Key Takeaways

- Dividend stocks are shares of companies that regularly share a portion of their profits with shareholders, either in cash or additional shares. These are usually stable, well-established companies.

- They offer a steady income even if the stock price doesn’t rise. Reinvesting dividends can lead to long-term compounding returns, especially useful in bear markets.

- Focus on key metrics like dividend yield, payout ratio, and earnings per share. A high dividend yield is attractive, but it must be sustainable and always check the company’s financial health.

- For individuals, dividends are taxed as per their income tax slab. For corporations and non-residents, different rates apply, often influenced by tax treaties.

- Pros: Steady income, less volatility, suitable for long-term goals.

- cons: Limited capital appreciation, dividends not guaranteed every year.

Every investor in the stock market invests their money with the aim of increasing their net worth by adopting various investing strategies.

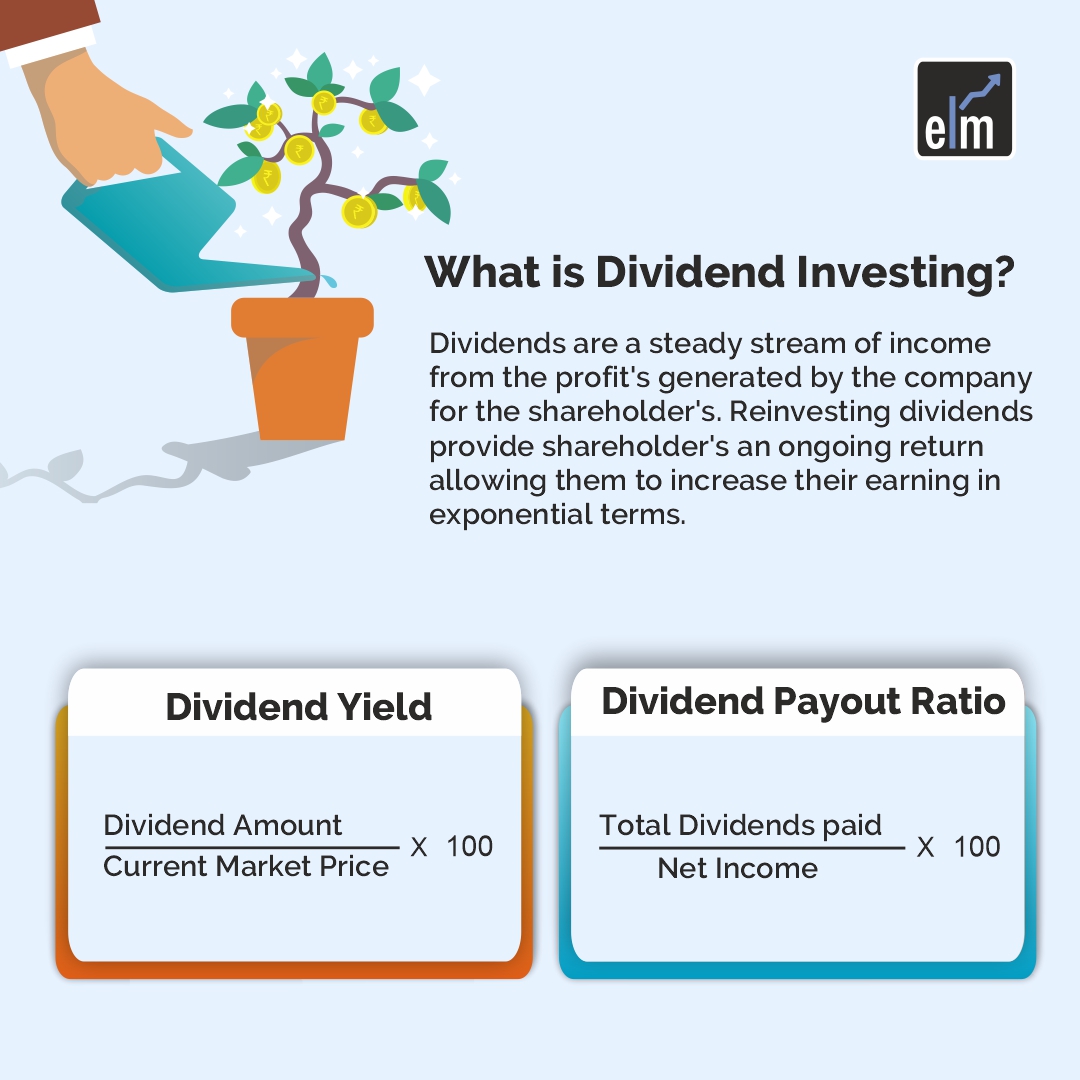

One of the strategies is the dividend investing strategy which investors might approach to increase their net worth.

Risk-averse investors are more prone to invest in high dividend-yielding stocks. Dividends are the portion of the profit that the company gives to eligible shareholders who hold the shares as of the ex-date of the dividend.

The Board of Directors of the company decides on paying the dividend desirable for the company depending upon various economic and financial factors. Thus, investors adopt the approach of purchasing the stocks that issue dividends in an effort to generate a steady stream of passive income.

Most retired individuals see a high dividend yield stock as a passive source of investment for themselves. The investing strategy that investors adopt is known as a dividend investing strategy.

Table of Contents

What are Dividend Stocks?

Companies that routinely distribute a portion of their profits to shareholders are known as dividend stocks. These businesses are often well-established and have a track record of distributing profits to shareholders. They often have a track record of profitability and a dedication to dividend payments in the future.

Quarterly, yearly, or monthly dividend payments are all possible. A firm does not have a fixed payout amount. To decide whether stockholders are qualified to receive a dividend, the corporation sets a record date. The money is subsequently credited to investors’ accounts on the payment date once the corporation issues the payment.

