Do you love taking a risk? Do you have risk taking ability?

No! Let me tell you that “risk” is a term which is often used in a negative sense.

Frankly speaking, risk is present everywhere and it is just that it can be used in a relative sense i.e. less risky or more risky.

Allow me to share what the most successful investor of our generation has to say about risk:

| Table of Contents |

|---|

| Factors that determine risk taking Ability | Bottomline |

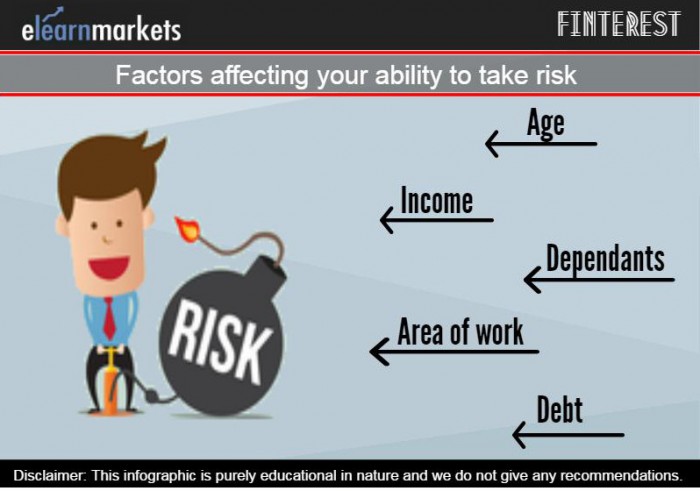

Most of the time, it’s not that you don’t want to take a risk but a combination of certain factors stops you to do so.

Factors that determines Risk Taking Ability

1. Income

An Erratic source of income can impact your risk profile.

Individuals who don’t get paid on a monthly basis need to maintain a liquid investment in a buffer to meet the situation of emergencies.

On the other hand, a salaried person who has a regular source of income can opt for instruments that have a short-term risk but may give a higher return in the long run.

2. Age

It is one of the most important factors in your risk profile.

You can take more risk in the early stage of your life than you grow old.

You can choose to invest a large part of your savings inequities in your early days and reduce the proportion going forward.

Moreover, these equities work well in the long -term so it’s always a better idea to start early in a systematic manner.

Know More: What Is The Minimum Age Limit To Invest In Share Market?

3. Dependants

The level of risk tolerance is also impacted by the level of dependency.

An individual should not take higher risk if he/she is the sole earning member of the family.

Moreover, he/she should also have a large emergency fund and insurance policies for the family members.

Evaluate to invest in stock market with Stock Investing Made Easy course by Market Experts

On the other hand, an individual with a working spouse and no dependents can choose to have a risk.

4. Debt

Avoid taking debts as possible.

But if you already have a bigger debt like a home loan or any other debt, avoid taking big risks with your savings.

However, you can choose to invest in a riskier asset if you don’t have a burden of any liabilities.

Please avoid using credit cards as it is a weapon of mass destruction.

5. Area of work

The place where you are currently working determines the stability of your income.

The person working in a well-established firm at a better post would be in a better position to take a risk as compared to a person working in a young start-up company or in the BPO sector, which poses a little doubt in the stability of your work.

Boost your financial expertise today with our comprehensive Financial Planning and Analysis Course.

Bottomline

A risk is present everywhere and you just need to figure out which type of risk suits you.

The combination of smart decisions and risk-taking ability could help you to achieve your goal and lead you to success.

Keep learning!!