Valuation forms an important part of Fundamental Analysis. Free Cash Flow to Firm (FCFF) is one of the most widely used tools which is used to analyze the free cash available in the company by taking into account the free cash flow generated by the company in the future and arriving at the present value of the forecasted cash flows as on today.

It involves a lot of forecasting and estimation based on the past and present financial and economic environment of the business.

To forecast the cash flow one needs to study the business fundamentals thoroughly in order to understand that at what rate will the cash flows grow or fall in the coming next years.

It is an essential step in the process of DCF valuation.

Forecasting is not an easy task as it is the essence of a good valuation model.

The better one can estimate the future cash flows and the financials, the better and closest it brings to the actual value of the firm.

So lets see the steps on how to arrive at the Free Cash Flow to Firm (FCFF) estimates:

1. Forecasting the Profit & Loss:

Forecasting the P&L majorly involves the expected revenues, EBITDA and PAT of the company in the next few years.

Now, one needs to analyze the historical growth of all three data as well as study the current macroeconomic condition of the economy to get an idea of the expected revenue growth in the coming years.

In some cases, the management also guides regarding the revenue or EBITDA or PAT growth for a company during the concalls or during interviews or meetings.

One needs to take that as the guidance and accordingly make an estimate of the future growth.

Let’s take an example of the same:

We can see that in HUL, the revenue growth seems quite stable during the past 5 years. It has grown by around 10.58% in FY18-19.

Thus, according to the current macro economic situation we need to forecast the future revenues growth along with the EBITDA and Net Profit growth of the company.

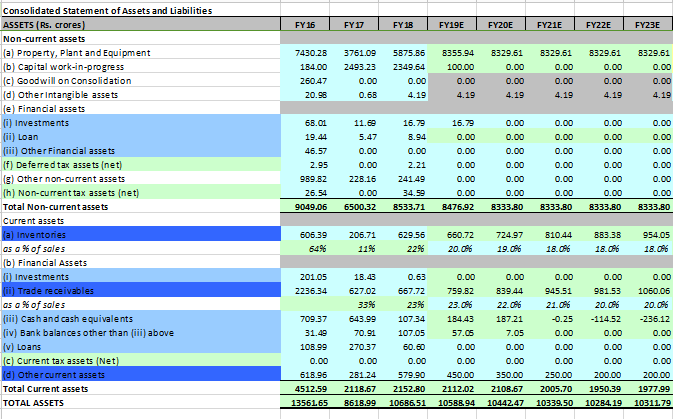

2.Forecasting Balance Sheet:

For balance sheet forecasting, it is not possible to analyze and estimate all the heads. Thus, we need to estimate only a few of them which will be required in the process of valuation.

Some of the data which needs to be fore-casted are Fixed assets of the company (Property, Plant, and Equipment), Current Assets (Inventories, Trade Receivables, Cash & Bank balances, and Other Current assets).

Under Liabilities, the data which needs to be fore-casted are Shareholder’s Funds, Non-Current Liabilities (Long term borrowings), Current Liabilities (Short term borrowings, Trade Payables & Other financial liabilities).

Forecasting the balance sheet data gets a bit difficult as compared to the income statement as no information is generally provided by the management on this front.

It is purely an art as to how does an analyst view the business going forward.

One needs to understand the business fundamentals in detail in order to forecast these data more precisely.

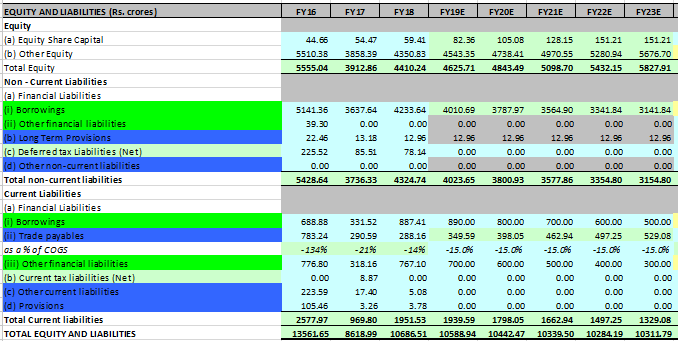

3.Forecasting Cash Flow Statements:

In the cash flow statements also, it is not possible to forecast each and everything. Thus, one can forecast only the parts which are required in the valuation of the company from the DCF point of view.

One can start with the cash from the operations but pay special attention to the Cash from Investing activities, (Purchase of property, plant, and equipment) as this forms the CAPEX which the company plans in the coming few years.

Although most of the time the management guides the investors regarding the CAPEX planned for the next few years. In that case, one need not refer to the fore-casted Cash Flow statements for the CAPEX plans.