Different dividends come in various forms. A stock dividend, for instance, is a payment made to shareholders in the form of more shares rather than cash. Each existing share gets paid a fraction of the distributions. For instance, if a business declares a 5% stock dividend, it will issue 0.05 shares for each share that a shareholder owns.

Reasons for Dividend Investing

Dividends provide us with an ongoing income while we wait for capital appreciation. So, as the dividends per share continue to grow, investors will enjoy the benefit of exponential growth.

This exponential power of dividend investing growth provides a competitive return to the investors even if the share price does not increase.

When the market is bear the dividend received is reinvested and more shares are accumulated during that time. This kind of investment boosts dividend growth kind of investing for better returns in the long run.

For example: You have 2 companies namely MERCURY LTD. and NEPTUNE LTD.

Mercury Ltd pays dividends and Neptune Ltd. does not pay dividends. So, if the stock price of both the company rises by 5% you earn 5% and vice-versa you lose when the stock price decreases by 5%.

So, when the Mercury company pays a dividend of 4%, then you as an investor will have an overall income of 9%, if you have invested in Mercury Ltd and if stock price decreases then you will only lose 1%.

But if you have invested in Neptune Ltd which does not pay you dividends then with price appreciation you only gain 5% but if the price decreases by 5% then you will lose the entire notional gain. So, adopting a dividend strategy is better.

But there are various other factors that need to be considered to identify which companies pay high dividends and which will not.

How to Identify the Best Dividend Stocks?

When you as an investor is make a decision for dividend investing in stocks that will pay a high dividend, many ratios need to be considered. These ratios are:

- DIVIDEND YIELD: This ratio indicates the amount of money that is paid out as dividends each year relative to its stock price. A higher ratio indicates that a higher dividend is paid out.

- PAYOUT RATIO: This ratio indicates the amount of dividend paid in relation to the net income that a company generates.

- CASH DIVIDEND PAYOUT RATIO: This ratio measures the proportion of cash flow that is paid to stockholders after the dividend is paid to preference shareholders. Investors can use this ratio with the payout ratio to get a better picture of dividend sustainability.

- TOTAL RETURN: This is the sum of capital gains plus dividends paid. This indicates how much have been earned including the increase in share prices and dividend.

