Investors before making any decisions on investing in any company or stocks carry out the fundamental analysis of company so as to invest their money in the best.

One way of analyzing the company’s financial health is the fundamental analysis which gives in-depth feedback on the company’s strengths and weaknesses.

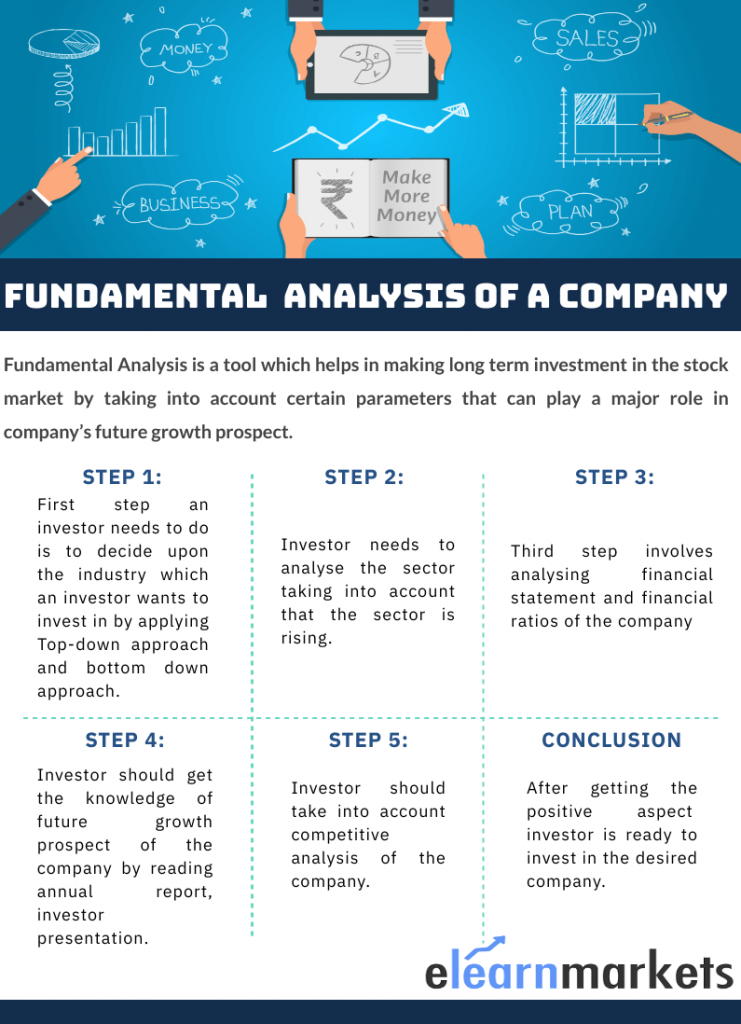

It is a tool which helps in making long term investment decision in the stock market by taking into account certain parameters that can play a major role in company’s future growth prospect.

Importance of Fundamental Analysis of Company

Fundamental analysis of company helps to analyze the financial health of the company with the help of, profit & loss statements, cash flow, balance sheet and annual report.

By carrying out analysis it helps the investor to identify the best stock which they can invest in and remove the stocks which will not provide them required returns.

Carrying out fundamental analysis of company will help the investors to analyze whether there is any growth in the company or not.

Steps Involved In Carrying Out Fundamental Analysis

STEP 1:

First step an investor needs to do is to decide upon the industry which an investor wants to invest in by analysing the economic factors that will have a positive impact on the growth of the industry and then to analyse the company in that particular industry in which they can invest.

This approach of identifying the company for investment is known as the Top-down approach. Investor can even choose bottom-down approach by first analysing the company which they want to invest, then analysing the industry and the economic factors.

STEP 2:

Second step involves analysing the sector taking into account that the sector is favorable or not.

STEP 3:

Third step involves analysing financial statement and financial ratios of the company. Financial ratios includes (Earning per share, sales growth, dividend- taking into account of last 5 years ,other ratios like price earnings ratio, debt to equity ratio, etc.)

As financial statement laids the path to analyse about the company’s growth and its longevity. Financial ratios provides the information on how efficiently the company is working and about the solvency of the company.

