractiveness of a stock.

Just like Warren Buffet said that he uses the following criteria to invest in stocks-

a. A Business which he understands

b. Run by competent and able management.

Also Read: How to Evaluate management of a company

c. With long-term focus

d. Attractively priced

He further adds

We usually can identify a small number of potential investments meeting requirements (1), (2) and (3), but (4) often prevents action.

However, many a time when a business passes all tests, it’s better to avoid the stock if the valuations are not attractive as compared to its intrinsic value.

In order to get the latest updates on Financial Markets visit stockedge

Hi

Can you please tell calculation method of intrinsic value of stock.

Hi,

The method of calculating intrinsic value is given in this blog.

Thank you for Reading!