- EARNING PER SHARE: This ratio indicates the amount of earnings of a company each shareholder has earned. The companies whose earnings per share have grown over time indicate being the best dividend stock.

- PRICE-EARNING RATIO: This ratio indicates the relationship between the company’s stock price and earnings per share. It indicates whether fair price of the share is paid by the investor or not. Along with dividend yield it is also considered to determine if a dividend stock is fairly valued or not compared to its peers.

Learn to invest in stocks easily with our Stock Investing Made Easy course

Let us understand this with an example:

How to Invest in Dividend Stocks?

Like any other stock, dividend stocks can be purchased through a brokerage or other investing account. Dividend stocks can be compared according to their growth or yield. How much a firm pays out in dividends in relation to its share price is indicated by its dividend yield. You can earn more if the yield is larger. But remember that greater dividends might not be sustainable and that poorer stock performance inflates the yield.

Examine stocks based on dividend growth as well. Over time, these businesses have consistently raised their dividends. Although their yields are often modest, they may become more alluring over time due to their steady payout increases.

What is Dividend Yield?

A financial ratio called dividend/price, or dividend yield, is a proportion that indicates how much a firm pays out in dividends annually in relation to the price of its stock.

The dividend payout ratio, which is the total dividends paid divided by net income, is the counterpart of the dividend yield.

The dividend yield formula- dividend amount/current market price.

Example: List of 10 Highest Dividend Stocks 2023

Here is the list:-

| Stock Name | Dividend Yield | Year-End |

|---|---|---|

| Vedanta Ltd. | 42.6 | 2023-03 |

| Hindustan Zinc Ltd. | 23.59 | 2023-03 |

| IDFC Ltd. | 9.26 | 2023-03 |

| Coal India Ltd. | 8.69 | 2023-03 |

| Polyplex Corporation Ltd. | 7.28 | 2023-03 |

| Oil India Ltd. | 7.11 | 2023-03 |

| 360 One Wam Ltd. | 6.27 | 2023-03 |

| Gujarat State Fertilizers & Chemicals Ltd. | 5.72 | 2023-03 |

| Power Grid Corporation Of India Ltd. | 5.58 | 2023-03 |

| Oracle Financial Services Software Ltd. | 5.12 | 2023-03 |

Implication

The above list of stock represents list of High Dividend yield stocks

High Dividend Yield ratio indicates that higher dividend is paid with respect to market price. But sometimes just depending on the dividend yield is like falling into a trap.

Thus, before making any investment decision company’s dividend history as well as balance sheet, cash debt, dividend payout, growth etc should be taken into account as a guide.

Dividend Investment Strategy

Dividend investing strategy is an important part of portfolio management. Under this strategy, investors are allowed to reinvest their cash dividend in additional shares or in the fraction of shares of the underlying stock on the dividend payment date without any fees or commissions.

This strategy is good for investors when they are investing for long-term purpose because in the long run returns that shareholders receive is compounding. So, when dividends are increasing investors are receiving higher income on each share they own which can be reinvested to purchase more shares.

How are Dividends Taxed?

For an individual shareholder, dividends are taxed as per the applicable slab rates. According to section 115BBDA of the Act the government has abolished additional tax of 10% on dividend income in excess of Rs.10 lakh per year for resident non-corporate taxpayers.

For corporate shareholders, dividends are taxed as per the effective tax rates, ranging from 25.17% to 34.94%.

As per the provisions of the Act Indian companies are liable to withhold taxes at the rate of 20% on payment of dividend to a non-resident shareholder. Various other tax treaties a lower tax rate, typically ranging from 5% to 15%.

Pros and Cons Of Dividend Investing

Every strategy has their advantages and disadvantages. Some of the advantages of dividend investing are listed below.

- Dividends are a stable source of income for individuals as it can be utilised to fulfil any personal needs, or for reinvesting in the stock market. Such returns ensure high yields for investors.