STEP 4:

Analyse the future growth prospect of the company by reading the annual report, Management discussion and analysis as it gives the information about the industry outlook, company outlook, opportunities, challenges that company is facing. It is the most important document as it provides the information about the company’s growth prospect and about the management of the company.

Going through investor presentation, conference calls of the company and management interview will give the entire information about the company’s growth, its financial health and overall working of the company.

STEP 5:

Investor should take into account competitive analysis of the company to have the knowledge about which company is performing better in the chosen sector and also have the knowledge of shareholding pattern about the company.

Investor should know about the percentage of promoter, FII-DI, public shareholding of the company. Promoters buying its own company’s share and share buybacks are a good signal for the company.

Example of Fundamental Analysis

We will take Maruti Suzuki India ltd, it’s under an automobile industry.

In order to carryout fundamental analysis of company we will first check whether the economy has any future growth potential for the auto industry stocks or not. In other words we need to carry out sector analysis.

Policies issued by the government is in the favor for this industry?

Once the economic conditions regarding the automobile industry is positive then we will research about the sector taking into account whether this sector has a rising potential globally in future or not.

Then we will analyse annual dividend payout, earnings per share, P/E ratio, and many other quantitative factors. We will consider qualitative and quantitative data of the Maruti Suzuki Company.

By reading the annual report, investor’s presentation, conference calls we need to analyse the future growth prospect about the company. Information will be provided in the MDNA section in the annual report.

We will further analyse the shareholding pattern about the Maruti Suzuki Company. Then financial parameters need to be compared with its peers in order to find out whether the company that we have chosen in this sector has a much better growth opportunity or not or there is some other company in this same sector with a good growth potential better than Maruti in the future.

If all the points have a positive impact then we can invest in Maruti Suzuki India Ltd.

Advantages:

- Fundamental analysis helps identify the company which is best among its peers.

- It is very much effective for investing purpose as it determines the actual value of the stock.

- With the help of this analysis, future growth prospects about the particular sector or industry is determined.

All the analysis have some positive as well as negative points.

Disadvantages:

- This analysis is very time consuming.

- Large amount of documents are needed to be considered while conducting the analysis.

Despite of the disadvantages every investor needs to conduct fundamental analysis in order to take a decision before investing in any company.

Frequently Asked Questions

What are some best resources to learn the fundamental analysis for stock?

Some best resources to learn about the fundamental analysis of the stocks are annual report, investor’s presentation and conference calls.

What are the types of fundamental analysis?

Types of fundamental analysis are Top-down approach and bottom -up approach.

How do you calculate fundamental analysis?

we calculate fundamental analysis by calculating various financial ratios like Earning per share, sales growth, dividend- taking into account last 5 years data ,other ratios like price earnings ratio, debt to equity ratio also are important for calculations.

What is fundamental analysis used for?

Fundamental analysis is used analyze the financial health of the company and its growth prospect. It is used to identify the best stock which will provide a good return on investment.

Who uses fundamental analysis?

Investors uses fundamental analysis in order to make a decision before investing in any company’s stock to create wealth for oneself.

What is the difference between Fundamental Analysis & Technical analysis?

Fundamental analysis is a method which is used to analyse securities by considering the intrinsic value of the stocks and thus investing into undervalued stocks. On the other hand technical analysis is a method to determine the future price of the stock with the help of charts in order to identify trends and patterns.

Key Takeaways:

- Fundamental analysis of company focuses on the parameters that impact directly the company’s future growth potential.

- It is the study which determines the company’s longevity and strength.

- In order to carry out a fundamental analysis of company we need to consider the quantitative and qualitative aspect of the company.

- We also need to analyse the risk and return of the company in order to invest in the company which is best among its peers.

Happy Learning!

Nice Article

Which book should be read to understand in depth of fundamental analysis of company.

Thanks

Vinod

Hi,

You can refer to our blog Top 9 Must Read Fundamental Analysis Books

Thank you for Reading!

Will u make blog on intrinsic value

Hi,

Please refer to our blog on Intrinsic Value from here

Thank you for Reading!