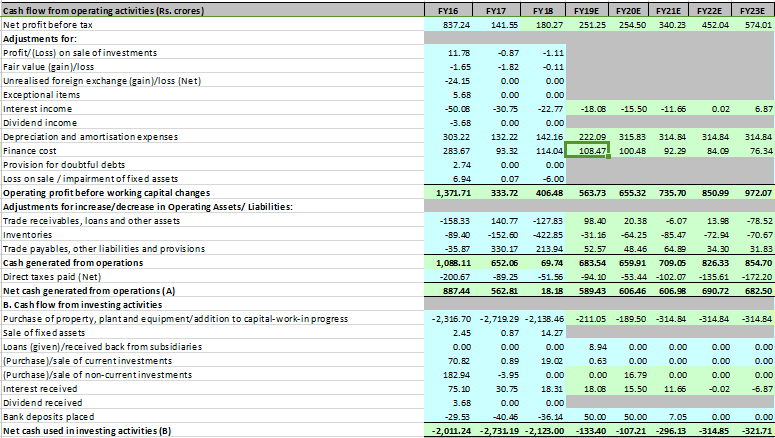

Arriving at the Free Cash Flow to Firm:

To arrive at the Free Cash Flow to the Firm we need to first have a look at the formula.

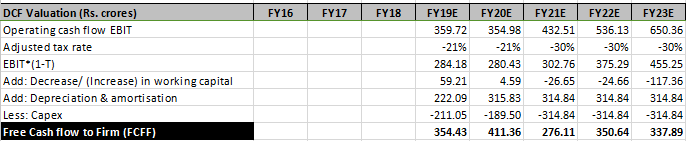

As we can see in the formula, most of the data has already been fore-casted. Let’s discuss the forecasted year FY19E:

First, we take Earnings before Interest & taxes from the Forecasted P&L statements which is, in this case, Rs 359.72 Crs. We then subtract the 21% taxes for the year. Generally, taxes can be considered at a constant rate.

Following the post-tax EBIT of Rs 284.18 Crs, we add back the Non-cash charges (depreciation or amortization) to the EBIT. For the fore-casted period, we had already done that while doing the P&L statements. Thus, from there we get the forecasted depreciation and amortization charges of Rs 59.21 Crs.

Then comes the changes in the working capital which represent the Current Assets and Current Liabilities. We can get the fore-casted Current Assets and Current Liabilities from the fore-casted Balance Sheet. We find out the working capital (CA minus CL) for the preceding year (FY18) as well as for the forecasted year. Then we get the change in the working capital for the year FY19E which comes at Rs 59.21 Crs. .

Finally, we get the CAPEX data either from the management guidance or from the Cash from investing activities (Purchase of Plant & Equipment). In the above case, we have assumed that the management has guided us for CAPEX of Rs 400 Crs in two years. And for the succeeding years, we have assumed a constant CAPEX of ~Rs 315 Crs.

After adjusting all the above heads we finally arrive at the Free Cash Flow to the Firm of Rs 354.43 Crs for the year FY19E, which is the Net cash available after adjusting the major cash changes of the company.

This is an important measure that guides us whether the company generates enough cash from its operations in order to first pay off its debt liabilities and if it further has anything left for its future growth then it can think of expansion.

Just like this, we can forecast the FCFF for as many years as we want but the estimates tend to fluctuate, as predicting the business environment itself gets difficult in the current dynamic situation.

A company might be profitable but on the other side, it will have negative cash flow due to higher working capital changes or CAPEX which results in higher cash outflow from the firm compared to the inflows.

Now, I hope you must have got a brief idea as to what all data we need to know in order to arrive at the Free Cash Flow to the Firm.

Key Takeaways:

Conducting a DCF valuation is a lengthy process which involves studying and analyzing a lot of data points, company financials and macro economic data.

The better an analyst has knowledge about the particular company, the more precise will he be able to forecast the financials and arrive at the fair value price or target price.

DCF involves few steps to arrive at the target, out of which FCFF forecasting involves most of the work.

To start with we need to forecast the P&L statement by studying the historical data and also listening to the management concall.

We also need to have an in depth idea of how the economy as well as the particular sector is fairing at the time of forecasting period.

Balance Sheet forecasting is a bit difficult due to unavailability of information. Thus, it is done purely in view of DCF evaluation.

Cash Flow Statements forecasting can be done only for the CFO and CFI activities section.

Finally, after adjusting the non cash charges, working capital and CAPEX requirements, we arrive at the Free Cash to the firm.

We must always keep in mind that forecasts are just estimates of the respective analyst. These may vary from time to time and person to person. Thus, one should always be flexible with the estimates and the actual.

In order to get the latest updates on Financial Markets visit https://stockedge.com/

Can you please elaborate how to forecast the amount for balance sheet and cash flow statement?

I could get the same.Or else if you can make video explaining the same will the best.

Thank you.

Hi,

We will surely try sir.

Thank you for Reading!

Hey thanks for posting this useful tips here, I really hope it will be helpful to many. I got to know about free cash flow to firm (FCFF)- Forecasting P/L, B/S & C/F statements. You have done an excellent job with this content I must say. Appreciative content!!

Hi,

Thank you for reading our blog!

Keep Reading!!

Thanks for sharing it with others it’s a nice post i m looking for such a place where you can just trust and spend money on things you like to invest in. Keep up the good work. Good luck for your future posts!! I have also found this resource oneciti.co.nz useful and its related to what you are mentioning.

Where do we get Free Cash flow details for the company. Is company provide cash flow statement yearly or quarterly?

Hi,

You can check the cash flow details in the annual report.

Thank you for Reading!