Did you know that women’s participation in the stock market has increased during Covid -19 Pandemic because of pay cuts and lay-offs that has brought them to trade in the stock market?

Also, women are looking for investment alternatives as the bank’s fixed deposit rates have decreased.

Yes! And more interestingly, most of these women are the first time investors and most of them are housewives.

And also, it’s been said that female investors have advantages over their males in terms of being good at saving and can differentiate better between price and value.

So, on this Women’s Day, we will discuss five golden rules for women who invest in the stock market to help them trade more effectively-

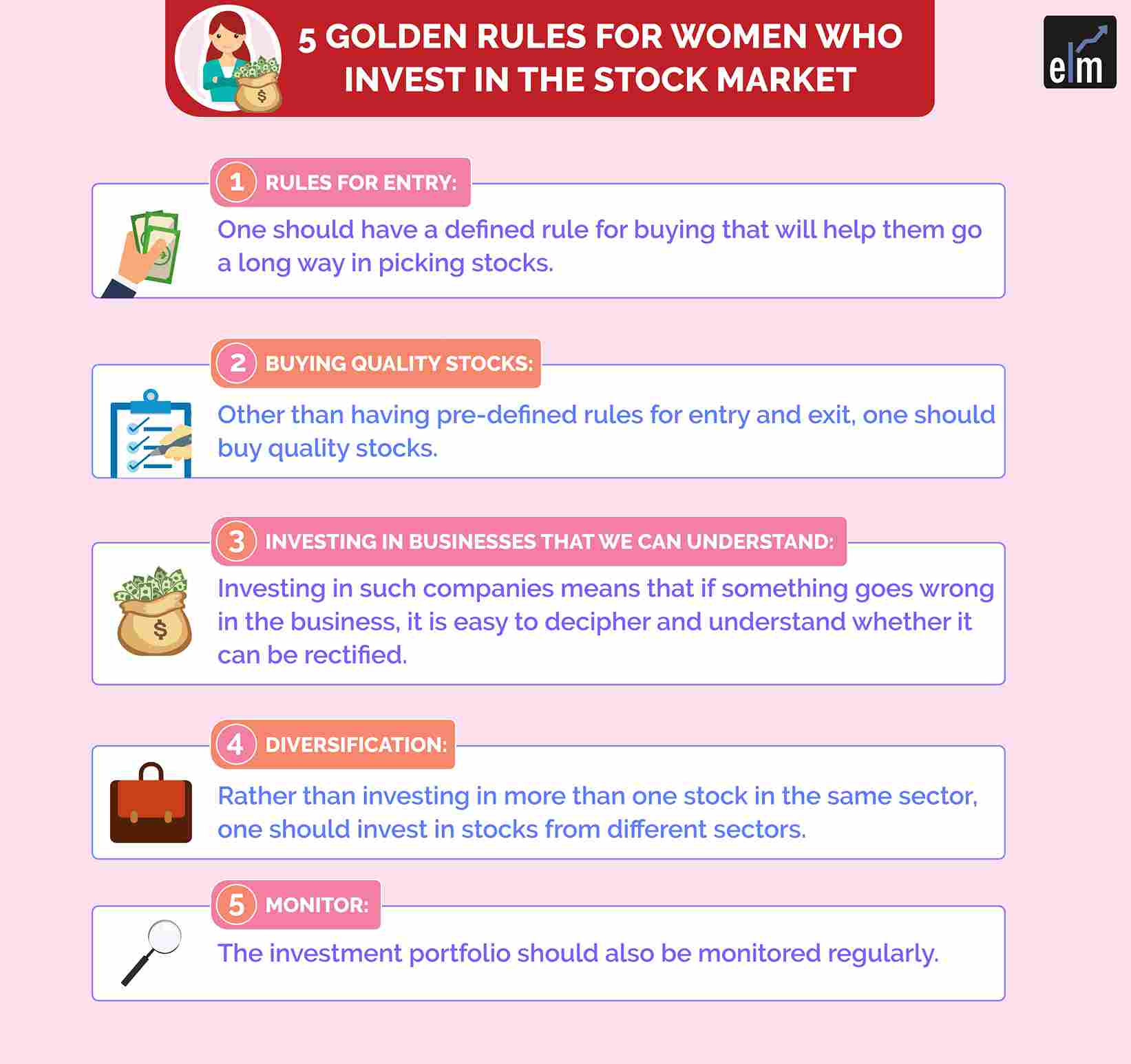

Five Golden Rules for Women who Invest in the Stock Market

1. Rules for Entry

One should have a defined rule for buying that will help them go a long way in picking stocks.

When we buy fruits or vegetables, we should know the quality and price at which to buy; this logic also works while picking stocks in the stock market.

They have to be bought at a bargain. Similarly, for long term investment, we should buy stocks at support or near a 52 week low at lower prices.

Other than entry rules, one should also have pre-defined stop loss and exit levels so that they do not suffer from many losses if the trade goes against their expectations.

2. Buying Quality Stocks

Other than having pre-defined rules for entry and exit, one should buy quality stocks. By buying quality stocks we mean buying companies that have strong management and that have withstood various business cycles.

To buy quality stocks, one needs to check various fundamental parameters like PE ratio, EPS, management quality, etc.

These can be checked in one place by using StockEdge, as shown below:

3. Investing in those Businesses that we can understand

Legendary investor Peter Lynch used to explain the investment rationale in a single piece of paper that he learned from seventh graders who in an investment game beat the Index.

Investing in such companies means that if something goes wrong in the business, it is easy to decipher and understand whether it can be rectified.

This would help the investors decide either on adding more shares and averaging when the price falls or to exit that stock with losses.

You can learn more about business analysis on our online sharemarket courses.

4. Diversification

Rather than investing in more than one stock in the same sector, one should invest in stocks from different sectors.

As the business cycles are different across various sectors, diversifying will help us to cushion any fall in one sector.

This Women’s Day, join our course on Stock Market All-Rounder for Women to gain knowledge on the stock market specially designed for women investors!

5. Monitor

The investment portfolio should also be monitored regularly. So any sign of weakness needs immediate and clinical attention. Also, monitoring the growth of companies is important for assessment.

Bottomline

The first step that women need to take is to start their wealth creation journey and then follow these strategies with a strong game plan to succeed at wealth creation. We believe that women’s representation in the stock market will be significant in the next two years. We hope you found this blog informative and use it to its maximum potential in the practical world. Also, show some love by sharing this blog with your family and friends and helping us in our mission of spreading financial literacy!

You can also visit web.stockedge.com, a unique platform that is 100% focused on research and analytics.

Happy Investing!

Happy Women’s Day!

Very nice blog. Keep it up.

Hi,

We really appreciated that you liked our blog! Thank you for your feedback!

Keep Reading!

Very nice content, will be helpful for new investors . Looking forward for such stuff

Hi,

We really appreciated that you liked our blog! Thank you for your feedback!

Keep Reading!