- Since large cap companies issue dividend they possess a strong market presence and mitigates the risk factors. So, unfavorable fluctuations in the market price of a stock do not affect the company’s dividend paying capacity.

Some of the disadvantages of dividend investing are listed below.

- Capital gains cannot be made from dividend paying stocks as they are issued by large companies that does not demonstrate fluctuations with high variations.

- Since paying dividend is not mandatory company will only pay dividend if it will generate substantial profit. So, as a result growth opportunity is limited.

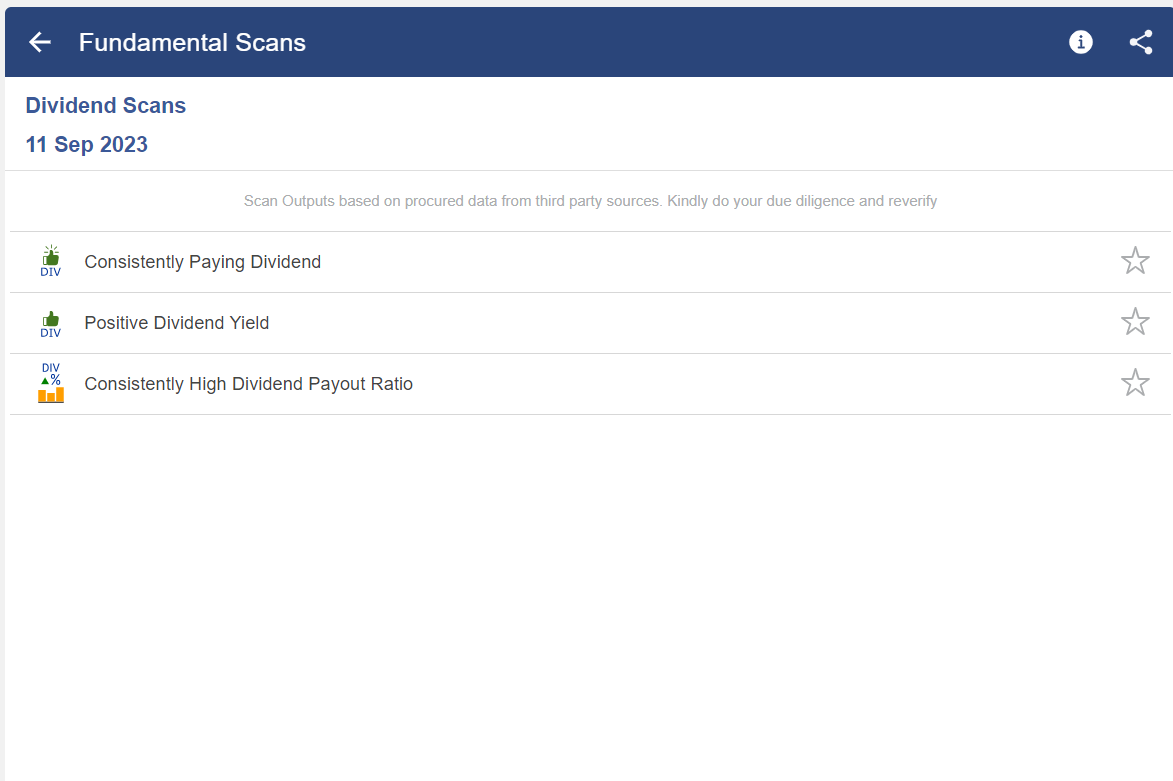

How to find Dividend Stocks using StockEdge?

