Every individual has some financial goals like retirement, medical plan, child’s education, traveling, getting a new house, car, etc and accordingly, prepares for financial planning and wealth management to meet these financial goals.

Our expectation is to earn maximum returns out of these assets to reach our financial goal. Keeping high returns in mind, we should have enough equity investment in our portfolio to achieve higher returns.

For earning maximum returns out of these assets to reach our financial goal you can take help of Kredent Money App.

While there are many asset classes available, in this blog we are going to understand the importance of equity investment in our portfolio and maximization of returns.

Reasons for equity investments

– Stocks or Equity Mutual Funds or ETFs have better growth potential compared to bonds and short-term investments

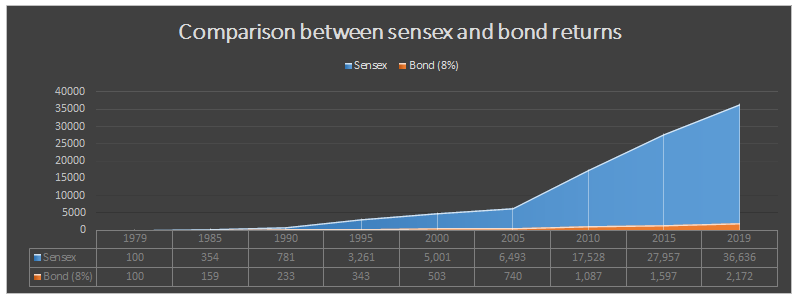

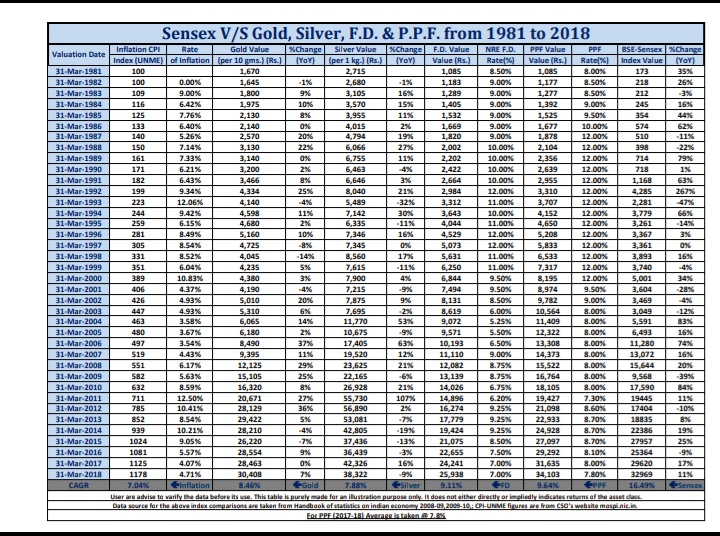

Stocks or equity funds have consistently earned a better rate than bonds over longer term. Despite ups and downs in equity market, investors have earned superior return if they are patient and are able to ride the downturn. The Indian stock market index or Sensex grew at a CAGR of approx. 16% p.a. since its inception in 1979. While bond investments on an average gives 7-8% return. A major portion of our investment portfolio should be in equities if we want those higher returns.

– Stock markets are volatile but if you are saving for long-term goals you can overcome stock market downturns

If you remain invested for long period of time, you can overcome downturns in stock market. Historically it has been observed that after every downturn, there has been massive upside in equity markets.

– You should have a diversified portfolio

You have to be careful with the types of stock you invest in. Enough importance should be given to the quality of the stocks. Quality stocks always rebound after any major fall. Also, we must invest in a variety of stocks to diversify our portfolio because if few stocks are down it will be balanced by rise in other stocks.

“Never put all your eggs in one basket”

If you are someone who is not an expert at picking stocks, invest in equity mutual funds managed by fund managers. Fund managers are professionally trained experts who manages a portfolio of stocks for retail investors. However, do some proper research before choosing a particular equity fund or a fund manager. Check the past track record of the fund as well as the fund manager. Take help of a financial adviser in choosing funds and building a portfolio according to your financial goals.

You don’t have to invest everything in equity, some portion of your portfolio should consist of low-risk assets like debt and fixed deposits.

There should be an appropriate mix of equity, bonds and other short-term assets in your portfolio. Investment in variety of assets provides diversification to your portfolio. Having all your savings in equity will be too risky, especially if there is a recession and it takes a lot of time for the market to recover.

Why equity investment gives us confidence?

India, an emerging economy is maintaining a GDP growth rate of 7% (approx.). With little improvement in growth rate or even at this rate, our equity markets are expected to do well in near future.

India has a huge young population which provides massive demographic advantage. A lot of families are expected to move into middle class and upper middle class. Discretionary spending will increase. Government schemes like “housing for all” and “smart cities” will lead to capital expenditure by government. Credit boost by government schemes like “mudra yojana” will help the economy grow. Investors need to observe and study which sectors and companies are going to be most impacted by the underlying growth factors.

These are common asset classes that we invest in:

- Equity

- Debt/ Fixed Deposits

- Real Estate

- Gold

Why do we have so many asset classes?

Each asset class serves a specific purpose as per their nature. They help us diversify our investment. Diversification helps to avoid the risk of losing everything in case of poor performance of any one asset class.

Equity investment has the potential to deliver highest return. (over longer time period)

Debt/Fixed Deposit gives protection of capital and but gives lower return.

Real Estate investment requires huge capital, is illiquid in nature and if the location is not appropriate, earning rental income or value appreciation over time is difficult.

Return on gold is usually low, or it will just beat the inflation, in which case investing in gold for financial goals is not prudent.

Equity and Debt are such asset classes where all investors can participate and there is more than one way in which one can invest in them.

Portfolio adjustment as per risk bearing capability

Younger people who have time for investment to grow and compound should have a major portion of their portfolio in equities (say 60-65%). While risk-averse and elder Investors should have more of debt, liquid assets and lesser equity (less than 30%) in their portfolio.

Key Takeaways

- Invest in equity to gain higher returns.

- Stay invested in equity for longer period of time.

- For short term investments, prefer bond funds and liquid assets.

- Portfolio should be well diversified and at the same time have assets which can meet financial goals.

- Investment in equity should also consider risk taking ability of the investor.

Want to learn more about equity research? Join our equity research training now!