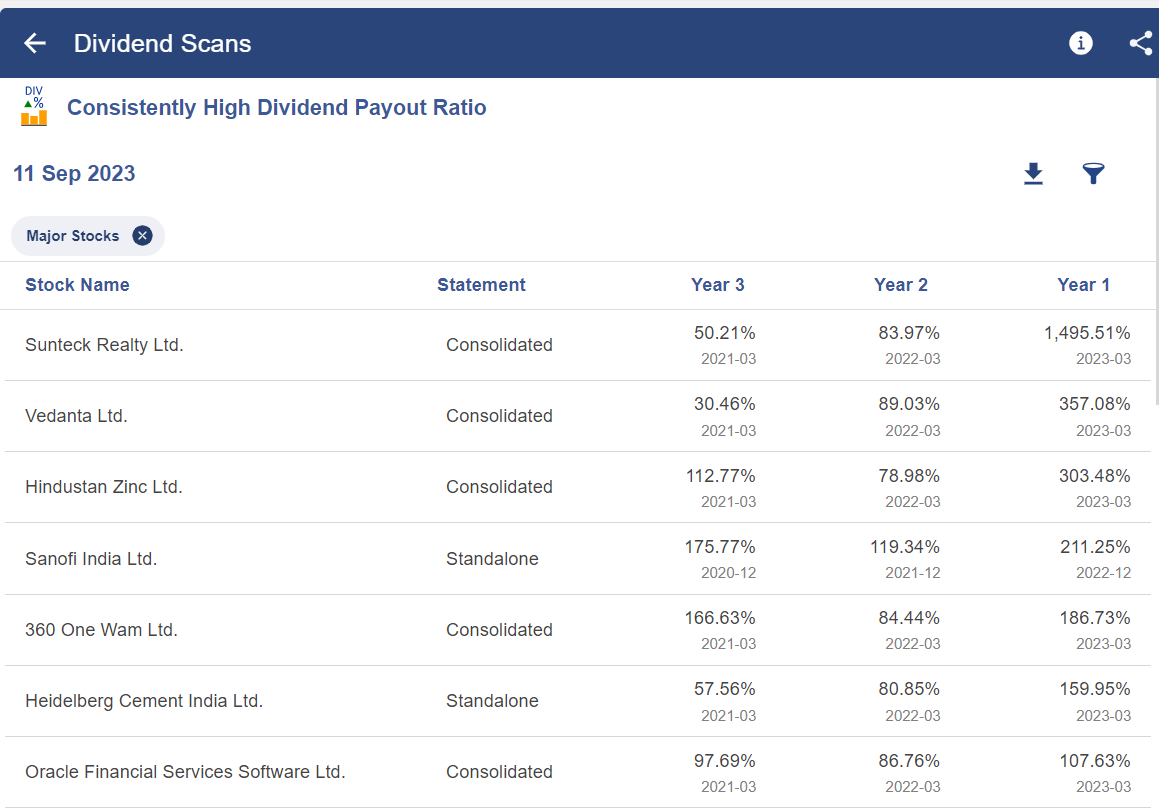

You can filter out dividend stocks using StockEdge with the help of dividend scans as shown below:

When you select any of the above scans you will get a list of stocks as shown below:

Bottomline

Dividends are the cash flows received by an investor from the profits generated by the company.The dividend provides an ongoing return allowing the investor to benefit from the exponential growth of the company. Investors adopt the approach to purchasing the stocks that issue dividends in an effort to generate a steady stream of passive income. When dividends of any company are increasing it means that the operational efficiency of the company is also robust. For an individual shareholder, dividends are taxed as per the applicable slab rates and for a corporate shareholder, dividends are taxed as per the effective tax rates, ranging from 25.17% to 34.94%

Reserve your seat for our webinar to master the art of selecting stocks with relative strength

Frequently Asked Questions (FAQs)

Are dividends a good investment?

Given that dividends are produced from a company’s profits, it is reasonable to conclude that, for the most part, dividends are an indicator of sound financial condition. In terms of an investment strategy, adding stability to a portfolio involves purchasing reputable companies with a track record of paying out respectable dividends.

What is the best strategy for dividend investing?

This is the traditional dividend investment approach. Here, the emphasis would be on long-standing, slow-growing businesses that generate a lot of cash flow and offer substantial dividends.

How to earn 1 lakh dividend?

Instead, you should concentrate on funding PSUs and businesses with a proven track record of rewarding investors. Don’t worry; with the appropriate approach and information, you can create a dividend portfolio that is reliable and consistent and will serve as a secondary source of income.